Good morning, it's Paul here, with Tuesday's SCVR.

Estimated timings - mostly done by 1pm official finish time, but I've got nothing else planned for the afternoon, so will probably keep adding sections until about 7pm.

Edit at 19:"7 - sorry, it took much longer than expected, but today's report is now finished.

I'm going to start with my views on the current coronavirus situation. Sorry if this is not very well-structured, but there's so much to cover;

Coronavirus thoughts

It seems to me that (to mangle a phrase from Churchill) we're not even at the end of the beginning. Coronavirus is clearly spreading internationally, and is highly contagious. Therefore, the most logical stance to take, is to assume that it's likely to become a pandemic. Hopefully not, and there are of course other possible scenarios - e.g. that containment measures slow it down, or even gradually eradicate it, as people either recover or die (it is binary, after all). My sources in the pharmaceutical sector tell me that hopes for a vaccination, let alone cure, are premature. After all, they've never managed to develop a cure, or vaccine for the common cold, after trying for more than 50 years. But who knows, there must be lots of scientists working on this, and they could get lucky. Even then, testing would take the best part of a year before it could be widely distributed.

I monitor this website (from a good source, which I've checked out) every morning, and note that;

Reported cases in China seem to be reducing now. The number of people reported as having recovered, is rising strongly now. That's great, but bear in mind that many cases (elderly & already sick) are severe & require hospitalisation. The number of cases could be under-estimated, if people who have mild symptoms don't need medical help. We saw from some of the social media coverage just how bad the situation was in the early stages of the virus outbreak, as so many people needed hospitalisation in China. Remember the new hospital they built in 8 days? How could that be done here in the UK? It was reported on last night's TV news that we only have 2 hospital beds per 1,000 people, well below other developed countries (e.g. France & Germany), therefore the worry is clearly that if people become sick from coronavirus & require hospitalisation, then how could the NHS possibly cope? Remember that mortality rates might not be that high, but severe cases who need hospitalisation, is considerably higher than the mortality rate. How could open, Western societies deal with trying to lock-down entire cities? It just wouldn't work. Would we tolerate the army on the streets enforcing lock-downs? It's almost inconceivable here, but not in China. My point being that the extreme measures taken by China to stop the spread (shutting down the economy in large areas) couldn't be done effectively, in open, democratic societies.

From looking at US websites, and the very powerful rally in US shares currently underway, I get the feeling that they could be seriously under-estimating the risks. Therefore, I'd expect to see another big sell-off in the US, when coronavirus really hits them, as it's bound to. I think the very recent, powerful rally in large caps (especially in USA) is probably a selling opportunity. Remember that, in falling markets, powerful rallies are the norm, but they fizzle out and then another, larger sell-off occurs. It looks that way to me right now, and reminds me of 2008 actually. There were big rallies then too, before repeated new waves of selling, as people realised the situation was getting a lot worse, not better. The parallels to today look striking. But we don't know, it's a fluid situation. Hopefully this article might look ridiculous and alarmist in future, if they get on top of things. We can only base our views on the information we have right now, with the future very uncertain.

In terms of the markets, there are really 2 issues on my mind;

1. The temporary but still serious potential impact on company profits. Supply shortages from China haven't really kicked in yet, but March & April is likely to see many profit warnings from companies that either import finished goods from China (think lots of non-food retailers), or make stuff using some components sourced from China. I'm expecting to see many surprises, from companies that I didn't know were reliant on China - it's the workshop of the world, on which many sectors are highly dependent. Because of this, I think it's too early to be buying the dip. I'd rather buy after profit warnings, which in many cases look inevitable.

2. Whether the panic and worry of coronavirus spreading widely, could be a trigger for not only a recession worldwide, but also a credit crunch. Many companies are highly geared, because credit is so cheap. But if earnings crash, then covenant breaches could make debt repayable on demand. So in a bad case scenario, coronavirus could conceivably be the trigger for a credit crunch - i.e. withdrawal of credit, causing banks to retrench in order to lower their risk, with the knock-on impact on geared companies which might be forced into refinancing at the worst possible time (and hence bad terms - e.g. emergency placings at a big discount), or even insolvency.

