Good morning, it's Paul here.

Estimated timings - this depends on how much news there is, but I'll be aiming to finish here by about 2pm. Update at 14:09 - it's taking longer than expected, to I'll keep going, with shorter sections from now on. Should be done by 3pm. Update at 14:48 - today's report is now finished.

I've reported on 7 companies' interim or final accounts today (see header above)

De La Rue (LON:DLAR)

Share price: 141p (down 19% today, at 09:05)

No. shares: 103.9m

Market cap: £146.5m

De La Rue plc (LSE: DLAR) ("De La Rue", the "Group" or the "Company") announces its half year results for the six months ended 28 September 2019 (the "period", "H1" or "half year"). The comparative period was the six months ended 29 September 2018.

This group prints bank notes, and other security products.

As you can see below from the 3-year chart, this has been a disaster for shareholders. DLAR used to be considered a safe, high yielding share. Not any more;

I can't seem to find my previous notes on the company, but from memory there have been a series of problem/lost contracts, causing profit warnings (shown by solid red vertical drops in the share price chart above), an SFO inquiry over possible corruption in South Sudan, and disputes over the composition of the Board, with several main board members leaving.

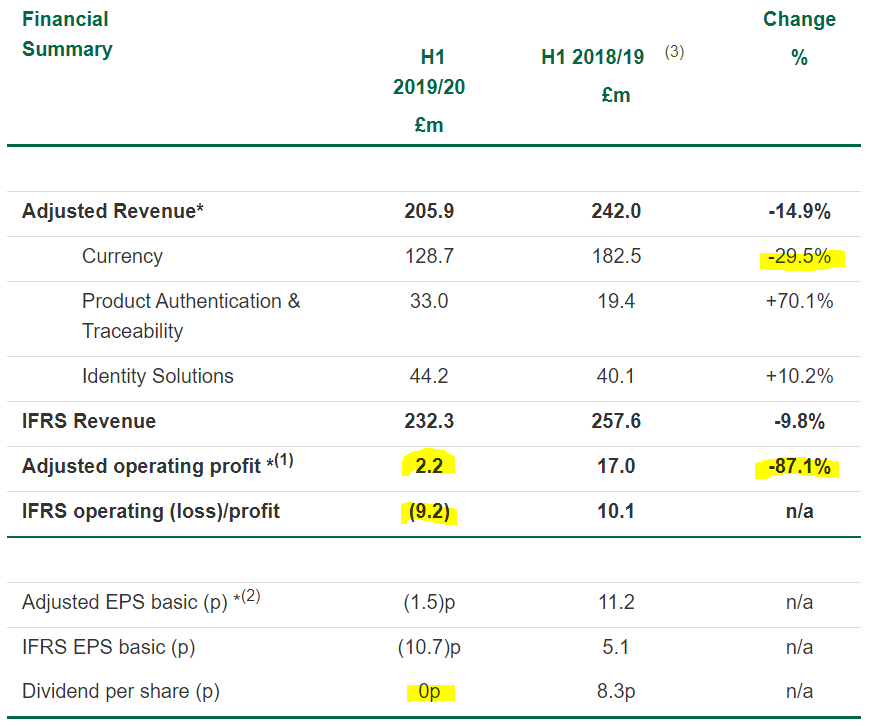

Interim results today are poor, as expected;

In a nutshell, profitability has collapsed, and dividends have been suspended. The main culprit is its currency division, where a 29.5% fall in revenue was about double the increase in revenue in the other 2 divisions.

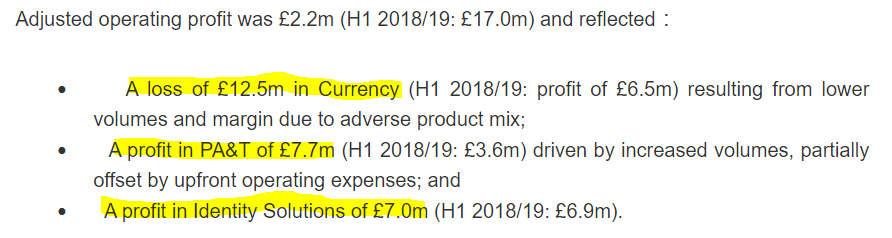

Note how there seem to be 2 good, profitable businesses, and the problem, loss-making currency division;

I quite like situations like this - where problems are confined to one part of the business, that can be turned around. Investors and banks are more likely to continue supporting the overall business, if there are good bits within it, trading well.

