Good morning, and happy new year, it's Paul here!

I'm working the afternoon shift today, so should be finished here by 6pm.

Edit at 17:17 - this portfolio review is taking much longer than expected, so I'll just keep going until it's finished, est. 10pm. Apologies for any inconvenience. I'm sorry if some people don't like variable timings, but that's what achieves the best overall results - I'm not going to rush for deadlines, churning out sub-par quality.

Edit at 21:33 - today's report is now finished.

There's only 1 company to report on today. So I'll use the spare time after that, to do the previously promised commentary on my current small cap holdings. That will then complete everything I wanted to write about for 2019. I very much appreciated all the kind comments from subscribers about my end of year articles, so thank you for those.

Tasty (LON:TAST)

Share price: 3.75p (37% today)

No. shares: 141.1m

Market cap: £5.3m

Trading update & property disposal

Background- I don't normally go below £10m mkt cap for reporting purposes here, but there's nothing else to cover today, and Tasty has been on my watch list for a while as a potentially interesting company.

It operates casual dining restaurants, under the Wildwood brand (pizza, pasta, grill), and dim T brand (oriental). The Kaye family are involved here, who have had previous success with pizza/pasta restaurants - although perhaps their ideas are a bit dated & stale now? Arguably newer operators (e.g. Franco Manca by Fulham Shore (LON:FUL) ) are doing better, and more affordably priced pizzas. Wildwood relies on permanent discounting (amongst other discounts, they are trialling the BigDish (LON:DISH) platform in one site). Also, I think the everyday low pricing model (with no discounting) that Franco Manca uses is a lot more sensible than permanent heavy discounting.

As you can see from the share price chart below, this share is little more than a call option on the company surviving. Its previously reasonable level of profitability collapsed into breakeven/losses from 2016 onwards. The main problems?

- Over-capacity in the hospitality sector

- Rising wages costs (if anything this is getting worse, with a large recent increase in Living Wage announced by the Govt)

- Unaffordable rent/rates

It's difficult to see what is likely to change, to reverse that trend.

Trading update - this sounds reassuring, although note that the company seems to be receiving informal support from its landlords;

The Company is also pleased to announce that fourth quarter sales to date remain in line with management's expectations and, with the continued assistance of landlords, the Board remains confident that current market forecasts for the year ended 31 December 2019 will be achieved.

Property disposal - this is quite a coup, as it has enabled the company to get rid of its remaining bank debt - the importance of which can't be over-stated. Once the bank debt is paid off, then a company has breathing space, and the main risk of insolvency is removed.

...pleased to announce the exchange of contracts for the sale of its dim t More London site for a gross cash consideration of £2 million. This disposal is in line with the Company's strategy of reducing exposure where it is experiencing increasing property and labour costs and strengthening the Company's balance sheet.

The More London restaurant produced an EBITDA of £106,000 for the year ended 31 December 2018 and had a net book value of £878,000 as at 30 June 2019.

The sale proceeds, net of associated costs, are expected to amount to approximately £1.95 million and will be applied towards paying off the Company's remaining bank debt, and to fund the Group's working capital and selected restaurant refurbishment plans. A further announcement will be made on completion of the sale.

That looks a fantastic price for a restaurant that only made £106k EBITDA - a disposal price of almost 20 times. I had to do some googling to find out why this site (presumably just on a lease, not a freehold) would attract such a high value. The answer is that it has panoramic views of London Bridge, hence is a prime London site. It would have been amazing to watch the NYE fireworks from a window table there!

Although the high property disposal price of £2m is a reminder that TAST is not terribly good at generating returns, even from a prime site like that. I would have thought that a river view, high end site like that would be better suited to a high end restaurant operator, not a mass market offering that Tasty does.

It makes me wonder what other gems there might be in the property portfolio, as this is the second time that Tasty has pulled a few million quid from under the sofa, with property disposals? Or as others have put it, is this a case of the company selling off the family silver?

Balance sheet - I've looked again at the last (interim) balance sheet, and if we adjust for this property disposal, it should now be OK. For that reason, I don't think Tasty is under any immediate risk of going bust.

CVA? - it seems to me that Tasty would make an ideal candidate for a CVA - a form of solvent insolvency, whereby problem leases are either jettisoned, or more affordable rents agreed with landlords.

But it depends on the profile of the company's leases - i.e. how close to lease expiry or break clauses are they at each site? That's the crucial information which shareholders need to know, but is not provided. Therefore valuing the shares is almost impossible at this stage.

My opinion - even if sales stabilise at the current level, Tasty will still be facing rising wages costs of maybe 5-6% p.a., since Govt policy is to increase Living/Minimum Wage faster than inflation. That is bound to put great pressure on already beleaguered retailers and hospitality companies.

