Good morning, it's Paul here.

I'm making a guest appearance today, so that Graham can prepare his talks for Mello investor conference next week, in Chiswick. I'll also be pottering around at Mello, being generally affable to passers-by, but am not doing any talks this year, because I haven't really got anything new to say compared with last year. I'm still largely invested in the same shares, and my views on them have not changed much. The main change is that they've mostly gone down in price!

Estimated completion time - it's a bit complicated today, because I'm still on holiday in Gozo, the little sister island to Malta. My 50cc scooter has to go back to the hire shop by noon, but I'm itching to have a final whizz around the island on it. See moped-cam below, later! However, in order to not disappoint readers here, I'll write about half of today's report by about 10:00am today, then I'll come back and write the rest this afternoon. Apologies in advance for any inconvenience. So the full report should be complete by 3pm.

Update at 15:34 - it's taking longer than expected (due to technical problems updating the article), so I'll be finished by 6pm. Apologies for any inconvenience.

Update at 20:44 - I've been having technical difficulties updating this report this afternoon, hence the delay. I'll have one final attempt at getting the section on System1 up. Success! Today's report is now finished.

.

Kudos to Graham - for having the initiative to write to the Competition & Markets authority, asking them to put more detail in their RNSs. They have obliged, and instead of almost every RNS from them being titled "Merger Update", they are now including the company name(s) which the RNS refers to, in the title. This is a small, but very useful change, which will save lots of people some time and frustration, having to open numerous RNSs which won't be of any interest to them. So congratulations to Graham for prompting this improvement. It just shows that sometimes, a polite email with a good idea in it, can actually change things for the better. Also kudos to the CMA for listening, and responding positively to a sensible suggestion.

Today I'll be reviewing the following announcements;

Superdry (LON:SDRY) - Half year trading update

Purplebricks (LON:PURP) - Half year trading update

Works Co Uk (LON:WRKS) - Half year trading update

System1 - Interim results

Please bear in mind that reader requests mean less time for me to enjoy on holiday. Could you live with that guilt? ;-)

.

.

Superdry (LON:SDRY)

Share price: 445p (up 5% today, at 08:35)

No. shares: 82.0m

Market cap: £364.9m

Superdry today announces a trading update covering the 26 week period to 26 October 2019...

It's amazing to think that this previously high flying designer brand/retailer, is now a small cap. This is a potential turnaround, with the founder having turfed out previous, seemingly incompetent management. Although note that shareholders generally did not support his return - it was only his large personal shareholding which clinched it. That said, I'm positive about him re-taking the helm. If anyone can turn around a struggling business, it's usually the founder. Hence for me this share is a potential opportunity.

H1 revenue figures look grim;

.

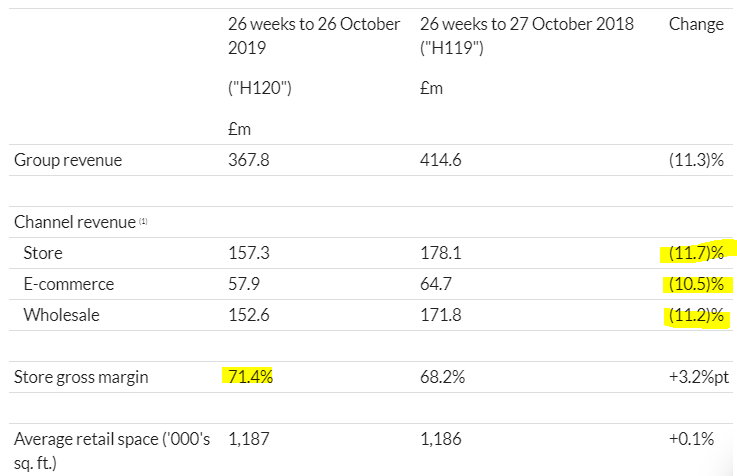

Revenues - note the bottom row, showing that retail space has barely changed. Therefore, the store revenues will be almost the same as LFL store revenues. A fall of 11.7% in store revenues is bordering on catastrophic. The reason being that store costs are mainly fixed or rising, so any drop in revenues will feed through to an operationally geared (i.e. much larger %) drop in profit.

