Good morning, it's Paul here.

Apologies for yesterday's report not getting off the ground. There wasn't any interesting news, and I had a case of writer's block unfortunately. I'll circle back, and write something about BigDish (in which I hold a long position) in yesterday's report, which also ties in nicely with the theme of investing mistakes!

EDIT at 20:49 - yesterday's report is now finished.

Note that the London stock market closes early today, at 12:30. This is easily forgotten. I remember one year, when I was still staring at my screen, monitoring prices at 1:00 pm, when it suddenly dawned on me that the market had been shut for half an hour! Too much eggnog probably.

EDIT at 14:11 - today's report is now finished.

I'll be watching out for any profit warnings that are slipped out today.

There are a couple of trading updates out today, so here goes;

ECO Animal Health (LON:EAH)

Share price: 215p (pre market open)

No. shares: 67.5m

Market cap: £145.1m

ECO Animal Health Group plc ("ECO" or "the Group") researches, develops and commercialises products for livestock. Our business strategy is to generate shareholder value by achieving the maximum sales potential from the existing product portfolio whilst investing in Research and Development ("R&D") for new products, particularly vaccines, and seeking to in-license new products.

Results for the six months ended 30 September 2019

We can see from the two-year chart, that the price has been steadily drifting down, then a gap down in Nov 2019, which must have been a profit warning:

I reported on the profit warning here on 11 Nov 2019. My conclusion then was that this looks a potentially interesting recovery situation, with a strong balance sheet, good dividend yield, and problems specific to one particular market - China, its largest market (due to Swine Flu). Although I decided that this share was impossible to value at the time, due to lack of detailed numbers. Also it reported some accounting irregularities, which is usually a warning for investors to run for the hills.

Note how broker consensus earnings for this year, FY 03/2020, have recently been more than halved from 20.3p to 9.65p. This is a useful reminder of the impact of operational gearing - something that investors often overlook - i.e. it doesn't take much of a problem to really clobber many companies' profits, due to the gearing effect of fixed costs, combined with reduced sales. Especially where the gross margin is high.

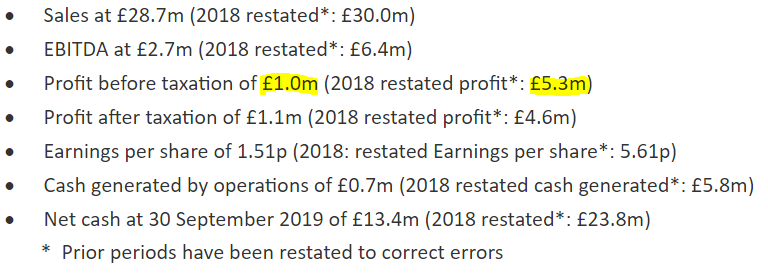

To illustrate that point, here is the financial highlights section of EAH's interim results today;

Profit has been absolutely smashed, from £5.3m in H1 LY, to just £1.0m this year, which must be due to more factors than just the relatively small drop in revenues.

Gross margin also fell significantly, from 48.9% in H1 LY, to 43.0% in H1 TY.

In addition, both administrative expenses, and R&D rose significantly.

Putting all those negative factors together, results in H1 profits falling by 81%. I'm writing this before the market opens, but my hunch is that the market is not likely to be impressed with these numbers, so we could see another lurch down in share price today, possibly. It depends on how much the commentary can calm investors, and convince them that the problems may be receding.

Dividend - this could hit the share price today, as income seekers might be tempted to sell up;

The directors recognise the importance of the dividend to shareholders. However, having due regard to the Group's operating cash flow, the investment in the new product pipeline and the trading conditions described above, the directors consider it prudent to defer the declaration of a dividend at this time.

Balance sheet - is strong, although both inventories & receivables strike me as a little too high.

Note also that the £23.8m cash pile a year ago has fallen sharply, to £13.4m - worrying, if that becomes a trend, rather than a one-off.

Outlook - there's a fair bit of detail, so I'll summarise it into bullet points;

- Swine Flu in China - "Early indications in buying behaviour for the Group's products support a stronger second half in China."

