Hi, it's Paul here.

EDIT at 12:28 - sorry, I forgot to include today's estimated time of completion. It's mostly done now, but I'll add a couple more short sections after lunch, so the full report should be finished by about 3pm.

Edit at 15:11 - today's report is now finished.

Edit at 18:38 - here's moped-cam video from my holiday last week in Gozo, if you want to to be pillion passenger!

Edit at 21:30 - here's a fascinating video I took, of my visit to the underground command & control WWII centre, in Malta's Valletta's underground rocks. I'll tell you later this week a bit more about a lovely lunch I had with a Stockopedia member, who is a retired engineer, who played a major part in restoring the Lascaris War Rooms, and other world heritage sites in Malta. In the meantime, high-five Derek, what a pleasure to meet you! :-)

I'll be writing most of this week's reports, apart from Tuesday, which Graham is planning on writing, as well as presenting the SCVR live at Mello London. It's a total nightmare having to read the day's news, write a report, and then get up on stage and present it to an audience. Hence why I refused to do it this year, lol!

Mello London

David Stredder, the private investor who set up Mello, has just messaged me to say that ticket sales have gone well, and there are many excellent companies to talk to - David prioritises quality over quantity.

Above all, Mello events are so friendly, and most people come away having made some new investing contacts and friends, that they stay in touch with, and share investing ideas & research. As I always say, investing really is a team sport.

Having a common interest, you can stop and talk to anyone, with ease. I just say, "Hello, I'm Paul Scott. What's your favourite share?", finding that a very good way to start a conversation! Or, "What type of shares do you invest in?", Is another good conversation starter.

I really enjoy meeting Stockopedia subscribers, so if you spot me at Mello, please feel very welcome to say hello & have a chat!

Here's the full programme for the event, and the timetable of talks. Tickets can be bought here. Some people baulk at paying for things, but then cheerfully punt thousands of pounds on buying shares that they've not properly researched. Pretty crazy if you ask me! Things like Stockopedia subscriptions, and Research Tree, plus Mello tickets, are necessary expenses to help me learn & make better investments, in my view. Presumably you agree, otherwise you wouldn't be a paying subscriber here, reading this!

I've just asked David, and he's currently setting up a special discount code for you, which is: SCVR50 - 50% off for SCVR readers! This is to attract Stockopedia subscribers, who are already serious about investing - exactly the type of people David wants at the event.

For the avoidance of doubt, I only ever recommend things that I think are genuinely good events or services. I never take any commission, that's just not my style.

OK, that's it for Sunday. See you back here on Monday morning.

Regards, Paul.

Greggs (LON:GRG)

Share price: 1771p (pre market open)

No. shares: 101.2m

Market cap: £1,792.3m

Greggs is a leading UK food-on-the-go retailer, with more than 2,000 retail outlets throughout the country

This update is for Q4 to date (6 weeks to 9 Nov 2019).

I'm including a note about Greggs, despite it being a mid or large cap, because its performance stands out as completely bucking the trend we're hearing from pretty much everyone else on the High Street. It's difficult to understand how such strong figures are being achieved against a backdrop of falling footfall in many towns, and increased costs (especially wages);

EDIT @ 11:30 - see comment 7 below, where iwright7 makes a good case for why Greggs is achieving strong growth. Thanks for your contribution.

Also see Ben1's comment no.11 below - where he makes the good point that Greggs probably sells lunches to many people working in town centres, hence it wouldn't be so dependent on footfall from people visiting, to shop.

Summary

Other companies whose trading updates & results I'll be reviewing today are;

Dignity (LON:DTY) - in line Q3 update, but terrible, overly-indebted balance sheet makes it uninvestable for me. Regulatory issues create uncertainty.

ECO Animal Health (LON:EAH) - profit warning. Operational problems seem confined to China - temporary/fixable, maybe? Accounting corrections worry me more - and not quantified.

Wey Education (LON:WEY) - interesting little business. Nice cash pile. Probably priced about right for now.

Carr's (LON:CARR) - good results. Looks a decent value share on a PER of just under 10. Balance sheet OK. Worth a look for value investors.

Kainos (LON:KNOS) - looks expensive.

