Good morning, it's Paul here.

My plan today is to set aside some time to catch up on a few things that I missed earlier in the week. In addition to reporting on today's news too, of course.

Move to subscriber-only editorial

Most readers here are subscribers. We got one or two negative, and inaccurate reader comments yesterday, complaining about the move to put all editorial here behind the pay wall, w.e.f. next Saturday.

To prevent any more misunderstandings, Ed explains here why this decision has been taken. It's worth a read, as he also updates us on other improvements to Stockopedia.

A couple of small acquisitions are announced;

Begbies Traynor (LON:BEG) is acquiring a profitable, small firm of chartered surveyors. The deal looks sensibly structured, with a 3-year earn-out on stretch targets. I like BEG's strategy of developing its property services division. This generates some growth, which is lacking in its core insolvency division.

Scientific Digital Imaging (LON:SDI) is acquiring a small but profitable, complementary business here. Again, not material.

Treatt (LON:TET)

Share price: 392.5p (up 1%, pre-market open)

No. shares: 58.8m

Market cap: £230.8m

Treatt, the manufacturer and supplier of innovative ingredient solutions for the flavour, fragrance, beverage and consumer product industries today publishes a trading update for the half year ended 31 March 2019 (the "Period").

Nothing madly exciting here, it's an in line update (right at the end, in the outlook section);

... the Board, therefore, continues to believe that profit before tax and exceptional items will be in line with its expectations for the financial year ending 30 September 2019.

Other points sound reassuring overall;

- H1 revenues up 7%

- Encouraging opportunity pipeline

- New $14m US facility, completed in Mar 2019, will be fully operational by June 2019

- UK relocation, costing £35m, due to start summer 2019, occupancy due to begin in summer 2020

- Forex hit of £0.6m - doesn't really matter, as it's swings & roundabouts

My opinion - there could be a good opportunity here. It's not cheap, on about 20 times forecast earnings, but that doesn't include upside from the major new production facilities it is creating.

The new facilities could increase margins (from more efficient manufacturing), and also increase capacity (hence revenues & profits, if there is currently unmet demand). I think these are the key issues to focus on, when researching this company further.

Lord Lee was (and I presume still is), very keen on this company, rating it & management highly. Long-term I think it looks a potential winner, if the new facilities work out well.

EDIT: I've just confirmed with Lord Lee that, yes he is still very keen on Treatt, and it remains his largest personal shareholding. End of EDIT.

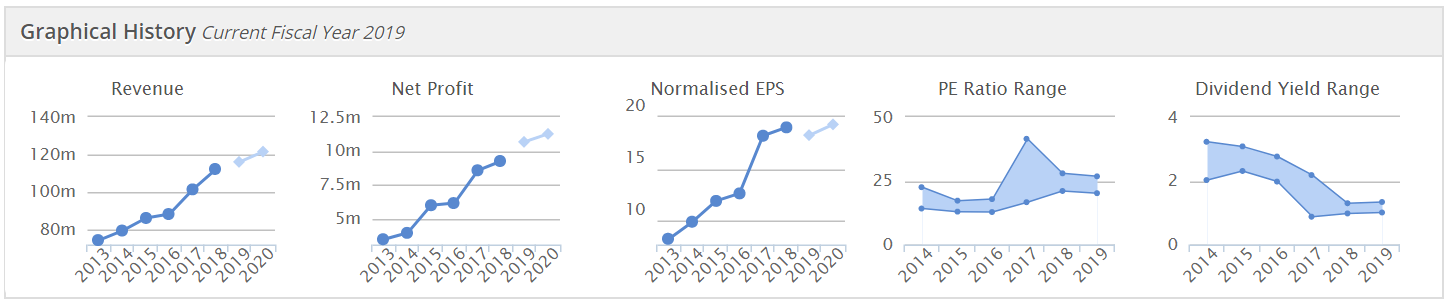

The progression of profits & EPS looks excellent. Heavy capex now & into 2020, should hopefully deliver considerably higher profits in future. It would be worth getting hold of some broker research on the expansion underway;

Motorpoint (LON:MOTR)

Share price: 190p (pre-market open)

No. shares: 96.1m

Market cap: £182.6m

Motorpoint Group PLC, the UK's largest independent vehicle retailer, is pleased to announce the following trading update ahead of its preliminary results for the year ended 31 March 2019 ("FY19").

