Good morning, it's Paul here with the SCVR for Weds.

Apologies for yesterday's report fizzling out, I'll finish it off later & flag here when that's done.

Please see the header for today's announcements that I'll be covering. Although I want to get through these quickly, so I can spend time on the more interesting companies that I didn't get round to covering yesterday.

Estimated timings today - I've earmarked the whole day for SCVR-writing, so this & yesterday's report should both be finished by 5pm.

Edit - change of plan, I have to nip out mid-afternoon, so will have to wrap things up here by 2:30pm.

Update at 14:19 - today's report is now finished.

Revolution Bars (LON:RBG)

Share price: 71p (up 4%, at 09:10)

No. shares: 50.0m

Market cap: £35.5m

(at the time of writing, I hold a long position in this share)

This is a UK-based premium, late night bars group, trading as Revolution, and Revolucion de Cuba (the latter targets a slightly older demographic than the main brand). It currently has 74 branches.

There's a neat summary at the start;

Like-for-like2 sales positive, Adjusted1 EBITDA higher, debt reduced, on track to meet expectations

Background - I've written a disproportionately large amount about this share in recent years! We had the excitement of a 203p cash takeover bid for the company in autumn 2017, which then fell through. The share price lost two thirds of its value by the spring of 2019, and flat-lined for the rest of the year. Recent signs of life have been snuffed out by coronavirus worries - investors worrying that people may not want to congregate in close confinement, in say aeroplanes, cruise ships, bars, etc. Such worries are bound to hit shares in pubs/bars/restaurants, as well as travel companies, which they have. After all, it would be difficult to drink in a bar, with a face mask on. Even less chance of pulling too!

Given that RBG serves a mostly younger customer base (people in their twenties & early thirties), and given that coronavirus is generally mild for that age group, then I wonder how much of a deterrent it might be to them going out on a Friday or Saturday night (which is when RBG makes its profit)? The way things are going, we'll probably find out fairly soon.

Operational problems emerged after the failed takeover bid. These were caused by what the company calls a "brain drain" - some disloyal area managers left, and took some of the best site managers with them. Other key staff were also poached by competitors. The focus on new site openings left many existing sites tatty & neglected, resulting in negative LFL sales, with a highly geared (75% gross margin) impact on the bottom line. So profits plunged.

Therefore the new CEO Rob Pitcher, who started in June 2018, had a conceptually straightforward job, of putting right these basics. His strategy is absolutely correct, in my view, which is why I decided to hang on to my RBG shares. I meet management every 6 months, and have growing confidence that their strategy is clearly beginning to work. I should be seeing them again this Friday.

Here's the main strategy;

- Attract & retain good staff, especially site managers

- Numerous individual "work streams" to make operations more efficient, and create a memorable night out for customers (hence driving repeat visits)

- Extricate the company from loss-making sites (achieved with recent property deal)

- Refurbish tired sites (underway) to steadily improve LFL sales, and hence profits

- No new site openings or divis until debt reduced

That all makes complete sense to me, hence why I've remained bullish on this share. It seems a fairly straightforward and obvious turnaround, hence a good investment from current bombed out levels. Negative investor sentiment strikes me as very odd - hardly any investors I know are even interested in looking at the numbers, and there seems a universally negative perception of the company - which is very much out of kilter with reality, in my view. Reality, as I see it anyway, is that this remains a highly cash generative business, with good recovery potential almost guaranteed from self-funding site refurbishments. These typically cost £200k per branch in refurb costs, with very little downtime (they start on Sunday night, and aim to be completed by Fri evening, thus not missing any of the key days trading). Refurbs done so far are showing excellent results, in improved performance, delivering a higher ROI than new sites capex was showing. So we already know that the refurb strategy is working, but has not yet been reflected in a higher share price.

An example is the Clapham Junction branch, which was delivering -16% LFL sales before refurb, which improved to +5% post-refurb [source: company results presentation slides, FY 06/2019]

I think today's interim results are pleasing for a turnaround that is now beginning to show signs of success.

Interim results - note that H1 is seasonally stronger than H2, because it includes the key Xmas/NYE period. The company has already reported a decent performance over Xmas/NYE, in its "in line with market expectations" update on 15 Jan 2020, which I reported on here.