Dignity (LON:DTY)

Share price: 521p (down 1% today, at 08:13)

No. shares: 50.0m

Market cap: £260.5m

Dignity plc (Dignity, the Company or the Group), the UK's only listed provider of funeral related services, announces its trading update for the third quarter of 2019.

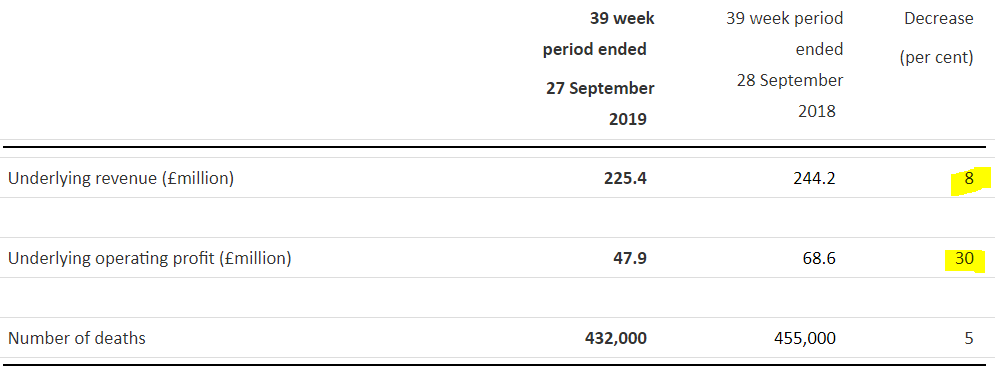

The headline figures look poor, especially underlying operating profit being down heavily, at -30%;

In line with expectations - the commentary says that this poor performance was expected;

Operating performance in the third quarter was in line with the Board's expectations, driven by robust funeral market share and average income in line with the Board's expectations.

Operating performance in the year to date was consistent with the Board's expectations allowing for the significantly lower number of deaths, particularly in the first half of the year.

Improving trend in reduction in losses. As you can see below, Q3 saw a reduction of 8% in underlying operating profit vs Q3 LY.

Whereas the YTD numbers for 9 months show a 30% drop in profitability.

Regulatory matters - today's RNS reminds us of the investigation of this sector by the Competition and Markets Authority . It seems pretty obvious to me, from the high level of profitability, and the nature of the work, that undertakers seem to be exploiting vulnerable & traumatised customers, to make excessive profits. Or at least there's inadequate competition, leading to high prices sticking. Therefore this CMA investigation could potentially be damaging, if it fines companies like Dignity.

After all, how many people are going to shop around for the best deal when a loved one has just died? This used to be put forward as a good reason for buying shares in Dignity, by cynical investors. However, that seems to have back-fired now that the sector is being investigated.

Note how the long term share price has lost all the gains of the last 14 years, and is back to 2005 price level. It's remarkable how quickly some high flying shares can collapse. For many years, this share was widely seen as expensive, but completely safe. When actually, all along it was expensive, but very vulnerable;

Apparently the internet is now making inroads into profit margins. This is because some customers are beginning to compare prices online, whereas in the past this didn't happen.

There is also a growing trend for simpler, more ecological funerals, and even no funeral at all - i.e. to put it crudely, just a body disposal service (at lower cost, and hence less profitable).

The decline of religion in the UK means that many people just don't want a formal funeral service any more, with a priest talking about someone they never met. Plus the awkward and feeble attempts of the congregation to sing hymns that hardly anyone knows the tunes to, let alone the words. I just mime.

It's surprising how suddenly (albeit temporarily) devout some of my friends/family have become, when they've needed to use a local church as a pleasant backdrop for a wedding /funeral, or wanting to get their kids into the local CofE school!

That reminds me of the story of the lifelong atheist, I forget his name, who was seen to be rummaging through the bible on his death bed. When asked why he was reading the bible, he quipped, "I'm looking for loopholes!". My other favourite joke about death, is when someone was lying in their death bed, they quipped, "I wish I'd bought a normal bed!"

The other regulatory issue is headed HM Treasury, and says;

... The Group continues to anticipate regulation of pre-arranged funerals and is preparing accordingly.

That sounds a bit vague. I wonder if this might involve additional costs of some kind? Or possible back-dated liabilities?

Debt covenants - this is very important, and looks as if the company is running with little headroom on some of its debt covenants.