- USA - improving margins for farmers will enable EAH to reduce discounting in 2020

- Other territories are expected to perform in line with expectations

- Important milestones in the R&D programme in next few months (could provide some positive newsflow, hence help the share price recovery, maybe?)

Overall;

The Board looks forward with confidence; it is not possible to declare that the past six months' poor trading conditions are behind us but it is correct to indicate that the rest of this financial year will be significantly stronger than the first half.

Brexit - comments below from EAH on Brexit today are very interesting, and confirm my thinking that many UK companies can mitigate Brexit risk by setting up a subsidiary within the EU, and authorising/selling product via that subsidiary, whilst the main work continues as before, in the UK.

The key point is that companies adapt to changing circumstances, and the disaster scenario peddlers have always struck me as doing a disservice to everyone by failing to take into account such mitigating factors.

The Group has successfully transferred all EU marketing authorisations to a new European subsidiary, ECO Animal Health Europe Limited with a registered address in Dublin, Republic of Ireland. All contingency planning is in place and the financial and operational impact of Brexit is expected to be minimal, irrespective of the outcome and the timing of its implementation.

My opinion - the table of revenues split out per country/region does confirm that China is the main problem, with revenues down 53%. Although N. America isn't so good either, with revenues down 21%. Other areas seem to be trading fine, with reasonable growth. Growth into new markets provides interesting upside potential (Mexico, Brazil & India are mentioned positively)

My main concern is the extent of the fall in H1 profit, down 81%. Even though a better H2 is expected, I wouldn't be surprised to see full year forecasts come down again.

This share is so difficult to value, without detailed sector knowledge. How do we value its R&D pipeline, for example? There could be the seeds of considerable future growth in there, or there might not be, I don't know. Reading some broker research on the company could help give some pointers in that regard.

I see the shares have opened down 9% this morning, but that is on negligible volume so far.

This does look like quite an interesting company, but I'm struggling to see any reason to rush out to buy the shares right now. I wonder if it might attract bid interest, if the share price keeps falling?

Bango (LON:BGO)

Share price: 125p (down 8% today, at 11:22)

No. shares: 70.7m

Market cap: £88.4m

Trading update (profit warning)

Bango (AIM: BGO), the mobile commerce company, provides an update on expected financial performance for FY 2019.

This is the financial year ending 31 Dec 2019.

The market has been kind, punishing Bango with only an 8% drop in share price today. I can see why, because although it's missed expectations for 2019, the announcement today has plenty of positive noises in it too.

Revenue miss - is due mainly to a specific deal, which sounds like a timing issue - I don't mind profit warnings due to timing issues, providing the deal(s) do actually happen in the new year;

Group Revenue growth of over 40% to at least £9.3m. Total revenue below market expectation primarily due to a Customer Data Platform (CDP) license and Marketplace supply deal not concluding in December as expected. These deals are now expected to close in early 2020.

Although as a general point, companies & brokers really should factor in more of a safety margin, so that forecasts are not dependent on closing particular deals by the year end date. I would rather see achievable forecasts, and companies generally beating them. Rather than setting the bar too high, then missing.

Stockopedia is showing forecast revenue of £11.9m, so actual revs of £9.3m is a 22% miss - not good at all, coming so close to year end.

Note that interim revenues were £4.32m (up 64% on H1 LY). FY revs of £9.3m would mean H1 to H2 sequential growth of only about 15%. That doesn't tie in at all well with the talk of exponentially rising revenues.

Profit miss - this is a big miss, as gross margin is high. Adj EBITDA forecast drops from £2.3m to £0.4m. I'm becoming increasing surprised that the share price is only down 8% in response to a big miss.

The company is capitalising around £2m p.a. of costs into intangible assets, so the EBITDA number does not translate into a proxy for cashflow. Although, tax credits are an important contributor to cashflow - the last balance sheet (interim) shows just over £1m sitting in receivables, due from the taxman. The new Govt recently announced its intention of making this scheme even more generous.

In a separate announcement, it turns out that R&D tax credits have been wrongly accounted for by the Govt, for years, and that the annual deficits were actually quite a bit bigger than previously reported.

