Good morning, it's Paul here.

Please see the header for the shares I will be looking at today.

Estimated time of completion is 1pm.

Edit at 12:17 - I want to spend more time on MPAC and SHOE, so am going to continue until 3pm. Hopefully there will be enough here to keep everyone happy in the 1pm email. Update at 15:09 - today's report is now finished.

Early snippets - no doubt MrC will cover these in his usual (very helpful) morning comment below, but this is what caught my eye on my first scan of the RNS today;

Ramsdens Holdings (LON:RFX) - strong Xmas trading, "comfortably ahead of market expectations" for FY 03/2020. Higher gold price helps pawnbrokers.

Greggs (LON:GRG) - exceptionally good year. FY u/l profit "slightly higher" than previous (already raised) expectations. Tough comparatives from now on. Cost inflation - wages & pork. Popularity of new vegan products. A remarkable success story, priced accordingly (PER of 26!)

MPAC (LON:MPAC) - trading ahead of upgraded forecasts

(all 3 of these companies are covered in more detail below)

Ramsdens Holdings (LON:RFX)

Share price: 249p (up 6% today, at 08:52)

No. shares: 30.8m

Market cap: £76.7m

Background - Graham normally covers this one, but I'm trying to broaden my coverage a bit as a 2020 aim, so I'll have a go at interpreting this. It's a pawnbroker, with additional focus on other financial services, especially forex. Today's update is for the FY 03/2020.

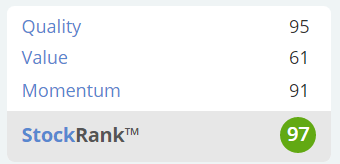

Stockopedia likes it, with "Super Stock" classification, and a very high StockRank (before today's update);

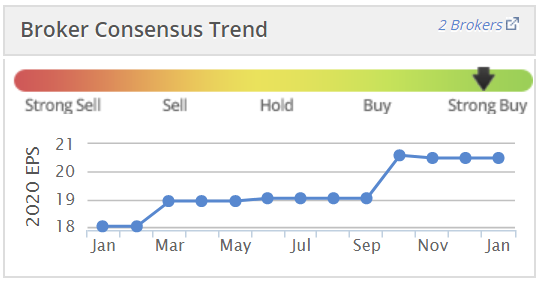

One of the things I like about the StockRank system, is that it picks up on companies with improving trends, which we might otherwise miss, e.g. in this case note the steadily rising earnings forecasts;

Anyone who was buying companies with earnings upgrades in the autumn, whilst all the political shenanigans was keeping many other people on the sidelines through fear, will have done spectacularly well in the last couple of months, as money has flooded back into this type of share.

For more background on Ramsdens, here is our archive of Graham's extensive coverage of it. If I'm short of time, I tend to just read the most recent couple of articles, including the most recent results. This interesting review of its interims, from Graham, is particularly helpful in getting me up to speed.

Trading update today sounds very good;

... the Group has delivered strong trading during the Christmas period, with each of the Group's key business segments performing ahead of the prior year. As a result, the Board now expects the Group's full year profit before tax to be comfortably ahead of market expectations.

Comfortably ahead - what does that mean? Materially is usually 10%, so I would guess that comfortably ahead probably means about 5%. Isn't it ridiculous that we have to guess like this? I know it provides wiggle room, but surely they could have given a range of percentages, e.g. 3-7% or something like that? We need more clarity & standardisation when it comes to trading updates, instead of coded wording, then the brokers being told the actual numbers, to put into their forecasts.

Thankfully there's a good quality update note today, available on Research Tree, to guide us. The broker has upgraded forecast for FY 03/2020 from 20.6p EPS to 22.6p EPS, so a rise of just under 10%. I was too low with my 5% guess!

At 249p per share, the updated PER is now 11.0 - which looks good value - although this type of business tends not to attract a particularly high rating.

Another positive factor is the rise in the price of gold this year, which boosts profits for pawnbrokers.

Outlook comments sound positive.

Balance sheet - as usual, I always have to check the financial strength of every company here.

Looking at the last interim accounts, its balance sheet looks excellent - very strong, so no issues there at all.

Dividends - the yield of 3.3% is well covered, about 2.7 times, and importantly, the company has a strong balance sheet, so has the capacity to pay more generous divis if it wishes - investors often overlook this important point. In an ideal world, I like to see not only a decent yield, but plenty of capacity to not just maintain, but to grow future divis. That can work out better than chasing very high, but unsustainable yields.