I'm almost fanatical about balance sheets, and I think we're entering a market phase where highly geared companies could be severely punished. People who ignore balance sheet risk in a bull market, could be about to be taught a painful lesson, in my view. Risk is badly mis-priced already in my view. Hence it's a ticking time-bomb for both equity and credit markets. We could very easily see another major dislocation, as happened in 2008-9. It doesn't really matter than interest rates are ultra-low, if banks are not willing to lend - which is what happens in a recession. Although having said that, banks are more inclined to be lenient, if the interest charges are modest, and a company can at least afford to service those interest charges. Hence the situation doesn't get any worse for the bank, so it can justify leniency on repayment of capital.

Whereas in the downturn of 1990-93, I remember that the banks were absolutely brutal in putting so many companies into receivership, because interest rates were far too high (that numpty John Major took us into the ERM at far too high a level, so cripplingly high interest rates were maintained to defend sterling, unsuccessfully as it turned out) . The result of which was that compounding interest, at high rates, saw banks' problems get bigger by the day, so they pulled the plug on many decent but highly geared companies, thus actually just crystallising a bad debt for the bank. The only beneficiaries were the insolvency practitioners, whose fees often mopped up a lot of the recoveries from fire sales of assets at the worst possible time in the cycle. Anyway that was then, and this is now, where low interest rates mean banks are not likely to be so brutal this time. They can force companies to raise more equity though, and that could mean severe dilution for existing shareholders.

Stocks/sectors -

Transport - still the most vulnerable. Some airlines are already reporting bookings down c.20%. Holiday companies are also looking extremely vulnerable - why on earth would you book a summer holiday abroad, knowing that if just 1 person in your hotel is even suspected of having coronavirus then your hotel becomes a luxury prison, with local police stopping people from leaving? Then apparently you need to get a doctor's certificate within 24 hours of your flight, so if you can't get that organised, then you can't fly home. I reckon airline bookings are likely to drop much further than 20%. I've already told my social secretary not to book any holidays or short breaks for the foreseeable future. But at some point, that risk & cost will be priced in, and investors will inevitably look to anticipate the recovery. I closed my short on International Consolidated Airlines Sa (LON:IAG) and am now wondering whether to go long. But the share price has only corrected back down to where it was last summer. Is it really that cheap, now that we have no idea what earnings are going to be?

The TV reports on this kind of thing are very powerful. I expect "staycations" to become much more prevalent this year, across the world. Let's hope it's a hot summer. As for cruise lines, who on earth would want to book a cruise, after we saw that the lock down measures taken on the Carnival Princess resulted in hundreds of people becoming ill and even dying (old people are concentrated on cruise ships, after all) due to being quarantined. So expect a class action against Carnival (LON:CCL) for that, in due course. I remain short of CCL. Cruise lines & airlines rely on the cash paid up-front by customers, to finance their businesses. If bookings dry up, then many are vulnerable to insolvency. That said, customers could get some cracking deals in a few weeks or months, if you're prepared to take the risk.

Hotels - well that depends, as so far a lot of places haven't really been affected much, or hardly at all, by the virus. But what happens when it becomes more prevalent, as seems highly likely, based on the information & trends we currently have? Personally I wouldn't even entertain buying or holding any hotel companies' shares right now. The outlook is far too uncertain.

Bars - this is a bit more tricky. I was in the City last Friday, meeting management of Revolution Bars (LON:RBG) (I'm long). It was an excellent meeting, to run through the presentation slide deck for recent interim results. With coronavirus at the forefront of my mind, as I stretched out for a handshake, I did a double-take, and quipped, "Actually let's do a fist-bump instead of a handshake!". Whereupon, the softly-spoken, very calm and rather serious CFO clonked his large fist on mine, causing me to say, "Ouch - you were obviously a boxer in your day!". The CEO then quipped, "They don't call him Mad Mike for nothing!". It was a great icebreaker (and nearly a bone breaker too!).