I'm not sure how the recent disposal would affect the above figures though. Also, bear in mind that heavy exceptional charges of £11.0m are not included in the above figures. This was mainly £8.2m in restructuring costs - typically employee termination costs, which are real cash outflows, so cannot be ignored.

Outlook - this sounds quite upbeat about H2;

The banknote print market and security features market has become increasingly competitive, as the strong demand driven by overspill in the last few years is normalising, impacting margins and creating significant headwinds.

We see continuing growth in Authentication in FY 2019/20. Our three-year cost reduction programme intended to deliver in excess of £20m in annual savings by FY 2021/22 remains on track and we are aiming to accelerate this programme and to exceed the original savings target.

In H2 2019/20, we will benefit from cost reduction measures, which were implemented in H1 2019/20 and we continue to progress our Authentication contracts.

As a result of this and a more favourable Currency volumes than in the first half, we expect an improving second half performance, leading to adjusted operating profit for FY2019/20 of between £20m and £25m.

Given that the business only delivered £2.2m adj operating profit in H1, then this implies a dramatically improved result in H2 of c.£18-23m. The current financial year ends 03/2020.

Going concern - In comment no.4 below, Edward John Canham homes in on the main issues, including worries over a going concern note included in today's interim results.

To summarise it, the going concern note says that the company should be able to continue operating within its banking covenants. However, the worst case scenario, of several contract losses in its currency division, could result in a covenant breach;

The revised forecasts prepared by management indicate that the Group can continue to operate within its banking covenant ratio Net Debt/EBITDA ≤3.0 times. In addition, the plausible downside risks referred to above continue to be actively managed to mitigate the impact on EBITDA and net debt.

However, given the more binary nature of the most significant plausible downside scenarios, if more than one of these were to occur concurrently without mitigation the Group would breach its net debt/EBITDA ratio.

Therefore, we have concluded there is a material uncertainty that casts significant doubt on the Group's ability to continue as a going concern.

In mitigation the Directors have suspended future dividends and management is focused on delivering the Company turnaround plan.

That's fairly serious stuff. Personally, I wouldn't want to be holding any share where such a material uncertainty exists. That's moving from investing into punting.

The audit report also flags up the going concern material uncertainty.

Pension fund - very heavy cash outflows, this appears to be a serious problem, even though the balance sheet liability is not that big. Once again, this shows up the inadequacy of accounting rules on pension schemes, which tend to under-state the real-world liability;

Cash contributions to the Scheme will be £21.3m for FY 2019/20.

Net debt - high, but doesn't strike me as insurmountably high;

...Group net debt increased to £170.7m at 28 September 2019, from £107.5m at 30 March 2019. This net debt position does not include the benefit of proceeds of £42m from the sale of International Identity Solutions, which were received after the end of the reporting period.

The Board has reviewed a plan for the remainder of FY 2019/20 that shows the Group will operate within its banking covenants

Bank covenants - the net debt to EBITDA covenant looks tight;

The Group has a revolving credit facility of £275m that expires in December 2021. At the period end, the covenant tests were as follows: EBIT/net interest payable 9.9 times (covenant of ≥4.0 times), net debt/EBITDA 2.72 times (covenant of ≤3.0 times).

The covenant tests use earlier accounting standards and exclude adjustments including IFRS 16, IFRS 15 and IFRS 9.

Note the last sentence. This confirms what I've heard in the City, namely that banks and institutional investors are generally regarding IFRS 16 as a nuisance, and want companies to continue reporting figures on the old, pre-IFRS 16 basis. That's absolutely correct, as IFRS 16 doesn't give investors any useful information at all. In fact it obscures commercial reality, rather than helping accounts users to understand the true financial position. The sooner IFRS 16 is scrapped, the better.