Improved gross margin - there is a notable improvement in store gross margin, from an already high 68.2%, to an extremely high 71.4%.

This partially offsets the reduction in sales. In fact, we can work out by how much, as follows;

Before - Notional revenue of 100. Gross margin of 68.2% = gross profit of 68.2

After - Revenue down 11.7% from 100 to 88.3. Gross margin up to 71.4% = gross profit of 63.0 (down 7.6% on previous level of 68.2)

Therefore, a revenue fall of 11.7%, combined with the higher gross margin, produces gross profit down by 7.6%. In other words, the improvement in gross margin has recouped about a third of the fall in revenues.

The above is a simple technique which I learned from my accountancy training. You always start with 100, and then put through the various % changes, and it gives you a useful result.

That said, a 7.6% fall in gross profit is still a big problem, given that store costs (rent, rates, utilities, etc) are fixed, and the other big cost of staff wages is rising due to increased minimum/living wage driving wage differentials up all the way up, as supervisors & managers push to maintain their differential above the lowest paid. Plus pension, and apprenticeship levies coming in. Employers are under a nasty squeeze with higher costs right now, which is proving ruinous for many retailers, as they're also losing sales & margin at the same time.

I reckon it's likely to be carnage in 2020, once Xmas is out of the way. Insolvencies in retail are often staved off until January, to get the peak Xmas trading & January sales in, to liquidate as much stock as possible. Expect many insolvencies in this sector in 2020, not just for smaller, independent retailers. I doubt whether Debenhams or House of Fraser are likely to last much longer, for starters. Although that will of course leave more market share for the survivors. Hence why I am not bearish on M&S. I think the short trade in MKS is lazy, over-crowded, and ignores some powerful positives.

E-commerce sales - down 10.5% - this is a serious concern too. Fashion businesses need to have a large (ideally half, or more) sales online, and growing strongly, to be of interest to me. This has been proven by the success of Next (LON:NXT) - where investors who spotted that it is successfully transitioning online, have done well.

Superdry's online sales are just over a third of its store sales, which is OK. But online sales should be rising by about 20%, not falling by over 10%. That worries me a lot.

Shop leases - It strikes me that Superdry is following the right strategy, using its stores for full price sales. The >70% gross margin should enable those stores to remain profitable, if sales volumes are also strong. SDRY has a problem in that it took on a lot of "flagship" stores, in prime sites, on big rents. This could drag down the whole company, if sales continue falling, due to exorbitant rents & leases which prevent them escaping from loss-making sites. This is my biggest concern about SDRY.

There's a lot to be said for SDRY selling only full price in-store, then sending unsold goods back to the warehouse, to be sold online only. The narrative seems to suggest this is what they're doing. As opposed to permanently discounting in-store. Therefore, reading through the narrative today, I agree with the revised strategy under Mr Dunkerton - namely focusing on getting the product design & quality right, then just selling at full price in-store. That way, enough gross profit should be generated to make the stores viable. Once consumers have been re-educated to not expect permanent discounting in-store. That is part of the reason why LFL sales are down - because the prior year comparative had a lot more discounting going on in the stores.

The problem is that, trying to sell more product at full price, could simply be deferring price discounting. Product that customers don't like has to be discounted in price, otherwise it just won't sell.

Outlook - cautious, challenging market. But makes optimistic noises about improving product designs.

My opinion - there are definite signs of life here, with improvements having been made. However, the trajectory of profits for H1 is likely to look pretty awful when the figures are published. Therefore, I won't be even considering buying this share without first seeing its interim results, due out on 12 Dec 2019. These are likely to look dreadful, given the 7.6% fall in gross profit at store level, combined with increased costs, plus big falls in online and wholesale revenues.

It's on my watchlist as a possible recovery share, but I wouldn't be surprised to see another lurch down in share price to go with the interim results in Dec.

The founder is obviously under pressure to report improvements, but that's not coming through in the numbers yet. Talk is cheap.

