Morning!

This list is final.

- Property Franchise (LON:TPFG)

- Be Heard (LON:BHRD)

- Next (LON:NXT)

- Elektron Technology (LON:EKT)

- Some snippets on other stocks.

Property Franchise (LON:TPFG)

- Share price: 169.5p (+2%)

- No. of shares: 26 million

- Market cap: £44 million

(I have a long position in TPFG.)

Half Year Trading Update and Directorate Change

This is a collection of estate agent brands, from whom TPFG collects management service fees, which we can think of as royalties. The standout brand is probably Martin & Co. It also has a small, hybrid agency called Ewemove (like Purplebricks (LON:PURP), but much smaller and managed more carefully).

I've had a tiny stake in TPFG since April, to give me a chance to study it more fully and decide if I want to promote it to a full-size position. Please note that these shares are illiquid - if you take out the top shareholders, what's left for private investors is tiny.

Also, the dividend yield is quite high (>5%), which creates a tax problem for me. So I'm probably just going to keep my tiny stake in it, for now. I'll have to reflect on it some more.

Apart from paying too much for the acquisition of Ewemove, it has been disciplined when it comes to capital allocation and has generated a nice stream of cash flows for shareholders.

Today's update shows a small increase in total revenues. Reduced sales market activity has been offset by improvements in lettings and by 11% growth at Ewemove.

Within total revenues, management service fees are "the Group's key, recurring revenue stream", and these are up from £4.4 million to £4.6 million. Trading is in line with expectations.

Balance sheet and cash flows are a big attraction with this one. Despite paying out healthy dividends, TPFG's cash position has increased by £2.3 million to £2.8 million over the past 12 months.

CEO retirement - the long-standing CEO intends to retire at the end of the calendar year 2020, giving TPFG 17 months to find a replacement. This is a great length of time to work on the succession plan and it reflects well on him that he has given so much notice.

Tenant fee ban - a few words on this:

Although we have yet to see the full impact of the tenant fee ban which came into force on 1st June 2019, we are confident of the actions being undertaken by our franchise network to mitigate the impact on revenues.

My view

I liked it before, and I still like it now.

There are few wrinkles to work out in the short-term, such as the tenant fee ban and current trends in the property market. My sense is that TPFG will ride out these issues, but you may disagree!

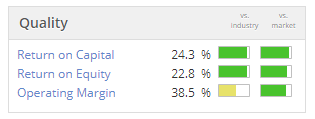

Please note that the StockRanks positively adore it, giving it a QualityRank of 99 and an overall StockRank of 98. I guess the computers have noticed things like the very high ROCE, high dividend yield, excellent cash flows, etc.

It passes three screens related to dividends and cash flows and gets a Magic Formula score of A+, indicating that it's a high-quality business which is also quite cheap.

Be Heard (LON:BHRD)

- Share price: 0.925p (unch.)

- No. of shares: 1.25 billion

- Market cap: £11.5 million

Update re Share Issue, Option Grant & PDMR Holding

I want to be sensitive about this, since many companies operate this way. But I'd like to point out Be Heard's bonus scheme as an example of a plan which is not ideal for investors.

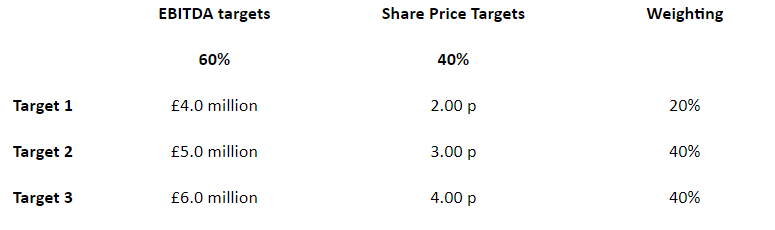

Nearly 100 million share options have been granted under Be Heard's LTIP, with the following targets for vesting:

We haven't got all the details of the plan yet - for example, I don't know when the options expire.

We also don't know how acquisitions will be treated. All we know is that the RemCom can "amend targets to reflect such matters as acquisitions and disposals".

The real problems here are:

- EBITDA is a fluffly metric that can be driven higher through shareholder dilution, excessive risk-taking and the bloating of the balance sheet.

