Good morning, it's Paul here!

Please see the header for the trading updates & results announcements which have caught my eye so far today.

Debenhams (LON:DEB)

The saga drags on, with yet another announcement today from Sports Direct.

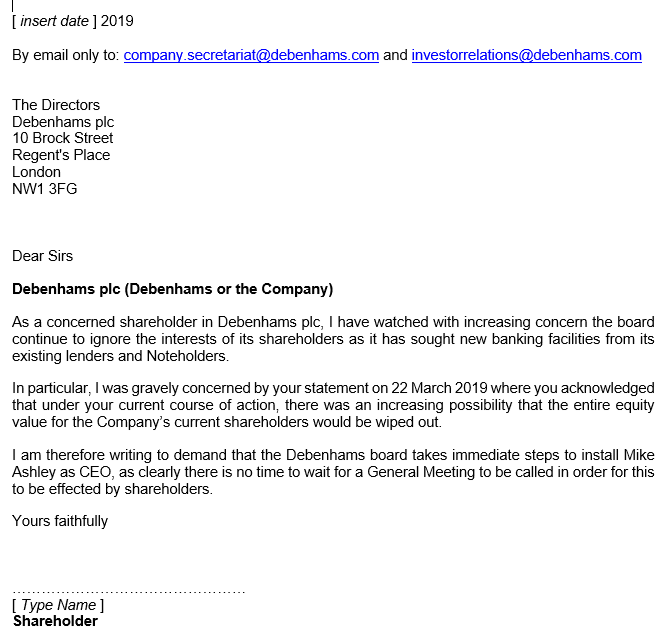

Sports Direct is encouraging other DEB shareholders to write to the DEB Board, using this template, which has been published on the Sports Direct website;

It's all looking rather desperate, and pretty amateurish. Several of the previous SPD announcements have been notable for being poorly written. It just feels like Mike Ashley is thrashing around, trying to salvage something from one of his many very poor investments in other retailers.

There was an interesting article in the Telegraph over the weekend, detailing the extensive, and seemingly haphazard investments he has made, managing to blow £300m in the process.

Genius retailer, or out-of-control egomaniac? You decide.

It looks to me as if the bondholders holding a gun to the heads of DEB's Board, makes it more likely they will succeed. In these situations, bondholders usually win, because debt ranks above equity in distressed situations. But who knows? It's interesting to watch from the sidelines, but definitely not a share I would go near.

Renew Holdings (LON:RNWH)

Share price: 403p (little change today, at 09:22)

No. shares: 75.3m

Market cap: £303.5m

Renew (AIM: RNWH), the Engineering Services Group supporting UK infrastructure, announces an update on trading in advance of the interim results for the half year ended 31 March 2019.

Trading - it's an in line update today;

Group trading in the period was ahead of the previous financial year and in-line with forecasts. The Board remains confident in achieving its expectations for the full year.

Trading in the Engineering Services division has been strong whilst Specialist Building activities have reduced, as expected, due to our continued approach to contract selectivity.

Net debt is as expected now, and anticipated to be in line for the year end (end Sept 2019).

Order book - also as expected;

The Group's order book continues to be underpinned by long-term framework positions, including new awards during the first half of the year, and is expected to be in-line with that reported at our AGM in January.

My opinion - I cannot see any attraction to investing in this sector, given that so many companies go badly wrong.

My concerns over the balance sheet remain valid - it's very weak. The last reported balance sheet had negative NTAV of -£46m. The working capital position looks precarious. The business seems to be financed by up-front cash receipts from customers. I don't like that one bit. The risk is that, after so many insolvencies in this sector, the Govt might insist on contractors having stronger balance sheets.

Renew seems to have done a good job in avoiding any disastrous contract losses. It has also gradually increased its operating profit margin over the years. But why would you want to own shares in this company? A PER of 10 isn't especially cheap (given the weak balance sheet), and dividends are nothing to write home about.

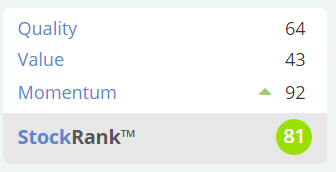

The Stockopedia computers are more upbeat though;

Instem (LON:INS)

Share price: 314p (up 2.6% today, at 10:13)

No. shares: 16.2m

Market cap: £50.9m

Instem (AIM: INS.L), a leading provider of IT solutions to the global early development healthcare market, announces its unaudited full year results for the year ended 31 December 2018.

I'm not familiar with this software company. At a glance, the headline figures look good.

Adjusted*** fully diluted earnings per share of 15.5p (2017 restated*: 11.0p)

That rates the share on a PER of 20.3 - a punchy rating for a small cap in the current market.

