Good morning, it's Paul here. This is the usual placeholder article, for reader comments from 7am. The full report will be ready by 1pm. Update at 12:48 - I need a bit more time to complete today's report, so will be working until 4pm today, adding new sections. Today's report is now finished.

The newsflow from coronavirus continues to be appalling. I was deeply disturbed by the actions of the police over the weekend - e.g. harassing dog walkers, etc. This is completely unacceptable, and will be triggering one of my letters to my MP. I understand the need to discourage or ban gatherings of people, but turning the UK into a police state where we get challenged for walking our dogs, is totally unacceptable. History shows that democracy is easily destroyed, using some kind of disaster as the pretext for emergency powers which start as temporary, and end up permanent. I see there are concerns about this in Hungary and Poland also.

I see that Carluccio and Chuiquito restaurant chains have gone bust. The first of many no doubt. It's just not possible for many retail/hospitality companies to continue operating at zero turnover. Therefore the economic devastation that this lockdown is producing, is likely to become apparent very quickly. I'm extremely nervous about investing in those sectors, and have now sold most of my positions (e.g. Next (LON:NXT) and Restaurant (LON:RTN) ) as it's dawned on me just how difficult the recovery is likely to be, and the costs of the lockdown could easily be ruinous. There's no shame in sitting on the sidelines, to wait for greater clarity.

Other press reports which caught my eye over the weekend, are that shopping centre Hammerson (LON:HMSO) are suffering because it is struggling to collect in rents from tenants that have been forced to close. This is now a widespread problem. The big question is whether landlord balance sheets will be robust enough to absorb the short term lack of cashflow from tenant rents, plus the write-down in valuation of shopping centre assets. I haven't looked at Hammerson yet, but have looked at the detail for Newriver Reit (LON:NRR) (in which I hold a long position) and my number-crunching says to me that NRR should survive, and therefore looks a bargain right now, taking a 6+ month view. The danger is that, if I'm wrong, and NRR runs into financial trouble (e.g. breached banking covenants), then it could go to zero, or require a deeply discounted equity fundraise to keep it afloat. Time will tell. Fortunes are going to be made from some shares at current levels. The trouble is, we don't know which ones!

I don't follow anything to do with natural resources, but was staggered by an article over the weekend, suggesting that oil prices could even turn negative! This is due to a collapse in demand, combined with over production, and an increasing lack of storage space for the glut. Therefore the attractive dividend yields in this sector could be a dangerous signal. As so many companies are cancelling their divis, I think it is safest to assume that all shares are currently yielding nothing, unless there is some reason to believe otherwise (e.g. the company specifically confirming payment of divis).

Kape Technologies (LON:KAPE)

Share price: 176p (up 15% at 10:59)

No. shares: 154.3m

Market cap: £271.6m

COVID-19 Update - Kape on track to deliver on 2020 targets

Kape (AIM: KAPE), the digital security and privacy software business, provides an update regarding the impact of COVID-19.

Several readers have pointed out an interesting-sounding update from this company today. I'm not familiar with the company, so am not sure I can add any insights, but let's have a look;

As a result of the restrictions being imposed on movement across the globe in response to the COVID-19 pandemic, and an increase in both remote and home working, Kape has seen increased demand for its products. This has been especially apparent within the Group's digital privacy division, and in particular Kape's VPN offering has experienced increased demand globally but most notably from North America and Europe.

Demand for Kape's digital privacy products is robust, and the Group is on track to deliver revenues of $120-123 million and Adjusted EBITDA1 of $35-38 million in 2020.

It sounds like KAPE could be an interesting share to look at, since the trends of home working look set to continue. I heard something in a similar vein on CNBC this morning, saying that $MSFT is also benefiting from a trend towards its cloud based services being used more. Zoom is another company which is in the spotlight for the same reason.

There are usually unintended consequences from wars & other disasters like coronavirus. They can accelerate existing trends. Many companies which are operating reasonably normally from having staff work from home, must be asking themselves why they have a big, expensive office, and require staff to waste a couple of hours every day travelling to work in unpleasant conditions. When actually the same work could probably be done just as well via happier & more productive staff working from home. I've worked from home for 18 years, and I absolutely love it. Then I fix up meetings & regular Friday lunches (which apparently have become notorious in the City!) to fulfil the need for human contact & socialising.

Although it's fair to say that many companies do benefit from having staff working together. For example, when I pop into the Stockopedia office in Oxford, you can feel the energy & how people are all bouncing ideas off each other. I don't think the same atmosphere would be possible if everyone were working from home. So I can see both points of view on this issue.