Adjusted PBT for FY 12/2019 has been revised down from £0, to -£2.0m. But remember to allow for the positive impact of R&D tax credits - arguably we should use PAT not PBT as the benchmark for companies which claim tax credits in this way - as it's a bona fide contribution towards cashflow.

Forecasts for 2020 have also been slashed today - which doesn't make sense to me, if the problem is a contract slipping from 2019 to 2020 - surely that would mean 2019 forecast figures are cut, and 2020 forecast profit should actually be increased?

Adj PBT for 2020 forecast drops from £2.7m to £0.9m.

Cash - has improved in the last 6 months, probably due to receipt of tax credits;

Cash has increased from the end of 1H 2019 and will be at least £2.5m at the end of 2019.

Strategy Day - is being held on 29 Jan 2020. These meetings can often be a precursor to a placing. Bango looks as if it could benefit from a smallish top-up placing, to give it more headroom. So I would imagine that a £5-10m placing is possibly on the cards? With a market cap of £88m, that's not much dilution, so isn't a major concern.

You have to remember that big name customers expect their key suppliers to be well financed.

My opinion - I feel that the bullish commentary today doesn't quite match up with the sharply reduced forecasts. Maybe the PRs were allowed a bit too much leeway, given the time of year?!

If this company does manage to produce exponential growth, at high gross margins, as it talks about, then the shares could do very well indeed. The figures today put a question mark over how realistic that is. It looks to me as if the growth rate is slowing, at least for now.

Overall then, I can see the potential here, if growth accelerates again, but for the time being I'm a bit sceptical due to today's unimpressive update & big forecast reductions.

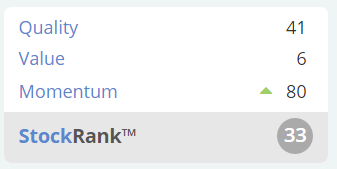

Stockopedia is very sceptical, with a low StockRank. Bear in mind that the high momentum score is likely to fall, once revised forecasts work their way through;

Good, with that out of the way, I can focus on what I really want to write about today, which is a review of my investing year.

My Investing Year

As mentioned recently in another report here, I've had a pretty dismal 2019, on top of a dismal 2018. Therefore, the most useful thing to do, is reflect and learn from those mistakes.

Background

Newer subscribers may not know my background. So to recap;

Did 3 year training with PWC (chartered accountants) after university - got sick of it, and flunked my finals exams. There had to be more to life than doing the most boring work (auditing) and studying for exams - pointless & boring accounting rules - in what spare time I had left. So I talked the staff partner into giving me a 6-month payoff to leave voluntarily (they wanted to reduce numbers anyway, due to the recession)

An astute employment agent matched me up with a small, ladieswear retailer called Pilot, in 1993. I went in as a sales ledger data input clerk, and 3 weeks later was running the finance department - part luck (as the existing CFO was working his notice period), but also me spotting & grabbing the opportunity

I spent 8 years as the CFO for Pilot, as we grew it from 16 shops to about 150 shops. My team grew from 4 to 25 people, all of whom I recruited & trained. The business was severely under-capitalised, and lurched from crisis to crisis along the way, but was in rude health when I got sick of it, and decided to leave in 2002.

Professional investor - 2002 to now, which splits into 3 parts - or the short version is this: try to visualise a roller-coaster!

Phase 1 - from 2002 to 2007 - everything I touched seem to turn to gold. A starting pot of about £180k turned into several millions, even after spending a lot, giving away lots, paying a lot of tax (not a problem - people who do well should be happy to pay tax, not try to avoid it)

Phase 2 - the roof fell in, with the great financial crisis. It took me down with it, and by the time the dust had settled in late 2008, my portfolio was gone, and I owed Spreadex nearly £2m. As I never tire of telling people at investor meetings, the crucial thing is to never combine gearing with illiquidity. I made that mistake, and boy did I pay a high price for it, it ruined my life at the time - I had to sell everything, house, cars, furniture, the lot.

Phase 3 - sorting things out. This took a lot longer than I expected, about 9 years to fully fix things. Spreadex were amazingly helpful, because I didn't run away from the problem, but kept communication channels open & made modest monthly payments to acknowledge that the problem existed, and could somehow be sorted out.