Balance sheet - this is one of the worst balance sheets I've ever seen. Therefore this share needs to be seen as high risk.

Financial engineers have clearly incurred excessive debt, on the basis that the businesses acquired were cash cows. When cashflows deteriorate, it leaves the business very vulnerable. We're seeing this with lots of highly indebted companies at the moment, eg. Thomas Cook, AA, and Dignity.

When last reported, on 28 June 2019. NAV was slightly negative, at -£13.8m

However, that includes £232.5m goodwill, and £149.8m other intangible assets. Deduct those, and we arrive at a hideous shortfall of NTAV negative at -£396.1m

Financial liabilities (i.e. debt) look enormous - at £547.1m in long term creditors, plus £189.2m of deferred revenue.

Overall, the balance sheet looks highly precarious to me - a house of cards that could easily be blown over by a shock to the system, e.g. a negative outcome on either of the regulatory matters perhaps?

Outlook - doesn't sound particularly reassuring;

The Board's expectations for 2019 remain unchanged from the time of the interim results in July. Operating performance in 2020 will rely heavily on the number of deaths, which may or may not revert to higher levels witnessed in previous years compared to the 576,000 seen in the last twelve months to September 2019. In addition, following the appointment of Clive Whiley as Chairman, the Board is also reviewing its current strategy in the context of the current challenges within the industry.

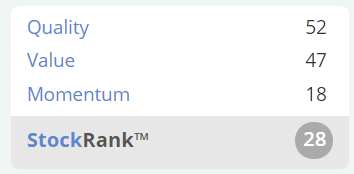

My opinion - this looks a complete can of worms, I wouldn't touch it.

Situations like this, with very weak balance sheets, and lots of debts, can often end up with equity holders being wiped out, and the debt providers owning the business.

Stockopedia doesn't rate it either, with a low StockRank;

ECO Animal Health (LON:EAH)

Share price: 227p (down 36% today, at 09:31)

No. shares: 67.5m

Market cap: £153.2m

Trading statement (profit warning)

ECO Animal Health based in London U.K. is a leader in the development, registration and marketing of pharmaceutical products for global animal health markets. Its products for these growth markets promote well-being in animals and include the novel antimicrobial, Aivlosin®, as well as a range of generic therapeutic products.

ECO Animal Health Group plc issues an update today ahead of release of its interim results for the six months ended 30 September 2019, which will be announced during December 2019.

Summarising the RNS below, I find it easier to take in information if it's edited & re-organised into bullet points;

- certain important markets for the Group have out-performed management’s expectations

- African Swine Fever (“ASF”) has continued to have an adverse impact on the Group’s trading performance in China (its largest market).

- China-USA trade tensions have further exacerbated the effect

- these factors have had a significant negative impact on Group revenues and in the six months to 30 September 2019 our unaudited sales in China have declined by approximately 60% compared to the same period in 2018.

- We see some encouragement for the second half .... However, there inevitably remains significant market uncertainty which we continue to monitor.

- As a result of the challenging trading conditions in China, the Group’s trading results for the six months ended 30 September 2019 will be below those achieved in the first half of 2018.

- expect that full year trading performance will be significantly below current market forecasts if these trends continue.

- Outside of China, Brazil and Mexico (pigs) and India (poultry) have traded ahead of management’s expectations ... Unaudited revenues for the six months to 30 September 2019 (ex-China) have seen low, double digit percentage growth over the prior period in 2018.

That sounds as if problems are specific to China, with the rest of the business doing OK. I am wondering whether this profit warning might fit into the temporary and fixable category of problem. These can often turn out to be good buying opportunities, once the share price has formed a base over several months.

However, another different problem is disclosed today;

Accounting issues - "new financial leadership and external auditors" have found some problems that require correction;

work is ongoing (so we don't know full extent of the problems)

- Revenue recognition (discounts, and timing of shipments)

- Treatment of R&D expenditure

- Expected to restate previous accounts for FY 03/2019 and subsequent interims

- Treatment of US JV - but likely to be balance sheet presentation only (i.e. no profit impact)

We're not given any indication of the impact on profits, or the balance sheet. Not even a vague comment on whether these issues are major, or minor. That makes it impossible for me to value this share, since we don't know what the profits are.

Accounting problems are nearly always deliberate over-statement of profits, in my experience. Which begs the question, can management be trusted?

