Good morning!

There are not any backlog things for me to write about, so this article will appear blank for the morning - so subscribers can add comments as usual.

Managing expectations - the main body of this article will appear during Friday afternoon, section by section, and will be done by 6pm. If that changes, I'll update this introduction accordingly. I'm sorry if it annoys people that I haven't finished each article by 1pm, but that's just how it is. I'd rather take my time, and write something worth reading, with some thought having gone into it, than rushing for deadlines.

Thanks for bearing with me. You now have my undivided attention for the rest of the day.

Update at 16:40 - today's report is now complete.

Sanderson (LON:SND)

Share price: 140p

No. shares: 60.5m

Market cap: £84.7m

In my view, this bid undervalues the company, and was at an insufficient premium. Although the share price did have a nice run upwards in the months before the bid.

Today the bidder, Aptean, says it has got irrevocable undertakings and letters of intent over 49% of the company's shares. That seems a bit lacklustre, clearly some shareholders are not impressed with the 140p offer. So it's not necessarily a done deal yet.

Why did management recommend a bid at such a modest premium? The deal might be driven by institutions wanting an exit? (as it's too illiquid to allow Instis to sell in the market). A city contact told me this week that small cap fund managers are worrying about liquidity, after the Woodford fiasco, nobody else wants to get caught out holding lots of illiquid stocks, whilst facing client redemptions. That's an interesting point, and sounds plausible to me.

The risk is that, if the bid falls through, then the share price could tank back down to 100p maybe.

My own experience of takeover bids is usually very good, I've had lots of them over the years, including once amazingly, when I had three on the same day! Wish I could remember the details of what they were, but I definitely didn't imagine it.

Then there was the debacle with Revolution Bars (LON:RBG) (in which I hold a long position) where a (with hindsight, generous) cash bid at 203p was rejected by major shareholders, pushing for more. The share price has since ground down to only 63p (far too cheap in my view, but let's reserve proper judgement until the imminent trading update).

It's very rare for an agreed bid to fall through, but that's what happened at RBG. Given that I lost my shirt on that (but am hopeful of getting at least some of it back!), these days I tend to play it safer with takeover bids, as follows;

If it's a large position in my portfolio, then I would probably sell half, to lock in the gains, in case it falls through.

If it's a small position in my portfolio, the I would normally hold, as sometimes a higher competing offer comes along (Lavendon was a good example of that, a few years ago).

Whatever you decide, good luck to holders!

Burford Capital (LON:BUR)

Share price: 859 (up 13% today, at 14:12)

No. shares: 218.6m

Market cap: £1,877.8m

This shorting attack by Muddy Waters has been by far the biggest story of the week, and tremendously exciting to watch - although I don't suppose shareholders enjoyed this week very much.

I reviewed Burford's rebuttal document here in yesterday's SCVR. It comes across very well, I think - giving plausible-sounding explanations to refute Muddy Water's claims. Similarly, I tuned in to the conference call yesterday afternoon, but had enough after about 90 minutes. Again, management seemed thorough in their answers, and give the impression of being determined to restore theirs and the company's reputation. Subjectively, it seemed to me that management were giving honest answers, and didn't seem to be hiding anything.

It seems fairly clear that Burford is likely to take Muddy Waters to court, over what it seems as market manipulation. I think that's probably a good thing. Shorting dossiers are fine if they reveal a fraud, like the many Chinese companies, and others like Globo, and Quindell.

However, if they try to deliberately trigger a plunge in share price, by putting out a dossier that turns out to be full of inaccuracies & misrepresentations, then the shorter looks, prima facie, guilty of market manipulation.

All that remains now is how to value BUR? Given that current huge profits are probably not sustainable, due to the big cases eventually settling, then a PER basis is problematic. I would suggest valuing it on a multiple of NAV. At 850p per share right now, the market cap is £1.86bn. Its last reported NTAV was $1,420m (which I've calculated as $1,567m NAV, less $134m goodwill and $13m intangibles).

That works out as at NTAV of £1,176m when coverted into sterling at £1=$1.207. Therefore, at 850p the share price is at a 58% premium to NTAV. That seems a bit steep if anything, to my mind, given that the company forward books a lot of the profits on cases in progress. Therefore, on valuation grounds, I'm not interested in buying any shares here.

One of the questioners on the conference call yesterday made the interesting point that even experts find this company difficult to understand. So is it a suitable investment for private investors (shares or bonds)? Probably not, especially after the extreme volatility we've seen this week.

Opinions differ on how to see the concentration of profits into the top 4 cases. A bull would say that the company showed how canny it was in identifying these lucrative cases, deserving a premium share price. A sceptic might point out that once the big cases end, then there's no guarantee the company will be able to replace them, hence profits would fall because margins on smaller cases are lower.

What an interesting situation! I really don't have a strong opinion either way.

