Good morning,

There's quite a few things to catch up on today. I will probably write through the afternoon.

There are updates from Fletcher King (LON:FLK), United Carpets (LON:UCG) and Triad (LON:TRD) - these are all sub-£10 million market cap, but I plan to cover them briefly.

Also:

- Beeks Financial Cloud (LON:BKS) (added this in response to reader comments)

- Catalyst Media (LON:CMX)

- Focusrite (LON:TUNE)

- Warpaint London (W7L)

And from yesterday:

- Goodwin (LON:GDWN)

Please bear with me while I work through this!

Cheers

Graham

Fletcher King (LON:FLK)

- Share price: 42p (-3.5%)

- No. of shares: 9.2 million

- Market cap: £4 million

This tiny property company has occasionally looked like an attractive "value" investment, available to purchase at a discount to tangible book value.

It provides a range of property services, including the management of small property funds, and invests in its own funds.

These H1 results show a fall in revenues to just £1.3 million, giving rise to a small pre-tax profit of £108k.

At least this is better than the pre-tax loss that was suffered in H1 last year.

Performance reflects "the subdued property market associated with uncertainties over Brexit and the UK political situation".

Sales and lettings were "severely impacted", and decisions were put on hold due to political uncertainty.

Commercial property investing reached a 5-year low, and this situation helped to bring about the suspension of M&G's property fund.

As others have already said, I think the clarity that the economy might enjoy in the next few months could trigger quite a lot of pent-up activity - we shall see!

On the bright side, for FLK:

Steady and predictable revenue from asset management clients provides ongoing support for the business along with a regular supply of valuation instructions from lending banks.

Outlook statement concludes by saying that no clear guidance can be given:

Although the political climate is now clearer, it remains hard to predict the final outcome for the rest of the year and our previously stated views on the difficulty in maintaining profitability remain.

My view

This is valued at approximately its book value (£4 million, mostly consisting of cash and financial assets). That strikes me as fair value, although the StockRanks are more impressed, giving it a StockRank of 86.

Some interesting facts: this company's share count has barely changed in 30 years, and the Chairman (who surname is in the company name) owns 15%. These are the sort of things to look out for in a "safe" or "value", conservatively-run microcap.

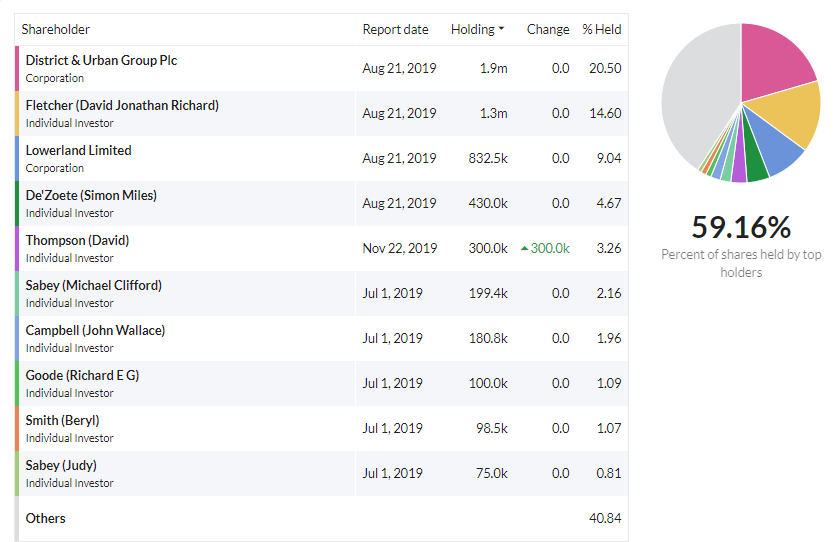

Edit: I've just tried Stockopedia's new "Major shareholders" facility. Huge congrats to the team for getting this feature set up!

This is what it looks like for FLK:

What an attractive way of presenting this data. It was worth the wait!

To get this data for any share, go to "Accounts - Major Shareholders" from the StockReport, on the new site.

United Carpets (LON:UCG)

- Share price: 5.5p (+5%)

- No. of shares: 81 million

- Market cap: £5 million

United Carpets Group plc (LSE: UCG), the third largest chain of specialist retail carpet and floor covering stores in the UK, today announces its interim results for the 6 month period ended 30 September 2019.

I owned shares in this before, and lost money on them. The experience helped me to give up on investing in "cheap" retailers. It also created in me an allergy when it comes to floor covering shares in general.

If you check out the history of this share, you'll see that it sort of went bust in 2013, but the franchise model saved it and UCG shareholders avoided ruin. The franchise model continues to be something that is of interest to me.

These H1 results are "ok" - there is a small profit before taking IFRS 16 into account.

IFRS 16 front-loads lease expenses to the start of their term. This effect unwinds as leases expire.

So when UCG takes IFRS 16 into account, the result for the period is breakeven, rather than a small profit.

CEO Paul Eyre (click here for 1990s vintage advertising!) has the following remarks, after revenue increased by a remarkable 36%:

the Group generated a significant increase in revenues, primarily driven by a small increase in the average number of stores trading compared to the prior period and the Group's fledgling instalment payment model, a new business channel for the Group with the potential to become an important future profit centre.

Instalment Sales

The new instalment payment channel is being treated separately to the existing operations. It targets "a different customer base" and offers "a separate, limited range of products". Customers pay weekly on an interest free basis.

I've noticed a few funny things about this:

- £770k of these new instalment sales had to be written off during the six-month period, due to customers defaulting - that's 15% of UCG's market cap!

- The impairments are also very large when you consider that total instalment sales during the six-month period were only £2.2 million. A very large percentage of customers must be defaulting!