Forget all the IFRS 16 nonsense, that's irrelevant. The key thing is that the business is recovering - underlying interim profit was up. LFL sales are recovering, with an improving trend - knocked back a bit by the flooding/storms in last 2 weekends of February, but the underlying trend is that they're now at a current run rate of about +3% LFLs. Costs are being well controlled, with increased wages cost in particular being mitigated with better staff scheduling & productivity (e.g. simplifying & speeding up the time to make cocktails). Amazingly they've managed to save £70k by finding a new supplier of goats cheese! Almost all the loss-making sites have now been disposed of through a deal with their largest landlord. Net debt is coming down (although note that the interim period end is a seasonal high for cash), but they're still on track to meet the forecast year end (FY 06/2020) reduced net debt figure, despite paying out about £.5m in order to exit the leases on loss-making sites. Still highly cash generative now that expansion capex is on hold, and new site roll-outs going to restart next FY 06/2021 - but looking only for large, city centre sites, so probably just 2 big new sites each year. Sounding out opinion on whether investors want dividends to resume. The turnaround is happening, it's not a hope, it's a fact. Therefore RBG shares look dirt cheap in my view.

Oh by the way, I asked about why receivables and trade creditors are both high? It's because volume-based rebates (prevalent in the bars sector) are shown as receivables, when they are billed to the main drinks suppliers. Therefore most of the receivables figure really should be netted off against trade creditors. I specifically asked if the creditors were being stretched in order to suppress net debt? The CFO (who I trust, because he's got a track record of giving me truthful answers to my questions at previous meetings) emphatically confirmed that RBG pays its suppliers on the agreed terms. Average payment terms are 40 days. Therefore, in my opinion, anyone who says that the balance sheet is stretched, is just plain wrong. Maybe they're confused by IFRS 16, which wrongly classifies future years' rentals as debt. When actually rents are future years' operating costs, which should not be on the balance sheet at all.

Is coronavirus a threat to bars/restaurants generally? Clearly yes, to some extent. A few months lost trading would be very expensive - with rent & rates having to be paid, with little revenue coming in, then it wouldn't take long for the more highly geared operators to go under. That said, would people stop meeting in bars? Some maybe, but many would just carry on, and take better hygiene measures such as washing hands, and using hand sanitiser, etc.

I think in the UK we're renowned for our stoicism. We've seen that with terrorist attacks - people generally don't change their habits or behaviour at all, after the initial shock has worn off. This was evidenced by a conversation I overheard in the Lord Aberconway, just after my meeting at FinnCap's offices to see RBG management. Thankfully there were 4 real cockney geezers in the pub. I say thankfully, because I didn't want to be the only person drinking peroni at 11am (I had a 1.5 hour gap between the meeting, and a lunch appointment at Paddington). I was struggling to contain my laughter at their conversation & probably the most extreme cockney accents I've ever heard. Anyway, the geezers started talking about coronavirus. I jotted down some notes to help me remember, given that it seemed highly unlikely this would be my only peroni of the day (well, it was Friday, and the market was in freefall). Their main comments were, "Well, it's just like a bad cold, innit?!", and, "If you're gonna get it, you're gonna get it!".

Cross-referencing that with the fact that RBG's core customers are aged 18-25 (about 10 years older in their smaller, "de Cuba" brand - which incidentally is trading very well - as you can see from the slides) - and of course at that age people feel invincible. Given that young people seem least affected by the virus (mild symptoms mostly), I see it as unlikely that they'll give up their Fri & Sat nights out. That is RBG's core business, where they make their profit. So it doesn't matter if their bars are empty during the week (which many are already), as long as the big Fri & Sat nights out continue to some extent, then they should be fine. There's a good geographic spread too, so even in an extreme case where some cities/towns are put into lockdown, then it would only partially impact the overall business.

The way I look at things, is to ask what would a share price be, if coronavirus had not happened? With nicely improving fundamentals, and more refurbs coming through (which are boosting LFL sales & have a great payback time of just over 2 years), then I reckon RBG would by now be around 100-120p. The fact that its shares are actually 60p to buy, says that they're cheap. Very cheap. That said, anyone buying now has to be clear that, if things get a lot worse in the UK with coronavirus (which seems likely to me), then the share price of RBG and many other shares, could get cheaper still, purely on sentiment & panic selling. The big problem with small caps, is that when people are panic selling, even if it's only a small number of shares, then the bid side can dry up completely - i.e. you can't sell in any size. Therein lies someone else's opportunity. But we need cash on hand, to be able to take such opportunities.