Profit forecasts have collapsed in the last year from 122p to 41p;

.

(incidentally, note that brokers are assuming an automatic improvement in 2021 figures, above 2020. Why? I would suggest that the 2021 forecasts line should be below the 2020 line! That applies to lots of companies right now. The risk of broker forecasts being wrong by a considerable margin, i.e. way too optimistic, looks very high at the moment. So buyer beware! We need to really question why forecasts for next year would be higher than this year? Unless there's a very good reason, then I'd be inclined to chop 20-30% off next year's forecasts, and then see if a purchase makes sense.

In order to drive EPS back upwards again, SDRY will need to start generating positive LFL sales growth from its stores, and positive E-commerce growth. It doesn't seem to be anywhere near that at the moment. Although remember that this year's poor figures become next year's soft comparators.

In conclusion, I think a turnaround might be starting, but it's very early days, and I wouldn't want to risk buying at this stage. I'll wait to see what the interim figures look like, and Xmas trading, then review it again in early 2020.

.

.

Purplebricks (LON:PURP)

Share price: 113.3p (up 4.3% today, at 10:07)

No. shares: 306.8m

Market cap: £347.6m

Purplebricks Group Plc (AIM: PURP), a leading estate agency business, announces a trading update for the six months ended 31 October 2019 (the "period" or "First Half") ahead of reporting interim results on 12 December 2019.

This is one of many growth companies whose share price soared in the boom of 2017, but has since come all the way back down again. This is because growth stalled, and some overseas expansion turned out to be an expensive mistake. Also, I think the bears were right (as I said at the time, and thankfully decided to sell my own shares in it) that the advertising by PURP claiming to be the same as a normal estate agent, simply isn't true. Its business model is leaving behind a long tail of dissatisfied customers with unsold properties, having paid the fees up-front. My family bought a property which was advertised by PURP, and found them largely useless. We managed the purchase with the seller, and PURP became irrelevant. In our experiece, the only purpose for PURP is to list properties on Rightmove, and enable prospective buyers & seller to connect through an app.

Trading update today - this sounds reasonably OK, in a tough market (where an online operator has considerable advantages, in having flexible, not fixed costs);

During the period, there was a weakening in the overall UK property market as political and economic uncertainty impacted confidence, reducing home sale volumes. This was particularly notable in the South East.

Against this backdrop, Purplebricks maintained its 4% overall market share and also expects to report an improvement in the marketing-to-revenue ratio as planned efficiencies are now being realised.

The Canadian business modestly outperformed expectations over the period.

At a Group level, pro forma revenue is expected to be broadly flat relative to the same period last year[1] and the significant losses incurred in the prior period have now been reversed and the Group enjoyed profitable trading in the First Half.

My opinion - the above sounds reasonable to me. I'd like to see the accounts when they come out on 12 Dec before commenting further, as trading updates really don't give the full picture.

PURP is the market leader in the UK, amongst online estate agents. Although conventional estate agents are not ignoring the online option. All that's needed is a very simple app, to handle enquiries. Another problem with PURP is that their supposed local property experts are nothing of the sort! They cover patches that are far too big to possibly understand local issues. Hence I think a traditional estate agent is far more likely to secure the best price.

Even though the share price went from £1 up to £4, and then back down to £1 again (rough figures), this doesn't necessarily make it a bargain. The market cap is almost £350m, which looks high for a business which may have had the best growth behind it now, perhaps? I'm not tempted to revisit for the time being, but reserve the right to change my mind at any time, if the facts change.

.

.

Works Co Uk (LON:WRKS)

Share price: 44.7p (down 42% today, at 15:39)

No. shares: 62.5m

Market cap: £27.9m

Half year trading update (profit warning)

TheWorks.co.uk plc, the multi-channel value retailer of gifts, arts, crafts, toys, books and stationery, announces today a trading update covering the 26-week period to 27 October 2019

Checking the archive, we've only looked at this July 2018 flotation, on a fully listed basis (not AIM) twice;

9 May 2019 - Graham reported on a profit warning, and urged "extreme caution"

3 July 2019 - I reported on the surprisingly good results, but wasn't convinced it had enough of a competitive advantage to continue growing profits.

