Good morning,

I am back from a brief trip to Hamburg.

I had a look at the Tesla (TSLA) store in Hamburg's most prestigious shopping district, surrounded by jewellery stores. I'm not surprised that it's still open - walking away from that lease at short notice might be tricky! (I am short Tesla.)

Companies reporting today:

- IQE (LON:IQE)

- Science in Sport (LON:SIS)

- Tasty (LON:TAST)

- Alpha FX (LON:AFX)

Cheers

Graham

IQE (LON:IQE)

- Share price: 83.4p (-4%)

- No. of shares: 778 million

- Market cap: £649 million

I still don't feel like I understand what "VCSEL" wafers are all about.

Where I do feel confident is in my ability to read financial results from companies. Today's results are consistent with my previous impression of IQE.

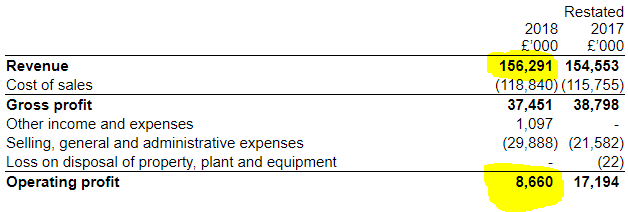

Revenue improves marginally to £156 million. This is still a weak number in terms of asset turnover - compare it with average assets being carried during the year of c. £350 million.

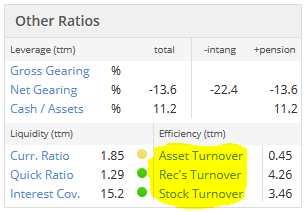

Stockopedia includes three of the major efficiency ratios on the StockReport. These are good to check, especially Asset Turnover, for a quick overview of balance sheet efficiency. See the "Other Ratios" section:

Poor asset turnover like IQE's is not a fatal flaw, but it heightens the need for it to make a very good operating margin. As we are about to see, IQE hasn't been particularly strong when it comes to margins, either.

Bulls will say that the prospects for revenue growth from new applications of IQE's technology are so strong that we should look past the company's inability to generate much cash in the short-term.

For someone who is confident in their understanding of the semiconductor industry, that may be a fine approach. Investing isn't just about reading accounts, after all. But for a simple financial analyst like me, who isn't an industry expert, all I can do in a limited review time is provide a "check-up" on its historic financial performance and its near-term outlook.

IQE's historical performance, in my opinion, has been pretty average. Operating margin has never been consistently high enough to compensate for the company's weak asset turnover, and deteriorated in 2018 to 5.5% on a reported basis.

Let's put it this way: after deploying c. £350 million in average assets for 12 months, of which c. £300 million was funded by shareholders, the company generated a pre-tax, pre-interest profit of less than £9 million. There is no way that this can be interpreted as an exciting rate of return on shareholder funds or on the total balance sheet.

The company says that £7 million of its expenses in 2018 were "exceptional", and perhaps it deserves the benefit of the doubt on that front, but note that there were £9 million of exceptionals last year, too.

Weak numbers for ROCE/ROA/ROE translate to poor free cash flow and IQE's cash balance reduced by £25 million during the year, leaving it with net cash of £21 million. It has a debt facility to help fund future investments.

Outlook

The company remains confident that its investments are going to bear fruit:

the Group has made significant progress in positioning itself for operational execution at scale.

In the short-term, however, it is facing "the unwind of inventory levels in the VCSEL supply chain" and "general market softness" in semiconductors and especially mobile handsets.

My view

IQE's long-awaited financial success might be just around the corner. It is forecasting revenue growth of 9% in FY 2019.

Personally, however, I don't see anything in the company's long track record to suggest that it is about to turn into a high-return business, rather than a fairly ordinary manufacturer generating below-average returns on capital.

StockRanks share my puzzlement at IQE's valuation: the ValueRank is 19, and the overall StockRank just 16.

For those of you with proper industry insights, you may be able to understand the bull hypothesis, and you deserve to do well out of this share.

As the bulletin board motto goes: "GLA".

Science in Sport (LON:SIS)

- Share price: 51p (-1%)

- No. of shares: 123 million

- Market cap: £63 million

This is another one that has been working its way toward success for a considerable period of time, and used plenty of shareholder funds on its journey.

Unlike IQE, however, Science in Sport has never shown a profit. Its losses have grown wider each year thanks to a huge marketing budget, as it tries to create a trusted consumer brand.

In 2018, losses widened to £6 million (from £4 million), not helped by £600k of acquisition costs. Today's losses are in line with expectations.