I feel the best solution for Tasty would be a CVA, whereby it could exit the problem sites, and lower the rents on remaining sites to affordable levels.

In the meantime, today's news of the £2m property disposal greatly reduces short term risk, and buys the company time to consider what to do next.

It's tempting to have a dabble in the shares, at such a low market cap.

The other risk to consider is that of de-listing. There was another small restaurant chain where the Kayes were involved, where they took it private at a not very good price a couple of years ago. The name escapes me. Ah, it was Richoux. It wouldn't surprise me if Tasty goes the same way, with either a low-ball bid, or a de-listing. Many investors can't, or don't want to, hold shares in private companies, so become forced sellers (at any price) when a de-listing is announced.

Review of my personal shareholdings

Introduction

As promised late in 2019, I intended to fill the gap in company announcements over this quiet period, with several articles, as follows;

How I see the outlook for UK small caps in 2020, published here on 27 Dec 2019

Mistakes I made in 2019 - review of my performance for the year, published here on 31 Dec 2019 - which ended up turning into a warts & all abridged autobiography!

Review of the individual shares I currently hold - which is what this article you're reading now will be about.

Disclaimers

- The shares I'm writing about below are all ones which I hold personally. So obviously I see them positively. I'll try to comment in an even-handed way pointing out downside risk as well as upside, but there is bound to be unconscious bias - as we all have for stocks that we hold.

- These are not tips! We don't tip things here nor give advice about shares, because the whole ethos of Stockopedia is to help educate investors and provide tools & opinions to help people do their own research & take ownership of your own investing decisions.

- Some of my shares will in future go up, some stay about the same, and some will go down. I don't have a crystal ball, so unfortunately don't know which ones will be in each category!

- My opinions are subject to change on future newsflow. I may add to, or sell positions at any time, and am not under any obligation to publish my personal trades. Although in practice, I trade very little these days, and keep positions for typically 2 years+, to give them time to develop.

- I run a concentrated portfolio, with most of my money in the top 5 positions - which is a high risk strategy. It works brilliantly when I get the stock picks right, but can be horrendous when things go wrong with one or more of my larger positions.

- Many of these shares are illiquid, hence can be very difficult to enter or exit from, especially selling after bad news can be difficult to impossible.

Commentary on individual shares I own

Large positions

These are companies where I have a high conviction that the shares should do well in future, and/or might be undervalued today. In alphabetical order;

Intercede (LON:IGP)

56p - £28m mkt cap - turnaround - cyber-security ID authentication software

I've held this share for about 18 months, and so far so good. There are lots of articles from me in our archive here. As you can see from them, after initially being negative, I gradually turned positive as the first signs of a turnaround strategy began to tentatively emerge under new management.

The tone of the meetings I have with management roughly every 6 months has been getting a lot better recently, which gives me a high level of confidence in the company's future.

Bull points (IGP)

- Amazing client list, including US Federal Govt agencies, 5 of the 6 top aerospace companies, major banks, etc.

- Sticky recurring & repeating revenues - once signed up, clients tend to remain clients for 10+ years

- Cash burn stopped by binning speculative R&D spending. Hence no need for further fundraising, and has enough cash to repay loan notes when they fall due

- NED Jacques Tredoux, increased his personal holding in 2 stages to 29.7%, most recently in Sep 2019

- Big sales push is next stage of the turnaround plan - high margin additional revenues could transform profitability, if successful

- Takeover bid potential?

Bear points (IGP)

- Convertible loan notes are expensive at 8% coupon, and if strike price of 68p exceeded, then could lead to some dilution

- Client concentration risk - dependent on large contracts renewing each year

- False dawns in past, under old management - inability to grow revenues sustainably - the same thing could happen again, possibly?

- Shares are extremely illiquid, so difficult to buy and sell

Revolution Bars (LON:RBG)

82p - £41m - turnaround - late night cocktail bar operator

Regulars will know that I've been banging on about this share for years now! It all came good with a cash bid at 203p from Stonegate in autumn 2017, which then fell through, resulting in the share price grinding down to only 65p until recently.

I don't know why it has shot up 18% today? Possible speculation on key Xmas/NYE trading having gone well? Who knows, the price can move on not much volume. We should get an update on H1 (Jul-Dec 2019) trading very soon - last year it was published on 14 January.

Having dug into the detail of the turnaround plan, in meetings with management, I'm confident that their actions should deliver improved performance. If so, then the share price could re-rate higher, and possibly attract another bidder.

