Good morning, it's Paul here. I'll be looking after you this week.

HQ tell me that subscribers like it when I give a rough idea in advance of anticipated timings for each report. My plan for Monday is to write mainly in the afternoon, with anticipated completion time for this report of c.6 pm.

Tue, Wed & Thurs reports this week should be finished by late morning, because I have meetings lined up in London for the afternoons.

There's hardly anything to report on today.

IXICO (LON:IXI)

Share price: 41.8p (up 23% today, at 15:48)

No. shares: 46.8m

Market cap: £19.6m

IXICO plc (AIM: IXI), the data analytics company delivering insights in neuroscience...

The company description means this share is well outside my comfort zone!

As the +23% share price suggests, today's update is very good;

Given the performance in the period to date, the Board anticipates that the results for the full year ending 30 September 2019 will be materially ahead of current market expectations.

I usually assume that "materially ahead" means about 10% ahead.

- Strong revenue growth in H2

- New & expanded contracts coming on line

- Increasing demand

- Newly developed algorithms

- Faster turnaround times

That all sounds encouraging.

Interim results - 6m to 31 Mar 2019 - these figures were published on 22 May 2019. Improved profitability, of £215k after tax (on £3.4m revenues in H1).

I focus on the after tax figure for any company that has a negative tax charge due to R&D tax credits (which I'm assuming is the case here). Since tax credits are a bona fide contribution to profitability (assuming the tax rules remain the same).

Balance sheet is notably strong, with almost £7.5m in cash, and no debt. That followed a placing, which seems to have raised more money than the company needs. Still, a balance sheet stuffed full of cash is very nice for investors, as it de-risks things considerably.

My opinion - this looks worthy of a closer look. I have no idea how to value it, as this is not a sector I have any knowledge at all on.

The very strong balance sheet, and good current trading, plus a strong order book, all look attractive.

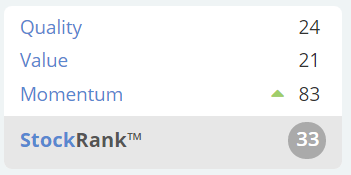

Stockopedia is not impressed yet, with a low StockRank.

On the downside, it's a small & illiquid share.

The crux here, is whether the company can deliver faster growth. If it can, with strong operational gearing (66% gross margin in H1), then profit could rise fast.

BREAKING NEWS!

Greene King (LON:GNK)

Share price: 846p (up 50% today, at 16:21)

No. shares: 310.0m

Market cap: £2,623m

Recommended cash offer - for this pub/brewer group.

850p per share, a thumping 51% premium to Friday's closing price.

This is very interesting, as it follows on from the recent bid for another large pubs group, EI (LON:EIG)

Googling the parent company of the bidco, CK Asset Holdings Ltd, it seems to be a Hong Kong based property investor.

Yet another foreign takeover bid for a UK company. Something is going on here - no doubt helped by weak sterling, foreign investors seem to be untroubled by Brexit risk, and are snapping up UK listed companies at a remarkable pace.

Which pubco will be next then? I remain of the view that late night bars operator Revolution Bars (LON:RBG) (in which I have a long position) looks ludicrously under-priced, on an EV multiple of only about 2.5 times site EBITDA basis (NB. site EBITDA ignores H.O. costs). That's a sitting duck for a takeover bid (again) in my view, but it might be too small to attract much interest. Time will tell!

Batm Advanced Communications (LON:BVC)

This share has been around seemingly forever - I remember it being one of the leading tech story stocks in the 1998-2000 technology boom/bust.

It's an Israeli-based medical & data communication products group.

I tend to steer clear of overseas small caps that list in the UK. There's usually something wrong with them below the surface.

H1 results today show a move from a small loss ($0.6m) last time, into a small adjusted profit this time of $1.6m.

Good growth expected in H2, in line with expectations.

It's not something I would ever buy, so can't motivate myself to look any deeper.

£MTI

Similar to the above, this is another Israeli tech company listed in the UK.

This share looks quite good value, based on the StockReport here. Note in particular the high dividend yield.

H1 figures today look quite good - increased profits, and a decent balance sheet.

Again, not something I would ever invest in, as I avoid overseas stocks listed in London wherever possible.

All very boring really, apart from the Greene King takeover bid - well done to any subscribers here who hold that one.

See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.