What would happen if the company were to breach its banking covenants? Given that the H2 outlook is much better than H1, then it would make sense for the bank to give a waiver over temporary covenants, and let DLAR trade its way out of trouble, and do an equity fundraising once things have been stabilised. It strikes me as unlikely that the bank would pull the plug, which they are generally very reluctant to do, especially for listed companies. Also, in such a low interest rate environment, even problem borrowers can usually still meet the interest payments.

SFO Investigation - no additional information given. Ongoing.

Balance sheet - this is too weak.

NAV: negative, at -£24.3m

NTAV: negative, at -£56.2m

It seems to me that an equity raise of £50-100m is needed to shore up this weak balance sheet.

My opinion - going through all the detail has put me off the temptation to have a punt on this share recovering.

Key questions;

Will the company survive? On balance, I think DLAR is likely to survive, because the improving trend expected in H2 profitability gives the bank a good reason to continue supporting it. Also, covenants haven't actually been breached so far, and may not be.

Will its turnaround plan work? Who can say? I don't know the business well enough to offer a view on this.

Therefore, whilst my hunch is that this could work out alright in the end, it looks too risky to be attractive as an investment.

Treatt (LON:TET)

Share price: 427p (down c,3% today, at 11:13)

No. shares: 59.0m

Market cap: £251.9m

Treatt plc, the manufacturer and supplier of innovative ingredient solutions for the flavour, fragrance, beverage and consumer product industries, announces today its results for the year ended 30 September 2019.

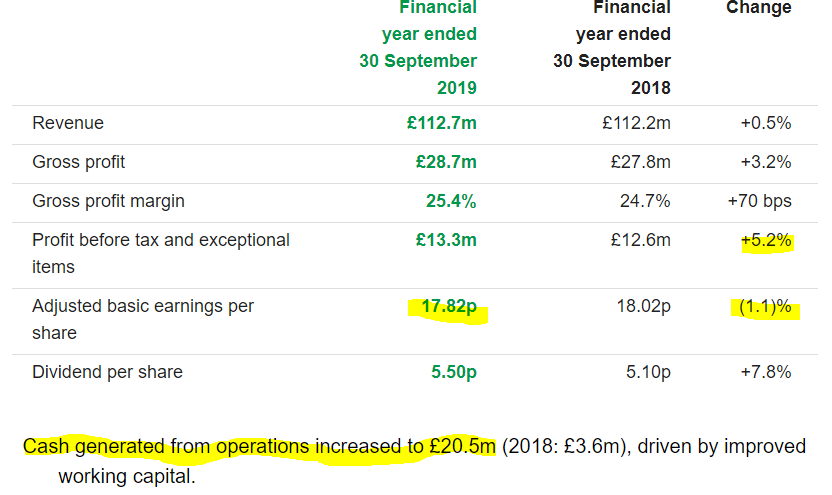

These figures look OK, not madly exciting. I'm not sure there's much to be gained from drilling into the figures, because the issue with Treatt is that it's spending a lot of capex on building new factories, enabling it to increase sales & hopefully profits, in 2020 and 2021.

For completeness, here are the financial highlights below. For me, the standout number is the positive cashflow figure of £20.5m at the end, so I'll take a closer look at the cashflow statement next;

Based on the 17.82p adj EPS, the PER if 24.0 - a fairly high valuation, which is clearly anticipating higher profitability once the new production capacity comes on stream - which strikes me as reasonable.

Directorspeak - management sounds pleased with the results, and current trading;

"I am pleased to report that the Group delivered solid results for the year. The strength of our strategy shone through strongly as we increased our profitability in the face of citrus market headwinds. To have decoupled our financial performance from external market factors which were once a dominant feature of Treatt's financial performance augers well for our future."

"We are driving ahead with confidence and whilst it is still early in the new financial year, the Group continues to perform in line with the Board's expectations for the year ending 30 September 2020."

Outlook comments - highlight the importance of the new factories being built, coming on stream next year. This is the crucial issue in how to assess & price Treatt shares;

The next year will see us capitalising on the benefits of our enhanced facility in the US and completing our relocation in the UK, scheduled for late 2020. Both are major milestones in Treatt's development, and we are excited about the opportunities they open up. Ongoing consumer trends that favour innovative, natural and authentic flavours will continue to underpin demand for our expertise, and the recent launch of our coffee proposition adds a further pillar to our offering for both existing and new customers.