I tried to rebuild a new portfolio, using a bit of money lent to me by a family member, but after a superb 2009, things soon went into reverse, and I was more or less back down to zero by 2012. I can't really remember much about those 4 years from 2008-12, as it's a period of my life that I'd rather forget - feeling miserable & depressed all the time, and repeated attempts to rebuild my portfolio going nowhere.

Anyway, things started to improve from 2012. One day I decided that I needed a big challenge, and thought about writing a shares blog, covering every small cap in the UK market. The number of companies was too large, but by splitting off some sectors (e.g. junior resource stocks, biotech/pharmas, blue sky, etc) the number reduced to about 500. That should be do-able, and would certainly keep me busy & focused on something positive.

Soon my shares blog built up a decent following, and I had initially thought of monetising it through ads. I think the ad revenues peaked at £100 per month, and by the time Google had realised that people were clicking on the ads to help pay me, it dropped to £10 per month. Then I wondered about asking people to pay a subscription to read it, but that idea sounded like a lot of time & effort on admin, so fell by the wayside.

Meanwhile Stockopedia asked me to syndicate my blog through their website, this would have been around 2012. It would open it up to more readers, so why not? Some time later, another website had spotted my reports, and offered to pay me to publish them there instead, with exclusivity. I met the Stockopedia guys for a drink, and to explain that I wouldn't be able to syndicate my blog through them any more, and quick as a flash they offered to match the other website's deal!

From that point on, things started to really improve. I had a regular income coming in, so wasn't worrying about money all the time any more. Readers seemed to like the SCVRs, and I focused on improving them gradually, going into more detail.

I think people definitely make better investing decisions when the essentials in life are sorted out - number one is having a secure roof over your head, and then having enough income to pay the bills, and being able to live a vaguely normal life. That meant having to unlearn my previously profligate ways, which felt like a humiliation at first, but after a while became quite liberating. It's a great feeling to wander through a glitzy shopping arcade, and not actually want to buy anything!

After a couple more years, with a more stable grounding, I was able to build up a "start again fund" to a reasonable size, and work out a payment plan deal with Spreadex, where they wrote off a good chunk of the money I owed them (we haven't actually got a confidentiality agreement, but I feel it would be wrong & commercially sensitive to mention any figures here), in return for a hefty initial payment, followed by instalments until 2023.

From that moment, there was light at the end of the tunnel, and I felt highly motivated. Also it was rather lucky that a roaring bull market in small caps started c.2016. This completely turbocharged my new portfolio, and everything I touched seemed to turn to gold again (we all think we're geniuses in bull markets, but really we're not!)

This enabled me to pay off Spreadex early, in 2017, and buy some property, and sort out pretty much everything else that needed sorting out.

An old friend of mine from Motley Fool days, called BillyBonkers, used to ring me up when he was blind drunk, and spend hours on the phone, which was fun at first, but then got a bit annoying. So I asked him to stop ringing me when drunk, which he took umbrage about, and I've not heard from him at all since, which is a pity. The reason I mention Bill, is because he always stressed to me, this is pre-2008, that I should divert some of my good fortune into buying a house. He always said that, as long as you own the property you live in, preferably without a mortgage, then it doesn't matter what happens with the market (providing you're not geared). I should have listened to his advice first time around. Well second time around, I have taken his advice, and I must say that having a secure roof over my head has made the difficult markets of 2018 & 2019 much more bearable.

Incidentally, this is all very personal, so I'd appreciate it if this article could be not copied elsewhere. There are a few haters out there, sadly.

2016-2017 Bull Market

Looking back, this was an incredible time for small caps, with a clear speculative frenzy developing in many more racy stocks.

I find it impossible to avoid getting caught up in that type of bull market, because it's so ridiculously easy to make large amounts of money, especially through spread betting accounts.

Ironically, in my situation, the only way I could grow a small portfolio (remember I had to start again after 2009 with a starting position of not zero, but minus £2m!) rapidly, was to use gearing again - exactly the thing that had ruined my life in 2008.

Although this time I did keep the gearing at a relatively more modest level, and spread it over more stocks, so that in theory it would be easier to exit from positions if the whole financial system shook itself to pieces again.