According to today's footnotes and my own calculations for 2018:

- the pre-existing SIS business made revenues of £19.8 million and a pre-tax loss of £5.3 million, (adding back the acquisition costs).

- The acquired business, "PhD Nutrition", made revenues of £21,2 million and a pre-tax profit of £2.6 million.

SIS paid £32 million for PhD, or £35 million including working capital investment. That's 13.5x trailing pre-tax profits. That valuation seems perfectly reasonable, assuming that its outlook is benign.

PhD enjoys lower gross margins than SIS, but I guess that its marketing spend must be a lot lower, since PhD was able to generate a profit on a similar amount of revenues to SiS. Sounds like PhD could be a decent business.

Group Outlook - optimistic.

We are seeking further strong revenue growth in 2019 and the year has started well for us. Our intention is for the Group to move to a breakeven situation at EBITDA* level this year.

Cost savings from the integration of PhD are guided to be in line with expectations. There are lots of plans to boost the combined group, e.g. through combined purchasing and logistics.

EBITDA breakeven isn't real breakeven, but it's a good start.

Checking last year's results statement, there was no promise of group EBITDA breakeven in 2018. So I'm assuming this is the first time it has signalled this intention.

My view

This share could be worth researching in more detail. Shareholders have been very patient so far.

The cash balance is reported as £8 million at year-end, after a £3 million operating cash outflow for the year (before negative working capital movements, which brought the total operating cash outflow to well over £6 million).

I would not rule out the possibility that another equity raise might be needed here at some point. Planned investments in its Lancashire facility sound like they could be expensive, on top of routine capex. And growing sales could mean more negative working capital movements.

Overall, though, I'm feeling more positive about SIS than I ever have before. It still has an awful lot to prove, but I'm keen to continue watching its progress and see how the integration of PhD Nutrition works out.

Note that the StockRanks view it as a Sucker Stock. In other words, from a statistical point of view, most companies at this early stage of development don't turn out well for shareholders.

The share-based bonus payments are worth digging into: £1.9 million in 2018, and £1.6 million in 2017. These look too big compared to the size of the company and its financial results.

Tasty (LON:TAST)

- Share price: 6.75p (-21%)

- No. of shares: 60 million

- Market cap: £4 million

This restaurant group operates "Wildwood" and "dim T".

"Challenging conditions continue to affect the casual dining sector" - no surprise.

The % like-for-like sales decline isn't provided. This is a big omission, surely?

The number of sites has reduced to 58, including a number of movements already this year. More disposals could happen soon.

Tasty revised its banking facility in October. At the end of the year, it had borrowed £6.4 million from the £7 million facility, and had cash at bank of £4.3 million. It seems to have a little bit of breathing room.

The adjusted operating loss for 2018 is small but the £11 million of adjusting items on top of that (e.g. impairments) are a big blow to the balance sheet. Net asset value falls from £22 million to £10.5 million.

My investing life is better when I don't get involved in shares like this. This company looks like an outright gamble, unless or until you had very strong evidence of a turnaround on the ground.

Alpha FX (LON:AFX)

- Share price: 670p (+5%)

- No. of shares: 36.5 million

- Market cap: £245 million

Alpha FX (AIM: AFX), the UK-based foreign exchange service provider, is pleased to announce its audited Full Year Results for the year ended 31 December 2018.

Sparkling results from Alpha FX today.

This company IPO'd with a placing at 196p as recently as April 2017.

More recently, it issued £20 million at 620p in October 2018.

It has been a big success and stands in stark contrast to the lack of recent progress at Record (LON:REC), where I am a shareholder.

Both of these FX-focused stocks have excellent quality metrics. The difference is that Alpha FX is enjoying all of the growth right now, and is priced at 26x forward earnings according to Stocko.

The FX market is so big that either of them could grow considerably from the current level, if they got their pitch right.

At the moment, Alpha FX is the one doing this. It has a beautiful website serving as its online shop window, which never hurts.

While company statements about their culture can often be a waste of time, I was impressed by Alpha FX's statement today. It certainly left me with the impression that they are doing a good job of nurturing talent (for context, there were a total of 82 employees at year-end).

It will take me some time to unpack its competitive advantage but this does appear to be one that is worthy of further research.

That's it for today. I will try to add a few words on Volvere (LON:VLE) tomorrow.

In big-cap land, I think we should get results from Next (LON:NXT) and Ted Baker (LON:TED) first thing.

Have a good evening.

Thanks

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.