Good morning, it's Paul here.

Early on, I'll be focusing on the interim results from Sosandar (LON:SOS) (in which I hold a long position). I've got a telecon booked in with mgt early on. I'm expecting to see a big increase in marketing spend, fuelled by the recent £7m placing, and an acceleration in sales growth (after a slowish Spring/Summer season). Seeing as these are already known factors, then the key thing will be the current trading statement. If Autumn/Winter sales are going well, then the recent share price recovery could continue.

Estimated timings - as always, it depends on what newsflow there is. My intention is to start early, and be finished by 3pm. Update at 15:34 - apologies, I nodded off after lunch (trainee pensioner LOL!). Am back at work now, so I'll be finished here by 5pm. Update at 17:00 - today's report is now finished.

On my agenda today;

Sosandar (LON:SOS) - interim results & a quick call with management

SCS (LON:SCS) - AGM trading update

Ab Dynamics (LON:ABDP) - results headline figures look fantastic, so I'll report on this, even though it's moved above my usual upper mkt cap limit

OnTheBeach (OTB) - preliminary results FY 09/2019

Water Intelligence (LON:WATR) - upbeat-sounding trading update

Rejects

Filtronic (LON:FTC) - in line. Not very interesting, so I won't report on this one.

Grafenia (LON:GRA) - only £8m market cap, and headline figures look weak - I'm not convinced this company has a viable business model. Therefore not of interest.

Appreciate (LON:APP) - interim results out today are not very important, as it has a strong H2 trading bias. Trading outlook unchanged, so nothing for me to report on.

Sosandar (LON:SOS)

Share price: 25.75p (up 3% today, at 08:09)

No. shares: 162.9m

Market cap: £41.9m

(at the time of writing, I hold a long position in this share)

Sosandar PLC (AIM: SOS), the online women's fashion brand, is pleased to announce its unaudited results for the six months ended 30 September 2019.

Short results presentation video is here

Preamble - Revised strategy - the business plan at Sosandar changed somewhat earlier this year. Therefore over the summer £7m was raised in a placing at 15p (same as the IPO price, less the 0.1p broker fees). They decided to accelerate growth with a big expansion of product range for Autumn/Winter (roughly doubling of number of styles). This required an increase in headcount (new designers/buyers), plus raised a cash requirement for increased inventories, from new factories.

Given the state of the whole sector (even major UK retailers struggling & at risk of going under), factories are less inclined to offer credit to UK retailers. This point is mentioned again in today's interim results commentary. Over time though, as confidence builds, then factories do extend credit. So it's a bit of a one-off hit to cashflow in this period. Not a problem as there's plenty of cash available.

This is reflected in working capital - e.g. inventories are up from £735k a year ago to £1,920k (essential for producing increased sales in the peak season). Whereas trade creditors have only gone up from £1.0m to £1.2m.

Plus it became apparent that SOS needed to spend a lot more on marketing, to achieve the necessary growth in sales. Put these various issues together, and it was clear that SOS needed a lot more cash than originally planned. This was all explained very well by management, in a series of meetings over the summer, one of which I attended.

Looking at the interim results today, management has done what they told us they would do - bolstering confidence. In particular, the expanded product range has indeed delivered the very challenging growth planned (c.100% Y-on-Y uplilft targeted, which looked very ambitious) for Autumn/Winter.

Sales growth - there was a soft patch in Q1 (Apr-Jun 2019) which caused a big (overdone) sell-off in the shares when it was announced that growth was only 23% on prior year.

The trend of sales growth vs last year since has been excellent;

Q1 (Apr-Jun 2019): +23%

Q2 (Jul-Sep 2019): +84%

Q3 (Oct-Dec 2019):

October - "sales growth well over 100%", over £1m sales (net of returns)

November - "on course to exceed" October.

Incidentally, I recalled that Oct 2018 was the peak sales month last year. Whereas this year, a very strong Oct is set to be exceeded by Nov sales. That's very good news, buried in the detail. I queried this point with management this morning, and James Bowling, CFO, confirmed that my recollection is correct.

Management were confident that they could achieve +100% sales growth in the seasonal peak season of Autumn/Winter, and (so far) they are delivering on this challenging target. With the caveat that it's being achieved by spending considerably more on marketing than originally planned.

Increased costs - We knew that costs would rise considerably (that's why they raised the £7m, to spend it on growing the business). Unfortunately, the nature of the business is that money has to be spent up-front on developing a range of products (it's all bespoke remember, nothing is off the shelf), and attracting new customers through marketing spend. Then the benefit flows through in future.