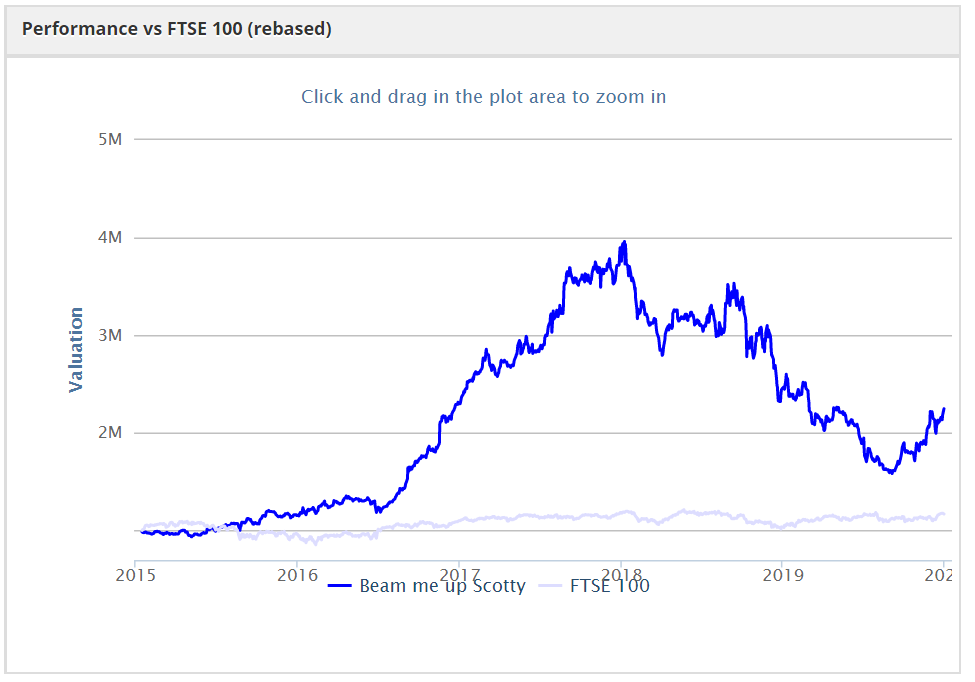

In early 2015, Ed challenged me to set up an online portfolio, to measure my stock-picking success, which went almost exponential in 2016-2017. In reality, the % gains were much higher than this, as I was geared (the BMUS portfolio is ungeared);

The same old problem then reared its ugly head - hubris! It's impossible for me not to get carried away with excitement when my portfolio goes through a patch of doing really well. Then as before, I laid the seeds of my own subsequently dismal performance.

This has lead me to a conclusion that may surprise you - namely that, whilst I love doing the analysis of shares & results/updates, I'm not temperamentally suited to managing a portfolio.

More specifically, I know exactly what I should do, but like a mechanic who neglects to service his own car, I don't have the discipline to apply that consistently. Instead I go through patches of extreme out-performance, followed by the inevitable hangover. By the way, I'm not looking for any advice here from anyone, as I already know what I should be doing!

I think everyone's enjoyed a decent bounce in the last 3 months, but why was my chart above so extreme in the small caps downturn in 2018 & 2019?

Let's look at what specifically went wrong, in order of importance:

Over-concentration

I deliberately run a highly concentrated portfolio. The reason being that, for experienced investors, putting most of your money into your top 5 shares, is the way to generate really serious returns, in a relatively short period of time. Obviously that carries risk, because unexpected things just happen, from time to time. So a concentrated portfolio is not to be recommended. But that's how I like to do things personally.

To be clear, I'm not asking anyone to follow my investments. I only publish BMUS because Ed challenged me to do it, and I feel it would be a cop-out to stop doing it now, just because things are going badly. In a way, the value of the thing is to show that I'm fallible, and to analyse what went wrong, and also hopefully what I'm doing to fix it. Why not be an open book, and expose this all to the glare of public scrutiny? I ate so much humble pie after 2008, that this all seems like a walk in the park, comparatively!