My opinion - on a purely financial basis, this share looks excellent. But do you really want to own shares in a pawnbrokers? I don't.

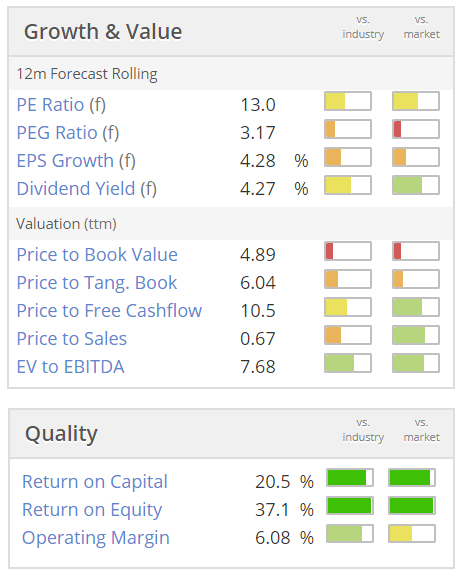

The shares would have made an excellent value buy last year, and despite a decent rise recently, are not expensive even now, on fundamentals;

Greggs (LON:GRG)

Share price: 2403p (flat on the day, at 11:46)

No. shares: 101.2m

Market cap: £2,432m

This is such an interesting stand-out company, I have to cover it, despite it being a mid cap.

It does strike me as odd that Greggs is doing so well, when practically everything else on the High Street is doing so badly. Although as we discussed here before, a lot of its business is probably repeat business for people who live & work in town centres, so need to be fed every day. Many of us are creatures of habit, and buy lunch from the same place every day, when working nearby. Greggs is quite cheap, and tasty food. Also, in many towns there's not much competition for properly fresh, cheap food.

Then there was the brilliant razzmatazz & strong sales that Greggs managed to create around its vegan sausage roll. They're sensibly continuing that theme, with a vegan steak slice being launched imminently, I believe. I'm looking forward to trying one of those, as like a lot people, I'm interested in reducing my meat consumption.

Even so, I'm staggered at the +9.2% LFL sales that Greggs achieved in FY 12/2019.

It's already increased forecasts repeatedly upwards in 2019, and despite this, still finished the year with a little extra;

Full year underlying profit before tax expected to be slightly higher than our previous expectations

Outlook - cost headwinds, and strong comparatives are an issue.

My opinion - the company's track record is superb, and I certainly wouldn't bet against it.

As the now firmly established leader for affordable food on the go, I could see sales continuing to rise. That said, with cost headwinds, profit growth might be harder to achieve, and given that Greggs are now ubiquitous across the UK, how much profit growth is there left in the tank?

Forecast profit growth for next year is only about 6%. So the PER of 26 looks very expensive. To justify such a rating, Greggs will need to substantially out-perform again in 2020, just to stand still (in terms of share price).

Overall, terrific company though it is, the shares look far too expensive to interest me. I'd be tempted to bank profits today, if I held, on valuation grounds. Then buy back on any future dips, if the PER fell to something more reasonable, like 20 times.

But it depends what you think is likely to happen to interest rates. If they stay permanently low, then a PER of 20 (earnings yield of 5%) for a great business, is actually not expensive. Particularly as recession risk for the UK seems to be receding. Tricky one, isn't it? Do we pay up for quality, or play it more cautiously?

MPAC (LON:MPAC)

Share price: 238p (up 15% today, at 12:18)

No. shares: 20.2m

Market cap: £48.1m

Mpac Group plc, a global leader in 'Make, Pack, Monitor and Service' high speed packaging and automation solutions, provides a pre-close trading update (unaudited) for the year ended 31 December 2019.

This used to be called Molins, making tobacco packing machines. Presumably the name change, and more generic self-description, was intended to put PC/ethical investors off the scent! EDIT - I'm told that the tobacco machinery division was sold some time ago, so looks like that isn't relevant any more. End of edit.