- Boosting the share price, perhaps temporarily, doesn't do a lot for people who don't sell their shares (i.e. it doesn't do a lot for long-term shareholders).

- The options being granted are nil-cost. If they were priced at the current level, managers would be rewarded more proportionally to the additional value they create. Instead, they will get 2p in value if they can boost the share by a little over 1p from the current level (by hitting Target 1). In this sense, they are "leveraged" to the BHRD share price.

I don't want to criticise Be Heard too harshly, since they are not alone - many companies have schemes which work this way.

I will also say in their defense that the targets are stretching, and might be very difficult to achieve. So it's not all bad. Management could do a terrific job for shareholders in future years, despite having the type of bonus scheme which I try to avoid in my companies. I'm not writing off the company's prospects or its managers purely on the basis of a less-than-ideal bonus scheme.

Having said all of that, there are plenty of other companies which do have very sensible schemes, and I think they deserve to be rewarded for this.

Comparison - If I look at TPFG's option scheme, by contrast, there is a clean and simple target for management to grow the company's adjusted EPS by at least 15%, with the reward increasing the more they grow EPS.

While this scheme isn't perfect either (for example, the options are effectively nil-cost), the adjusted EPS metric has a much stronger relationship with real shareholder returns than EBITDA. And TPFG managers also don't need to worry about the share price, which I think is only right. So purely on the basis of the format of their respective bonus schemes, I'd much rather be involved with TPFG.

This is the type of thing that is worth checking with your portfolio companies, to understand how your CEOs and other managers are incentivised.

Next (LON:NXT)

- Share price: 6105p (+9%)

- No. of shares: 133.6 million

- Market cap: £8,160 million

(I have a long position in NXT.)

This is definitely not a small-cap, and it's in Paul's area of expertise. However, since I'm invested in it, I might as well say a few words!

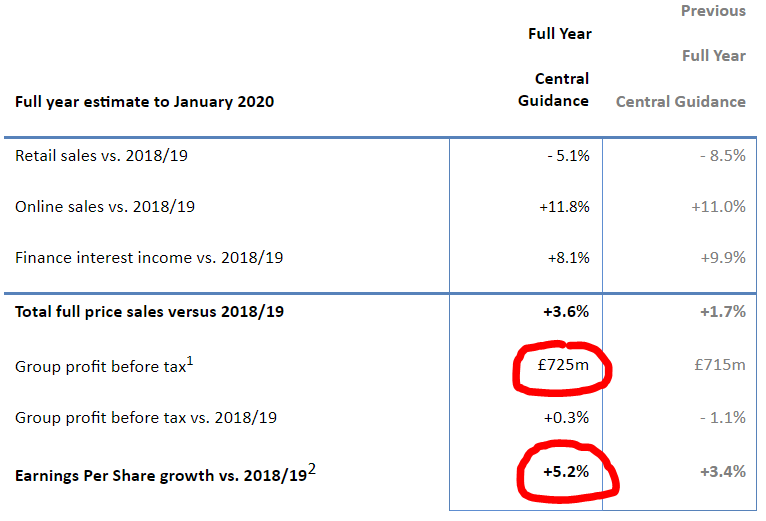

We have a small nudge up in full-year guidance after Q2 turned out to be quite a bit better than anticipated. Instead of a 0.5% reduction in full-price sales and interest income, as expected, Next enjoyed a 4.0% increase.

This comes on the back of a very strong July, which Next warns was related to "lower markdown sales in our end-of-season Sale", which it does not think is a good measurement of underlying growth.

I like the way that the company is always very prudent and manages investor expectations, so that we don't get too excited (and then subsequently get disappointed!).

The market cap has increased by some £650 million, which feels like an over-reaction in comparison to a £10 million improvement in PBT, but I guess this is the joy of a re-rating. Investors are happy to give it a better multiple, now that it shows a little growth in EPS which isn't driven only by the reduction in its share count.

My view - this has been a pleasant holding for me. I expect that I will continue holding it for the foreseeable future, on the basis that it can close a great many of its physical stores if necessary, and will continue to lead the way in mainstream clothes retailing.

