Good morning!

Markets have stabilised today, with the FTSE back up 50 points.

Monday is historically the day when we get stock market crashes, so perhaps we are being set up for more weakness at the start of next week!

Patisserie Holdings (LON:CAKE)

- Share price: 429.5p (suspended)

- No. of shares: 104 million

- Market cap: £446 million

Overall, it's a quiet news day on the RNS feed. But not for CAKE.

The Serious Fraud Office has confirmed that it has opened "a criminal investigation into an individual", in response to the RNS by Patisserie Holdings (LON:CAKE) that its currently-suspended Finance Director has been arrested and released on bail.

The Press Association reported yesterday that the company could go into administration as soon as this morning, without an immediate cash injection. So we should get an update very soon. Needless to say, the outlook is bleak. The possibility of a pre-pack administration has been mentioned.

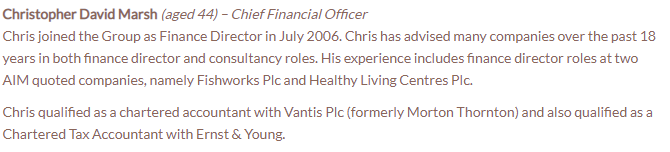

I was curious to learn about the Finance Director's history. This is his bio on the Patisserie Holdings website:

Ok, so he has been involved with the company for 12 years. Is that a bad thing? I wouldn't say so. Although it could be argued that it's unusually long.

But the two other AIM-listed companies he worked for ended badly for his investors.

The seafood restaurant chain Fishworks Plc went into administration, while the loss-making gym chain Healthy Living Centres delisted with its share price close to zero.

There is also a link with Gary Ashworth, who was involved in forcing Interquest off the stock market and into private hands. Paul Scott nominated Interquest as "the small company which seems to worst treat its outside shareholders" and described management as "incompetent, and not to be trusted".

Some links between all of the characters:

- Luke Johnson was the Chairman of Healthy Living Centres with Chris Marsh as FD.

- Gary Ashworth was the Chairman of Interquest.

- Luke Johnson was an investor and a director of Interquest.

- Gary Ashworth was the Chairman of Fishworks while Chris Marsh was FD and Luke Johnson was an investor.

The ties are clearly very deep between all three men.

What does it all mean? Could investors have avoided Patisserie Holdings (LON:CAKE) on the basis of its connections with Interquest and other businesses which ended badly for the private investor?

I don't think so. It's all a bit circumstantial so far.

This quote at the end of Burn After Reading sums up my feeling, and perhaps the feeling of many Patisserie Holdings (LON:CAKE) shareholders who have been burned:

CIA Supervisor: What did we learn, Palmer?

Palmer: I don't know sir.

Carclo (LON:CAR)

- Share price: 81.9p (-5%)

- No. of shares: 73 million

- Market cap: £60 million

This is "a global supplier of technical plastics products". It's quite a lot bigger than Plastics Capital (LON:PLA).

H1 trading was below the Board's expectations. Customer delays are to blame but the planned production had started by the end of the period.

The Board's expectations for the year ending 31 March 2019 remain unchanged, with results weighted towards the second half of the year, as expected.

It seems fair enough to treat this as a "mini" profit warning, as the expected H2 weightings frequently fail to materialise when H1 has been disappointing.

Checking our previous coverage of this share, the company has had a lot of bad news already this year, after a major profit warning in January.

Pulling out the most recent annual report, I'm reminded that customer delays were to blame for a weak H2 last year.

And now customer delays are responsible for more weakness in H1 this year. Perhaps the company needs to start expecting customers to be slow as a matter of routine, rather than being surprised?

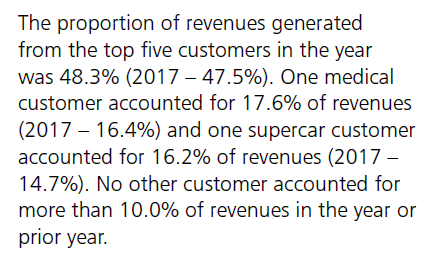

I have also noted a lot of customer concentration at Carclo. The 2018 figures were as follows:

Because of this concentration, it doesn't interest me as a potential investment.

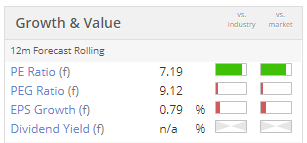

It's trading at a cheap multiple, which I suspect is justified:

There is nothing else of interest to me today, so I will call it a day. Get your crash helmets ready for Monday!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.