The other thing I noticed on Friday 27 Feb, in London, hardly anyone was wearing a face mask. In fact, after scanning what must have been many hundreds of faces during the day, I only saw a youngish man wearing what looked like a cycling mask (the black ones), and an oriental-looking woman wearing a paper face mask - which is common anyway, orientals often wore face masks in London before coronavirus. I'm still in London, and am looking out for face masks. I've got a small supply of my own, but feel that there is unspoken social pressure not to wear one. Mind you, going on the tube, I'm tempted to wear one now, given the appalling lack of hygiene shown by many. People are coughing & spluttering, with just a half-hearted attempt at putting their hand near their mouth - which is no good at all, without a handkerchief, which hardly anyone seems to carry these days. At Finncap's offices, someone from another company got into the lift with me, a youngish chap probably in his early thirties, and the second the door had closed he coughed heavily, twice, without covering his mouth. How un-self-aware can someone be? I was about to say something, then stopped myself, because in a confined space there would have been no escape route if he turned nasty. Just as I was weighing up risk:reward, he'd already exited the lift. Pity I didn't at least give him a perturbed glare, but he probably wouldn't have realised why, even if I had.

Why are the TV ads not inundated with Govt warnings, about always keeping clean tissues to hand, always covering your mouth if you need to cough or sneeze, frequent hand-washing & using hand sanitisers, etc.? People need to be taught these basics, as these common-sense measures which older generations had drummed into them back in the day (probably learned from the Spanish Flu epidemic just after WWI), but have since been forgotten. It's a bit like the foolish people who don't vaccinate their kids. They don't perceive a threat from these diseases, because they've been (temporarily) eradicated with mass vaccinations. So the diseases are now coming back again. We seem to need to unlearn, and then re-learn so many things. It's just like that in financial markets too - the same patterns of boom & bust play out in exactly the same way, every few years.

Mum mentioned to me that she was brought up with the slogan, "Coughs and sneezes spread diseases", and that she was always made to wash her hands before sitting down to eat. Now, people like a little wet towel to wash their hands at the end of the meal! Beforehand they're cheerfully handling a bread roll with their unwashed hands that were recently holding on to a handrail on a tube train that's probably covered in germs.

As an 83-year old asthmatic, I decided to put Mum in lock-down in her flat, about a week ago. But she's completely ignored me, claiming that she's more likely to die of deep vein thrombosis if she never goes out for a walk. So her daily trip out by free bus, to potter around, have a coffee at Pret, and drop off a small bag of clutter at the charity shop, are continuing to this day. She nonchalantly told me that, "If I catch it, I'll definitely croak it!". But Hitler didn't get her, nor did pneumonia or a heart attack a couple of years ago, so she's pretty relaxed about the situation overall.

Indices - are so volatile, that you can be right about the direction, but get stopped out, or suffer huge losses, if there's a big rally in between. I somehow managed to lose money on my Dow short hedges, during a 4,000 point fall! Timing is everything I'm afraid, and market timing is one of my weaknesses. It's so irritating to be completely right about the big picture, but manage to screw it up in terms of actions.

China supply chains - I'm less worried about this now. Of all the problems right now, this seems the likeliest to be fixed, as Chinese factories are going back to work, albeit slowly. Also, companies can mitigate, and potentially shift production elsewhere. We're far too dependent on China, in my view. So maybe one of the positives that might emerge from this crisis, is that companies might recognise that having a more distributed global supply chain is necessary. Although in the short term, expect lots more profit warnings, as UK inventories begin to run out, even if only temporarily.

Of the small caps I follow, Norcros (LON:NXR) stands out as having fallen a lot recently. It sources a lot of product from China, so is bound to see some disruption. Is it a bargain after having dropped by about a third? Possibly. Although with so many similar shares, it's only given up the gains from the big autumn/winter stock market rally. So we're really just back to where it was last summer. Does that make it such a bargain then? Arguably not really.