While we are not immune to the geopolitical challenges posed by factors such as the US-China trade dispute or the UK's relationship with the EU, our operating model gives us flexibility to optimise variables across production, tariffs, exchange rates or other relevant metrics between the UK and US.

With our expert teams, our work to enhance our operational capabilities and our product innovations the business has never been stronger, and we look forward with optimism.

Expansion & capex - Treatt's US facility has been doubled in size, to about 130k sq.ft.. It sounds as if the capex has been completed on this project, and the increased capacity is coming on stream in early 2020. It would have been helpful if the company could have given some guidance on the likely increase in sales & profits from this expansion.

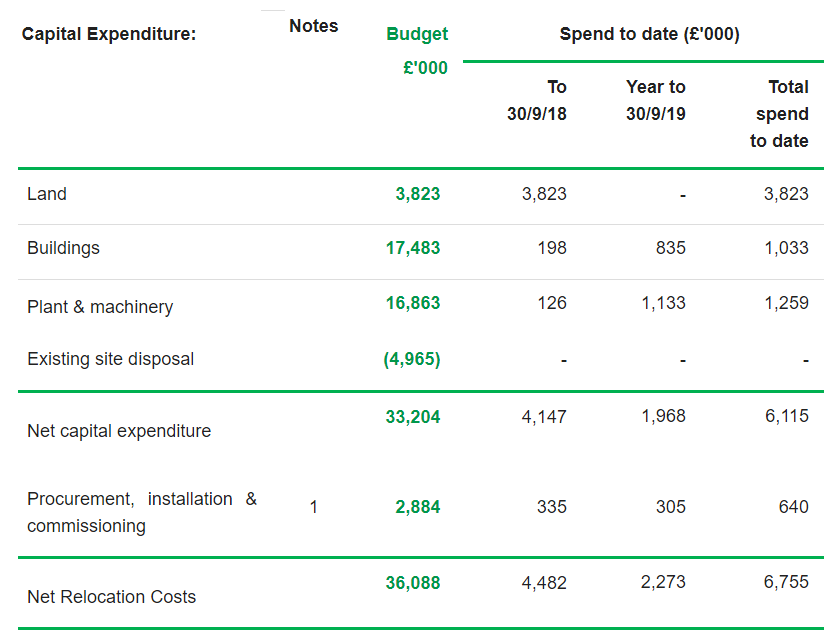

The UK relocation project is bigger, and a table is provided showing progress to date;

Looking at the bottom row, this suggests that there is an additional £29m of capex in the pipeline. I'll check to see if the company has adequate cash to fund this.

There was an equity fundraising in Dec 2017, and this comment today reassures me that the heavy capex should not result in excessive debt;

We expect the project to be completed in late 2020, with occupation shortly thereafter, and the cash outflows for the project are expected to result in rolling net debt to EBITDA ratio peaking at less than 1x EBITDA.

Balance sheet - a tick in the box here, it looks fine, even allowing for the £29m additional capex in the pipeline. I won't go into the detail, because there's no need, it's all fine.

Cashflow statement - looks good. There are some favourable working capital movements (reduction in inventories & receivables), some of which might be reversals of last year's negative movements? Here's an excerpt, showing that the business is nicely cash generative, before and after working capital movements, so again no issues here;

Valuation - I'm looking at updated figures out today from Edison, which don't look very exciting at all. Their forecast only sees revenues & profit rising marginally to 18.9p adj EPS in FY 09/2021. That's only slightly above the c.18p EPS that been reported today. If all this capex is not going to generate a return, then what's the point in doing it?!

They've only got adj EPS going up to 21.5p in FY 09/2022, when the new capacity should all be on-stream.

Therefore, it strikes me that the forecasts could be under-stating the likely uplift in sales & profits. Maybe management wants to keep expectations grounded, in case there are any problems or delays with bringing in new production capacity? And/or that they want to over-deliver, and bask in the glory of a successful expansion. After all, why make a rod for your own backs with aggressive forecasts?