Administrative expenses have therefore risen from the previous run-rate of about £3m per half year, to £4.3m in H1 of FY 03/2020. This is as expected.

The latest broker note has administrative expenses of £9.2m pencilled in for the full year, so that allows for a further increase to £4.9m in H2. The previous forecast was for £7.7m in administrative expenses this year. Therefore people who comment that the company is only hitting its sales targets by spending a lot more on marketing, are correct.

However, as an investor, what would I prefer? That the company limps along with slower growth, because management are too scared to spend big on marketing? No way. I want to see the business grow as fast as it can, providing the marketing spend is delivering decent results (which it is).

A key point in understanding the business model at Sosandar, and why its strategy makes sense, is that once a customer has been acquired, they tend to be loyal, and return. Therefore the lifetime value of customers is estimated to be very high (there's not enough data yet to put a figure on that).

Broker forecast - the latest forecast (from Oct 2019) shows an operating loss of £3.8m for FY 03/2020. The H1 loss is £2.8m. Management today confirms that they're trading in line with full year expectations, therefore we should see a sharply reduced loss of c.£1.0m in H2, which is seasonally stronger than H1.

Therefore anyone taking the H1 loss, and doubling it for the full year, is not paying attention!

The nice thing about online businesses, is that the main spend is on marketing, and this can be dialled up or down at will. The lead times are only about 1 month. This is a huge advantage over bricks & mortar retailers, whose costs are mainly fixed.

Clearly though, whilst the business remains loss-making, it's a speculative share, and not for widows or orphans.

Valuation - sometimes people say that the market cap of £42m is bonkers for a loss-making company. If you took that approach, you'd have missed many major multi-baggers. Many successful companies are loss-making in their early, start-up stages.

In particular, I think there have only been three pure-play online fashion businesses ever listed on the UK market. 2 out of the 3 (Asos & BooHoo) have been major multi-baggers. They have demonstrated how rapid early stage growth then snowballs. Both looked very expensive all the way up. Indeed, I explained why BOO was not expensive (as many people thought it was) when it was 34p, here in 2015. The same arguments could apply to how we value Sosandar today. Once SOS breaks into profitability, the sky's the limit in terms of valuation, as we saw with both Asos & BOO. That's why people are prepared to pay a premium now, because it looks like the business plan is going to work.

For completeness, the third UK-listed online fashion share, which has been a disaster from day one, is Koovs (LON:KOOV) but that operates in the much more difficult Indian market. There's 5-years worth of negative articles about KOOV from Graham and I, here. It was blindingly obvious that Koovs wasn't making any progress, and it looks close to going bust - although you never know, people have repeatedly bailed it out in the past.

Balance sheet - bolstered by the £7m placing, and a previous £3m top up placing, cash is fine for now. There's £6.9m in net cash, which is plenty for the next couple of years. Management made the right decision to raise more money in one lump, rather than leaving investors permanently fretting about future fundraises.

The house broker forecasts £4.7m cash remaining at 03/2020. That looks a bit too conservative to me, as H2 cash burn is not likely to be £2.2m, which is implied by that figure.

Q&A with management

There's nothing much else of interest in the Sosandar results today, so let's move on to my rather rushed Q&A early this morning with management.

Q1. Celebrity endorsements seem to have dried up compared with last year?

A1. No! (Julie then reeled off a list of celebrities spotted wearing Sosandar) - that's just this week alone - in 2 days! Various publications pick up on celebs wearing Sosandar, and link to Sosandar's website (in return for a small affiliate fee arrangement), which drives sales of those items.

Q2. I've noticed your website has a lot of old lines still on it.

A2. These are end of line, fragmented ranges, which are put on our "Outlet" page, at a discount. They sell quietly in the background, until everything is gone. It may look like a lot of styles, but the actual number of garments is small.

Q3. You mention taking on a lot of new suppliers. How do you manage product quality control with new factories?

A3. Suppliers (factories) are competing for our business, so they make sure the quality is right. Product quality is paramount for us. We approve pre-production & production samples. Plus our buyers visit the factories a lot, to build relationships & inspect goods personally.

Q4. There was previously talk of you selling via third party websites. Any progress on this?

A4. We're getting lots of approaches from websites wanting to sell Sosandar. Talks ongoing.

Q5. What's the payback on marketing spend?