Outlook

While like-for-like growth in the core retail/franchising business was 1.8% in H1, things have deteriorated since period-end:

For the business to flourish requires a positive market environment which has not been the case for some time alongside the ongoing political uncertainties which has unsettled consumer confidence and also the housing market. In the face of further Brexit uncertainty and a snap General Election, the important trading period since 30 September has proven to be more difficult with like for like sales for the 11 weeks since the period end 3.5% down.

While the Board remain confident in the United Carpets model, the outcome for the full year could be significantly influenced by the ultimate conclusion to Brexit and also in the event of any prolonged period of significant adverse weather conditions. The Board therefore remains cautious over the outcome for the full year.

My view

I still find this one interesting, and the results aren't too bad. The 36% revenue growth is very interesting, although the impairment of instalment sales and the set-up costs for that division held back profitability.

I would probably "punt" on this company and its ability to make a success out of instalment sales, if my portfolio had a section of it that was devoted to punting.

But the impairment numbers are scary, and I think the company is being brutally honest when it says that it needs a positive environment to do well.

In a recession, with depressed consumer sentiment, I expect that its franchisees will run into trouble again, just as they did in 2013.

Ultimately, this one is operating in a sector (cheap floor coverings and beds) that is too cyclical and too competitive to enable me to sleep well at night. For these reasons, I'm out!

Note that it has a StockRank of 98, so it is primed to do extremely well from a statistical point of view.

Triad (LON:TRD)

- Share price: 35.3p (-14%)

- No. of shares: 16 million

- Market cap: £6 million

This is a staffing/consultancy business that has slipped into the red in the latest H1 period.

I've written about it before, saying that it held little appeal. Probably not worth bothering with - let's move on.

Beeks Financial Cloud (LON:BKS)

- Share price: 107p (+19%)

- No. of shares: 51 million

- Market cap: £54 million

Thanks to readers for alerting me to this one - I missed it on my initial skim of the RNS. And well done to anyone who bought into it recently. I don't normally comment on contract wins, but let's take a look:

- The first contract is a "SaaS-based contract" that "will commence in January 2020 and is committed to grow to a run rate of $1 million annually, with the potential for further expansion thereafter.

A few quibbles - does this mean it's not starting at $1 million, but will grow to $1 million in a few years? What level does it start at, and when will it reached $1 million, I wonder?

The description is promising. The customer is a "global financial markets technology provider", for whom Beeks will be "the preferred cloud vendor".

- The second contract is worth £1.1 million over 3 years. It's in a new sector, "Open Banking and Payments".

The customer for this one is a "cloud-based payments solution provider", for whom Beeks will "design and supply a private network and fully managed infrastructure environment". It's hard for me to visualise this, but it certainly sounds impressive!

My view

I can't see any upgrade to forecasts, yet, from the likes of Progressive Equity Research or the company's broker, Cenkos. The share price reaction today does suggest that upgrades are expected.

Existing forecasts are for net income of £2.2 million in FY June 2020, followed by £2.9 million in FY June 2021.

As noted previously, I don't understand what the barriers to entry are in this field (cloud computing, with servers near financial exchanges). But Beeks deserves credit for achieving a very nice growth trajectory in recent years, so its above-average earnings multiple might be justified.

Stocko is perplexed, only giving it a ValueRank of 6.

Goodwin (LON:GDWN)

- Share price: 3139.5p (+7.5%, recovering some of yesterday's fall)

- No. of shares: 7.2 million

- Market cap: £226 million

Let's go straight now to Goodwin, since it's a company that many of you hold. It reported half-year results yesterday. I've never written about it before.

The results were met with dismay, and the shares finished minus 17.5%.

Revenue was up 3.8% but profits fell 5.1%, and I don't think that IFRS 16 can take any of the blame. Footnote 5 isn't very clear to me, but I think it implies that there was only a marginal impact from the implementation of the new accounting standard.

Goodwin is a mechanical engineering business with 1,000 employees and a large collection of operating subsidiaries engaged in casting, machining, making valves, pumps, cement, etc.

If we consult the new major shareholders section on the StockReport, we can see lots of involvement by the Goodwin family. That's good - they are likely to have a great sense of stewardship.

If I scroll through the archives, I see something remarkable: the company hasn't increased its share count or reported an annual loss for 30 years.

Companies with track records like this tend to be extremely attractive investments. Indeed, patient long-term shareholders in Goodwin have done very well.

More recently, things have been a little more difficult. Reduced profitability "is a feature of the disruption caused by the commotions in our parliamentary system over the past six months where the uncertainty has temporarily stalled projects."

I'm not sure if I can follow that explanation, seeing as revenues were higher - if revenues were higher, then why can't profits go higher, too?

Key points for the 2020/2021 outlook:

- profits to be flat in H2 (i.e. from now until April 2020), but cash flow to improve

- the company expects the demand for energy to increase, thanks to growth in developing economies, and this should boost the mechanical engineering division

- Radar systems subsidiary gets its first foreign order for surveilliance systems

- demand for jewellery has declined, which hurts demand for the casting powder which Goodwin suppliers. This market is "beginning to improve"

My view

Firstly, I need to concede that I don't know too much about this company. There are lots of subsidiaries to keep track of - too many, for my liking.

But I can't deny that it appears to earn its cost of capital with ROC of 12.5%, according to Stocko.

And I like to see family businesses which are profitable for extremely long periods of time, with the family maintaining its involvement.

Net debt of £27 million appears to be manageable. Banking headroom is said to be "significant".

I'm happy to give this a cautious thumbs up, based on an initial look.

That's all I can handle for today - have a good weekend everyone.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.