A key point to research, is what are the terms of the borrowing facilities Burford uses? Management said they have something like $400m in cash on hand, if I heard that correctly on the conference call. So it sounds as if there are no cash problems. However, that could change if debt facilities were withdrawn. Therefore, bulls on this stock would need to (and some probably already have) checked what the terms of the debt are. If the debt is secure, then there's no problem.

On The Beach (OTB)

Share price: 380p (down c.15% today, at 16:02)

No. shares: 131.2m

Market cap: £498.6m

Trading update (profit warning)

the UK's leading online retailer for beach holidays...

The company has been caught out by not hedging currencies (which seems surprising given the nature of its business). Weak sterling has therefore hit margins.

As a result, the Group anticipates delivering a full year performance below the Board's expectations.

Other points;

- Accelerating recruitment of "digital talent" into new Manchester head office. It's interesting to note that Manchester & surrounding areas seem to be becoming a hub for eCommerce businesses, and I believe there's something of a residential property boom going on there too

- Acquisition of Classic Collection Holidays - this sounds like a startup holiday portal for travel agents to use. This sounds quite interesting;

We expect that by the end of FY19, more than 1,500 agents will be using the platform and are confident that this new channel will deliver a meaningful contribution to Group performance in FY20.

- Long haul flights being increased - up over 100% in FY 09/2019

- International platforms still loss-making, but improved

- Exploring acquisition opportunities

My opinion - there's some interesting stuff above.

Not hedging currencies seems a strange policy for a travel business. Still, over the long-term forex movements are swings & roundabouts.

I can't find any broker updates on this, so am not sure how much profits are likely to be down.

I have a positive view of this share - it seems to be a reasonably-priced growth company. Forex & Brexit are passing issues, so shouldn't really bother long term shareholders. If the price carries on declining, then I'm minded to see that as a potential buying opportunity.

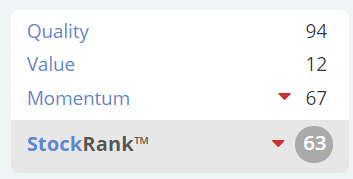

Stockopedia sees it as a very high quality business, but not cheap (which is quite surprising, as it looks cheapish to me, for a growing, online business);

EDIT: there's an interesting reader comment below from paraic84, who reckons that acquisitions have been flattering the growth, and the the core business isn't growing. That certainly needs looking into, for anyone considering buying this share.

Pennant International (LON:PEN)

Share price: 55p (down 29% today, at 16:06)

No. shares: 36.1m

Market cap: £19.9m

Trading update (profit warning)

Pennant International Group plc ("Pennant", the "Group", or the "Company"), the AIM quoted supplier of integrated training and support solutions, products and services which train and assist operators and maintainers in the defence and regulated civilian sectors, announces the following trading update ahead of the publication of its Interim Results for the six months ended 30 June 2019 (the "First Half", or "H1 2019") which are scheduled to be released on 24 September 2019.

I'm looking back at previous announcements, to get up to speed on this company.

Results for FY 12/2018 (published on 12 Mar 2019) look strong. Outlook comments said that FY 12/2019 would be significantly H2-weighted. Encouraging start to the new year. Order book of £37m provides good visibility.

A worrying update was issued on 2 May 2019, saying that a major contract had been delayed. Despite this, the company said no change to FY 12/2019 expectations (which seems odd, with hindsight).

Today's update - says that H1 has turned out better than expected;

The Company expects to report results for the First Half which are slightly better than management's expectations, with revenues of £7.25 million and an EBITA loss of £(1.49) million. Net cash stood at approximately £(0.35) million at the end of H1 2019.

H2 outlook - has deteriorated, due to contract delays;

With the change to revenue expectations on the Ajax programme and in the Aviation Skills Partnership business, together with the timeline for the award of certain potential contracts moving into 2020, the Group now expects its results for 2019 to be materially lower than current market expectations and anticipates reporting EBITA for 2019 as a whole of £1.8 million. The Group has more than adequate working capital facilities for the next period and beyond.

That looks to be quite a big profit miss. Stockopedia is showing £3.5m in net profit forecast for this year, which would be about £4m pre-tax.

However, as management admit in the comments today, this is just the nature of their business - large, lumpy projects, subject to delays, due to factors outside the company's control. Investors just have to live with that, with this share.

My opinion - there's more detail in the announcement today, which I won't go into.

Given that earnings are so unpredictable, how on earth do we value the shares?

The company has recovered from setbacks before, and it's still profitable, in what is turning out to be a not very good year. If you like the company, and believe it can get back on track in 2020, then this might be a buying opportunity?

It doesn't particularly appeal to me though. I'm trying to avoid buying any more illiquid micro caps with unpredictable performance.

If the share price remains depressed, then there's always the chance of someone bidding for it. There are 4 large shareholders, together holding 54.4%, so if their agreement was secured by a bidder, then a bid could go ahead. It's difficult to see why a small group like Pennant needs a standalone listing? It would make more sense to be part of a larger group, I think.

That's me done for the week! Thanks for all your comments, and being tolerant of my erratic timings!

Have a smashing weekend,

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.