Morning all!

There are a few minor political headlines but I'm sure what you really want to hear about is the company news.

Today we have:

- IG Group (LON:IGG)

- Next (LON:NXT)

- GAME Digital (LON:GMD)

- Strix (LON:KETL)

- Ted Baker (LON:TED)

IG Group (LON:IGG)

- Share price: 507.5 (-7%)

- No. of shares: 369 million

- Market cap: £1,873 million

(Please note that I have a long position in IGG.)

I've increased my position in this share today, up from 4% to 6% of my portfolio.

My original purchases were in early 2017, between 505p - 530p.

I topped up last October around 610p.

Today I am back at it, again around that 505p mark.

The EU's ESMA organisation is responsible for all the trouble in this industry - prior to the announcement of its regulations, IG shares had reached a high of c. 950p.

Subsequent to that announcement, from late 2016 to mid-2018, confidence gradually recovered and the shares climbed back to the high at 950p.

Unfortunately, the disruption caused by ESMA rules has been worse than we might have hoped, and this has been compounded in recent months by a lack of trading activity by clients. The same thing was reported by CMC Markets (LON:CMCX) (in which I have a long position).

According to today's update, IG's Q3 revenues (to the end of February) are down 12% compared to the prior quarter. The number of spread bet clients increased marginally, but they traded at significantly lower levels. As the ESMA rules were in force during the prior quarter as well, IG says that this is due to lower volatility.

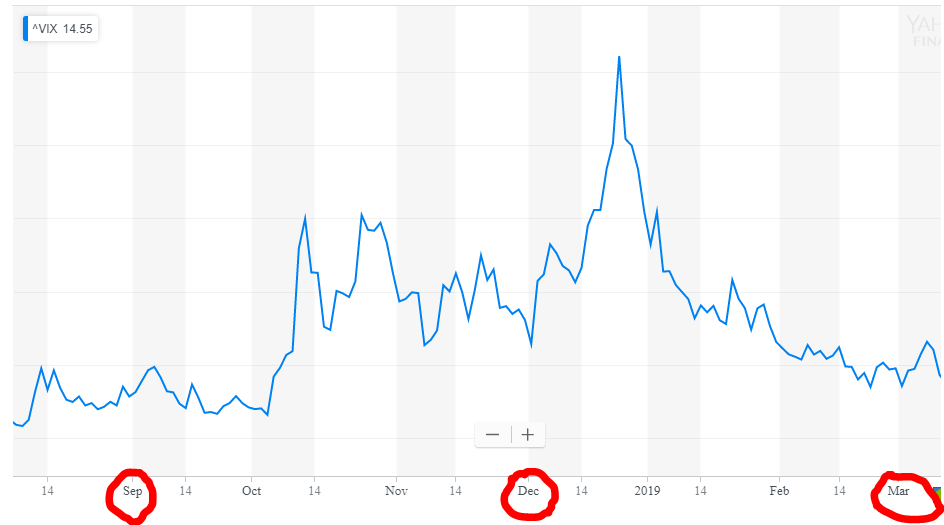

We can estimate volatility using the VIX and VFTSE indices (though these are supposed to be forward-looking rather than historical measurements).

VFTSE, the implied volatility of the FTSE Index, was high in December, but dropped back in February:

Similarly, the VIX had a big December but has spent much of January and February at lower levels:

So I do think it is possible that volatility is to blame for the 12% sequential decline in revenues.

It's also possible that clients are finding that they don't enjoy trading or want to trade as much as they did prior to the ESMA rules.

Or it could just be bad luck - the fortunes of these companies are tied to a small number of high rollers, and if they don't feel they are in a position to trade (perhaps due to Brexit preparations - who knows?) then that can have a big impact on results.

