Good morning, it's Paul here with Friday's SCVR. A reminder for new subscribers, that I post a placeholder article before the market opens (when I remember!) for your comments post 7am, whilst I'm preparing the main article based on the day's newsflow. Finish time is 1pm, anything after that is a bonus.

A reader commented that Sosandar (LON:SOS) (in which I hold a long position) trading update should be issued today. Don't worry, I'll be on the case first thing! If it's straightforward to understand, then I'll post a quick view pre-8 am.

Alas, no update from Sosandar as yet (at 07:17) so looks like we jumped the gun on this. It must be coming out next week instead.

Estimated time of completion - I should be done by 1pm today. There's hardly any news today. However, there's plenty left over from yesterday for me to cover, so it'll be a full report here as usual. See the header for the company tickers.

Edit at 12:47 - today's report is now finished.

Character (LON:CCT)

Share price: 302p (down 21% at 08:09)

No. shares: 21.4m

Market cap: £64.6m

Trading update (profit warning)

This company designs & distributes toys. Feast your eyes on acres of pink plastic on its website here. CCT has an unusual 31 August year end.

Key Christmas trading has not gone well, although this sounds like it was due to external factors rather than anything being wrong with its products;

The 2019 Christmas trading period was extremely challenging with the total toy market in the UK contracting for the second successive year, and those conditions will impact our results for the first half of the financial year.

Sales of our core products were down against the comparable period last year. Nevertheless they performed well with good sell through at retail in the UK.

The last paragraph sounds contradictory, and could have been better worded. I think what they're saying is that retailers bought fewer toys from CCT, but what they did buy sold well in stores.

H2 outlook - sounds good, so maybe this is a buying opportunity on today's c.20% share price drop? It depends how much reliance you're prepared to put on management expectations?

We enter the 2020 calendar year with a very strong product portfolio and, although the first half results will be below last year, we anticipate that the Group will deliver one of our strongest second half performances to date.

Our confidence for the second half has been boosted by the reactions from our customers to recent product previews and presentations. With further viewing opportunities and product launches planned for the London Toy Fair, which takes place next week at Olympia, we expect the momentum to continue.

Hmmm, potentially interesting.

Guidance - very helpfully, the company gives us full year guidance on profits (well done to Allenby, and TooleyStreet Communications for this!). Although they forgot to include a footnote stating what current consensus expectations actually are. I've been campaigning for this for a while now, as it's so helpful & saves so much time when companies add such a footnote, as is becoming more commonplace these days, and should be standard practice for all companies;

Despite the anticipated strong finish to the current financial year, the weakened Christmas performance has led the Board to believe that the Group's profit before tax for the year ending 31 August 2020 will be circa £10m, which is lower than current consensus expectations.

Valuation - I can't see any update note from Allenby yet, but hopefully they might issue one later (in which case I'll update this section).

This is the progression of PBT;

FY 08/2017: £14.6m

FY 08/2018: £11.6m

FY 08/2019: £11.1m

FY 08/2020: £10.0m - guidance provided today by the company

As you can see, the trend is negative, but it's still a decently profitable company, considering the market cap is only £64.6m.

Balance sheet - when last reported, this looked quite strong, although I don't understand why the company simultaneously holds cash, and borrowings. Maybe it has large swings in cashflow on a day-to-day basis?

Dividends - are very generous, and it has also been doing buybacks.

Peppa Pig - nothing is said in today's update, but I seem to recall that there was a question mark over whether CCT's licence to make & sell Peppa Pig products was going to continue after Hasbro bought the brand I think. Do any readers have any info about this please? If so, do leave a comment.

My opinion - while I've been writing this section, the share price has been recovering somewhat, it's down 15% at the time of writing (09:12). That makes sense to me, as the valuation is starting to look attractively low.

Overall, I think this one looks quite good, and this might possibly be an attractive entry point for a fairly decent business. The key challenge is for CCT to reverse the trend of declining profits, and get them growing again. Also, investors would need to satisfy yourselves that the Peppa Pig sales/profits are sustainable.