A5. Just over a year. Once a customer has placed their first order, it becomes much easier/cheaper, as we can contact them again via email & product brochures. Expanding the product range improves repeat purchases, as there's more likely to be something of interest. All marketing channels are performing well, and we target the money where we're getting the best return. Lots of sign-ups from TV ads, we send them a brochure immediately. They're hot leads, which convert well into sales.

Q6. How are new product categories performing?

A6. Really well. Denim dresses have been a success, and we're launching our own jeans range in the spring. Hope to have signature designs, which customers buy repeatedly over & over again. Returns rate is lower on denim & accessories. Accessories are being trialled at the moment.

My opinion - I spotted from day 1 that this management team have what it takes to make a success of this. So far, so good. Although it's a fair criticism that the original business plan greatly under-estimated the amount necessary for marketing. Show me a start-up that doesn't greatly under-estimate the costs of scaling up!

How to value it at this stage? That's very difficult. Personally, I'm comfortable with the current price, and am happy to wait for the company to grow into the valuation. Although history with Asos & BooHoo shows us, that once these things really start to motor, in terms of revenue growth & profitability (mind you, Asos has never really made anything much in free cashflow, despite being valued in the £billions), then the valuation is likely to look very expensive. PER is not the right way to value fast-growing, high gross margin businesses.

So if things go well, then we could look back in a few years, and kick ourselves for not seeing the potential in Sosandar at sub-£40m mkt cap.

If things go badly, then the downside case would be that the business needs to keep raising more money, and sales growth slows. There's no sign of that now though, rather the opposite - sales growth is accelerating strongly, and there's plenty of cash.

As I say, not for widows or orphans, but a very interesting little company, with superb management, in my view.

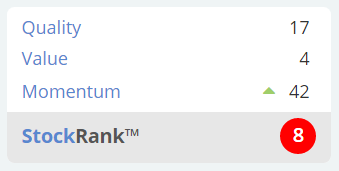

I should add that Stockopedia's algorithms hate this type of loss-making, speculative share. So as expected, they throw a cold bucket of water over SOS bulls (a useful sense check!), as follows;

"Sucker Stock" classification - ouch!

Very low StockRank;

The 2-year chart below is a reminder that this type of difficult-to-value, speculative share, can often be a stomach-churning ride of euphoria on good news, and stomach-churning losses if the newsflow disappoints. So definitely not for the faint-hearted;

SCS (LON:SCS)

Share price: 217p (down c.2% today, at 10:28)

No. shares: 38.0m

Market cap: £82.5m

AGM Statement (trading update)

ScS, one of the UK's largest retailers of upholstered furniture and floorings...

It's not very good, but is in line with expectations;

"It is clear that the ongoing economic and political uncertainties are continuing to impact consumer confidence and spending. However, the Board is pleased to report that the business is trading in line with our expectations.

In the 17 weeks ended 23 November 2019, the like-for-like order intake decreased 7.1% and the two year like-for-like order intake decreased 4.0%.

This is an improvement on the like-for-like trading for the first nine weeks of the year which we reported with our full year results.

Checking back to my notes here on 4 Oct 2019, the last reported order intake was a decrease of 7.6%. Therefore today's updated figure of -7.1% is only marginally better. Same ballpark really. So sales remain resolutely downwards, and a drop of 7% is a significant level, which would have quite a geared effect on the bottom line. Although it's no doubt already factored into the current forecasts, hence why management says it's trading in line with expectations.

Economic outlook- as the bad news is already factored in, then that could result in future good news being good for the share price, perhaps? With full employment, and wages rising well ahead of inflation, I can't help thinking that the outlook for 2020 might be better than many people currently think. Consumer confidence figures have been showing for a while now, that people are reasonably upbeat about their own circumstances, but extremely negative about the general economic outlook.

Everyone talks about Brexit uncertainty - but how much uncertainty really is there? Very little I would say. If you take the time to read the (short) Political Declaration which the UK & EU have agreed, both sides basically want to keep everything pretty much the same as it is now. Many peoples' views on Brexit seem to come from scare stories that they want to believe, rather than from any rational thought, or factual research. It often pays to remember that most human decision-making is emotional. Once I figured that out, life became a lot less perplexing! This is why economic models & predictions never work, because people don't behave rationally much of the time.

Back to ScS.

Valuation - because broker earnings forecasts have been cut, this has pushed the PER up from 7.3 when I last looked at it, to 9.6 today, despite the share price being slightly lower;

I'm struggling to see why I would want to buy it on a PER of 9.6, when LFL sales are running 7% below last year. The only reason to buy would be if I expected a strong recovery in sales next year.