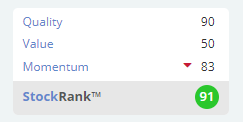

The StockRanks share my sunny outlook:

Elektron Technology (LON:EKT)

- Share price: 53p (+8%)

- No. of shares: 186 million

- Market cap: £99 million

Sale of Elektron Technology Limited

All change here. The main subsidiary, Bulgin, is being sold for £105 million in cash, leaving £94 million for shareholders.

This bit of small print is important:

The Board has taken specific advice on the structure of the Proposed Transaction and has been advised that the sale of the shares in ETUK pursuant to the SPA should qualify for Substantial Shareholding Exemption (as defined in the Taxation of Chargeable Gains Act 1992) and as such no taxation should arise.

(Rather than wading through the announcement, I simply used Ctrl+F to search for "tax").

Now that I've figured out the tax situation, the next question is: what will EKT do with the money?

The answer: a tender offer.

The Board, subject to applicable Company law, currently expects to return the significant majority of the cash by providing Shareholders the opportunity to sell a proportion of their shares back to the Company by carrying out a tender offer.

EKT thinks that 65p is the fair value of its shares, but will do the tender offer at a different price depending on its prevailing share price and on the result of consultations with shareholders.

The group will be renamed Checkit plc and it will change its ticker to CKT.

My view

It's tempting to speculate on this. We could buy shares today around 53p (plus the spread), then sell as many as possible in the tender offer at 65p. Perhaps we could sell most of them at 65p, and get rid of the rest of them in the market around breakeven?

The problem with this plan is that none of it is certain: it's impossible to know in advance how many shares it will be possible to sell at 65p, or if 65p will even be the price of the tender offer. So we have to look at what else this stock offers.

The primary remaining subsidiary, Checkit, reported sales of £1 million in FY 2019, and an operating loss of £4.5 million. Personally, this is too early-stage for me, so I would not be comfortable holding it.

There is another business, Electron Eye Technology, for which a buyer is being sought. It just reported sales of £2.6 million, and is around breakeven in terms of profitability.

I do suspect that the outlook is positive for shareholders from the current level, since Checkit and Elektron Eye, ignoring the effects of today's deal, could be worth more than £5 million together. That's their value implied by a £99 million market cap and a £94 million cash balance.

However, I can't quite convince myself that this is a good arbitrage opportunity. Not all of the disposal proceeds will be returned to shareholders: the remainder will be reinvested into Checkit.

So everything hinges on Checkit now. If you like it, then you should love the opportunity to buy EKT shares around current levels.

If you're not sure, like me, then you will sit on your hands.

Let's finish up with some snippets.

Thalassa Holdings (LON:THAL)

Thalassa subsidiary initial FinTech acquisition

This investment vehicle makes an acquisition - let's brace ourselves for something weird.

Indeed, there is something unusual about the deal. Thalassa's Chairman is extremely clever when it comes to navigating international legal systems, and is using a "share-for-share" transaction format in Switzerland. So no cash will change hands, except perhaps to the Swiss taxman.

The investees will give up 80% of their company in exchange for 20% of a Thalassa subsidiary. Why would they want to do this?

Digging into it a little bit, I see that that the investee's VAT obligations only started this year, which makes sense as a company with a similar name and the same directors was also founded this year according to LinkedIn. It's a raw startup, in other words, with only a handful of employees. You can see it has started a website here.

I would therefore suggest that the $7 million valuation notionally attached to it by this deal is an imaginary number. I wonder how it will be treated in Thalassa's accounts?

Dignity (LON:DTY)

This is in small-cap territory and reports a stabilised share of the funeral market since 2018 year-end. FY June 2019 operating profit is £28 million, not bad vs. £280 million market cap.

Net debt is £500 million, and the performance of its covenant on Secured Notes is worrying (actual debt service coverage is 2.05x, versus a minimum of 1.5x in the covenant).

Argo (LON:ARGO)

This Cypriot fund manager reports net assets of $22 million. For those with way too much time on your hands, have fun working out if it's "value" at a market cap of £8 million!

Out of time for today, thanks everyone for your input!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.