GYM (LON:GYM)

Share price: 311p (up <1% today, at 10:01)

No. shares: 138.1m

Market cap: £429.5m

The Gym Group plc ("the Company" or "TGG"), the fast growing, no contract, 24/7, nationwide operator of 175 low cost gyms, announces its pre-close trading update for the year ended 31 December 2019.

It's an in line (against lowered forecasts, see below) outcome, so no particular reason for the share price to move on this news, as this result was already factored into the share price;

This has been another excellent year of progress for the Company with strong growth in members and revenue. As a result, the Company expects to deliver full year financial results for 2019 in line with the Board's expectations.

This is a very good format for a gym, as it's cheap, and ideal for people who just want a no-frills gym, with no pool or fancy service, no contract, and which is open 24 hrs a day (they use CCTV to monitor things). A while back I (occasionally!) used their gym in Brighton, and found it very good. Although there are other operators copying this format now.

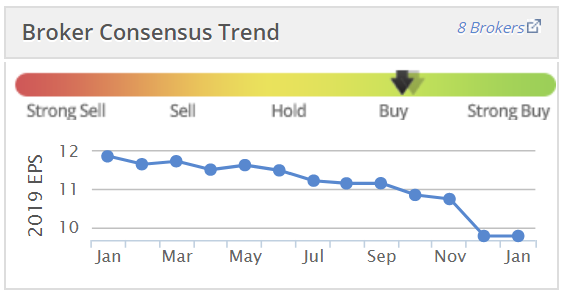

On the downside, note that brokers consensus EPS forecast has been steadily reducing in the last year;

Yet the forward PER is a very warm 25.6 - I can't quite reconcile that. Normally, if a business is under-performing against expectations, and seeing earnings downgrades, then one would expect the PER to be quite low - maybe 10-15 perhaps?

Roll-out - more sites are being opened in 2020. It has 175 sites now (20 new sites opened in 2019), with 20-28 sites of varying size planned for 2020. Gyms are easy to run, compared with say retailers/bars/restaurants/hotels, therefore I don't see any risk of the roll-out resulting in management losing their grip on existing sites (as e.g. happened with Revolution Bars (LON:RBG) (in which I hold a long position) in 2017-19).

GYM must be spoiled for choice in terms of deals being offered by landlords for cheap, empty sites. Therefore, I see this as a good time to be rolling out a multi-site business.

My opinion - we seem to be in a euphoric bull market at the moment, where momentum trading has come back with a vengeance since around Sept 2019. Some of that is justified, since the risk of a recession in the UK seems to have receded considerably, and the political uncertainty has also receded.

So that does justify a one-off re-rating for many UK shares, which is what's happened. However, now that re-rating has happened, and many shares are looking really expensive on forward earnings, I would say risk:reward has shifted more to the downside, at least in the short term.

For that reason, I wouldn't be interested in buying anything that looks over-valued at this time, because the risk of a correction, as people take profits from stellar gains in the last few months, looks too great.

Hence, whilst I like GYM as a business, it's too expensive to interest me at the moment. Mind you, I've said that in the past, and I was going to say was wrong, but actually looking at the chart, I was right - this share has had large corrections downwards in the past, from periods where it became over-priced. Therefore my worry now, is that buying at the current price could be potentially high risk - when the next market correction happens, this type of highly rated share tends to be clobbered;

OptiBiotix Health (LON:OPTI)

Share price: 50.5p (down 8%, at 10:53)

No. shares: 85.4m

Market cap: £43.1m

This company calls itself a life sciences business developing compounds to tackle obesity, cardiovascular disease and diabetes. I'm very sceptical about that. I think it's more a marketing company. It's spent virtually nothing on developing its products, and apparently doesn't have a proper lab, with scientists on the payroll. In a video interview a while back, when questioned on this the CEO replied that it uses post-grad students in Spain to formulate the product. Does that sound like ground-breaking science to you? No, me neither.

I've not seen any credible evidence that its products have any scientifically proven benefits. Claims for weight loss are spurious in my view - I tried the product, and it doesn't work. People lose weight because of burning more calories than they ingest. Therefore, anything can be proven to lose weight, if it's part of a diet that is lower in calories. That doesn't mean the actual product itself is driving weight loss.