A concentrated portfolio is fine up to a point, but being a rather over-the-top personality (I can't help it, that's just how I was made), I did take things to extremes. I became absolutely convinced (and still am actually) that Sosandar (LON:SOS) was likely to be a great success. Small caps are really all about backing great management. Arguably all investing is, but with small caps they don't have layers of intermediate management to run the company. So I put about 60% of my real, and BMUS, portfolios into SOS. On reflection, that was way too high.

Things went great for a while, but as with many/most small caps, there were bumps in road, which happened twice with Sosandar. The gut-wrenching falls did serious damage to my portfolio. The timing was awful too, as I was trying to buy the penthouse next door at the time, so was forced to take money out of spread bet accounts at the worst possible time. Thankfully my SIPP is out of bounds, as I can't draw anything out of that until I'm 55, which is probably a good thing.

For the avoidance of doubt, BMUS reflects my SIPP (long-term holdings), as it would be too complicated & time consuming (for no benefit) for me to be constantly updating it for whatever I happen to be punting on in spread bet accounts.

I've recently trimmed my SIPP position in Sosandar by about a quarter (reflected in BMUS update recently), but it remains by far my largest position.

My current view on the company is positive. Management are absolutely brilliant, and I have no doubt that the business should be a big success. They bit the bullet this year, and raised £7m more funding, which has been applied to greatly increase the product range, and the depth in which it is bought. Also, they're spending big on marketing. This makes a lot of sense, because once acquired, customers are sticky, and the underlying stats are that a typical customer buys twice from Sosandar each year. Rapid growth suppresses the published number to about 1.7.

It's fair to say that the original business plan under-estimated the marketing spend needed to drive growth as fast as planned. The most recent update from Sosandar confirmed that, with heavier marketing spend, the growth rate has shot back up again.

How do we value it? I don't know! Sceptics are wrong about this company, in my view, and I've not heard anything negative from sector experts. Yes, valuations can look crazy in the early days for growth companies - remember how Asos looked insanely expensive at about 80p, and went on to nearly 100-bag from that point? Look at BooHoo also - very expensive at sub-50p, people thought.

It's fair to reply that Sosandar is much earlier stage than those behemoths. But investors are now wise to the upside potential, once an online fashion business achieves critical mass. That's why I think Sosandar's valuation could go higher, sooner than people might think. However, a lofty valuation also makes it very high risk - if anything goes wrong, then confidence collapses, taking the share price down with it.

Sosandar had a tough patch in spring of 2019, but I think they've fixed the issues, and the growth numbers have since dramatically accelerated, due to the heavy marketing spend. I reckon we could be in for a positive Xmas trading update, but that's just my hunch, I don't have any specific information.

Over-concentration was also a problem for me with £RBG

Failing to sell at the right time

The number one question that investors ask, is when should I sell?

There isn't a simple answer, as Sod's Law seems to intervene more often than not.

Probably the best answer I've heard, is to sell when something better comes along, or when a share becomes over-valued. The trouble with that, is that it leads to often selling off our best stocks, and missing out on multi-baggers.

The reality is that people who make serious multi-baggers have usually ignored a patch where the share was significantly over-valued on conventional metrics. They've seen something special or they just got lucky.

A big mistake I made, was failing to sell Revolution Bars (LON:RBG) (in which I have a long position) when the takeover bid from Stonegate at 203p came along. I could have banked a large profit, but instead, foolishly imagined that a higher bid was likely, when it wasn't. The deal fell through, and the price has since crashed to only 68p.

Why haven't I sold since? Two reasons - because I've done detailed research on this, and firmly believe that the price is likely to go up considerably from here, if the turnaround gathers pace. I've met management several times, and gone through the detail with them very thoroughly. With strong reasons to believe the price is likely to at least partially recover, then it would be crazy to sell now. Yes it annoys me that I didn't sell previously, but who cares? The market doesn't know or care what price I paid. The only thing that matters is what the price is likely to do from this point onwards.

With a programme of refurbs now underway, and no expansion capex, the LFL sales have already turned positive, and should continue to do so. Management is doing all sorts of basic sorting out, none of which has yet been priced in. Therefore, I could see RBG being a nice recovery situation for 2020. As always though, I'm trying to predict the future, and sometimes will be wrong, and sometimes right.