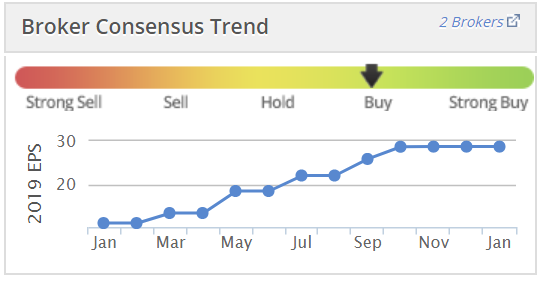

Continuing the theme of companies out-performing & getting repeated earnings upgrades, look at this! Earnings forecasts (broker consensus) has almost tripled in the last year - spectacular stuff;

This begs 2 questions;

1) What's going on to drive such an outstanding improvement in profitability? and,

2) Is it sustainable, or just a one-off good year? (EDIT: or maybe a large customer programme with a finite end point?)

I won't have time here today to drill down to that level of detail, but am certainly going to be printing off some broker notes, and doing some deeper research, and will report back at a later date.

Positive update today - this sounds great, coming on top of the very substantial forecast increases already;

On 5 September 2019, the Group reported that its profits for FY19 were expected to be significantly above the Board's and market expectations, with the momentum gained earlier in the year continuing throughout the second half of the year.

The Board is delighted to announce that since that date, momentum in the business has continued to accelerate and we expect to report a full year trading performance ahead of these upgraded expectations. This is primarily as the result of a strong Q4 order intake and accelerated project execution.

Outlook - this sounds positive for continued strong performance in 2020;

"I am pleased with the overall business development and the high level of performance delivered by our global colleagues which has enabled us to report a further trading performance upgrade for 2019.

Order intake and revenue growth have continued for both Original Equipment and Services and the Group will close the year with a strong order book for execution in 2020.

I am confident that we will be able to report an excellent financial performance for 2019 and improved outlook for 2020 which gives us confidence for the future progress of the business."

Pension deficit - is large still, so this needs to be factored into the valuation - i.e. it's the reason the PER is low. That said, if the underlying business is now trading its socks off, then the pension deficit becomes far less of an issue.

My opinion - I've not looked at this company properly for over 3 years, so am not going to rush out an ill-informed opinion today (that doesn't usually stop me, I hear you cry!).

However, today's update, and the latest note from Equity Development, sound very interesting. Therefore I'm going to flag this as definitely worthy of a closer look. It's tempting to buy a few shares straight away, and then do the detailed research later, when something crops up that has such strong earnings momentum as this.

There's an excellent summary from davidjhill in the comments section below, many thanks for that.

Topps Tiles (LON:TPT)

Share price: 76.6p (up 1% today, at 13:36)

No. shares: 195.0m

Market cap: £149.4m

Topps Tiles Plc (the "Group"), the UK's largest tile specialist, announces a trading update for the 13 week period ended 28 December 2019.

This tiles retailer has a 30 Sept year end, hence why it's reporting Q1 figures today for Oct-Dec 2019.

At first sight, the LFL sales of -5.4% in Q1 sounds bad. However, the trend is improving;

First 8 weeks: -7.2% (previously reported)

Next 5 weeks: -1.4%

Q1 total: -5.4%

It's still a poor overall result for the quarter, but this was a period of exceptional political turmoil, so I'm prepared to look through one bad quarter. The company's track record is that it sometimes has one bad quarter, so that's probably why this hasn't scared the horses.

More detail is given. The most interesting thing about this share, is its entry into commercial tile sales, which potentially doubles the addressable market. That's doing well, with sales up 250% from a low base.

Outlook - doesn't really say anything;

"As we enter 2020, we remain confident that our market-leading retail offer and growing commercial operations give us a strong platform from which to deliver sustainable growth over the medium and long term."

Valuation - the main attraction of this share is the decent divi yield, and the hopes for longer term growth. Having said that, I can't see any particular reason why the share price should be any higher than it is now.

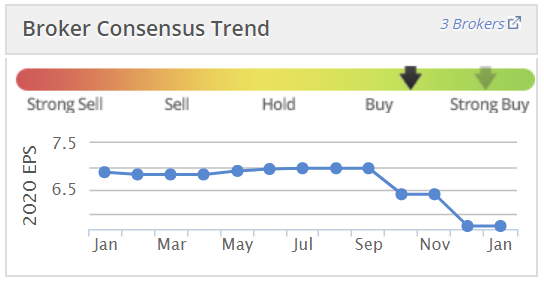

Unlike the other companies I've written about above, Topps Tiles has seen its earnings forecast fall over the last 12 months (see below). Note also that its EPS this year is lower than it was 6 years ago. What's likely to change, to trigger a sustained increase in EPS in future? Maybe if the commercial tiles division really takes off in a big way?