Today's figures are skewed by the introduction of IFRS 16 lease liabilities onto the balance sheet. I remain of the view (which is apparently how institutional investors and banks also view things) that whilst the IFRS 16 figures are interesting, once noted, they can be crossed out and ignored. That is because future years' rents payable are not interest-bearing debt, and cannot be withdrawn. Therefore these liabilities are completely different to bank debt, and should not therefore be seen as debt.

Moreover, if you are trading profitably from a site, then there is no reason at all why future years' rents should be accrued & put on the balance sheet. That violates the key accounting principle of matching costs to the year in which they apply. Companies are bound to pay business rates on all sites too. So why haven't those unavoidable costs also been accrued until lease expiry dates? That's another reason why IFRS 16 is illogical. Given that nearly all retailers/hospitality companies lease properties, then why do we need consistency with property companies that own freeholds? Investors understand the difference. The whole point of leases, is so that properties are flexible, and can be disposed of quite easily, with no associated bank debt that could be pulled in a recession.

In commercial terms, if a site is highly profitable, then a longer lease is a good thing, because it means you can continue trading profitably. That's assuming that 5-yearly rent reviews don't increase the rent by much. Yet IFRS 16 just shows a larger liability (and a corresponding theoretical asset) for longer leases, and largely ignores whether sites will be operating profitably, or highly profitably - which is commercially all that matters in reality.

IFRS 16 adjustments are as expected - the company briefed that there would be a £23.5m net assets reduction, in its presentation slides for the FY 06/2019 results. It also confirmed that the bank is ignoring IFRS 16 adjustments, and wants figures reported on the old basis. So this is a non-issue. It does complicate the figures today though. In particular, we have to be very careful when quoting EBITDA, since this figure is skewed the most under IFRS 16 due to rental costs being moved down into finance costs (which is crazy, but there we go).

Before I get too bogged down in details, here are the key points today;

LFL sales - up +0.7% in Q1, improving to +1.7% in Q2 , current trading is +1.6% - this should improve further, as more branches are refurbished

Profitability - various measures are given. EBITDA is important, as it's a good proxy for cash generation (before tax & interest, obviously). That is up 10.6% to £7.6m in H1 (on the old basis, i.e. ignoring IFRS 16). This makes the market cap look incredibly cheap, in my view.

Big reduction in debt, as forecast. This reinforces just how cash generative the business is, now that expansion capex has stopped. Investors don't seem to have grasped this yet! Hence why i have never seen debt as being a problem here. It would only become a problem, if LFL sales turned & remained strongly negative;

At the end of the period, the Group had bank borrowings of £11.5 million (FY19: £18.5 million), all relating to drawings on its committed revolving credit facility. The credit facility runs to December 2021 with available credit varying between £21.0m and £18.0m. At the period end, cash and cash equivalents were £3.1 million (FY19: £3.7 million) and therefore bank borrowings net of cash was £8.4 million (FY19: £14.8 million).

This is not only a manageable level of debt, it's quite low relative to EBITDA.

Note that the property deal (to dispose of loss-making sites by re-gearing leases on some other leases with the same landlord) will result in a post-period end cash payment of £3.6m, but there's enough headroom on the bank facility to cover that comfortably.

Dividends - none for the time being, as the focus is on turnaround, and debt reduction. That makes complete sense to me, and is an already-known factor, so no change.

Outlook - all sounds fine, in line with expectations for FY 06/2020.

When I see management this Friday, I'll ask them about the cost of funding +6.2% Minimum Wage increase that is scheduled for April 2020. So far the company has done well to mitigate this, but mitigation strategies can only save so much, unless they start bringing in robot bartenders (not as daft as it might sound! It would be a great selling point!) -

Our improved financial performance was achieved through growth in LFL2 sales of £1.0m coupled with 0.2% growth in gross margins and reductions in operating costs. Operating costs were lower despite an effective increase of 4.6% in hourly labour rates as a result of the National Living Wage, National Minimum Wage and pension increases. Well over half of this increase was mitigated through labour scheduling and worksmart initiatives to drive greater productivity. We have also achieved good cost savings on local marketing activity, cleaning contracts, network communications, cash collection and card payment charges.

My opinion - on an initial review, I'm pleased with these numbers.

I'll read the detailed narrative over a cup of tea later this morning, and add any additional thoughts below.