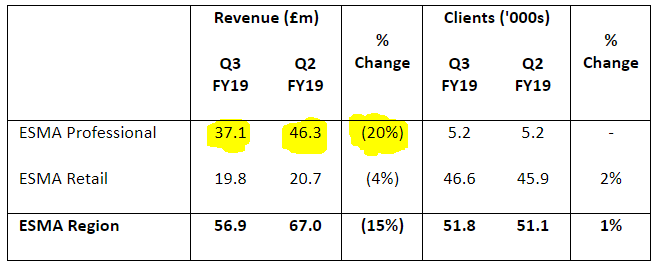

This table shows that the sequential reduction in revenues in the ESMA region was driven by the Professional Clients, i.e. by the ones who enjoy many exemptions from the rules. The behaviour of retail clients is substantially unchanged:

On a year to date basis, ESMA-region revenues are down by 27%, or by 24% if you exclude from analysis those clients who have been able to switch to an entity outside the ESMA region. This includes two full quarters during which the ESMA rules were in force.

Outside of the ESMA region, revenues continued to make gradual progress.

Outlook

There is little visibility - "the the level of revenue in the last quarter of FY19 is difficult to predict accurately".

Cost guidance is unchanged at c. £290 million.

Dividend to be unchanged at 43.2p on an annual basis until growth resumes.

My view

I have a lot of comfort with the integrity of this business as a whole, its market position and its reputation.

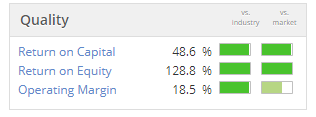

I'm also attracted by its high returns and the manner in which it is handling the ESMA rules.

New CEO June Felix is from an international payments background and I'm excited to find out what she can do, using her insights into financial technology. But she is probably still learning about the business at this stage.

As you can tell from my opening remarks, I have history when it comes to buying into IG around the £5 mark. It's easy to say in hindsight that I should have cashed in my chips at £9, but I want to be in this permanently and participate in the long-term growth of the core business, the APAC region and the stockbroking business.

As most people will know, valuation here is rather undemanding on a P/E basis. Even if turnover was as low at £432 million - annualising the very poor quarter just seen and bringing us back to 2015 levels - significant pre-tax profit margins would still be available after £290 million of operating expenses.

The consensus forecast prior to today was for 2019 revenues of £514 million. While I expect that hitting revenue forecasts will be difficult for the short-term, I don't plan to go anywhere as a shareholder and hope that I will still be around to enjoy the profit and dividend stream in 2021 and beyond.

Next (LON:NXT)

- Share price: £51.69p (-0.3%)

- No. of shares: 137.6 million

- Market cap: £7,112 million

Results for the year ending January 2019

(Please note that I have a long position in NXT.)

Next has outdone itself by presenting another comprehensive review of its business and the wider retail industry.

The key takeaway is that "NEXT's economic structure allows its profitable transition into the online world", based on a fifteen-year stress test which presumes that like-for-like retail sales will fall by 10% annually.

One of the big positives (which is incorporated into the model) is that rents are going to fall.

This year, rent reductions of 29% were achieved on lease renewals at 28 stores. The previous year, reductions of 29% were achieved. So rents don't have to be an endless source of pain: as they are renegotiated, they will adjust to wider conditions. Next's average lease term is 6 years, allowing for lots of lease renegotiations every year. The forecast for renewals this year is that they will produce a 27% reduction in rental costs.

There is a wider point here. Next reminds us that its stores play an important role not just in traditional retailing but also in assisting the online offer: online delivery is free to the customer's nearest store, and this can be more convenient for them than receiving the order at home. One third of online sales are delivered to stores rather than to the customer's home.

Additionally, more than 80% of online returns come back through Next's stores.

So the stores play a central role in the entire business, even if they must inevitably shrink in terms of their total number.