Online businesses - these should be some of the beneficiaries. After all, if people are nervous about going to the supermarket, or shopping the High Street at the weekend, then online shopping is the obvious answer. In my own portfolio, I see that Sosandar (LON:SOS) (I'm long) has sold off a bit in the recent, general panic. That doesn't make sense, as they should benefit from more home shopping. Also their balance sheet is cashed-up after a well-timed recent fundraising. Similarly, I see no reason for Best Of The Best (LON:BOTB) (I'm long) to have sold off. If people are bored at home on lock-down, then what better way to spend a bit of their now surplus-to-requirements holiday money by playing online spot-the-ball in the hope of winning a supercar?!

EDIT: Conclusion - pulling all this together, my current view (subject to change at any time, as the situation develops) is that the market doesn't seem to have adequately priced-in the increased risks of profit warnings, and the increased risk of a recession. Therefore, I am not actively looking to buy in the market just yet. However, I am building up a list of small caps that look attractively cheap, and at some point I'll push the buy button. Am just not sure that now is the right time. I don't see this as being a likely V-shaped recovery. It feels to me as if there could be (at least) another big leg down in the major indices. The reason being that the starting point (especially for the US market) was far too high - with stocks pumped up on steroids of cheap money, and a mindset of buying every dip (which so far has been a brilliant money-making strategy). But when that stops working, who knows how much downside there could be for US stocks? A lot, I think. The same could be said for more speculative, fashionable, UK stocks. Many look wildly over-priced to me still. End of edit.

Right, sorry if the above lengthy ramble has seemed OTT to some readers, but people seem to like me commenting on the major topic of the day, judging from the thumbs ups. I'll cover small cap trading updates & results below, in addition to the above.

Apologies, I nodded off on the sofa, after lunch. One of the dangers of being over 50, and working from home! Re-starting now, at 15:14. I see the Fed has just dropped interest rates by 0.5%, in a knee-jerk reaction. You can't stop a virus with interest rates. So that looks a flash in the pan to me. On to company news:

Vertu Motors (LON:VTU)

Share price: 32.0p

No. shares: 369.2m

Market cap: £118.1m

Vertu Motors, the UK automotive retailer with a network of 133 sales and aftersales outlets announces the following update with regards to the five-month period to 31 January 2020 (the "Period") ahead of its preliminary results for the year ended 29 February 2020.

Key points;

In line with expectations for the full year (which had previously been lowered, see below)

There's a lot of detail in the announcement, which I won't re-hash here. My overall impression is positive - the group seems to be making common sense moves to focus on margins, given that volumes are down. The after-sales (servicing) division seems to be trading well.

There are a couple of negative points flagged;

1) Commissions arrangements for financing are under review by the FCA (already known factor), and

2) Manufacturers taking parts stocking in-house is likely to be a £0.9m hit to profits for VTU in FY 02/2021 (and beyond, presumably beyond). To put that into perspective, it looks to be around 4-5% of profits - so a dent, rather than a write-off!

Broker updates - there are 2 good quality broker updates available today on Research Tree - thanks for those (Liberum & Zeus) as it saves us so much time, and keeps private investors properly informed.

FY 02/2020 forecasts are obviously unchanged, as it's an in line update, at 5.0p EPS - a PER of only 6.4

FY 02/2021 forecasts are cut by nearly 10%, to 5.1p - still up on the current year - a PER of 6.3

Given the asset-backed (freehold property) balance sheet, then I see this as good value - assuming that forecasts don't get cut again of course. A drop to 4.0p EPS would raise the PER to 8, and a drop to 3.0p EPS would raise the PER to 10.7 - not such a bargain if earnings forecasts do fall again.

My opinion - this share looks excellent value. I'm impressed with how well profitability is holding up, in a tough sector where others are faring far worse (e.g. Pendragon (LON:PDG) ).

I'm uneasy with the FCA investigation, so it would be wise to read up on this, and try to assess what the damage might be, if the FCA levies fines.

I've checked the last reported balance sheet, and it's excellent, with lots of freehold property. Therefore the bank facilities should be safe (banks love freehold property as security against lending, as it de-risks things for the bank). The share price is currently well below NTAV.

The 5.6% dividend yield is 3 times covered, and together with a strong balance sheet, I think the yield looks fairly safe.

Overall then I like this share at the current level. It looks excellent value, and is nicely asset-backed too. Who's got the balls to by it though, given current nervous market conditions?!

