Good morning, it's Paul here.

To get you started today, here is the link to yesterday's completed report, which turned out to be a bit of a monster, taking me until 21:30 to finish. It's a review of everything I currently hold personally. That completes my series of end of year reviews, which seem to have gone down really well with subscribers here, judging by the positive comments & high number of thumbs ups - much appreciated. It really makes a difference to the writers here, if we get decent feedback.

Today I'll be reviewing trading updates from;

Next (LON:NXT)

Johnson Service (LON:JSG)

Mobile Tornado (LON:MBT)

Estimated time of completion today is 1pm, as there's not much to report on, so that time shouldn't slip.

Next (LON:NXT)

Share price: 6954p (flat on the day at 09:01)

No. shares: 133.2m

Market cap: £9,262.7m

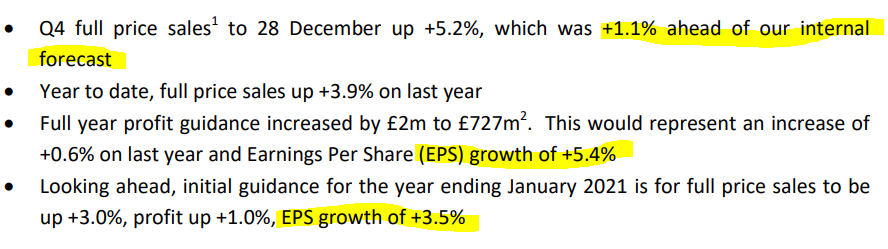

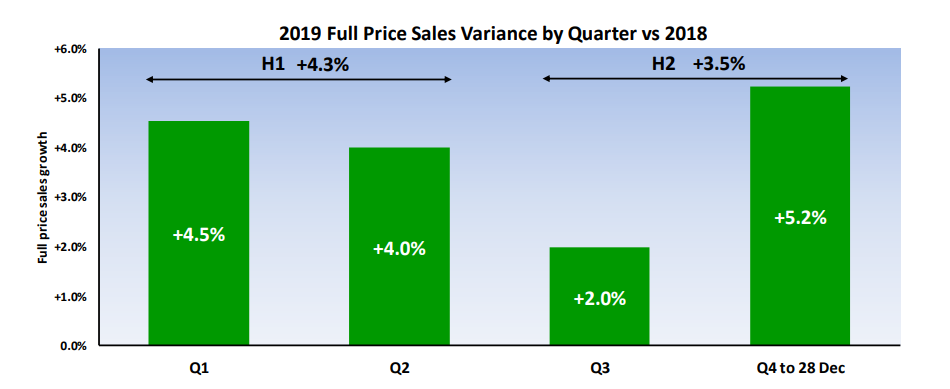

Fashion retailer Next has had a decent Christmas, as expected. The summary says it all;

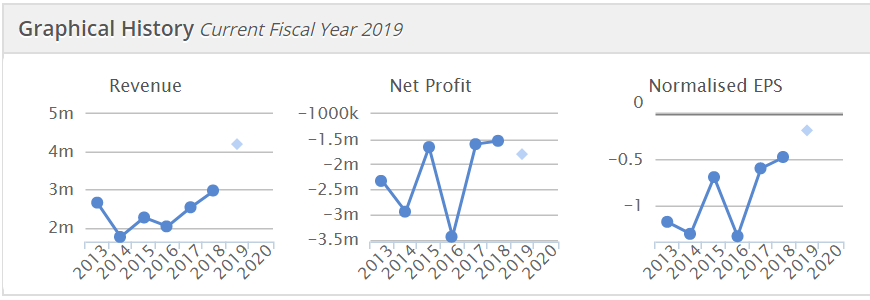

An unusual feature of Next is that it buys back its own shares with surplus cashflow each year. This is driving up EPS. Note from the StockReport (average no. shares in issue) this was 155.6m in 2014, and had fallen considerably to 133.2m now.