For clarity, this is not a share I want to hold forever, it just seems to cheap to me. My target exit price is c.120-150p, but that could change depending on newsflow - i.e. if LFL sales start zooming up, then I'd want a higher exit price.

Bull points (RBG)

- Turnaround under new, operationally focused management - numerous initiatives to deliver better customer experience

- Highly cash generative, targeting debt reduction from c.£15m to c.£10m this year

- Tatty older sites now being refurbished from cashflow, already delivering above targeted performance improvement, strong ROI on refurb spend

- LFL sales trend improving steadily in last year

- Cost & efficiency savings achieved & ongoing

- Very low valuation, compared with recent sector takeover activity

Bear points (RBG)

- Poor track record in last 2-3 years

- Loss of key site & area managers led to poor performance, although this is now being fixed

- Expansion paused, due to poor returns from expensive new site openings

- Dividends also paused, to enable debt reduction

- Relentless wage cost increases due to Govt policy on Living/Min Wage - although this also results in customers having more money to spend

- Overhang of expensive older leases, a drag on profits of c.£1m p.a.

- Downside risk of LFL sales (at high margins) failing to grow, thus seeing wages costs drag profit down further

Sosandar (LON:SOS)

27p - £44m mkt cap - growth company - online fashion brand

This is another share where we have masses of commentary here in our archive.

The share price has been a roller-coaster ride since this startup fashion brand reversed into the cash shell left behind by a failed junior resource stock, and shares re-commenced trading on AIM in Nov 2017. I've been impressed by the liquidity in the shares since then - a reversal into an existing shell seems an excellent route for micro caps, as it means there is already some liquidity to begin with, with a ready-made small shareholder base - some of whom want to exit, thus providing liquidity for new private shareholders like me to buy in the market.

After good early progress, the share price went a bit crazy on the upside in late 2018, then over-corrected on the downside by late 2019. There were 2 specific problems;

1) Growth slowed in Spring 2019, and

2) The original business plan considerably under-estimated the marketing spend required to drive growth.

Things are back on track now, with management biting the bullet and raising £3m + 7m in two funding rounds. This has been used to greatly expand the product range, and big increases in marketing spending (including TV ads which have worked well).

Last year we had a trading update on 9 January, so that ties in with an update hopefully late next week.

The most recent trading update from 27 Nov 2019 was strong, and here is my commentary on it, which goes into a fair bit of detail. There's an excellent video (38m duration) from Tamzin & Tim at PIworld here.

My view is that this company should be very much bigger, and more valuable, if we take a 3-5 year view. In the short term however, it is vulnerable to sharp pullbacks if progress disappoints at any stage.

Bull points (SOS)

- Excellent management, with unique experience

- Growth back on track in key A/W season

- Customer loyalty: once acquired, they repeat order, thus justifying higher marketing spend

- Large, under-served market opportunity of women in between fast fashion and mature markets

- High gross margin gives good operational gearing

- Outsourced logistics & IT, hence infinitely scaleable

- International sales growth

Bear points (SOS)

- Still loss-making, and needs further rapid growth to achieve breakeven

- Could it run out of cash again, in future years?

- Competitive pressures (but such a large market, there's plenty of room for a small challenger like SOS)

- High valuation for a loss-making company - so shares are vulnerable to sharp falls on any disappointing newsflow

Medium-sized positions

These are companies where I'm optimistic about the future, and could see the shares going higher (long term). However, for one reason or another, I don't want to let my position size get too large.

In alphabetical order again, but briefer sections, as it's taking too long to do big sections;

BigDish (LON:DISH)

1.2p - 4.3m mkt cap - highly speculative, discount dining app

This is a very controversial micro cap share, which has attracted (understandably) a lot of negative commentary, because management put out misleading RNSs last year, and generally over-hyped the company's prospects.

The one advantage of the huge spike in share price, was that a placing was done with a US investor at 7.2p. Therefore, being able to buy them now at one sixth of that price, seems an interesting opportunity.

Cash is forecast to run out in Q3 2020, so another placing is certain. Normally I wouldn't be comfortable with that, but in this case, the ducks seem lined up to produce genuinely positive newsflow in 2020. A recent switch has been made from using area managers, to telesales, to recruit new restaurants to the BigDish platform.

A recently added new CEO has proven successful track record in this precise field. Therefore I am anticipating strong newsflow in the coming months, then a placing at a higher price in Q3.

US investors in particular place much higher valuations on early stage food apps, as has already been proven with the 2019 placing.

Overall then, I think risk:reward is interesting here. It's binary to my mind - this is either a multibagger, or a wipe out at the current level.