As regards coronavirus, if people are cancelling their summer holiday plans, then who knows they might decide to treat themselves to a new car instead? Hence it could work out to be a net positive, possibly?

Looking at the 2-year chart, buying at the current level of just over 30p would have enabled us to make a 30-40% profit several times, and collect some divis along the way. Therefore this could be a nice trading idea? Or one for income seekers with a good, and well-covered yield.

.

Getbusy (LON:GETB)

Share price: 66p (up 1.5% today, at market close)

No. shares: 48.4m

Market cap: £31.9m

GetBusy plc ("GetBusy", the "Company" or the "Group") (AIM: GETB), a developer of document management and communication software products, announces its audited results for the year ended 31 December 2019.

A pal of mine is very keen on this one, and I've been meaning to look at it properly for a while now.

It looks small, but complicated, at first glance! For this reason;

"Within our product portfolio we have an established brand that is well-respected and highly profitable, a rapidly growing and very scalable SaaS product that has clear product market fit and a new entrant that is seeking to carve out a lucrative niche in a sector that is undergoing disruption. This unique combination of products is a key enabler of our aim to be a long-term sustainable growth business."

There's a useful slide pack here - follow link then click on "full year presentation".

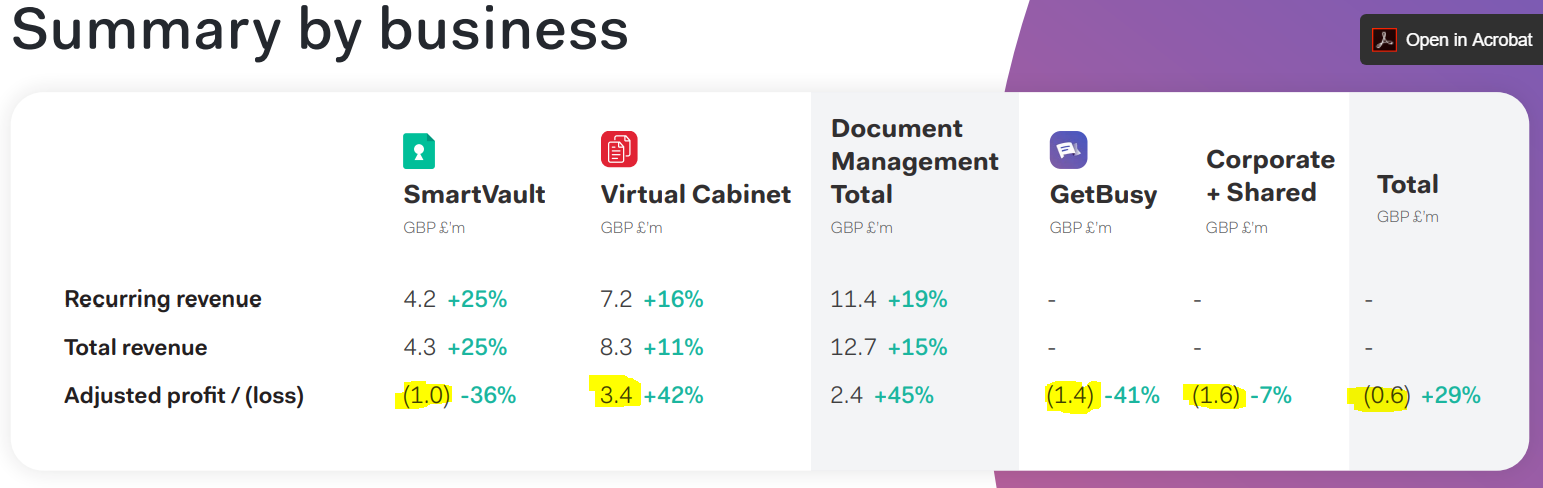

Slide 6, copied below, helpfully shows the breakdown of its various product divisions. I've highlighted the adjusted profit figures. What this is trying to show, is that the overall adjusted loss of -£0.6m is caused by 2 loss-making divisions, which mask the profitability of the Virtual Cabinet product. That's interesting, but personally I would tend to allocate most of the £1.6m central costs to the core business. So I prefer to look at it as a core business making £1.8m profit, with 2 loss-making ventures that lose £2.4m p.a.. Even so, that's still a lot better than all 3 divisions losing money. The implication being that the 2 loss-making divisions could be jettisoned if needs be, leaving a core, profitable business. So that's fine, I'm happy with this.