All the talk about the human biome strikes me as generic science waffle, and doesn't seem to actually relate to OPTI's products.

I appreciate this share has a cult-like following, and that this section will likely trigger some thumbs downs and vitriol from shareholders, but so be it! Of course, if I turn out to be wrong in future, then will be happy to revise my opinion with an apology.

On the upside, there have been numerous announcements from OPTI about deals it's signed with various companies who seem to want to trial products containing OPTI ingredients.

Today's update is for the year ended 30 Nov 2019.

Key points;

- Revenue of £808k for the year - at least it's generating some revenues, but not much

- Other income of £617k includes profit from disposal of shares in SkinBioTherapeutics (LON:SBTX) - a spin-off company that also looks pretty hopeless

- Cash is very low at £688k, but should rise to £1.4m, although that seems to include collecting in all debtors. I would take off the £370k creditors, so about £1.0m of net cash by the looks of it

- Can sell more shares in SkinBio if needed - "worth" £7m, but try selling them, and the real price to sell in size might be well below that, if there is a buyer in size at all

There's loads more narrative about future hopes. Jam tomorrow companies need to keep punters excited with talk about exciting future prospects, that's how the share price is propped up, and more placings can be done.

My opinion - as above, I'm very sceptical about this company.

The multitude of agreements with customers do look interesting, but nothing has generated any meaningful revenues yet.

If it can generate significant & rapidly rising revenues in future, then I would revise my opinion to being positive. For me though, hardly any shares of this type actually deliver what they promise. That's the reason that I tend to disregard the hype. If it had an amazing product that worked brilliantly, and was likely to take the world by storm, then I would be prepared to have a punt on it. But I don't see that at the moment with this company's products.

Good luck with it if you hold, but the odds look stacked against you at the moment.

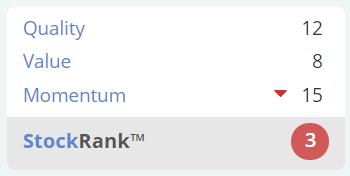

Stockopedia hates all speculative shares, and gives this a "Sucker Stock" classification, and a dismal StockRank of 3. Occasionally one of this type of share does work out well, so this is not a guarantee that it's rubbish, just a reminder that on balance it probably is.

Halfords (LON:HFD)

Share price: 153.5p

No. shares: 199.1m

Market cap: £305.6m

I was expecting a poor update from Halfords, but was quite impressed when I looked at it last night.

LFL revenues for the group were +1.3% in Q3 (14 weeks to 3 Jan 2020), which is an improvement on H1, which was -2.4% as disclosed in the interim results.

Cycling is the standout are of good performance. Autocentres (car repairs & MoT, etc) are also doing OK.

Most importantly, it re-affirms full year guidance of £50-55m profit, which is impressive in such a difficult retail market. Maybe retail park sheds are not suffering as much as the High Street, because going to Halfords is usually for a specific purpose - i.e. a destination visit, rather than just passing.

Click & collect is also going well.

My opinion - surprisingly good. Halfords profits have remained a lot more resilient than I would have guessed, in recent years.

Cost pressures (esp. wages) are an inevitable headwind for all retailers.

I've checked out the last balance sheet - it's OK, with modest net debt (ignoring the IFRS 16 entries).

The dividend yield is approaching 10%, which is far too high. In my view the company should halve the divis (at least) and use cashflow to build up its balance sheet. That way it would survive any further deterioration in retail. Continuing to pay out massive divis is very short-sighted in my view, and could ultimately bring the company down, if trading were to get seriously worse. Retailing is all about survival at the moment.

Based on this performance though, it looks like Halfords will still be around for some time to come. I wouldn't want to own shares in it though.

Short sections now, as I've booked myself in for 25% discount (courtesy of BigDish (LON:DISH) in which I hold shares) lunch at my favourite fish restaurant, as a treat for completing a manic week of reports!

Works co uk (LON:WRKS)

Share price: 40p (up 13% today, results were issued yesterday morning)

No. shares: 62.5m

Market cap: £25.0m

TheWorks.co.uk plc ("The Works", the "Company" or the "Group"), the multi-channel value retailer of gifts, arts, crafts, toys, books and stationery, announces its interim results for the 26 weeks ended 27 October 2019

Announced yesterday, the CEO has left with immediate effect, with the CFO taking over.