Outside investors never really know what's going on within a listed company. We delude ourselves that we know the business, but in my experience there are often things lurking below the surface that investors don't know about at all, but which matter.

Luck & when to sell

Most of the successful investors I know, cheerfully admit that some of their best investments have actually been down to luck.

Quite often the biggest gains are made from catching a speculative bubble, running it, and selling out at the right time. Mark Minervini points this out in his excellent book, where major multi-baggers very often go on to drop by 50-80% from their peak, sometimes a lot more.

This got me thinking, that I should pay attention a lot more to deciding when to sell things. If something is close to, or above what I think it's fundamentally worth, then I really should be selling, instead of doggedly hanging on.

If I'd taken my profits in 2017, when I knew that most of my stocks were fully valued (or more), then things would be looking a lot more rosy now!

Lack of liquidity

2019 has made me think a lot about whether I should be concentrating on small caps.

Specifically, my concentrated small caps portfolio resulted in a situation where I was needing to raise cash for properties, giving my broker a list of things to sell, and finding that there wasn't any market bid at all for some of my smallest positions.

In particular, a big disappointment this year has been £MLVN I bought some in the 4p placing a while back, and thought I was a genius when it went up to 7p. New management seemed to have a good turnaround plan.

Anyway, it's been a disaster, with the shares having lost about 90% from that peak, after a string of disappointing announcements. I managed to sell a few on the way down, but more often than not, attempts to sell resulted in an end of day phone call from my broker, saying "nothing done on the Malvern, I'm afraid". So I'm stuck with the damned things.

If it had been a mid, or large cap, I could have just sold on the opening bell when bad news came out, and moved on.

A lot of people have done a lot better than me this year, because they adopted a better approach of having a decent spread of large, mid, and small caps. I'm thinking in terms of possibly adopting that approach myself in future.

Although with small caps having done so badly, and large to mid caps doing well, then this might actually be the best time to be focusing on overlooked, under-priced small caps. Particularly as confidence is now returning. Yes, I've already talked myself out of switching to mid & large caps, the time isn't right.

Brexit

What a horrible experience this has been, for all of us, in the last 3.5 years.

Even quite sensible people became ranting maniacs. It definitely did a lot of damage to many peoples' mental health (including mine), so thank goodness a way out has now been agreed, even if it's not what some people wanted.

The protracted political stalemate definitely caused a partial buyers' strike, particularly affecting small caps. that dented my performance badly in 2019. It's already reversing though, with a very positive business sentiment survey out from the CBI recently, and a recent press report that £billions have flowed back into UK equities since the election.

On a personal level, it put a considerable strain on my relationships with friends & family. Although I'm pleased to say that we had a lovely family Christmas this year, with no political arguing at all. What with that, and the heart-warming Xmas special from Gavin & Stacey, equilibrium has been restored - and life really is mainly about friends & family, not money. As a bonus, I was pleased to hear that Gavin & Stacey even mentioned going to Revolution Bars, in the dialogue. What better endorsement could there possibly be?!

Conclusion

Both 2018 & 2019 have been lousy years for my portfolio, so I certainly need to try harder & act on some of the lessons learned in this article. Hence a lot of this is "memo to self"! Well, it all is actually. If other people find it interesting & thought-provoking, then great, it's been worth typing up.

Therefore, when reading my articles about companies reporting results or trading updates here, please remember that I'm definitely not either a shares guru, or a tipster.

These reports are just the personal opinions of a private investor who sometimes does well, and sometimes does badly. I'm not very good at managing my own portfolio, in a nutshell, and have psychological flaws which make me quite unsuited to managing a shares portfolio!

Despite that, I've somehow managed to make a decent (often very decent) living from the market for the last 17 years, so must be doing something right, some of the time!

However, I hope most readers will agree that digging round in the results statements often throws up some interesting points which you can take or leave as you wish, as part of your own research process.

It's been a pleasure writing here for you, and thanks to everyone who contributes such useful points in the comments sections. Maybe some of you lurkers could add this to your new year's resolutions lists?!

Let's hope 2020 is a good year, wishing you all the best.

Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.