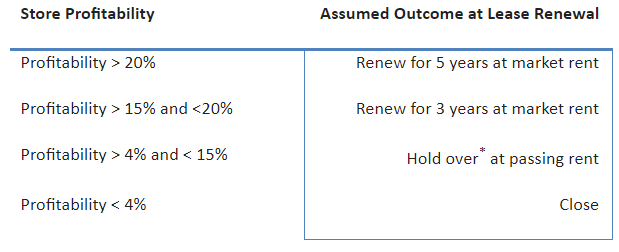

I love how clinical the company is when it comes to store decisions. It wants high margins: when it gets them, it stays. If it doesn't get them, it gets out. Assumptions in the fifteen-year model are as follows:

Of course there will be continued competition for retail space, even at the lower rates. But alternative uses such as residential, office, etc. offer much lower yields to landlords than Next and other retailers are currently paying (except in Central London). Therefore, Next is likely to only compete with other types of customer-facing retailer for space.

I don't want to get bogged down in too many details, but the conclusion of the entire exercise is as follows:

In summary, annual declines of -10% in like-for-like sales in our Retail business, combined with CAGR of +7.5% in our Online business looks likely to deliver cash generation of around £12bn over the next fifteen years, with cash generation in the final year being in the order of £1.1bn.

2019 Review

PBT falls by 0.4%, but EPS is up 4.5% (share count has reduced).

Within the online business, sales of 3rd party products are soaring (full price sales up 29%). This is consistent with Next's goal of being the first shopping destination for customers, who don't have to visit any other website to get a comprehensive offering. This division ("LABEL UK") is worth almost 20% of total online operating profit.

Within NEXT Finance, the consumer credit business, bad debts increased. Thanks to bigger overall scale and stable funding costs, net profit from this division still grew by 8.4% to £120 million.

"Discretionary cash flow" (roughly equivalent to operating cash flow, since it doesn't include capex) was £669 million. Capex of £129 million was paid out of this.

Outlook

Profits are forecast to "marginally decline". Next's record of forecasting its own performance is excellent, so I would lend a lot of weight to this.

EPS, on the other hand, is likely to grow by 4.9% thanks to continued share buybacks.

My view

I'm involved here for a number of key reasons.

Firstly, we have its excellent reporting style. Very clear, educational and humble.

Secondly, we have its focus on margins and returns. It doesn't waste time with activities that don't generate big returns. ROCE is consistently superb.

Thirdly, we have its long-term outlook. It takes actions today based on how those actions will affect results through an entire economic cycle, not just based on results for the next year. It has a plan and a model for the next fifteen years, not just the next two or three. That's the kind of business I want to be involved in.

Profit growth won't be easy and I'm not counting on it. Consensus forecasts see net income of c. £715 million p.a. out to 2021.

I do fully support the company buying back its own shares at the current level. If the market doesn't want to give Next an attractive earnings multiple, then it can simply force EPS growth by taking these cheap shares out of the market. Exactly the right course of action with spare cash, in my view.

GAME Digital (LON:GMD)

- Share price: 25.4p (-4.5%)

- No. of shares: 173 million

- Market cap: £44 million

At face value, these results are ok: GAME's PBT is up by 20% for H1, and adjusted EBITDA up 22%.

The cash balance was £96 million at January 2019, the seasonal high.

Revenues fell by 4.7%, however, and falling revenues could make life difficult during the quiet summer period.

Hardware was particularly weak. GAME is captive to the manufacturers and their design cycle. For example, it has been five years since the Playstation 4 was released, and the next one won't be released until 2020 or 2021.

Another weak category was pre-owned, down by 21%.

On the positive side, GAME is enjoying even bigger rent reductions than NEXT. And it has a famously short average lease length, as we've discussed here before.

Average lease length to break in the UK and Spain under one year and savings in the first half of 59% on those leases renegotiated

So there is a route to lower costs and a potentially reasonable outcome, although revenues at some point need to stop falling! Readers have been discussing in the comment thread below some new threats in relation to the online streaming of video games.

I share those concerns and therefore I would not be interested to hold this share for the long-term. Not only can games easily be ordered online, but they can increasingly be downloaded or streamed so there is no need even for a physical delivery. For this reason, I see GAME as a legacy retailer that would not be invented if it did not currently exist.

Its transformation strategy to become a provider of "gaming experiences and services" strikes me as a reasonable plan, but there is a very big tidy-up job to be done between now and then, and I see a risk of sustained losses while this is carried out. So far, the events and esports business is still really small and there is no sign of it springing into life.

