Good morning!

Did you see that TV programme about RBS last night? It was fascinating, and showed the extraordinary recklessness, hubris (and inadequate regulation) of the top brass at RBS leading up to the 2008 financial crisis.

This reminds me of an excellent book on the financial crisis, written by the then Chancellor of the Exchequer, Alistair Darling, called "Back from the Brink". This is a book I enjoyed, so it's well worth a read. I must dig out my copy & re-read it. Our banking system literally came within hours of collapse.

I see that Aston Martin Aston Martin Lagonda Global Holdings (LON:AML) has announced its offer price, which is £19.00 per share. With a total of 228.0m shares, this values it at £4.33bn. 57m shares are being sold by selling shareholders, about 25% of the shares in issue, with a further 5.7m shares possibly being sold. There doesn't appear to be any new money raised for the company.

I've added it to my price monitor, more for curiosity than anything else. There's a lot of volume being traded in the first 12 minutes of trading this morning, at the time of writing, 3.5m shares already traded, with the price moving slightly above & below the £19 issue price.

The development costs of new models are astronomical. So when I saw that AML was quoting EBITDA (which ignores those costs of course!), then I rejected it immediately as a possible investment. I like driving Aston Martins, but I wouldn't want to own shares in it.

It will be interesting to see how this deal works out. My broker tells me that the IPO and fundraising market is awful at the moment - with several proposed IPOs and placings being cancelled due to lack of interest from investors. Therefore this might not be a good time to be holding shares in listed stockbrokers, if they rely on deal income.

Topps Tiles (LON:TPT)

Share price: 66.4p (up 5.8% today at 08:06)

No. shares: 196.4m

Market cap: £130.4m

Topps Tiles Plc (the "Group"), the UK's largest tile specialist, announces a trading update for the 52 week period ending 29 September 2018.

Following on from surprisingly good results from SCS (LON:SCS) yesterday, this announcement also gets filed in my "surprisingly good" tray. A few key points;

LFL sales in Q4 (13 weeks to 29 Sept 2018) rose by 1.2%, a sequential improvement on -2.3% in Q3

Trading over the fourth quarter has seen an improvement due to a combination of the continued effectiveness of our strategy and outperformance of our market.

As a result, the Board now expects adjusted pre-tax profits for the year ended 29 September 2018 will be slightly ahead of the top end of the current range of market expectations2.

There's a footnote setting out what market expectations are - this is incredibly helpful, and saves investors time. I'm more inclined to buy a share, if its announcements are simple and clear, as this one is.

2 Market expectations for underlying profit before tax for the year ended 29 September 2018 are in the range of £14.6m to £15.2m, with a consensus of £14.9m

Therefore, the company is set to slightly beat the £15.2m figure for adjusted pre-tax profit.

I prefer to work on EPS numbers. Stockopedia is showing the broker consensus as 6.08p for FY 09/2018. If that's going to be slightly beaten, then we're looking at a PER of about 11. That seems fairly good value, but where's the upside going to come from? Earnings have roughly flat-lined for the last 4 years.

Outlook - cautious, so not much upside here either;

Looking ahead, the uncertainty in the UK economic outlook means we remain cautious and will be maintaining our focus on our industry leading gross margins, tight cost control and strong underlying cash generation.

My opinion - there could be a bit of upside on the current share price, as the company seems to be trading well, and the valuation seems undemanding. Note there's a good dividend yield of c.5%.

It joins my list of things that look quite good, and I might revisit once the current political/economic uncertainty has been resolved.

Wincanton (LON:WIN)

Share price: 224p (up 0.7% today, at 08:24)

No. shares: 124.5m

Market cap: £278.9m

Wincanton, a leading provider of supply chain solutions in the UK and Ireland, today issues the following trading update ahead of its half year results for the six months ended 30 September 2018.

A solid update;

The Group has continued to experience good levels of trading in the first half of the year and the Board expects results for the financial year to 31 March 2019 to be in line with expectations.

Pension deficit - this is just recapping on a previous announcement in August;

As previously reported, the Group concluded its Triennial pension negotiations in August. The agreement provides an affordable and sustainable platform, retaining the Group's ability to invest in the business and to maintain its progressive dividend policy.

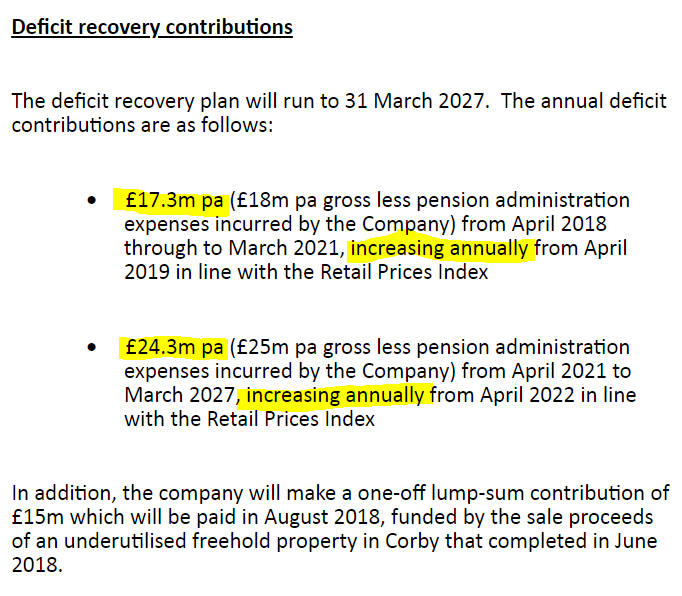

Checking back to the announcement in August, the pension deficit recovery payments are very considerable, so this is a big factor in how we value the company;

Looking at broker forecasts, these figures above seem to mean that about half the company's profits will be needed to fund the pension scheme deficit. This explains why this share trades on such an apparently cheap PER of 7 - it's because half the company is funding its pension scheme.

My opinion - Wincanton's track record of growing profits & EPS is excellent.

For me though, the very weak balance sheet is a deal-breaker. I sound like a broken record on this. There is another angle on this though - if you think the pension deficit may reduce, as interest rates eventually rise, then this share could be a bit of a punt on that pension scheme issue becoming smaller over time, and maybe the above recovery payments could be revised down in future?

CEO Interview - Best Of The Best (LON:BOTB)

I've been busy working on this today, so apologies that the rest of the report has been somewhat neglected. I think in future I'll schedule interviews for days when Graham is writing the main report, otherwise it overloads me (as there's hours of preparation necessary to do an interview).

Anyway, I think it went well, with interesting answers to your questions submitted here on Monday. Thanks very much for the excellent questions you asked.

Here is the link to the audio interview, on my interviews website. It's 31 minutes long.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.