Good morning, it's Paul here with Monday's SCVR.

Please see the header for the companies that have caught my eye from the 7am RNS.

As there's not much company news today, I'll write some macro stuff later, as there was lots of interesting news in the Sunday papers. Change of plan - I'll put this into tomorrow's placeholder article instead.

Estimated time of completion - 1pm

Edit at 12:56 - today's report is now finished.

China / coronavirus interview

The only update I can find today which refers to the situation from China, is another update from Volex (LON:VLX) - see the section below.

I was thinking last week, that this is such a topical issue, that I should do an interview with an expert on china supply chains. Accordingly, I'm pleased to advise that the CEO of Up Global Sourcing Holdings (LON:UPGS) has agreed to talk to me, in an audio interview, this Thursday. (NB. I am not charging a fee, and don't hold any shares in UPGS, so it's a genuinely independent interview).

Rather than bombard him with lots of detailed questions, I'll mainly be asking him to just brief us on how things are going re China supply chains, and how UPGS sees things developing, both for them & the many other companies which rely (arguably too much) on China supply chains.

If you have an specific thoughts on this, then feel free to leave a comment below. I usually read all your comments, and am happy to incorporate any particularly insightful points/questions that you raise, in the interview. It should be published on this Thursday early evening. We'll put a link up here of course, in Friday's SCVR. Should be interesting!

Laura Ashley Holdings (LON:ALY)

Share price: 2.2p (down c,33%, at 08:45)

No. shares: 727.8m

Market cap: £16.0m

Response to press speculation (trading update & warning of possible insolvency)

Laura Ashley Holdings PLC (the "Company" and, together with its subsidiaries, (the "Group") notes the recent press speculation regarding its financial position.

Poor trading - sales are down sharply in the last 6 months, although some of the fall could be due to store closures perhaps? The more meaningful like-for-like (LFL) sales drop is not given. This is bad either way;

Trading during the current financial year has continued to be challenging. For the 26 weeks to 31 December 2019, total Group sales were £109.6m (H1 2018: £122.9m), a fall of 10.8%. The decline in total revenue was due to the market headwinds and weaker consumer spending during the period, which led to a decline in sales of bigger ticket items.

Bank facilities -

Recent movements in the Group's stock and customer deposit levels have led to a reduction in the amount that the Group can draw down under its working capital facility with Wells Fargo, the lender to the Group. The Company confirms that Wells Fargo and the Company's majority shareholder MUI Asia Limited, are discussing arrangements that will allow the Group to utilise sufficient funds from the Wells Fargo facility to meet the Group's immediate funding requirements and to draw down additional amounts to meet ongoing working capital needs for the Group in the short to medium term. These arrangements do not involve a cash injection by MUI Asia Limited into the Group.

That's rather odd. Why would the bank want to extend its exposure to a failing business, if the major shareholder isn't prepared to pump in more cash?

Warning - this is fairly stark, and is making it clear that insolvency is now a distinct possibility;

The Company welcomes the discussions between MUI Asia Limited and Wells Fargo and is proactively monitoring the situation closely. If the Group remains unable to access the requisite level of funding, then the Company will need to consider all appropriate options.

Turnaround? -

In addition to the discussions between MUI Asia Limited and Wells Fargo, the Company is well advanced in developing its turnaround strategy, the execution of which remains at an early stage, but the management team is encouraged by the early signs. Sales were flat for the first 7 weeks of trading this year.

This strikes me as possibly too little, too late.

My opinion - I don't see how this can move forwards, without an equity fundraise.

If the major shareholder can persuade the bank to extend larger facilities, great. But why would they? It might need the major shareholder to guarantee the bank lending, which is a possibility I guess.

It's probably safest to assume that the equity could well turn out to be worth nothing. It's the same problem that so many other older retailers have - falling sales, combined with fixed or rising costs (in particular unaffordable rent, and higher wages).

Is it worth catching the falling knife? I'm not going to. Risk:reward looks unfavourable to me. With its financial problems out in the open, that's likely to trigger difficulties in securing supplies, since nobody is likely to want to sell goods to ALY on credit terms any more.

Shareholders might get lucky, if the Malaysian controlling shareholders can pull something out of the hat. But I think it's safest to assume the most likely outcome is insolvency, hence this share is now uninvestable to me. Well, rather it was already, but today's update makes it more so.