Outlook

H2 has got off to a tough start with the wider gaming market down 5.9% in the UK, and also down in Spain. No other numbers are given in the outlook statement.

According to a note published on Research Tree, analysts have reduced FY 2020 forecasts from a small pre-tax profit to a small pre-tax loss, and FY 2021 forecasts are reduced to a tiny profit.

My view

Not something I would want to own permanently. Thanks to the short lease length, I do think that it has a chance to survive rather than heading back into administration (the last administration was in 2012). But it will spend most of its time shrinking and simply trying to minimise losses for the foreseeable future.

StockRanks see it as a Contrarian Buy.

Strix (LON:KETL)

- Share price: 159p (-5%)

- No. of shares: 190 million

- Market cap: £302 million

Strix Group Plc (AIM: KETL), the global leader in the design, manufacture and supply of kettle safety controls and other complementary water temperature management components, is pleased to announce its audited results for the year ended 31 December 2018.

This is an interesting company, headquartered on the Isle of Man. It makes kettle controls for which it owns the IP and supplies most of the world with them.

It IPO'd at 100p in August 2017.

Today's results show small increases in revenues, EBITDA and net income. Market share globally is flat at c. 38%.

Defending its intellectual property is an important part of what it does: eight cases were successfully concluded in 2018.

The final dividend is hiked up to 4.7p, making for a 7p total dividend for 2018. Debt reduced significantly during 2018.

Outlook - confident in the expectations for 2019.

My view - I like this company. I am currently trying to ascertain what is the average remaining life on its patent portfolio, and will let readers know when I have more information on this point.

Ted Baker (LON:TED)

- Share price: £16.01p (-6%)

- No. of shares: 44.6 million

- Market cap: £714 million

Ted Baker reports results under its Acting CEO, following the resignation of Ray Kelvin.

While sales were strong, margins suffered and pre-tax profits fell by some 26%. This is blamed on several factors:

...competitive discounting across the retail sector, consumer uncertainty, the well-publicised challenges facing some of our UK trading partners and the unseasonable weather across our global markets at different points throughout the period.

26% of total retail sales were online. This could be better (50% of retail sales are online at Next (LON:NXT), excluding finance income).

Dividend - small reduction in the final dividend. Total dividend for the year is 58.6p.

Outlook - "trading continues to be impacted by ongoing consumer uncertainty and an elevated level of promotional activity across many of our global markets". Confident in the Spring/Summer collections.

My view - seems like it's worth keeping an eye on this luxury brand. I'd probably be a buyer if the price was low enough. At the same time, I'm wary of ending up with too much retail exposure in my portfolio, so I'll stay away for the time being.

If I had to guess, I would say it is undervalued at current levels.

I'm out of time for today, I'm afraid. Tomorrow, if the company news takes a break, I will be able to go back and look at:

- Volvere (LON:VLE)

- Sopheon (LON:SPE)

- Portmeirion (LON:PMP)

- FW Thorpe (LON:TFW)

- Xaar (LON:XAR)

- Safestyle UK (LON:SFE)

For those of you following the battle between Local Shopping REIT (LON:LSR) and Thalassa Holdings (LON:THAL), there are new announcements as each party makes its case to LSR shareholders. The LSR Board is still hoping to liquidate and avoid the takeover offer by Thalassa:

- Thalassa Statement regarding LSR's Response Circular

- LSR Statement and Shareholder update

Thalassa makes a fair point that the precise NAV of LSR is currently unknown, but I think the LSR argument is much stronger: if the deal goes ahead, then LSR shareholders will be left with a large quantity of Thalassa shares whose long-term value is highly uncertain.

Some liquidity in Thalassa shares is provided by its buyback programme, but this programme might not be continued and ultimately it reduces the free float, making the shares even more illiquid. Selling large quantities of Thalassa shares could turn out to be very difficult.

Hopefully, LSR will succeed in achieving the liquidation that it has been working towards for so long.

Bye for now,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.