My opinion - I think this is a really interesting business. Based on the existing forecasts, there's not much of a bull case for this share. However, I suspect the plan might be to considerably beat the forecasts, if the expansion capex delivers good results.

The business looks fully funded to complete its major expansion.

I'd be interested to hear from people who hold this share. Do you agree that the bull case is all about beating soft forecasts?

Overall then, it gets a thumbs up from me. I should mention the risk that something could go wrong with major capacity expansion which is underway currently. It's probably safe to assume that delays are likely. Although that contingency looks already factored into the soft forecasts.

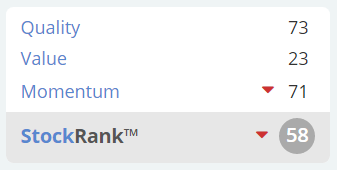

Stockopedia is giving us mixed messages. Treatt is awarded "High Flyer" classification, but has an only moderately good StockRank of 58;

Of course, the Stocko computers don't know that new production capacity is coming on stream next year, and we do. Hence it is questioning the high valuation.

Treatt qualifies for a short-selling screen, under the James Montier screen. Personally I think that's probably a red herring in this case, but it's always interesting to follow up on potential negatives. This screen has a good long-term track record of selecting shares which go on to under-perform. Although that's for a basket of shares, within which there are bound to be some which do OK.

IMImobile (LON:IMO)

Share price: 321p (up c.6% today, at 12:35)

No. shares: 74.4m

Market cap: £238.8m

IMImobile PLC, a cloud communications software and solutions provider, today announces its consolidated unaudited interim results for the six months ended 30 September 2019.

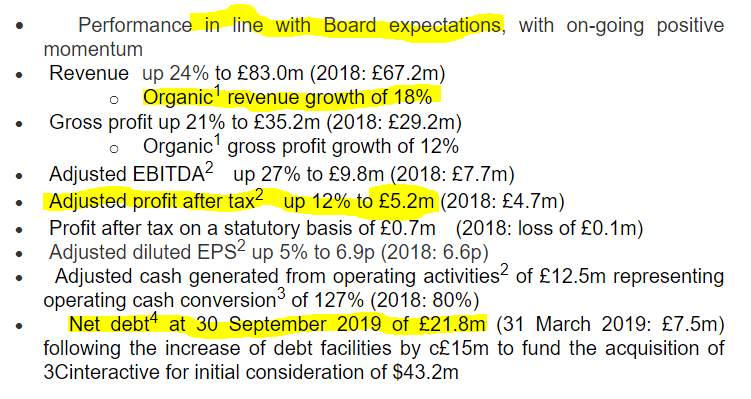

The H1 highlights are well presented I think - confirming that results are in line with expectations, and clearly showing the total, and (strong) organic growth rates;

Note the last point - a fairly sizeable acquisition was made in the period.

There are quite a lot of adjustments to the P&L every year with this group, so statutory profit tends to be much lower than adjusted profit.

Here's a 5-minute video of the CEO, Jay Patel, summarising the results.

I've met Jay several times over the years, and he struck me as one of the most switched-on CEOs I've ever come across in the small caps space. I know that's subjective, but there we go.

Outlook & current trading - is fine;

The Board has been encouraged by the strong first half of the year having delivered growth in all regions in which the Group operates. We remain excited by the structural growth opportunity in customer communications and, with an experienced team established in key geographic markets, the Board believes that the Group is well positioned to continue to deliver on its strategic priorities in the second half with current trading in line with expectations.

Balance sheet - this is the deal-breaker for me. I know that IT companies can operate fine with weak balance sheets, but for me there are several issues;

- NTAV is negative, at -£44.3m - quite a large deficit, once goodwill & intangibles are written off

- Receivables look very high, at £50.0m this year, and £50.6m a year earlier

- Current ratio is a bit low, at 0.96 (even though most bank debt is outside of this, in long term creditors)

- Bank debt looks a little high (gross long term bank debt is £34.7m)

- Deferred consideration of £7.7m would be another cash outflow, if it can't be issued in new shares

It might all turn out to be fine, but personally I look for a more robust balance sheet, because a strong balance sheet provides a cushion in case anything goes wrong. Whereas a stretched balance sheet like this one could cause bigger problems, if something else were to go wrong.