Another stand-out feature is that revenue is nearly all recurring, which is a very positive thing.

Overall losses of -£0.6m are modest, which is another plus point, compared with many other similar businesses which burn cash like it's going out of fashion.

.

.

Slides 11-13 show that the group seems to be mainly dependent on the accountancy sector for its revenues. That's great, it looks like it's cracked that niche. But will it be able to duplicate that success in other sectors? Maybe, but it could be costly & take time. That said, it can be a good thing for small tech companies to crack one niche first, then go for wider expansion later, once the running costs are covered by the core business's recurring revenues.

Slide 26 - Churn rates are very low, and improving (but shown monthly, instead of the more usual yearly). Even so, multiplying by 12 still leaves them low.

Slide 28 - shows cashflow. It's probably going to need more cash. Ah, I've just realised that it raised £2m in a placing in Dec 2019, but the proceeds did not hit the balance sheet until early 2020. Therefore we need to manually adjust the 31 Dec 2019 cash balance of £1.7m for the increased cash of say £1.8m net. Therefore it should now have £3.5m in cash, which is probably enough for now.

As always, presentation slides make me want to rush out and buy the share! That's what they're designed to do, after all.

Looking at the accounts next, can I find any funnies?

Capitalising development spending - very modest, I'm pleased to say;

On an IFRS basis, we have capitalised £0.3m of development costs in 2019, which relates solely to work carried out on Virtual Cabinet and SmartVault. Capitalised amounts in 2019 relate, amongst other things, to the migration of SmartVault to AWS, the development of the VC Go suite of mobility apps and the creation of key integrations for SmartVault. No costs related to the development of GetBusy have been capitalised as there is insufficient certainty over the commercial viability of that product at this stage.

R&D tax relief - not claimed yet, nor accrued for. So could be an upside surprise here of about £0.6m.

Outlook - sounds encouraging in parts;

We expect SmartVault's growth to continue to be strong, underpinned by a very encouraging start to the new year and investment in product development and customer acquisition that will be at a higher run-rate than in 2019. Improvements in Virtual Cabinet's operating margin will be driven by strong operating leverage and more modest recurring revenue growth. We are not forecasting any material revenue for the GetBusy product at such an early stage, although we remain encouraged by the initial progress thus far.

Profit figures - I'm not comfortable with the adjusted profit/(loss) numbers. To my mind, the statutory loss of -£1.2m in 2019 and a similar figure in 2018, is a more sensible & prudent way to look at things. A £-1.2m loss if fine for a growing tech business, I don't have a problem with that level of annual losses.

Balance sheet - is weak;

NAV: negative, at -£2.9m. Subtract modest intangibles of £650k, and NTAV is £-3.6m. Recurring revenue businesses can operate OK with a negative balance sheet, however, I would prefer to see NTAV decently positive. Note that the £2m placing in Dec 2019 would improve these figures by say £1.8m net of fees.

Current ratio: very poor, at just 0.46 . The reason is that there is a large creditor of £4.2m for deferred revenue. This is the book entry for cash that has been paid up-front by customers. Therefore the business is partly being funded by customers paying up-front. As it's about a third of annual revenues, this is not customers paying monthly, there must be lots who pay annually, up-front. Again, this will have improved somewhat post year-end, with the placing.

My opinion - this looks potentially interesting. My main worry is that the group seems to be trying to do lots of things at once, on a very limited budget. Trying to expand 3 products, internationally, on a shoestring, is a tall order. That said, I'm impressed at what they've achieved so far.

I'm not looking to buy anything right now, but this one is going on my watchlist, as something that I need to research further, and possibly buy on any pullback. I doubt there is any need to chase the price up, in current markets.

That's all I can manage today. Thank you for the positive comments, and unusually large number of thumbs up, so clearly readers like me covering current macro topics. I didn't think there was much point in ploughing through loads of boring company updates, when the market is so vilatile & fear-driven right now.

See you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.