My view is that, if we were to imagine a world without coronavirus, then this share would probably have recovered to 100-120p by now. Therefore, the 70p-ish level at present seems artificially low, but I understand the reason for that - with a worldwide pandemic appearing to be underway, or at least the potential for it being clear, then why would anyone want to buy into a bars group right now? Or a travel company, etc? That's why these sectors are starting to look cheap. The low prices are to compensate for increased short term risk.

Once coronavirus is out of the way, then I imagine RBG shares could be usefully higher - because the fundamentals are starting to improve. In the meantime, I can also understand why people would be nervous about buying shares in a bars group right now. One for the watchlist maybe? I remain a holder, as I hedged my portfolio with shorts when the coronavirus started, which is enabling me to take a longer term perspective, and not worry, with my longs.

.

.

Mccoll's Retail (LON:MCLS)

Share price: 36.4p (down about 17%, at 10:46)

No. shares: 115.2m

Market cap: £41.9m

I won't spend long on this, as I cannot imagine why anyone would want to buy or own shares in this. It's an also-ran, in a sector where bigger competitors have been expanding for years, and even they can't eke out much of a margin, so what chance does this have?

26 February 2020 - McColl's Retail Group plc, the UK convenience retailer, ("McColl's" or "the Group") today announces its preliminary results for the 52 week period ended 24 November 2019 (FY19), and a trading update for the 11 week period to 9 February 2020.

It's still profitable though, I was expecting worse. The goodwill impairment charge doesn't matter to me, as I write off all goodwill for every company, as do many investors & analysts;

That's not so bad, but I think it's probably this bit which has hit the share price today;

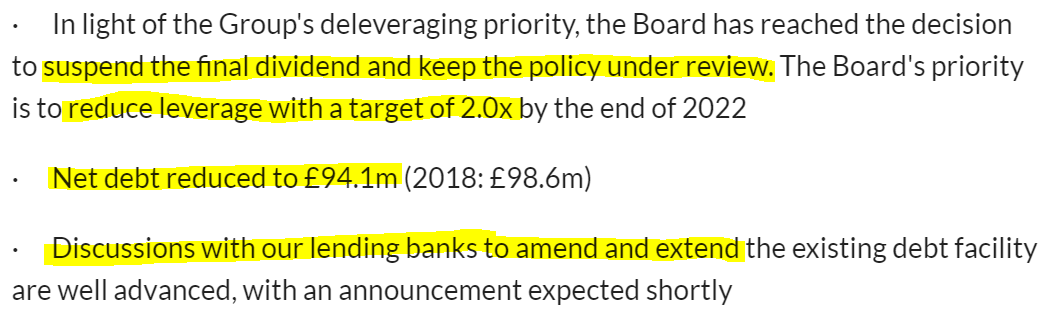

.

Reducing gearing to 2.0x EBITDA implies it needs to reduce from £94.1m to c.£64.2m, quite a tall order I'd say. Therefore be realistic, I think shareholders should probably assume that divis have stopped forever. Therefore, the only reason to hold this share, is if you think they can pull off a miraculous recovery. I don't see that happening, given cost price inflation, especially wages costs potentially rising 6.2% in April 2020, if they only pay Min Wage.

Management has a strategy to rationalise the business, which sounds sensible. Whether it works or not, is the big question.

Balance sheet - can only be seen as very weak, considering it has £156.9m intangibles, even after a large write-off. Deleting all intangibles, takes the balance sheet into a very bad negative position of -£118.2m NTAV.

My opinion - I wish the company well, but in my view, the equity is probably worth nothing now. Creditors have a large exposure to the business, so will want it to keep trading. If it survives, then shareholders may well need to stump up fresh money to stay in the game. And why would you want to?

With possible disruptions to supply chains, and other possible coronavirus-related disruption, then this is really not a good time to be holding shares in companies with stretched balance sheets & a lot of debt. If shops are forced to close, then overheads keep going, but revenues stop. Another reason to be cautious here. We should be at least considering the worst case scenario.

Avingtrans (LON:AVG)

Share price: 285p (down 9.5%, at 12:07)

No. shares: 31.4m

Market cap: £89.5m

Avingtrans PLC (AIM: AVG), the international engineering group which designs, manufactures and supplies original equipment, systems and associated aftermarket services to the energy and medical sectors, today announces its interim results for the six months ended 30 November 2019.

Revenues up 15%, but flat once acquisitions are stripped out.

Anticipated H1 losses from acquisitions of -£0.9m, hit overall profit, down to only £0.3m.

