Morning all,

A very quiet day in RNS-land today. Which is helpful seeing as I've been occupied with a wide range of administrative chores. Being self-employed can be very complicated, as I'm sure some of you will appreciate!

Anyway, that's my excuses out of the way.

Today we have interim results from System1 Group, a company that is no longer in my investible universe but which I'm happy to keep half an eye on.

I can't see anything else of interest so I suppose this is the bit where I take requests and ask if there is anything from earlier in the week that I missed?

Cheers

Graham

System1 (LON:SYS1)

- Share price: 195p (+8%)

- No. of shares: 13 million

- Market cap: £25 million

Let's see how Brainju... I mean, System 1, has been doing recently:

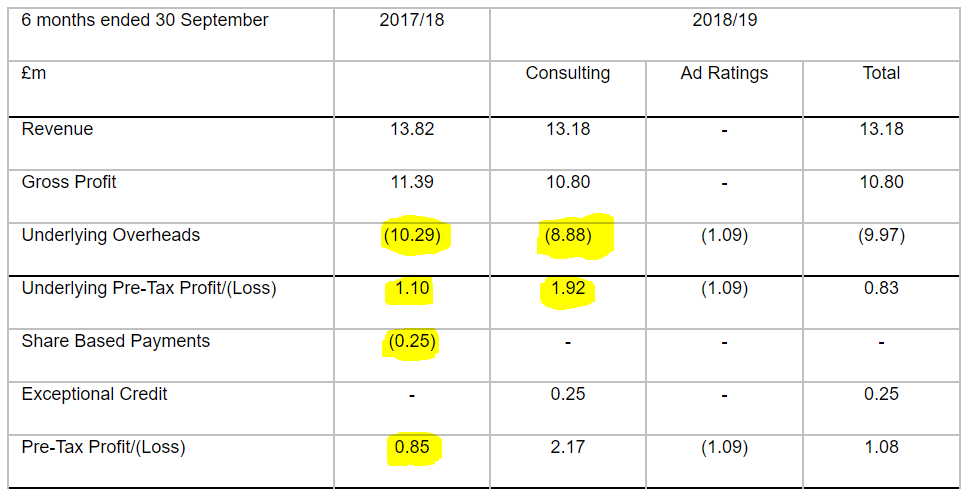

This table says it all:

The key points are as follows:

- revenues and gross profits down, but...

- underlying overheads also down significantly, with average headcount down by 19%, so we get a much improved underlying PBT result from consulting activities (£1.92 million vs. £1.1 million).

- System1 breaks out the £1.09 million spend on developing its new Ad Ratings product, so that we can treat it separately. That's fair enough.

- The result this period also benefits from the lack of any share-based payments. Good.

So what are the most important numbers in this table? I would say that the £1.9 million in underlying PBT from Consulting is the most important one.

We do have to bear in mind that this figure is before share-based payments, which are likely to feature again in Systems1's future.

It's still a decent result and makes the shares look modestly priced with a £25million-odd market cap.

AdRatings: £1.59 million in total has been spent developing this new business line. Of that amount £1.09 mllion was expensed (i.e. included on the income statement) while the rest was capitalised (i.e. recorded as an asset on the balance sheet).

Cash: System1 has historically had a very strong balance sheet and cash pile. With the increased investment, cash reduces to £3.55 million. That's still plenty for a company of this size.

Dividend: unchanged for now, but the final dividend may be reduced.

CEO comment: excited about the new Ad Ratings service, and thinks the existing business "will continue to stabilise and in time return to growth."

Divisional breakdown: there is a detailed table showing how each of the consulting divisions has done in terms of gross profit for every quarter going back to FY 2017. The result for the quarter just finished (Q2 2019) is almost exactly the same as results for the first quarter in the table (Q1 2017). So it doesn't look to me as if there is any growth trend over this timeframe.

My view: I no longer would consider investing in this, as I have become more sensitive to the labour intensity of what I'm buying shares in. In short, I don't invest in businesses which can be classified as consultancies.

System1 didn't always refer to its existing business lines as consultancies. It referred to itself simply as a market research agency.

If you look back a few years, the company had big plans for two of its existing business lines (Communications and Brand), hoping for them to scale up and achieve big recurring revenue streams. But they seem to have stalled, at least in the short-term.

If you read the FY 2015 results, for example, the strategy at that time was to increase:

"the proportion of business which is 'Ongoing' (sole supplier and regular usage) as opposed to 'Ad Hoc' (one-off projects). The exclusive and regular nature of Ongoing business makes it higher margin, more predictable and easier to win additional work from the same client.

The "ongoing" business lines have been doing ok, but the gross profit numbers haven't exactly soared. nor do they seem overly predictable when you look at the quarterly results.

So I find it difficult to get excited about this share. In addition to the labour-intensive nature of its activities, any future growth now seems to be predicated on a completely new service, Ad Ratings:

Ad Ratings is a subscription service which will enable clients to assess the effectiveness of their historic adverts, compare their scores with those of competitors and category averages, and correlate their advertising effectiveness with media spend.

System1 already has a service to test ads prior to broadcast. How much more valuable is it to be able to test historic adverts? It doesn't sound all that valuable to me, compared to what they already do. I suppose in combination with the existing service, it could improve their overall ad testing capabilities.

Therefore, while I don't object to System1 stripping out its investment in this new service from the rest of its results in H1, it doesn't sound to me as if it is going to be a radically different or more valuable service than what it already has. I could be completely wrong, that's just my impression!