My opinion - I'm hampered by the fact that it's been over 4 years since I last looked at this company. Plus, today's update doesn't give us enough information to determine how serious the accounting corrections are going to be.

Therefore, for the time being, this share looks impossible to value.

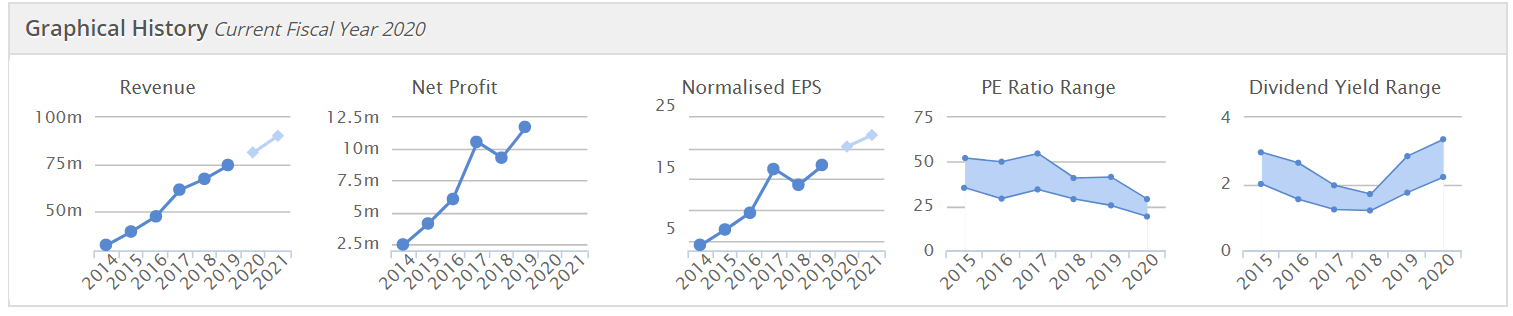

That said, assuming the accounting errors are not too serious, then the track record is very good. Also note that it generates a decent profit margin;

The above PER and yield is based on last night's much higher share price. Therefore, after today's 36% fall in share price, the yield would now be nearer 5% - attractively high, if it's sustainable?

I've checked out the last balance sheet, which is very strong. Therefore I don't see any worries with solvency, and the divis might be maintained, who knows?

The cashflow statements look interesting. The group seems to be self-funding new product development, which it capitalises, as well as paying big divis. So possibly divis might be curtailed, if the problems mentioned above are serious?

Overall though, on a brief review, this company looks quite good. A solid, cash generative business, albeit one that has run into problems with pig flu in China. I think it is very unwise for UK companies to rely on China, either for supplies, or for sales - given that it is a dictatorship with poor human rights, which is actively attacking Western democracies with large scale online hacking, etc.. These issues create a serious risk of future demand/supply disruption, in my view.

On balance, the discovery of accounting problems is enough to put me off. Although once there is greater clarity, then this share could be a potentially interesting recovery situation. It's financially strong, with a good track record previously. Hence recovery looks likely at some point.

Wey Education (LON:WEY)

Share price: 10.7p (up 6% today, at 10:24)

No. shares: 131.2m

Market cap: £14.0m

I won't spend long on this, as it's a small, illiquid share. It's an online education business. The concept looks great, and it's easy to see why its online schooling would suit kids who have maybe suffered bullying in conventional schools, or whose parents move around a lot overseas, etc.

Chairman's summary - I like the bit about accelerating growth;

Commenting on the results, Barrie Whipp (Chairman) said:

"These results represent a pleasing outcome in a year where Wey underwent significant change. We have increased turnover, delivered profitability at the operational level and hold significant cash resources allowing us to continue our growth journey.

The Board plans to not simply consolidate but accelerate growth in our core businesses"

Profitability - is small, at just £322k, and relies on big adjustments to get there.

Balance sheet - is in really good shape, with £5m cash - not bad for a £14m mkt cap.

My opinion - I really like the concept here. The share price looks about right to me - reflecting the growth, future potential, and the cash pile, rather than the lack of any significant profits to date.

The business is probably best served by ploughing back cashflows into digital marketing, to grow the business at a manageable pace.