My opinion - overall then, whilst I think the company is good, and the CEO extremely good, the weak balance sheet rules it out for me. Maybe I'm too cautious about balance sheets, but there we go.

Renew Holdings (LON:RNWH)

Share price: 407p (up c.7% today, at 13:23)

No. shares: 75.3m

Market cap: £306.5m

Renew (AIM: RNWH), the Engineering Services Group supporting UK infrastructure, announces results for the year ended 30 September 2019, another record set of results, achieving both growth in revenue and operating profit during the year, in part reflecting a full year's contribution of QTS, acquired in May 2018.

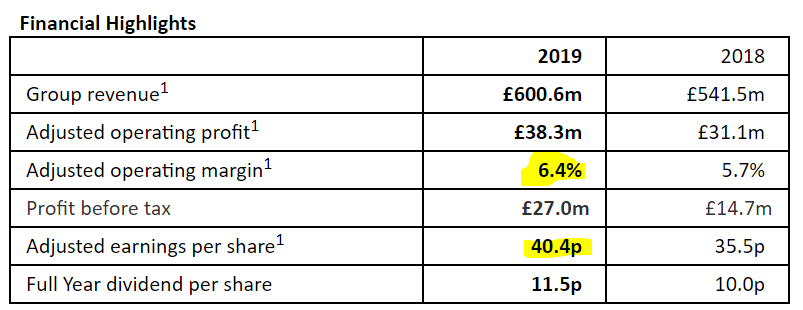

The financial highlights below look impressive. In particular, I like the decent operating profit margin. I remember a few years ago, this was a smaller, and very low margin business. Management set out to increase the margin from low single digits, to a target of 5%, which looked challenging at the time. Wind forward to today, and they're up to 6.4% adjusted margin. Pretty good going! (assuming the adjustments are reasonable).

There's a useful summary from the house broker today, which highlights the strong relationship with Network Rail, and this;

As ever, the outlook statement highlights (1) the non-discretionary spending drivers for the business – critical infrastructure work which cannot be neglected – and (2) long-term prospects good and driven by regulation.

Specialist building division - this part of the business excavates basements under expensive London houses, so that people with more money than sense can have an underground swimming pool, gym, and home cinema. Whilst destroying their relationships with neighbours, due to all the noise & vibration.

However, the figures today show that this is now an insignificant part of the business, since the other parts have grown so much. I vaguely recall that it used to help cashflow, since customers paid for work up-front, so that might be the reason it remains part of the group?

Outlook comments - not much of note in here, other than it is seeking more organic, and acquisitions to drive growth.

So far, so good, it all looks excellent.

Balance sheet - this has been my repeated area of concern in the past, and it remains a concern. The reality is that Renew has performed very well in recent years, but it has achieved that using a high risk approach of operating with a very thin balance sheet. Here are some figures to prove the point;

NAV: £92.3m, which includes intangibles of £114.7m. Deduct those, and we get;

NTAV: negative, at -£22.4m. That's not good.

Pension scheme - is shown as an asset on the balance sheet, of £25.6m, yet the cashflow statement shows an outflow of payments into it of £5.3m in the year. It's not clear if that relates to deficit reduction, or payments for current employees. I don't have time to dig any deeper on this point, but am just flagging it for anyone interested.

Current ratio: is very poor, at 0.76. It should be something like 1.3 to be safe. So there's a yawning gap in this group's balance sheet. The good news is that it's not bank debt. Net debt is modest, at £10.2m, down more than half from last year.

The problem (or opportunity, depending on your point of view!) is that the group is financed through its customers paying it up-front, in advance of work being done. This is deferred income, which is within trade creditors. If you can persuade customers to pay up-front, then that's great - providing it can be maintained forever.

I remember a few years ago, that Costain (LON:COST) did an equity fundraising, stating that it needed more capital, as contracts were being awarded with tighter working capital requirements. I don't know why, but this doesn't seem to have affected RNWH at all. But there's a possibility it could do in future. I'm just flagging the risk, please don't shoot the messenger!

