Good morning!

I'm back for one day only, to give Paul a break. A few stories popping up on my radar today:

- Confirmation of intention to float by DWF

- MySale (LON:MYSL) trading update

- EU Supply (LON:EUSP) trading update

- Hardide (LON:HDD) fundraising

- Earthport (LON:EPO) improved offer

Graham

DWF - Intention to float

Confirmation of intention to float

It continues to amaze me that firms which traditionally would have stayed private, are now selling their shares to the general public.

Another example of this today with DWF, the international law firm headquartered in Manchester.

Law firms are perfectly good LLPs, and they've always been LLPs. Why is now the right time to take on the PLC model? And can they really function as publicly-listed PLCs? I suppose we will find out.

The simplest explanation for me is that there's still quite a lot of complacency out there, and that this has manifested itself in the flotation of companies which would never ordinarily float (not only because investors wouldn't bite, but also because the companies themselves would want to stay private, for the sake of their long-term futures).

Another example of this complacency in my opinion is the property portal On the Market (LON:OTMP), which Paul discussed on Wednesday. This was a mutual organisation which demutualised, and yet its strategy now is to continue acting as if it were a mutual (i.e. to act for the benefit of its customers, rather than its shareholders). In other words, it wants to have its cake and eat it, too.

I used to work for a mutual organisation, so I have seen how they work from the inside. There is nothing wrong with being a mutual, but I would never want to own shares in one. The whole point of the thing is to serve its customers, not shareholders! So shares in a mutual which don't come with the privileges of being a customer are unlikely to generate a good long-term return, in my view - they are a structurally bad investment (disclosure: I own shares in Rightmove (LON:RMV) ).

Similarly, law firms are a structurally bad investment. Why work for a law firm which has to pay out a percentage of profits to external shareholders, when you could work for one which pays out everything to staff? In the end, the external shareholders will be nothing more than a drag on the company's competitiveness. Combine that drag with an acquisition strategy, and you have a recipe for disaster.

Back around 2015, I made a quick profit shorting the Australian law firm Slater & Gordon (SGH), whose shares are now almost worthless versus their previous value:

UK listed law firms so far include Gateley Holdings (LON:GTLY), Knights Group (LON:KGH), Keystone Law (LON:KEYS) and Gordon Dadds (LON:GOR). I tend not to do any shorting these days but I might keep an eye on these as potential candidates, along with DWF. DWF's potential market cap should allow for much better liquidity than the others, but beware that the opening free float will only be 25% of the company's shares.

MySale (LON:MYSL)

- Share price: 20.95p (-8%)

- No. of shares: 154 million

- Market cap: £32 million

MySale Group plc (AIM: MYSL) (''the group''), the leading international online retailer, today provides a trading update for the six months to 31 December 2018.

Paul commented on Mysale's profit warning in December. The Australia-focused online retailer announced then that it would make an EBITDA loss in H1, and guided for "a small underlying EBITDA profit" for the full year.

The company reiterates this guidance today, with cost savings and improved margins set to generate a "significantly improved performance" in H2.

We also get more detail on what happened in H1. The gross margin weakness is pretty bad: down from 30% to 23%. Especially since i thought that it's strategy was to grow its gross margin by holding its own inventory - so how could margins fall?

Active customers also fell, by 7%. I'm not aware of any disposals that might have triggered that reduction. So it shrank on an underlying basis.

The cash position improved, and this seems to be the only bright spot. Net cash of A$2.7 million. With sales down 17% and a lower working capital requirement, it makes sense that the company could convert some of its inventory back to cash.

CEO comment:

"The group has a strong balance sheet and the anticipated improvements in working capital are being achieved and cash balances increased. We believe the reconfigured business will be stronger, more efficient and continue to provide a compelling consumer offer and deliver unique solutions to our brand partners.''

Brokers are leaving their forecasts unchanged, so the EBIT forecast for FY 2020 is A$5.5 million (about £3 million).

I can see how a short-term recovery to profitability could happen through cost savings, rationalising operations and disposing non-core businesses. I'm less clear on why we should expect sustained organic growth and strong returns in the core business. It's a collection of clearinghouses for cheap clothes - nothing wrong with that, but I don't know what the competitive advantage is. So I'm happy to leave this for others to dabble in.