Above all though, I use the BigDish dining app a lot myself, and it's absolutely brilliant. Management have made a lot of mistakes (which they admit to), but the share price is so bombed out now, that at 1.2p I reckon the upside could be quite exciting. This time round though, I'm intending on selling half if another major spike upwards in price occurs. I was a complete idiot not to sell any when it more than 5-bagged in 2019, as it went all the way back down again.

Beeks Financial Cloud (LON:BKS)

115p - £59m mkt cap - cloud software for trading platforms

I was hoping to buy more of these, but a recent contract win RNS has driven a strong share price recovery. So I'll sit and wait for a pullback, before buying some more.

This stock is really all about backing talented management, with an interesting niche product.

See PIWorld for videos of the CEO explaining the company.

It's difficult to value in the short term, but strikes me as the sort of company to just tuck away and forget about for 5 years. It's likely to be much bigger, and more valuable over that time period, in my view.

Best Of The Best (LON:BOTB)

349p - £33m mkt cap - growth company - weekly online supercar & lifestyle competitions

Another long term holding of mine. As with most micro caps, there were some bumps in the road - mainly a VAT dispute, and adverse change of taxation basis to Remote Gaming Duty.

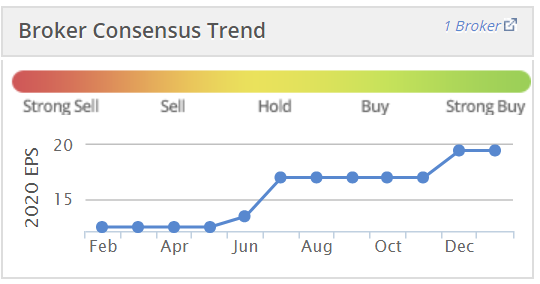

Despite this, forecasts have been raised a lot in the last 12 months;

I think this should be re-rating the shares faster & further than has so far happened. To my mind, it's already worth 500p+ The difficult is actually finding any shares, as it's so illiquid.

Again, this share is all about backing decent, trustworthy management, who look after their minority shareholders well - both in communications, not drawing excessive salaries, and paying big divis (including some specials).

I'm very pleased with progress, and wish I owned more shares.

Cloudcall (LON:CALL)

98.5p - £38m mkt cap - growth company - integrating cloud telephony into CRM systems

Another long-term holding of mine, which has been a serial disappointer - missing both sales, profit & cash targets year after year.

However, I think it reached a tipping point in 2019, where operational performance is gaining traction. Also it raised a big chunk of cash, so that it won't need to come back for more. That's diluted the upside, with a higher share count, but protects the downside now. Hence I think risk:reward looks potentially very good from this point.

This is another tech company which is already attracting interest from US investors, and could end up being bought out from an American buyer - who pay big money for growing tech companies like this.

Hence I see more upside than downside risk now.

French Connection (LON:FCCN)

37p - £36m mkt cap - turnaround - international fashion brand

Interim results were not good, but they were affected by later than usual deliveries of wholesale product. The last outlook statement was in line with expectations, which is for a small profit - a better outcome than any of the last 6 years.

Wholesale & licensing are doing OK, and the problem retail division should see several horrendously loss-making stores close soon. Indeed, its Oxford St London store did close earlier this year, and by my calculations that should give the P&L a nice boost. It was on a crazy rent, which must have resulted in it losing several £m's p.a. alone.

The company has been in play, with a protracted sale process failing so far to clinch a deal. With the political uncertainty now removed, perhaps a sale of the company could now happen? I like it a lot at the current valuation (about par with its own working capital), and the longer it drags on, the more problem retail leases expire. So I don't mind waiting as long as it takes.

Small positions

These are either small because they went wrong, or small because I wanted to dip my toe in the water, and then follow the newsflow with a view to either buying more, or selling up. As in the other sections above, I've written lots of commentary about all these shares before in the SCVRs, so feel free to look up previous articles in the archive.

Cenkos Securities (LON:CNKS)

58p - £33m mkt cap - turnaround - stockbroker & corporate financier for small to mid caps

This broker's balance sheet underpins the downside very nicely, with £25m in working capital, and no long term debt. In other words, at £33m we're really only paying £8m for the actual business.

It's going through a lean patch at the moment, for deals (IPOs and placings), which is where it makes the big money in good years. Obviously, market conditions have been poor in 2019, but it has a flexible overheads structure, so even it a really bad year, it usually still makes a profit. In the boom years, it makes a ton of profit, which is paid out in divis.

Therefore, I'm happy to continue holding, given that the downside risk is covered by the strong balance sheet, and the upside (of a recovery in deals) is in practically for free.