Outlook - sounds positive;

We are very pleased with the performance of the business during 2018 with regulatory requirements delivering the expected significant increase in demand for our technology enabled outsourced services.

Growth was also particularly strong in the Asia-Pacific region, with bookings up 37% on the prior year, primarily attributable to the continuing funding of pharmaceutical Research & Development by the Chinese government.

With increasing momentum in the business from recent contract wins and the growing pipeline, we are confident about the outlook for the Group for 2019 and beyond.

While our strategy remains focused on Instem's strong organic revenue growth, expanding operational gearing and improving positive cashflow, management will continue to consider complementary acquisition targets to further develop our position as a market leading provider of IT solutions to the global life sciences market.

Lots of positive phrases above, which I've bolded.

Balance sheet - not great. It's all intangibles basically. Take those out, and the NTAV is slightly negative.

Note there is a pension deficit of £2.2m.

My opinion - if you understand this sector, then this could be an interesting share to research. I wouldn't know where to start. Based on the positive figures, and upbeat outlook, the company seems to have the wind in its sails.

It's certainly been a good share to have held over the last 2 years, unlike so many other small caps;

Low & Bonar (LON:LWB)

Share price: 13.6p (down 20% on the day, at market close)

No. shares: 689.8m

Market cap: £93.8m

Trading update (profit warning)

Low & Bonar PLC ("the Group"), the international performance materials group, today issues a trading update for the period since 30 November 2018.

[note that the group's financial year end is 30 Nov, so this is an update for the first few months of FY 11/2019 - Paul]

Hmmm, this looks like a complicated situation;

As set out in January in the Group's 2018 financial results announcement, 2019 is expected to be a year of transition as the Group simplifies its portfolio and structure and works on resolving legacy issues to improve operational performance, following the successful equity fundraising that was completed in February.

Disposals - are in progress;

The planned divestment of the Civil Engineering ("CE") division is proceeding well, with sale processes for the two businesses in this division, Construction Fibres and Needle-Punched Non-Wovens, progressing positively. Both of these processes are expected to conclude during the current financial year, and the division has continued to trade in line with expectations.

During the quarter, the Group completed the exit from the Bonar Natpet joint venture in Saudi Arabia.

Continuing operations - are not trading well;

As a result of reduced volumes, Group revenues in the first quarter were below prior year levels and management's expectations. A temporary increase in inventory as a result of the lower sales will be addressed during the year as part of a continued focus on working capital.

Overall, despite some benefit from lower raw material costs, the weaker revenues and some manufacturing inefficiencies contributed to lower than expected profitability in the quarter, which the Board expects will have an impact on full year performance.

Outlook - improving trends are hoped for, later in 2019. Uncertainties are mentioned.

Fundraising - the group recently decided to strengthen its balance sheet, with a £50m (after costs) equity raise at 15p per share. That was definitely necessary, I've been saying for years that the balance sheet here has too much bank debt. This raise doesn't resolve the issues fully, but certainly helps.

Results - for FY 11/2018 are not good. In summary;

- Underlying operating profit fell 45% to £16.7m.

- Net debt of £128.5m was way too high (albeit since reduced by £50m)

- £58.9m of exceptionals, mainly writing off goodwill - value destruction from previous acquisitions, in other words, belatedly recognised

My opinion - it's all down to whether management can turn around the business successfully. It looks quite a large, and complex group, with all sorts of problems. I prefer to invest in smaller, more simple businesses, where everything is running smoothly.

It's almost impossible for private investors to assess what the prospects are for this group. So how can we value the shares? It's too much of a leap into the unknown for me, even though it looks a lot of business for under £100m market cap.

It's not clear to me what competitive edge this business has (if any), and whether competitors might be squeezing it? Altogether, this is just outside my ability to assess whether or not the shares might be a good investment or not. Hence I'll steer clear.

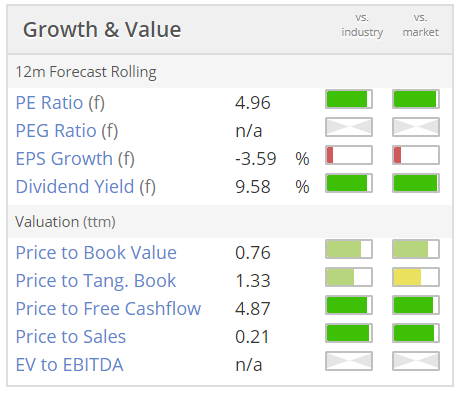

When the forward PER, and dividend yield are this cheap, it nearly always means that there's something wrong (i.e. the numbers are not likely to be achieved);

All done now.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.