Dividends - are very generous, but not terribly well covered, at 1.37 times. Another downgrade to profits could raise the spectre of a dividend cut perhaps?

Balance sheet - absolutely excellent, no solvency issues here.

My opinion - probably have to be neutral on this one. If consumers spend more next year, then this share could do well. On the other hand, do I want to bet on that happening? Not especially.

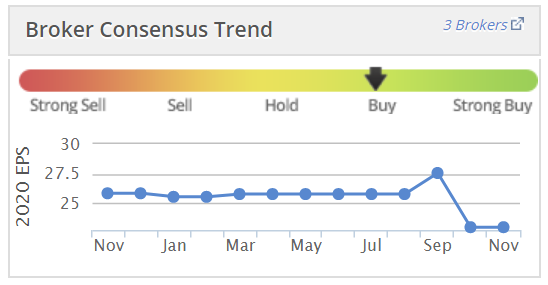

Stockopedia loves it;

Ab Dynamics (LON:ABDP)

Share price: 2615p (down 8% today, at 11:51)

No. shares: 22.4m

Market cap: £585.8m

AB Dynamics plc ("AB Dynamics", the "Company" or the "Group"), the designer, manufacturer and supplier of advanced testing systems and measurement products to the global automotive market, is pleased to announce its final results for the year ended 31 August 2019.

The headline figures caught my eye this morning, as they look outstandingly good. So I was a bit surprised to see the share price down 8% today. Although looking at the chart, it's only giving back some recent gains, and the share price has been trending sideways for the last 6 months, after a terrific run in recent years;

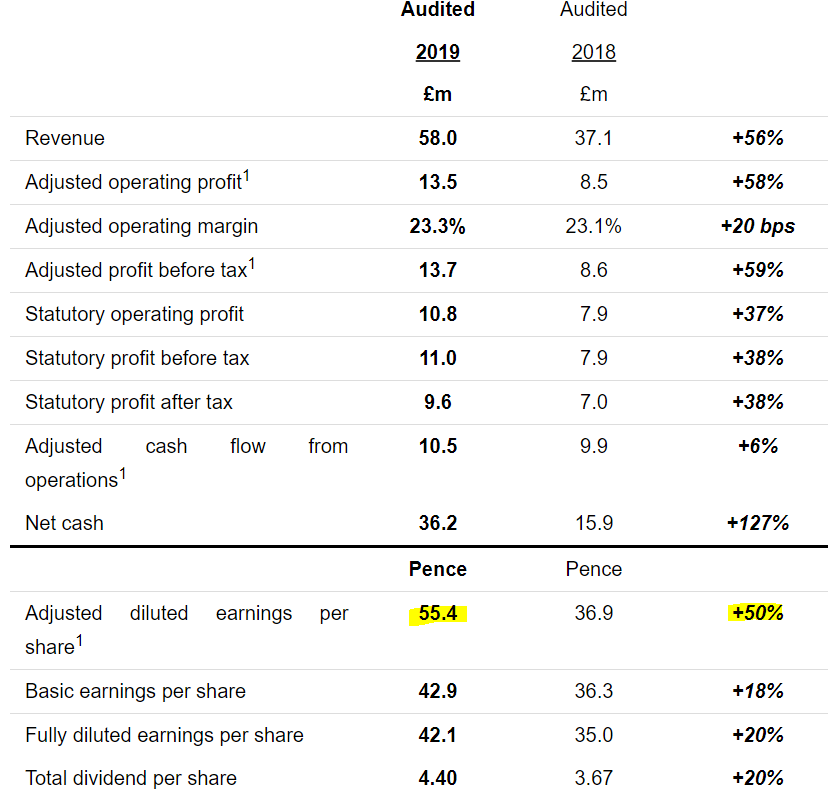

As the highlights show, ABDP has performed very strongly in FY 08/2019;

Mind you, a market cap of nearly £600m is incredibly high, for a company that's only delivered adj operating profit of £13.5m on £58m sales - still quite a small business, albeit one with strong growth, and high margins.

If for any reason this level of profitability proved to be unsustainable in future, then this share would see a very dramatic fall. That's the general problem with shares - it's all very well valuing things on a multiple of profits, but how do we know whether profits are going to be sustainable or not? In reality, a lot of it is really just educated guesswork.