Interim results look grim;

- LFL sales down -3.6%

- Adj EBITDA loss of -£4.3m (vs -0.9m PY)

- Adj loss before tax of -£8.0m (vs -4.4m LY)

- Net debt of £14.9m (LY: £4.4m)

Why have the shares gone up then? Probably because the Xmas trading update is better, and the outlook statement is for full year results in line with expectations (no footnote given for what those are though!). H2 is seasonally stronger than H1.

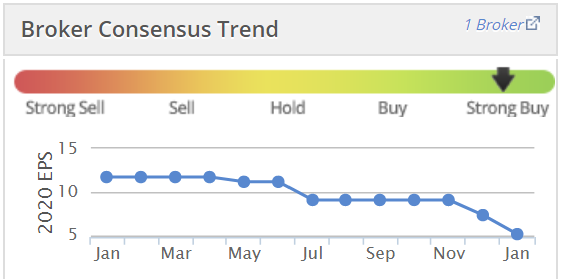

The trend of broker consensus has been downwards, and it wouldn't take much to push the company into losses in future, given the operational gearing of large turnover & largely fixed overheads;

My opinion - I'm not going to spend any more time on this.

Although the company has put in a solid performance over Xmas, I can't see how it will be immune from the ongoing cost pressures (esp. c.6% rise coming in Living Wage in Apr 2020), and declining High Street footfall.

Also, I visited a store recently, and thought to myself, if this didn't exist, why would you invent it? It reminded me a bit of part of an old Woolworths store in the 1980s.

The company should scrap its divis, and focus on using cashflow to strengthen its balance sheet, to enable it to survive. I don't see any attractions to this share.

Moss Bros (LON:MOSB) - trading update for 24 wks to 11 Jan 2020.

The Group expects to report a full year adjusted loss before tax (pre-IFRS16) of approximately -£1m.

Again, as with TheWorks above, it's difficult to see what's going to change, to reverse the decline in profitability. Management talk about what they're doing to raise margins, etc, but it all feels a bit like slowing the decline of the business, rather than there being any realistic hope of the future prospects becoming better.

Discounting by competitors is described as "more intensive", together with "materially lower level of footfall". Combine that with cost increases in the pipeline, especially wages, and I would say the outlook seems grim.

Again, given the awful sector outlook, why would you want to own shares in this? I'm coming round to the view (triggered by my hefty loss on buying Card Factory (LON:CARD) right before the profit warning!) that it's best to avoid all of these retailers. Why take the risk?

MOSB is likely to stick around for a while, due to its decent balance sheet strength, and of course it has a key differentiator in its wedding hire business.

Cello Health (LON:CLL) - an in line update from this marketing company was issued yesterday.

One division traded well, offset by the other being weak.

Says it ended the year in a strong net cash position.

My opinion - I've only had a very quick look, but it seems quite good actually. Broker earnings forecasts have been rising modestly in 2019, and the forward PER strikes me as reasonable at 13.5. There's a 3.2% divi too.

Overall, might be worth a closer look. I can't see any obvious problems, and the valuation appears quite reasonable, in an expensive market.

Lamprell (LON:LAM) - I've decided not to look more closely at this M.East oil rig maker. Glancing at the newsflow, it seems financially distressed, having to extend debt facilities whilst negotiating for new debt facilities. The risk of a discounted fundraising looks too much for me to want to look any deeper.

VR Education Holdings (LON:VRE) - revenue for 2019 is only 1.02m Euros! EBITDA loss of 1.5m Euros.

It's got 6-months of cash burn in the bank, so will need to re-finance.

I've heard enough, it's a no from me.

Apparently VR headsets are great, I'd love to try one out.

Right, there are some scallops and beer-battered cod with my name on them, so I have to leave it there for today, and this week.

Thanks for all the supportive feedback - it helps motivate me to go above the call of duty, that's for sure! Also, Dry January and a big recovery in my portfolio have triggered endorphin release! Long may it continue :-)

Have a smashing weekend. I'm having a week off, so Graham will be looking after you next week.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.