Business model - I like the business model of car supermarkets - large sites, selling secondhand cars only, at competitive prices. The StockReport shows that it generates c.£1bn in revenues, on just £8m of fixed assets. That's disruptive towards conventional car dealers, with higher fixed costs. Also, it's a simple model to roll out. So a thumbs up from me, for the basic concept. The main downside is probably that there are few barriers to entry for competitors.

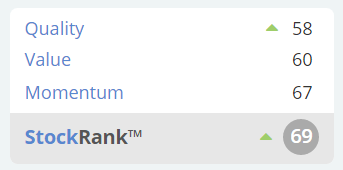

The StockRank is fairly healthy too, so no alarm bells here;

I hardly ever mention the 4 indicators on the StockReport, but after prompting from Graham, think I'll refer to these items more often in future;

3 of these 4 indicators look fine, but the Beneish M-Score is flagging a "High" risk of earnings manipulation. More details are here. I've never really looked into the M-score, but will check it out properly when time permits. Stockopedia obviously thinks it's important, or it wouldn't be on the StockReports.

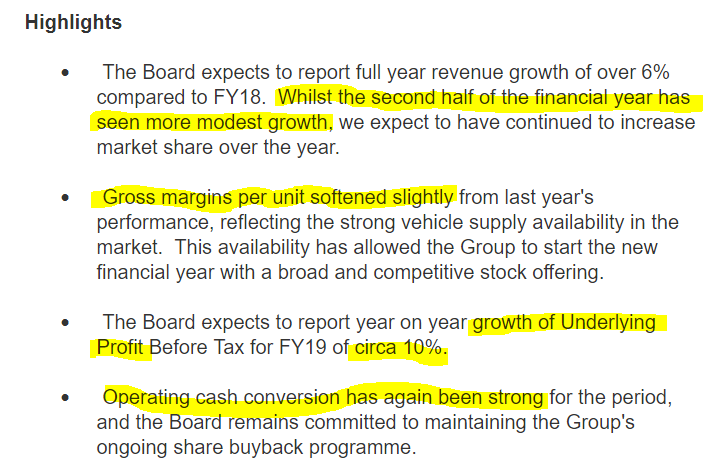

Trading update - this sounds a little soft to me, but not a disaster by any means;

It depends what the market was expecting. Stockopedia shows broker consensus forecast for FY 03/2019 net profit (which is after tax) up nearly 19% (£19m vs £16m).

Looking on Research Tree, a broker note from Nov 2017 is the most recent currently (although I expect there will be new note there later today) suggests that underlying profit before tax was forecast to grow nearly 16%. Therefore today's announcement looks like a profits miss - achieving +10% growth in aPBT, below the +16% forecast growth in aPBT.

Cash conversion - is always likely to be strong, as secondhand cars are sold for cash or external finance. So I would expect the cash to come in instantly, before cars are released to the buyers.

Valuation - was already modest, as the share price has been drifting down over the last year. However, that doesn't seem to matter at the moment. In this bearish-feeling small caps market, disappointments seem to often be punished quite hard.

Outlook comments are cautious.

I'm not sure what this means - could do with some clarification on this;

... In spite of this the Board expects to make further progress in revenue and underlying profit, but notes that there will be a c£2m (non-cash) profit headwind in FY20 compared to FY19 from historic deferred extended guarantee income.

My opinion - if the share price is really slammed hard today, that might present a buying opportunity. This strikes me as a sound business, with a decent business model, modestly priced.