This article from City AM is interesting. It says that the Wells Fargo borrowing facility is asset-backed - against customer deposits & inventories. I'm not sure how that would work. How can a bank have security over customer deposits? I would have thought that customer deposit funds would have to be returned to customers, in the event of insolvency, not swallowed up by the bank? Maybe not? It's a useful reminder to always pay for larger items using a card, because then you have protection in the event of the retailer going bust.

On that issue, the bank merchant services providers (i.e. credit/debit card processing) can also demand extra security in financially distressed situations, because they don't want to get lumbered with a load of costs of reimbursing customers in the event of insolvency. We saw that at Flybe, when it got into financial difficulties. Of course these events are a domino effect, and tend to hasten the demise of a struggling business, which is why it's so important to nip things in the bud, and prevent a meltdown by shoring up confidence. I suspect ALY might be too late for that.

If insolvency does occur, then the brand and some of the retail sites (viable ones) would continue of course, just under new ownership, with existing shareholders wiped out.

Volex (LON:VLX)

Share price: 160.5p (up 8.5%, at 08:51)

No. shares: 149.9m

Market cap: 240.6m

Volex, the global supplier of complex assemblies for performance critical applications and power products, today provides an update on the current situation in China.

Its update on 10 Feb 2020 gave us very little useful information, and no indication of the likely financial impact of factory closures in China.

Today's update shows things moving in the right direction, but again no specifics on how any of this might affect the company's performance;

Following the Company's announcement dated 10 February, we are pleased to announce that all of our four sites in China have now resumed operations, albeit at a reduced capacity.

My opinion - in situations like this, it's always worthwhile keeping an eye on the broker consensus graph, because the risk is that companies might slip through reductions in forecasts under the radar, and then claim that they're trading in line (against reduced forecasts).

So far, so good though. This graph below (showing 2 years in different colours on the new Stocko site) shows a marvellous increase in earnings forecasts over the last 18 months or so. An excellent turnaround by the looks of it. Let's hope China doesn't do too much damage. I suppose the company would have been obliged to tell us, if disruption from the Chinese factories was likely to be serious.

The other thing to consider, is that the coronavirus struck when factories would have been closed anyway, in a planned manner, for Chinese New Year. Therefore, the full impact is only really going to become apparent from now onwards, when factories should be coming back on stream again.

This also begs the question as to whether coronavirus infections might increase again, once people return to work, and start using public transport again, etc.? We've seen with the quarantined cruise ship in Japan, just how infectious this virus is, when people are in a confined space, which makes me worry that resumption of economic activity could accelerate the spread of the virus again possibly?

So a lot of questions still unanswered, which I'm hoping to get answers to later this week, when I speak to Up Global Sourcing Holdings (LON:UPGS) management.

.

Share (LON:SHRE)

Share price: 33.5p (up 15%, at 09:11)

No. shares: 143.7m

Market cap: £48.1m

It's a takeover bid, valuing SHRE at 41p.

So why are the shares only 33.5p in the market right now? (only up modestly on Friday's close of 29p)

The catch is that the bid is only 10% cash, and 90% newly issued shares in ii (Interactive Investor).

In this type of situation, the only thing that matters, is to find out the quality of the new paper that SHRE holders will receive. If it's good, then there's a case for buying SHRE shares, as a discounted way of acquiring ii shares.

OK, here's the catch, and it's a big catch, not in a good way;

The New ii Shares will be unlisted securities. There is no current expectation they will be listed or admitted to trading on any exchange or market for the trading of securities for at least the next 12 months.

That's not good at all, because many private shareholders in listed companies don't want, or even cannot hold, shares in private companies. Hence in that case, the only option is to sell in the market now. Furthermore, the takeover bid supposedly values SHRE at 41p, but that has to be based on an arbitrary valuation of ii shares - since they are not listed, they don't have a market value.

For people who are able to hold unlisted shares, then it might be worth considering the fact that Share's major shareholder, Gavin Oldham, who owns 68.9% of the company, is happy with this deal. Therefore it might turn out to be a good deal, I don't know. This does highlight the problem with any share that is controlled by one party, or a concert party - that minority shareholders are along for the ride, and have no say in matters such as takeovers.

Interactive Investor has been acquisitive, and might turn out to be a good share in the long run, who knows? Therefore I suppose there's the possibility that II could continue to grow as a private company, then list its shares at some point in the future, although there is apparently no intention to do so at the moment.

Meanwhile SHRE shareholders have 2 options now - sell in the market, or hold to receive 10% cash and the rest in shares in a larger, but unlilsted broker.