This could be a much bigger business in say 5-10 years time, so it might interest long-term investors. It shouldn't need to raise more cash, so dilution should be limited.

We have to accept that the stock market is currently down on small, growth companies. Therefore I don't see any particular rush to buy back into this one, but I'm keeping it on my watchlist as something to perhaps buy if there is another market sell-off for smaller, speculative companies.

With hindsight, the price got considerably ahead of reality some time ago! It's easy to get carried away in a bull market, as we all know. It's surprising how many small cap charts look like this one. 2017 was a pretty bonkers year, in hindsight, where we were wildly over-paying for growth.

Carr's (LON:CARR)

Share price: 145p (down <1% today, at 11:38)

No. shares: 91.9m

Market cap: £133.3m

Carr's (CARR.L), the Agriculture and Engineering Group, announces its results for the year ended 31 August 2019.

Headline numbers look OK - revenue flat, but adj. PBT up 9.0%, and adj. EPS up 5.0%.

Statutory figures are a bit lower.

Chairman's comments sounds quite positive. Although a cynic might comment that an outgoing Chairman will want to paint a rosy picture of their tenure;

"We are pleased to have delivered a strong financial performance in the year, moderately ahead of the Board's expectations, despite unseasonable weather significantly impacting trading across our Agriculture division.

"We also made good strategic progress during the year, including acquisitions across both divisions where integration is progressing well. In Agriculture, we are excited by plans to develop Animax, acquired in September 2018, into a centre of excellence for innovation and product development for the wider Agriculture division.

"Our Engineering division delivered a strong performance, building on momentum in the prior year. We believe the newly established structure of our Engineering division will position us better for sustainable growth, enabling closer collaboration between businesses and better business development....

Valuation - reporting adj EPS of 14.6p, that puts the PER at 10.0

That looks about right to me - I can't see why anyone would want to pay more for it? There again, if interest rates are going to stay low forever, then an earnings yield of 10%, and a dividend yield of 3.5% is good value.

Balance sheet - looks strong, although there's quite a lot tied up in fixed assets & working capital.

Dividends - of 4.75p for the year, giving a yield of 3.3%.

My opinion - I'm warming to this, as a fairly simple value share. It may not shoot the lights out in share price (which has gone sideways for 5 years), but on a forward PER of 9.5, with a fairly sound balance sheet, it does look quite good value on reflection.

So a cautious thumbs up from me. It might suit a SIPP, or other long term portfolio, possibly?

Kainos (LON:KNOS)

Share price: 537p (up 5% today, at 13:45)

No. shares: 121.5m

Market cap: £652.5m

Kainos Group plc (LSE: KNOS), a leading UK-based provider of IT, consulting and software solutions announces its results for the six months ended 30 September 2019.

Today's headline numbers for H1 look good - revenues up 29% to £86.9m, and adjusted PBT up 27% to £12.8m. This is in line with market expectations.

But a market cap of £652m! Really?! That seems incredibly high.

Forward-looking indicators don't look good enough - sales orders are only up 10%, and the contracted backlog growth is only 4%.

Acquisitions - terms of two investment/acquisitions today are not disclosed, which is very unusual Although I can see why it might be commercially sensitive, perhaps?

Chairman - the long-standing Dr John Lillywhite is retiring. Tom Burnet, a NED, has been appointed as the new Chairman. Is this the same Tom Burnet from accesso Technology (LON:ACSO) I wonder?

Balance sheet - looks OK, there are no solvency issues. However, it's worth bearing in mind that the £59m NAV is less than a tenth of the market cap. So the valuation rests entirely on future earnings/cashflows - there is no asset backing to speak of. Not unusual for this sector, but it's still worth pointing out.

My opinion - it looks expensive to me. The problem with that, is that if you wake up one morning, and something has gone wrong, then you instantly lose 30-50% of your money (e.g. as happened with Craneware (LON:CRW) earlier this year - although that seems to be recovering nicely now). Why take that risk? I suppose you could say that about almost any shares. Hence why having a portfolio approach, to dilute the risk, makes sense.

On the upside, Kainos has an excellent track record, and sometimes it makes sense to pay up for the best companies.

I don't feel that I know enough about the company to form a strong view either way.

Judging from the low number of thumbs ups today, it doesn't look like many people are interested, so I'll leave it there for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.