LoopUp (LON:LOOP)

72p - £40m mkt cap - turnaround - high end conference calling telephony

This is in the low sized positions end of my portfolio because I made a mistake, or got very unlucky depending on how you see it, catching a falling knife. It seemed to me that the turnaround potential looked quite good at 129p in July 2019, but within a few months it had plummeted down to as low as 50p. There's been a bit of a recovery now to 72p, but I'm still well underwater.

Normally in this type of situation, I would re-evaluate it, and either ditch them, or double up. In this case though, I really can't decide which is the better course of action.

On the one hand, I think management have made an unbelievable mess of things, including an over-priced acquisition. Plus they don't seem to have proper control over costs, nor the sales process. So a case of management who come across really well in person, but who've actually performed dismally.

That said, the company has a very impressive client list, including top firms of lawyers, e.g. Clifford Chance with a 3-year contract of minimum value £2.3m. So the product, which is very good when I tried it out a couple of years ago, looks good.

The downside is that the customers are using it less - which the company puts down to macro factors. I think it's more likely that customers are using some other system, some of the time. Also there is a question mark over the debt.

Overall, I'm monitoring it, and will let the newsflow guide my direction.

Malvern International (LON:MLVN)

1.0p - £2.5m mkt cap - turnaround that hasn't worked yet - educational businesses

I put money into this, in a placing at 4p some time ago. It looked like an interesting turnaround under new management with a track record of building up an educational business in New Zealand.

Unfortunately, it's been a bit of a disaster so far. Forecasts keep slipping, and I wasn't at all happy with the expensive loan facility (min 10% p.a.) entered into in Aug 2019.

That said, the recent trading update pointed to an improved performance in 2020, due to bookings being up. Maybe the really savage fall in share price in 2019 was an over-reaction?

My overriding feeling with this share was being unable to sell when I wanted to, as it drifted down. That almost complete lack of liquidity, means that I have no desire to add to my position, even if it is too cheap.

Memo to self - it really isn't worth the risk, getting involved in the tiniest companies on the market. That said, I'll give it another year, to see how things pan out in 2020.

Onthemarket (LON:OTMP)

70p - £49m mkt cap - online property portal (challenger to Rightmove & Zoopla)

Most people dismiss this company without even looking at the numbers. However, dig deeper and you will discover that it has made great inroads, and through initial free trials, has signed up a large number of UK estate agents. They are then offered free shares to convert onto long-term, paying contracts.

I met management in 2019, and came away thinking that this thing has a decent chance of success. Moreover, if it does succeed, by which we're talking supplanting Zoopla as the no.2 property portal, then the valuation could be maybe 30-40 times the current level. Who doesn't enjoy the occasional 30 or 40 to 1 bet?!

The downside, is that I think it will almost certainly need to raise more equity funding, which means more dilution, possibly at a discount. For that reason, I see this position as a placeholder in my portfolio - i.e. I would like to buy more, maybe lots more, if the newsflow justifies it. However, I'm not buying before its long-term funding is sorted out through the next placing.

Touchstar (LON:TST)

37p - £3.2m mkt cap - turnaround - mobile computing solutions

I bought these at 80p in summer 2018, and have been frustrated to see the price halve in my period of ownership. The company, which sells handheld computers & software, for logistics companies, seemed to be tapping into some good growth markets, and has some impressive customer logos on its website.

Unfortunately, the turnaround isn't really working yet. It put out one of those annoying profit warnings recently, which gave credible reasons as to why it would miss 2019 forecasts, and talked positively about prospects for 2020. That was enough to make me decide to hang on for another year. Although similarly to MLVN above, it's so small & illiquid, that I probably couldn't sell even if I wanted to. The CEO recently upped his stake, which gives me a little more confidence.

Also it has just moved into net cash, so shouldn't need to dilute. I'm more relaxed about holding onto a position if the risk of dilution is small. I'm more confident of Touchstar coming good in future, than I am about Malvern.

Zytronic (LON:ZYT)

242p - £39m mkt cap - turnaround - bespoke touch-sensitive screens

I bought the falling knife here too early, in May 2019, and immediately went into losses with it. However, patience seems to be paying off now, with it back at breakeven overall for me.

This company has a good long-term track record, but is suffering at the moment as several long-term programmes are reaching end of life. The sales pipeline for new projects is strong, so I'm hoping that it might be able to recover. Also the balance sheet is amazing, stuffed with surplus cash of about a third of the market cap.

Overall, I think it should probably recover over the long-term, but don't have enormous conviction over that, hence why it's only a small position.

That's everything I think, so today's report is now complete. Let me know what you think, especially if you have any insights into any of the shares mentioned above.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.