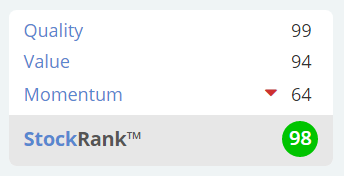

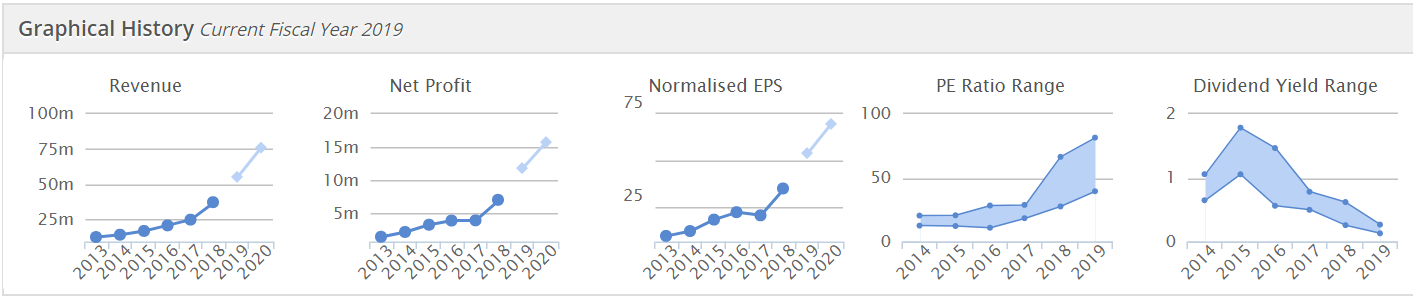

As usual the Stockopedia graphs provide a great summary - namely, a superb track record of revenue & profit growth, but combined with a rapidly increasing rating & reducing divi yield - so the key question here is, are ABDP shares now perhaps over-valued?

Earnings - the 55.4p adj EPS seems to be ahead of broker consensus of 53.9. The PER is 47.2

Forecast for FY 08/2020 is 69.7p EPS, for a PER of 37.5

Acquisitions - when you have very highly rated paper, then issuing more of it, to make acquisitions is an excellent idea;

Following a successful share placing in May 2019, raising net proceeds of £48.2m, acquisition expenditure totalled £35.4m with £18.1m on rFpro and £17.3m on Dynamic Research Inc.

Balance sheet - bulletproof. Although intangibles have shot up from nil, to £41m in the year, this was more than all funded with fresh equity. That has fully preserved the balance sheet strength.

Outlook - sounds positive overall, apart from the last section, which reminds us that the automotive sector is having a tough time at the moment. The comment about constraining margins doesn't help, either;

AB Dynamics operates in long-term growth markets and has established a unique position as a leading designer, manufacturer and supplier of advanced testing and simulation solutions to the automotive industry globally. We continue to invest heavily into new product development that is critical to our future success and it is particularly pleasing therefore to report that we have now received a third order for our advanced Vehicle Driving Simulator ('aVDS'). We expect simulation to play an increasingly important and critical part in the development of semi and fully autonomous vehicles in the future as manufacturers will need to evaluate their vehicles extensively under large numbers of complex scenarios to provide a safe environment for all road users.

As in previous years, we have a healthy order book that provides good forward visibility and will continue to invest in our capabilities and infrastructure which will tend to constrain our margins.

Whilst we remain optimistic about our prospects and the Group's future, we do remain alert to the continued difficulties faced by many of our customers selling into the global automotive market.

My opinion - that's probably as far as I can take this. The company has a superb track record, which is reflected in a high valuation.

What investors need to focus on, is what the outlook is like, and whether earnings growth is likely to continue - because the high valuation of this share very much rests on that being the case.

To pay this sort of lofty valuation, I think investors would need to properly understand the competitive landscape too. Who else is selling this kind of equipment? Are competitors developing similar products which might erode ABDP's margins possibly? Or does ABDP have an unassailable lead that will only get stronger? Without knowing that sort of stuff, I wouldn't want to pay such a high rating. It might be justified, I don't know. Hence overall, due to having limited knowledge, I can only be neutral on this share at the current level.

OnTheBeach (LON:OTB)

Share price: 439p (up c.1% today, at 15:36)

No. shares: 131.2m

Market cap: £576.0m

With over 20% share of online sales in the short haul beach holiday market, we are one of the UK's largest online beach holiday retailers...

The way the headline figures are presented initially confused me, as it looked like a big beat against last year. Then I realised that one column is adjusted numbers, and the other statutory ("GAAP" = generally accepted accounting principles).