My opinion - looks priced about right to me. There could be possible upside from a recovery in consumer confidence in 2020, and earnings upgrades. So I certainly wouldn't bet against it.

This seems a well managed business, but the shares don't have enough upside potential at the moment to get me excited. Although having said that, I think Topps Tiles definitely goes in the category of retailers that are weathering the storm. Hence it's likely to not only still be around, but likely to be a bigger business in say 5-10 years' time.

Shoe Zone (LON:SHOE)

Share price: 157p (down 3% today, at 14:08)

No. shares: 50.0m

Market cap: £78.5m

Shoe Zone PLC ("Shoe Zone"), the UK's largest value footwear retailer, operating in Town Centres, Retail Parks and Online, is pleased to announce its Preliminary Results for the 53-week period to 5 October 2019.

Background - as you can see from the chart below, this company had a wobble in Sept 2019, with a profit warning. That turned out to be a nice buying opportunity, and enabled buyers to lock in a fantastic divi yield. Of course, we didn't know that for sure at the time, unfortunately! It could have been the first in a series of profit warnings, but wasn't.

This is what I like about ShoeZone;

- Entrepreneurial management, with large personal shareholdings

- Short leases, and low fit-out costs, so very flexible - rent reductions

- High gross margins

- Expansion of big box format

- Cash generative & generous divis

- A High Street survivor - no question of it going bust

- Strong balance sheet

Results - per the profit warning in Sept 2019, profitability has reduced, but is still fairly good.

- EPS - underlying (i.e. pre-exceptional) EPS of 16.45p - giving a PER of 9.5 - good value.

- Divis - maintained at 11.5p, to demonstrate confidence in future growth. Yield of 7.3% - I reckon that's sustainable too, so very nice indeed.

- Balance sheet - very good. Although note there is unusually for this sector, a pension deficit, which has grown to £9.7m, and is a cash drag (recovery payments) of £890k p.a. I believe this is not accounted for within earnings, so needs to be adjusted for when valuing the shares.

- Cashflow - excellent, although not enough to cover divis and capex this year. Both of those are discretionary, so this is not a problem. Note the plans to open new stores & refurbish old ones, so capex looks ongoing (although it's far from excessive).

Property costs - note the comments on excellent deals being achieved from landlords, and that rent-free periods typically recoup half the capex spend over time. The company is only signing 5 year leases, and has average lease length of 2.1 years - hence ShoeZone management has completely side-stepped the main problem which has brought down many other retailers - namely uneconomic leases. That's the best evidence you can get of a really switched-on management team, in my opinion.

This is a great time to be expanding, as the lease deals available are so good. Rents are falling by nearly 24% on renewal too. That helps to offset other cost increases.

The company belly-aches about business rates, with some interesting stats in the commentary. Whilst I sympathise with them, the reality is that business rates are really a tax on the landlord. but paid by the retailer. When deciding whether to open a new shop, the procedure at all retailers is to estimate the revenues, and costs, part of which is to put the rent, service charge, and business rates into a spreadsheet model.

Therefore, if business rates go up, then the landlord won't be able to let out an empty unit to a new tenant, unless they reduce the rent down to a level where rent+rates are sufficiently attractive to sign up a new tenant.

Business rates is a significant part of overall Govt tax revenues, which they cannot afford to forego. So if they were to reduce business rates, then other taxes would need to be hiked.

Anyway, the comments from SHOE are very interesting, and worth considering.

There is an argument that online retailers benefit unfairly from operating out of warehouses, which have much cheaper business rates. That would carry weight if online retailers were making massive profits, but they're not. BooHoo is one of the few that makes a decent profit margin. Many other online retailers struggle to get into profit at all. So I feel the reality is that online retailers just have different costs (marketing & high product returns rates) which offset any benefit they gain from lower business rates on their premises.

My opinion - of the 2 retailers I've looked at today, Topps Tiles (LON:TPT) and Shoe Zone (LON:SHOE) my view is that SHOE is by far the better bet at the current modest valuation. Its >7% dividend yield looks great, and should be sustainable.

I see the dip in earnings this year for SHOE as probably being a temporary glitch, rather than a more worrisome trend. There's plenty of positive stuff in the narrative today, to imagine that profits should stabilise or recover in future.

That's it from me today, thanks for tuning in!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.