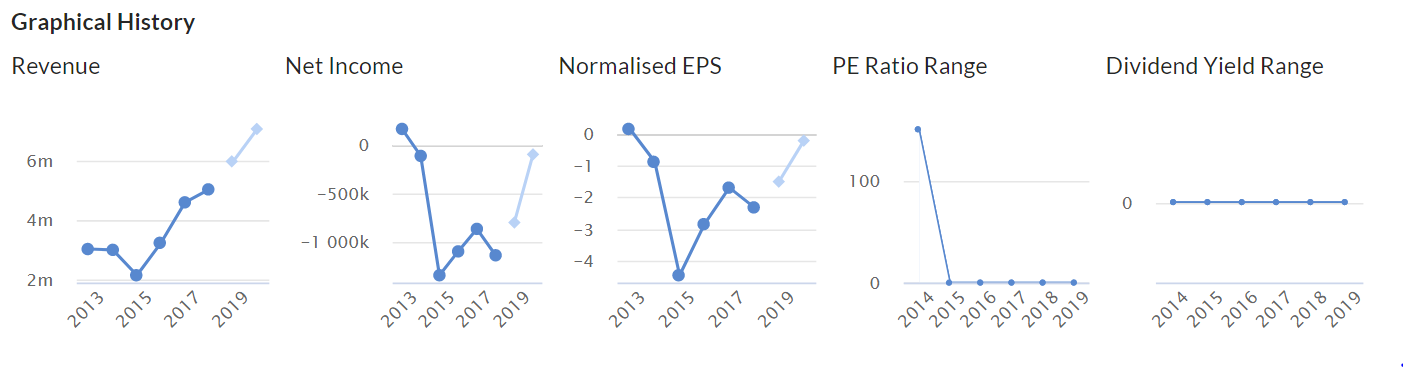

Hardide (LON:HDD)

Share price: 61.5p (unchanged, at 10:17)

No. shares: 53.1m

Market cap: £32.7m

AGM Statement (trading udpate)

This is an interesting little company, which I've followed for years, waiting for the elusive big commercial breakthrough.

It's an engineering company which applies a special coating to components used in demanding conditions, and has an impressive client list (e.g. Airbus). As you can see, it's still very early stage, commercially, hence the £32.7m market cap is already pricing in a lot of future progress;

.

Today's update - reassuring, but not price sensitive, as it's only in line;

"The Company has started the new financial year on a positive note and continues to trade in line with market expectations.

My opinion - various other operational details are mentioned today, but nothing earth-shattering, so you can read the RNS if interested.

Maybe the company could make more & faster commercial progress by licensing its technology/expertise? So far progress seems lacklustre -it's been listed on AIM since 2005! The chart below tells an interesting story. I wonder how much longer the patents have to run?

Warehouse Reit (LON:WHR)

Share price: 115.25p (down c.2%, at 11:38)

No. shares: 240.3m

Market cap: £276.9m

Pipeline update & potential equity raise

It's very rare for me to mention property REITs here in the SCVR, because it's a specialised area. However, property isn't rocket science, so they're not difficult to understand if you spend a bit of time doing some research.

A shrewd friend introduced me to WHR some time ago. It's a small, closed-ended property fund, that invests in warehouses, as the name suggests. This is why the share is interesting;

- Warehouses are cheap - sometimes below re-build cost - giving potential upside on capital values, and restricting supply (why build new warehouses, if they're not profitable to build, even if planning permission can be obtained?)

- Rental yields are good, at 5-10%- providing a nice income for investors in REITs (which have to pay out about 90% of income as divis, I believe)

- Tenant demand is strong, due to retail sales shifting online

That's it! Nice and simple investment case - you get a yield of c.6% with WHR, and the share price has been rising in the last year too. For those reasons, I see this share as something to consider & DYOR on, for income-seekers, e.g. SIPPs in drawdown, possibly.

Reading through WHR's updates, it seems very active, improving & buying/selling various warehouses. Details are given in today's update.

Dividends - it's raising the quarterly divi from 1.5p per share, to 1.6p

Equity fundraising - is being contemplated, more details to follow. The risk is that existing shareholders might suffer undue dilution, if it's done at a discount, although I don't think that has happened in the past.

My opinion - I'm tempted to pick up a few of these, for the income. Larger investors might struggle to buy in the open market, so it could be an interesting one to meet the management, and maybe participate in the next fundraise directly? This does strike me as a sensible niche to invest in, as opposed to retail property which of course is dire right now.

I'll leave it there for today. Where does the time go, it's insane, I literally blink and 6 hours has gone in a flash!

See you tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.