What's happened today then? It's a profit warning, saying;

Whilst LFL sales have improved over recent weeks, as the impact of the prior year's Mega Trend eases, they were not at a level previously expected. Accordingly, the Company is taking a more cautious view on trading ahead of the Christmas trading period and, as such, the Board now expects full year profit before tax to be significantly below current market expectations.

I regard the "mega trend" comments & figures as a red herring. This is where the company has a temporary sales surge in a particular product. You can't adjust sales to exclude such surges. Therefore in my view, the only meaningful figure below is the -3.6% LFL figure;

Total revenue increased by 5.4% year-on-year, and when excluding the impact of the prior year Mega Trend[1], LFL sales[2] were -1.9%. This performance reflected the difficult consumer backdrop over the Period. When including the prior year Mega Trend LFL sales were -3.6%.

As we've seen with other retailers, the increased costs which the sector is exposed to, means that LFL sales need to be positive, just to stand still in terms of profit. With footfall dropping, and sales migrating online, it's very difficult for retailers to generate positive LFL sales.

New stores - this is a surprisingly large chain, with 525 shops. It's expanding at a helluva lick, with an intention of opening 50 new shops in total this financial year. What's interesting is that they're getting great deals from landlords apparently. The payback time is said to be only 1 year, which is phenomenally good. Although I would be interested in how that figure is worked out - in particular how they handle landlord contributions such as reverse premiums (cash contributions towards fit-out costs) and rent-free periods.

My opinion - the problem, as I mentioned back in July, is that it only ekes out a small profit from a lot of revenues. Therefore, if LFL revenues turn significantly negative, the company could easily tip into losses. What happens then? There's no sign of High Street trends (footfall) improving, or even stabilising. Some smaller towns are becoming ghost towns if they had an M&S which has, or will be shut.

For that reason, even though TheWorks looks tantalisingly cheap, I'm reluctant to get involved. With a £50m p.a. wages bill, and average wages currently rising by about 4% p.a., then that's a reduction in profit of £2m p.a.. Combine that with negative LFL sales, and probably pricing pressure too, and it's easy to see last year's £6.7m profit disappearing altogether in the not-too-distant future. That also means that divis may not be sustainable.

Therefore I think this one is probably best being given a wide berth.

.

.

System1 (LON:SYS1)

Share price: 180p (unchanged today, at market close)

No. shares: 12.6m

Market cap: £22.7m

System1, the marketing services group, today announces its results for the six-month period ended 30 September 2019 ("H1").

I went through the main issues here on 14 Oct 2019, reporting on its H1 trading update. The figures today look to be in line with what was previewed then, i.e. £2.4m adjusted profit. The main issue is that about half of that adjusted profit was spent on startup losses on a project called AdRatings.

All I need to do today, is a quick review of the interims, looking for funnies. Plus a review of the outlook comments.

Figures - look OK to me. I can't see anything untoward in the balance sheet or cashflow statements.

It looks financially sound, with a decent amount of cash on the balance sheet.

Divis - quite good, at a yield of 4.3%. Although with limited earnings visibility, the divis can't be seen as particularly safe.

Outlook - I'm not sure how to interpret this. Is it putting down a marker for a possible H2 warning? I admire management honesty in stating that there's little visibility. But would I want to invest in something with little visibility, especially at a time when the macro picture looks wobbly, hence marketing budgets can be one of the first thing that clients cut back on.

We continue to have limited short-term revenue visibility, so, as always, it is difficult to predict how the year will unfold. Nevertheless, we continue to believe that the business is making progress and in the longer term has high upside potential driven by its AdRatings asset and the more general digitisation of the business.

.

My opinion - I'm intrigued by this company, so will keep it on my watchlist.

.

.

That's me all done for today. It's been very frustrating battling with the technology today - several wasted hours. Never mind, these things happen from time to time. Thank you to the readers who were patient. To our 2-3 resident thumbs-downers, you can have a middle finger from me in response!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.