Cashflow statement - looks OK to me. Although I feel management is making a mistake by paying out quite significant dividends, when it would make a lot more sense to retain cash in order to strengthen the balance sheet for a rainy day.

My opinion - I'm really impressed with the P&L performance of Renew. It seems to have carved out a lucrative niche, in a sector where so many other contractors have fallen by the wayside. The outlook looks good too, given the nature of its contracts.

However, the fact remains that its balance sheet is precarious, relying on up-front cash from customers, in order to fund the whole business. As long as people are aware of that risk, then I've done my job by flagging it. To date this risk has not caused any problems, but it hasn't gone away either.

In all other respects, this share looks good. Although personally, I'm not interested in investing in any contracting companies. The sector is too accident-prone for my liking.

Shorter sections from now on, as time is running short;

Severfield (LON:SFR)

Share price: 74p (down c.2% today, at 14:25)

No. shares: 305.9m

Market cap: £226.4m

This is a structural steel manufacturer.

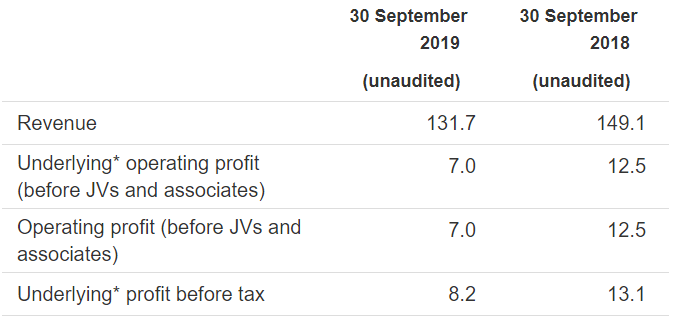

Poor H1 results, with revenues & profit well down on H1 LY;

However, the outlook comments are positive for the full year;

Whilst we retain an element of caution given the ongoing uncertain UK market conditions, with an increased UK and Europe order book, which provides good visibility of earnings, and a broadly stable pipeline of opportunities, the outlook for the Group remains good.

Our current trading levels remain good and in line with our expectations and we expect a number of large ongoing contracts to deliver stronger profits in the second half of the year.

Accordingly, we remain confident that the Group's results for the full year will be in line with expectations.

My opinion - I just don't want to own shares in a structural steel company. This one almost went bust in the last recession. People forget how cyclical it is. If (or when) we have another banking crisis, with credit being withdrawn, then companies like this get into trouble quite fast, as large projects are cancelled.

It's not really clear where we are in the economic cycle, but with recession indicators beginning to flicker, I think it's a good time to warn readers about the risks of buying highly cyclical shares at the end of the economic cycle. If that's where we are, who knows? With more Govt spending likely next year, and a possible end to Brexit uncertainty, then the economy could bounce back. Or it might go into recession. Nobody really knows for sure at this stage.

Ten Lifestyle (LON:TENG)

Final results - checking through my previous notes here, I've never understood why the market is so generous in giving this loss-making company a market cap of almost £100m? It all seems to rest on hopes that it might achieve profits in future. Or maybe it's caught up in the world of wacky valuations for companies that are perceived as high tech?

Having a quick skim through the results today confirms my negative view - it's still burning through a lot of cash, and seems to be offering more jam tomorrow.

NB. I'm only looking at the numbers. It could be that the service TENG sells is fantastic, and has huge potential, that's for readers to decide. All I can say is that the figures looks pretty awful.

HML Holdings (LON:HMLH)

I'll keep this brief, as the weak balance sheet rules out this share for me.

It's an acquisitive chain of residential property management companies. Looking at the track record, it's difficult to see how the expansion strategy makes sense - more acquisitions would mean further stretching an already weak balance sheet, and/or diluting shareholders with an equity raise.

The commentary talks about the problem of high employee costs.

A concern I have with this sector, is that a lot of the profit is derived from kickbacks from insurance companies, for arranging policies for clients. There's bound to be some regulatory risk with that.

All in all, not a share that I would want to hold.

All done for today, see you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.