Divis are pretty good too, at over 4%, and growth should come from rolling out more sites. It is planning on opening one new site, which will take the total to 13. There must be scope for many more in the UK.

Creo Medical (LON:CREO)

Share price: 192p (down 3% today, at 11:42)

No. shares: 121.5m

Market cap: £233.3m

Creo Medical Group plc (AIM: CREO), a medical device company focused on the emerging field of surgical endoscopy, announces its audited results for the 18 months ended 31 December 2018, in line with management expectations.

This is just a quick section, to get something into the archive here for future reference. This is not the type of share I would normally report on.

Revenues - nil - I don't usually invest in any pre-revenues companies, because very few of them deliver on the business plan sold to investors

Losses & cash burn - this seems very well-funded after a big fundraising;

· Cash and cash equivalents of £44.6m at 31 December 2018 (30 June 2017: £13.7m)

· Operating loss of £17.7m (12 months to 30 June 2017: £8.9m) including £1.8m share based payments, in line with management expectations

· Underlying operating loss of £12.6m (12 months to 30 June 2017: £5.6m)

The previous 18 months reflect a period of considerable progress in the development and path to commercial launch for the Company's CROMA Advanced Energy platform and Speedboat device for use in Gastrointestinal ("GI") therapeutic endoscopy, the first in a suite of products being developed for the CROMA platform.

My opinion - the £233m market cap suggests that some investors think this is going to be the next big thing. I've no way of knowing whether this is likely to work or not, so it's not for me.

Tricorn (LON:TCN)

Share price: 19p (up 19% today, at 12:54 today)

No. shares: 33.8m

Market cap: £6.4m

Tricorn Group plc (AIM: TCN.L), the AIM listed tube manipulation specialist, provides the following pre-close trading update for the financial year ended 31 March 2019 (the "Year").

I wouldn't normally mention something this small. However, a couple of readers have expressed interest, and it's up 19% in price, so there must be something potentially interesting going on.

Revenue up 2.5% on prior year. LY was £22.18m, so that's £22.73m for FY 03/2019

Adjusted PBT for the Group is expected to be around 30 per cent. up on the previous year. This looks good. The FY 03/2018 results report underlying profit before tax at £0.83m. Assuming that adjusted, and underlying, mean the same thing, then a 30% uplift gives us c.£1.08m adj profit for FY 03/2019. It did £553k of that in H1, so H2 is about the same. Therefore this looks to be a continuation of the improved H1 performance, rather than a further improvement.

That's consistent with the outlook comments at the interim stage, which said;

Over the past two years, we have seen significant growth in our end markets. However, towards the end of the period, we witnessed signs of this growth slowing. Against this background, and after considering the impact of new business wins, the Board anticipates Group revenues in the second half to be similar to the first and full year underlying profit before tax to be in line with market expectations."

[taken from RNS dated 5 Dec 2018]

Broker update - there's a one-pager out this morning, available on Research Tree. It confirms that results are as expected, so no changes to forecasts.

Balance sheet - had £3.3m net debt as last reported at 30 Sept 2018. This is funding the gap between inventories+ receivables, less trade creditors. It's not unusual to use bank debt to part-fund working capital, but it's better to be debt-free.

The 2018 Annual Report shows £1.34m of land & buildings within fixed assets, at cost. It would be interesting to find out if this is valuable property, worth more than book value, or not.

My opinion - it's difficult to get excited about this - a small engineering group, with a bit too much debt, is not going to attract a high rating. Once you get below £10m market cap, you have to be very careful about de-listing risk. That can hit the share price by 50% instantly, if the company announces it's going private. Do the listing costs make sense for a group with a market cap of only £6m? Is there any liquidity in the shares (probably not much)?

On the upside, it is generating solid profits now, which over time should help reduce debts. I see that divis are re-starting too, after a 5-year absence. If revenues can grow further, then operational gearing could improve profits further, on a geared basis.