There's a £7.7m hit to profit from the recent insolvency of Thomas Cook. The other adjustments are OK, being primarily the reversal of the amortisation charge relating to acquisitions (i.e. what used to be called goodwill amortisation). Practically all analysts & most investors are happy to value companies on adjusted figures, as am I - although it always pays to check the adjustments, just in case something daft has been slipped through as an adjustment. The principle is to value companies on a multiple of earnings that exclude one-offs costs or gains. That makes sense to me.

Adjusted EPS is only up 1% on last year, at 21.4p, for a PER of 20.5 - that seems a tad warm, given that there's not any profit growth to speak of.

Dividends - held at 3.3p per share, yielding only 0.75% - so there's not much earnings growth, and a lousy dividend. So far, not so good.

Outlook comments are interesting, so here's the bulk of that section;

The first quarter of our financial year (calendar Q4) has historically been the quietest trading period for the Group. The failure of TCG has led to a material shift in market dynamics as it had a 20% share of beach holiday passengers and approximately 20% of the seat capacity to beach holiday destinations. This has created a significant short-term lack of seat capacity as well as an unprecedented opportunity in the medium term to gain share.

Search demand has therefore been strong throughout the period following the failure albeit the loss of seat capacity has led to a supply / demand imbalance with a significant increase in flight pricing, particularly for winter 19/20 departures and for travel to Eastern Mediterranean destinations.

The Board strongly believes the correct course of action to ensure that On the Beach is best-positioned to capture market share, is to focus on price competitiveness and to increase the visibility of all of the Group's brands, with the expectation that seat supply will normalise during FY20. Whilst the consumer environment will continue to be challenging, we remain confident in the ability of our resilient and flexible business model to significantly increase our market share in the medium term.

That makes this share a lot more interesting. It's clearly got a really good opportunity to greatly increase market share. Hence why the PER of just over 20 is now starting to make sense. The market is clearly pricing-in increased profit in future years.

Forecast EPS for FY 09/2020 is a big increase in EPS to 26.2p, which would lower the PER to 16.8 - much more palatable. I'm warming to this share as I work through the numbers!

Balance sheet - given that Thomas Cook went bust, it would be wise to check how financially secure all other travel shares are. This one's fine, OTB has a sound balance sheet.

It should be noted that Thomas Cook had a bizarrely over-geared, train wreck of a balance sheet, years before it went bust. The seeds of its demise were sown years in advance, through bad, and ultimately disastrous financial engineering - piling massive debt onto its balance sheet. Internet competition only finished it off, but it was fatally wounded years earlier.

OTB is securely financed, so there are no such problems here.

My opinion - it seems that selling holidays online is very lucrative. I do wonder if the profit margins might come under pressure in the long term?

Overall, I reckon OTB looks quite good. Although if I had to pick one share from this sector, it would be Dart (LON:DTG) - which looks better value than OTB, despite having doubled in price in recent months.

Stockopedia agrees, giving OTB a StockRank of 59, but DTG an almost perfect 97.

Water Intelligence (LON:WATR)

Share price: 275p (up c.2% today, at market close)

No. shares: 16.9m

Market cap: £46.5m

Water Intelligence plc (AIM: WATR.L), a leading multinational provider of precision, minimally-invasive leak detection and remediation solutions for both potable and non-potable water is pleased to provide a trading update through the end of October with respect to a year-to-date sales growth milestone.

Is it just me, or does this update sound a little rampy? Sometimes less is more, and I don't think the company should have issued this update. It's only added 2% to the share price too, so it looks like the law of diminishing returns has kicked in.

The company put out a more detailed Q3 update, saying it was comfortably in line, just a month ago. So why say the same thing again today?

We report that once again we have surpassed the prior full-year revenue result earlier than expected. Through the end of October, we achieved $27.5 million in revenue which stands significantly ahead of the full year 2018 result of $25.5 million. Profit before tax (statutory and adjusted) remains comfortably in-line with expectations for full year 2019.

Outlook comments sound excitable, but tantalise us with the prospect of another possible increase in forecasts?

... While surpassing the sales milestone is important, we seek to finish the year strongly and to set even higher near-term targets than expected...

My opinion - it looks quite a good company, but is very small, mainly based overseas (USA), and doesn't pay divis. I like the profit growth, and strong trading updates, but feel the share price currently looks about right. Therefore I'm neutral.

All done for today, see you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.