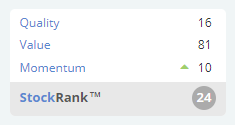

The StockRanks continue to view it as a Value Trap, and it passes a short-selling screen.

EU Supply (LON:EUSP)

- Share price: 10.5p (-2%)

- No. of shares: 72 million

- Market cap: £7.5 million

This is a small, growing software company. It provides something called Complete Tender Management (CTM), which is "a comprehensive tool that allows tenders to be created, distributed and evaluated without the need to create and manage paper documents". So it's a modern way of doing the tender process.

Key points for FY 2018:

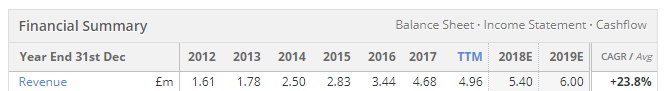

- Revenue +10% to £5.1 million, slightly below market expectations. Most revenue is recurring.

- Maiden PBT of £0.4 million, materially above market expectations. The company discloses that this includes a £0.3 million boost from capitalising development costs.

- Development of a "micro procurement solution" is proceeding according to plan.

My view

This could be worth researching in more detail - it's great when a small company crosses over into profitability, and can fund its own growth from a stronger base.

The StockRanks no longer view it as a Sucker Stock, instead describing it as "Style Neutral".

I'm open to the idea that this could be a winner. It has perhaps failed to catch the market's attention yet, or get rewarded for today's earnings beat, because its top-line is still very small, and 10% sales growth in 2018 isn't exactly mindblowing.

That said, it has been making steady progress. And if the revenue is truly recurring, that gives it a nice tailwind for the future.

Hardide (LON:HDD)

- Share price: 1.6p (-9%(

- No. of shares: 1700 million (pre-Placing)

- Market cap: £27 million (pre-Placing)

Fundraising & Share Consolidation

I've been getting up to speed on this maker of patented coatings for metal parts.

Checking the archives (always very useful), Paul has previously flagged up the concentration risk with Hardide's customer base. The 2017 annual report confirms that the top 3 customers accounted for almost 60% of the company's revenue - way too much for comfort.

At the 2018 preliminaries, the company said it was making progress diversifying, but also that this diversification was taking longer than it would like.

It has been well-supported by investors despite mostly losing money, with £11 million of losses having accumulated on the balance sheet as of September 2018.

Today's proposed fundraising for £3.6 million, at a proposed price of 1.5 pence, will enable it to replace its UK facility (it is also active in the US). It has identified a new, modern building with double the floor space, and wants to invest in additional machinery.

The positives:

- strong revenue growth in 2018 (though at lower margins)

- oil and gas sector is currently strong, and O&G customers predict that conditions will remain favourable

- discussions with Airbus and its partners ongoing

- currently developing parts for other aerospace manufacturers

My view

Another one that could be worth a look, it has well-defined intellectual property in the form of patents and appears to be highly valued by its customers.

There is no point in looking at a P/E multiple at this stage. If we look at the forward price/sales multiple instead, it seems rather adventurous to me at about 5x. For a business with lumpy sales and exposure to cyclical industries, I would want bargain pricing. So I am inclined to agree with the Value Rank of 10 attached by Stockopedia.

Earthport (LON:EPO)

- Share price: 44.2p (+14%)

- No. of shares: 623.5 million

- Market cap: £275 million

Vsa - Increased Recommended Offer

Mastercard is Considering its options

What a dream for shareholders! Not only does Visa increase its bid to 37p (its second bid for the company, after Mastercard offered 33p). but Mastercard is still lingering and "considering its options".

Well done to anyone who owns shares in this company, which makes cross-border payments faster for its customers. It made huge losses for many years, but built a product which the big boys clearly want.

The current share price of 44p says that Mastercard is likely to come in with an improved offer. It would be understandable for some shareholders to take risk off the table at this point, unless they have huge conviction in the value of the business.

I think I'll leave it there for today. Paul will be with you next week!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.