It doesn't really float my boat, but it's almost certainly one of the better companies at a sub £10m market cap.

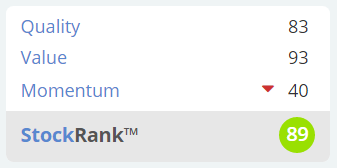

Stockopedia's computers really like it;

This section is from Monday's report, which I have now finished. Here is a copy of the new section;

Low & Bonar (LON:LWB)

Share price: 13.6p (down 20% on the day, at market close)

No. shares: 689.8m

Market cap: £93.8m

Trading update (profit warning)

Low & Bonar PLC ("the Group"), the international performance materials group, today issues a trading update for the period since 30 November 2018.

[note that the group's financial year end is 30 Nov, so this is an update for the first few months of FY 11/2019 - Paul]

Hmmm, this looks like a complicated situation;

As set out in January in the Group's 2018 financial results announcement, 2019 is expected to be a year of transition as the Group simplifies its portfolio and structure and works on resolving legacy issues to improve operational performance, following the successful equity fundraising that was completed in February.

Disposals - are in progress;

planned divestment of the Civil Engineering ("CE") division is proceeding well, with sale processes for the two businesses in this division, Construction Fibres and Needle-Punched Non-Wovens, progressing positively. Both of these processes are expected to conclude during the current financial year, and the division has continued to trade in line with expectations.

>span class="al">During the quarter, the Group completed the exit from the Bonar Natpet joint venture in Saudi Arabia.

Continuing operations - are not trading well;

As a result of reduced volumes, Group revenues in the first quarter were below prior year levels and management's expectations. A temporary increase in inventory as a result of the lower sales will be addressed during the year as part of a continued focus on working capital.

Overall, despite some benefit from lower raw material costs, the weaker revenues and some manufacturing inefficiencies contributed to lower than expected profitability in the quarter, which the Board expects will have an impact on full year performance.

Outlook - improving trends are hoped for, later in 2019. Uncertainties are mentioned.

Fundraising - the group recently decided to strengthen its balance sheet, with a £50m (after costs) equity raise at 15p per share. That was definitely necessary, I've been saying for years that the balance sheet here has too much bank debt. This raise doesn't resolve the issues fully, but certainly helps.

Results - for FY 11/2018 are not good. In summary;

- Underlying operating profit fell 45% to £16.7m.

- Net debt of £128.5m was way too high (albeit since reduced by £50m)

- £58.9m of exceptionals, mainly writing off goodwill - value destruction from previous acquisitions, in other words, belatedly recognised

My opinion - it's all down to whether management can turn around the business successfully. It looks quite a large, and complex group, with all sorts of problems. I prefer to invest in smaller, more simple businesses, where everything is running smoothly.

It's almost impossible for private investors to assess what the prospects are for this group. So how can we value the shares? It's too much of a leap into the unknown for me, even though it looks a lot of business for under £100m market cap.

It's not clear to me what competitive edge this business has (if any), and whether competitors might be squeezing it? Altogether, this is just outside my ability to assess whether or not the shares might be a good investment or not. Hence I'll steer clear.

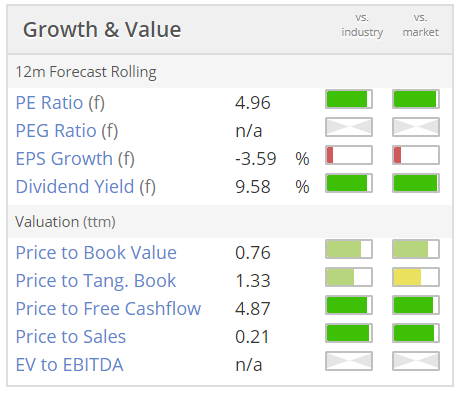

When the forward PER, and dividend yield are this cheap, it nearly always means that there's something wrong (i.e. the numbers are not likely to be achieved);

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.