The chart below shows how Q4 to date (it's a 01/2020 FY) has been the best quarter of this financial year - helped by colder weather in November, and better stock availability;

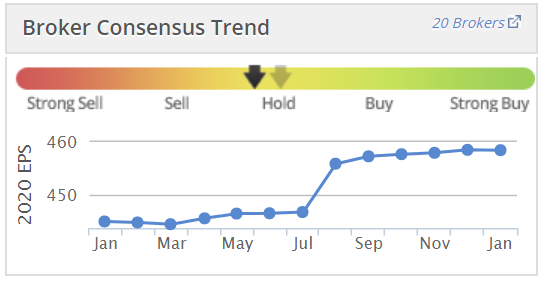

Valuation - latest guidance from the company is for 458.7p EPS this year, rising 3.5% in the following year (implying 474.8p). Taking the new year estimate of 474.8p, and dividing it into the current share price of 6954p, gives a PER of 14.6 - which looks about right to me, since EPS growth is quite pedestrian and mainly driven by buybacks.

My opinion - both Graham and I have been long-term bulls on this share, because it has managed to offset declining High Street business with a very successful internet operation.

I think the re-rating in the last year has been fully justified, but I'm not convinced there's much more upside to be had from here onwards? Maybe another 10-20% upside, if this bull market keeps running strongly. Is that enough to tempt me to buy back in now, in a word, no.

On the other hand, we should remember that Next tends to be prudent with its forward guidance. Evidence for this is the consistent upgrades to forecasts in the last 12 months. Plus I think consumer confidence is probably going to be rising after the decisive election result. So maybe the PER might turn out to be lower than 14.6?

I might buy some of these if there's a decent pullback at any stage.

Johnson Service (LON:JSG)

Share price: 203p (up 2% today, at 10:19)

No. shares: 369.8m

Market cap: £750.7m

I hadn't realised that the market cap of this company had got so high, but might as well carry on, since I've already started writing about it, and there's little else to cover today.

JSG, a leading UK textile services provider, is pleased to provide a trading update for the year ended 31 December 2019.

It looks like 2019 ended well;

We remain positive about the future prospects for the business and we expect to announce full year results slightly ahead of market expectations.

An acquisition costing £12.5m is announced.

A new plant in Leeds is opening in spring 2020.

My opinion - it looks a good business, but the share price seems fully up with events.

It's valued at about 18 times forward earnings, and has a weak balance sheet (little tangible asset value), and a fair bit of debt.

A lot of UK mid caps are starting to look a little stretched in valuation terms, including this one.

That said, when you look at the historical track record, the group does seem to have earned its stripes;

Mobile Tornado (LON:MBT)

Share price: 3.5p (down 8% today, at 12:04)

No. shares: 379.7m

Market cap: £13.3m

Trading update (profit warning)

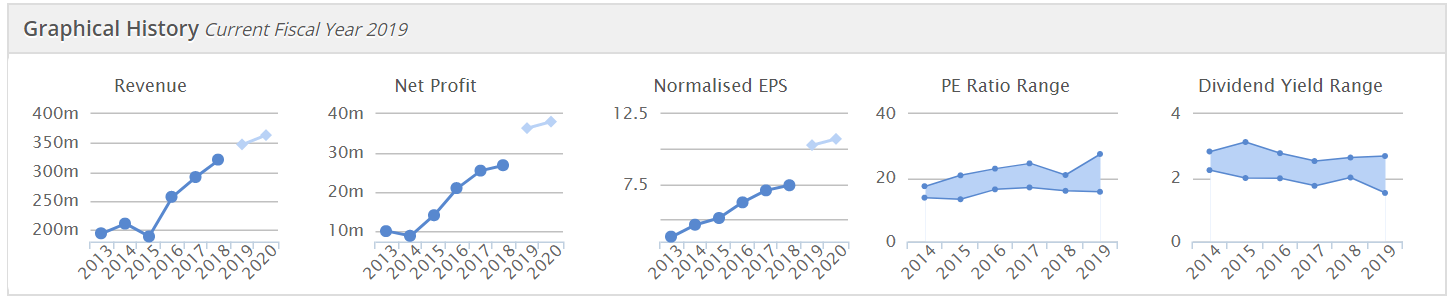

I've not looked at this company before. From the track record, it looks a bit jam tomorrow-ish;

Profit warning today says 2019 revenues will be £3.3m, below expectations.

EBITDA loss of -£0.3m

Cash position not stated.

Reason given is delayed contract deployment.

The last balance sheet looks awful, so I'm not interested in looking into it any deeper.

That's all for today, have a great weekend!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.