So I wouldn't consider investing in this, despite the apparent "value".

Forterra (LON:FORT)

- Share price: 233.8p (+4% today)

- No. of shares: 200 million

- Market cap: £468 million

Forterra plc, a leading UK producer of manufactured masonry products, provides this trading update covering the period from 1 July to 31 October 2018.

Covering this in response to a reader request.

The share price was volatile yesterday - it was bigger than the range of the previous eight sessions combined!

Forterra makes bricks and blocks and related bespoke products like precast concrete, concrete paving and chimneys.

Trading up until now has been in line with expectations. Demand is stable from the new build residential sector, and the combining is absorbing various cost pressures (energy, fuel and EU carbon credits).

Net debt is down slightly to £56 million.

There is some scary news about ones of it large ovens overheating recently. £2 - £3 million will be the cost to rebuild the damaged sections, including lost sales.

This means that profits for 2018 will be marginally below expectations.

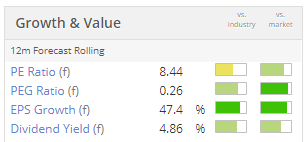

My view: This is interesting. I'm surprised that Forterra has such high quality metrics:

Through the efficient use of its assets and some financial leverage, it manages to convert a decent operating margin of 18% into a terrific 45% return on equity.

The shares are cheap, too (forecast P/E multiple of 8x).

Therefore the stock gets a Magic Formula score of A+. I didn't expect that !

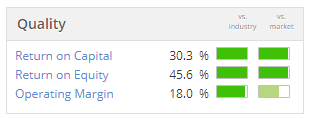

This isn't an industry I know much about. But according to Forterra's website, it is the second largest manufacturer of bricks in Britain and "the only manufacturer of the iconic and original Fletton brick which is sold under the London Brick brand".

This is the Fletton brick:

"Boring" companies are supposed to make for good investments, and it doesn't get more boring than bricks!

Forterra has only been listed since 2016 and that's maybe the one red flag that I can find - that it is still relatively new to the public markets. I note that it had a sharp fall in share price within the first couple of months of listing. Maybe it has had the customary wobble already, then?

Goes to show the importance of reader requests. I wouldn't even know this company existed if it hadn't been requested!

4imprint (LON:FOUR)

- Share price: £20.00p (-2% today)

- No. of shares: 28 million

- Market cap: £560 million

This is another one that has escaped my attention. It looks like I've not covered it before. Another reader request - cheers.

4imprint Group plc, (the "Group"), the leading direct marketer of promotional products, today issues an update on Group trading performance.

Momentum has continued in H2 and therefore revenue and underlying operating profit will be toward the upper end of the range of market forecasts. Unhelpfully, this range is not presented in the RNS.

I've got a great impression of this company so far. The service seems to be mostly related to the value of its website in enabling companies to specify and customise the labelled products they want. The manufacture of these products (promotional pens, notepads, etc.) is then outsourced.

Seems like a nice business. One to look into in more detail, I reckon. It passes five quantitative screens, including the Screen of Screens for Quality Investing. Impressive!

ETFs

I was asked my opinion in the comments about ETFs (exchange-traded funds). In what follows, please bear in mind that I am not authorised to give financial advice and that anyone in any doubt whatsoever should hire someone who is authorised to give advice.

My uncontroversial view on ETFs is that they are an essential and an attractive product for many types of investors.

Indeed, when non-financial friends of mine ask me for "advice" (which I can't give them, legally), I usually tell them that in my opinion, the cheapest way to invest in the stock market is with an ETF.

This is how I rank various options for a non-financial person who wants to own shares:

- The worst option is to open a discretionary account with a stockbroker. I am aware of certain brokers who charge outrageous commissions to churn their customers' accounts, up to 1.65% in commission for each trade (and that's before other charges). And if you ask who is making your stock selections in these accounts and on what basis, you'll often find that the person making your selection is not a real investor who ever takes much equity risk themselves or has much of a basis for making your selection. These accounts are the road to disappointment.

- The middle option is to buy actively managed funds. The management charge will eat into returns but if you succeed in making a reasonable selection, perhaps with the help of an IFA or wealth management company if necessary, and you're patient, then you can do well.

- The best option for a non-financial person, in my view, is to buy passive ETFs. For a FTSE tracker, this can cost as little as 7 basis points (0.07%) per annum. Price compression in this industry is such that some US tracker funds have even become free for US investors. If a non-financial person can have the discipline to drip money into one of these cheap tracker funds every month over a long period of time, I'm confident that they would outperform not just the average investor in actively managed funds but also the average investor in individual shares. This is because most funds and individual investors are structurally destined to underperform due to paying excessive fees, trading excessively, pro-cyclical trading habits, etc.

I personally own IS SHRT DUR HY CRP BD USD (DIST) ETF (LON:SDHY), because I wanted fixed income exposure, specifically to short-term US corporate debt, and this ETF was an efficient way to achieve diversified exposure. Given the size of my portfolio, it would be completely impossible for me to build a bond portfolio myself. I needed a fund, and a passive ETF is the best choice as far as I'm concerned.

ETFs have many other uses, beyond equities and bonds. For example, if I wanted exposure to gold bullion again, an ETF would be my first choice. There are many tactical and alternative ways to use this type of instrument.

Summary - I think ETFs are extremely useful!

That's it for the week - thanks everyone.

All the best

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.