Adjusted EPS from 4.5p to 5.1p

Net debt up sharply, from £2.0m at 31 May 2019, to £8.3m (pre-IFRS 16), presumably due to acquisitions

Outlook - quite long-winded, but the conclusion is;

Trading to date gives the Board confidence in its ability to achieve market expectations.

AVG doesn't sound concerned about coronavirus;

The coronavirus disruption may have some impact on our Chinese operations, but, again, mitigating actions are underway to limit any material risk.

It would be worthwhile looking into what element of the business is in China, and what supply chain exposure its other businesses have to China?

My opinion - in normal circumstances, I would say that it looks priced about right, and seems a reasonable quality company (Quality score of 88 on Stockopedia).

In current circumstances, I can see why people might be tempted to bank a profit. It's amazing how many charts look the same as the one below - sharp recent falls, but only giving up a few weeks or months worth of previous gains. Therefore it's not necessarily a bargain yet;

.

Eddie Stobart Logistics (LON:ESL)

Share price: 6.2p (down 91%, at 12:30)

No. shares: 379.3m

Market cap: £23.5m

This share has been suspended since last August, hence why it's dropped so much today.

There seems to have been a rescue-refinancing, and a change of management. So is today's 91% drop an over-reaction? I don't think I'd want to offer a view on that, as special situations like this need many hours work to properly untangle all the strands.

Net debt is obviously a huge issue, at £215m as at 30 Nov 2019.

The rescuer, DBay Advisors seems to have taken 51% control of the operating businesses. Therefore shareholders in ESL now seem to own 49% - not too bad in the circumstances, clearly much better than being wiped out completely.

Considering switching to an AIM listing, and co-investing with DBAY on other projects. This is interesting, as it sounds like DBAY wants to preserve ESL's shareholders & listing, to be used for other investments.

One way or another, it seems fairly obvious that ESL is likely to issue a lot more equity in due course, to invest in other projects and/or help refinance the previous ESL operating subsidiaries.

Balance sheet - looks awful, with negative NTAV of -£185.6m. Although, as we've seen with both Wincanton (LON:WIN) and Connect (LON:CNCT) in this sector, logistics businesses do seem to be able to operate with very weak, negative NTAV balance sheets.

My opinion -neutral, because it needs a lot more work. However, having a white knight financial backer in DBAY makes this a much more interesting proposition, and less risky, than just a common or garden financially distressed company. So, for people who know what they're doing with special situations, this could be quite interesting to research further.

Augean (LON:AUG)

Share price: 216p (down 0.5%, at 13:08)

No. shares: 104.1m

Market cap: £224.9m

Augean, one of the UK's leading specialist waste management businesses, announces its final results for the year ended 31 December 2019.

I wrote positively about this share here, when it reported a strong update for FY 12/2019.

Jack also wrote an excellent article here, digging a bit deeper.

There's another positive surprise today, with adj PBT reported as £19.2m, well ahead of January update's expectation of "at least £18.4m".

Jack flagged that AUG has a habit of adjusting out large amounts of costs, and 2019 is no exception to that, with a statutory loss of £15.3m - so I think we need to take a closer look at accounting adjustments, which are highly material for 2019.

Landfill tax - this makes up the bulk of the adjusting items. The company turns a loss into a profit by reversing out a £26.2m landfill tax assessment charge. It is disputing this assessment, but has paid it (by drawing down on bank debt), in order to avoid mounting interest costs. That worries me, as it sounds like there could be a chance of the disputed charges not being reversed by HMRC. Although another reason for paying the disputed charges is to reduce the corporation tax liability, which makes sense.

Dividends have been stopped until the debt is "significantly reduced".

My opinion - I wouldn't be interested in buying this share until after the HMRC dispute is resolved in late 2020, which is very large relative to the size of company. The problem is that, if the company is not able to recover the disputed amounts paid in landfill tax, then not only would it dent the balance sheet badly (writing off the debtor balance), but it would also mean that previous reported profits (and hence the valuation of the company) were wrong. An adverse outcome could hit the share price by 30-50%, I reckon. It's not a risk I want to take, as I'm not an expert on landfill tax, hence cannot work out the odds of various outcomes.

Hence we don't have the crucial information which we need to value this share.

Pity, as in all other respects, the figures look nice.

That's all I have time for today. See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.