Back to KAPE. My first concern is that it quotes adjusted EBITDA, which is a particularly unreliable performance measure for IT companies, who often bury a large part of their overheads into intangible assets on the balance sheet, thus inflating EBITDA to a completely meaningless high that bears no comparison with commercial reality. So let me check KAPE's last cashflow statement.

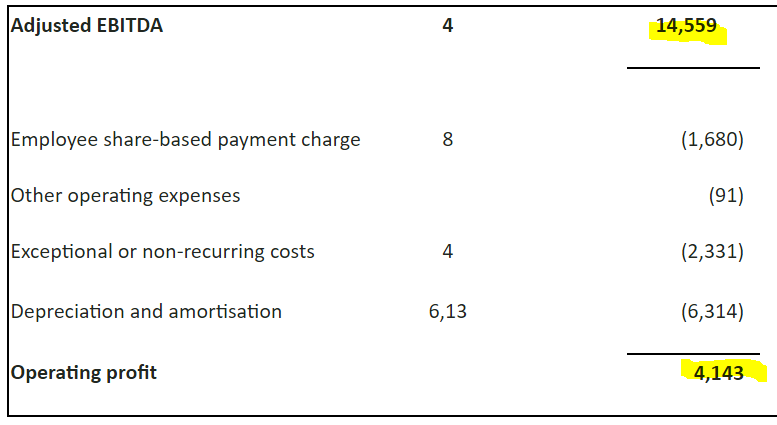

Adj EBITDA for FY 12/2019 was $14.6m, but that translated into only $2.8m in profit before tax. Here's the reconciliation;

.

The other complicating factor is that KAPE seems to have made a transformational acquisition in Dec 2019, which looks set to roughly double the size of the group in 2020. Therefore the valuation relies heavily on those forecasts being achieved. Hence why today's in line announcement is important.

Balance sheet - as at 31 Dec 2019 looks awful to me. It's dominated by $242m intangible assets. That takes NTAV to negative at -$87.1m. I know that IT companies can often operate normally with stretched balance sheets because customers pay up-front. But even so, this looks particularly stretched. Note there is a $40.2m shareholder loan shown in current liabilities, which is unusual. The terms of that loan would need to be carefully scrutinised. It suggests a dominant shareholder, again which needs checking out.

Cashflow statement - for FY 12/2019 has a couple of stand-out features. The main one is large outflows due to "increase in deferred contract costs". This seems to absorb all the cash generated above. Note that $2.6m of development spend was capitalised - which looks fine, that's not excessive.

The cash absorption into working capital however does concern me.

My opinion - this is not, at the moment anyway, a properly cash generative business, the way I look at things. That, combined with rapid expansion by acquisition, and a stretched balance sheet, makes me want to steer clear.

On the upside, it seems to be operating in a space which is growing, and there are not many companies putting out in line updates like this one has today. It's certainly rapidly restored investor confidence. People who are bold, buying the dips in the right companies at the right time, are making some spectacular gains right now, this is a good example;

.

Travel companies

I see that Carnival (LON:CCL) has just announced details of its fundraising efforts.

This brings me on to whether travel companies should get taxpayer bail outs? My feeling is that they should not. It is the job of shareholders to inject more equity when a financial crisis hits. If they are not prepared to, then the business should fold. The thing with travel businesses, is that they are operators of assets which won't disappear. If one airline, or cruise ship business goes under, then the assets would quickly be repossessed by lenders, and then sold or rented out to new operators. Staff would be re-employed by the new operators. Therefore I simply don't see why the taxpayer should pick up the tab for any of this. Are cruise ships or aircraft of vital national importance? No.

Shareholders have enjoyed a flow of dividends for many years, so why do they expect the taxpayer to pick up the bill once things go wrong?

What we're now discovering is that the business models of these companies are all wrong. They are based on an assumption that business will always flow in a continuous, unending stream of cashflow. This has enabled many travel companies to operate the business today using cash which customers have forward-paid for future journeys. A total shutdown for weeks/months was never even considered as a possibility. We now know that this has happened, and could happen again.

For this reason, I think travel companies will need to be completely refinanced. It might need a new structure, with customer cash deposits being held in escrow, and not available for use for working capital purposes. It might need a Govt scheme to enforce this.

It also brings into question the whole issue of dividends (in many sectors). Is it right that shareholders should be paid divis in the good times, then businesses just fold in the bad times, or are given taxpayer support? I think businesses will have to accept that the taxpayer will want some kind of payback once the crisis has passed. I think that should involve corporation tax being raised somewhat from current very low levels.

Businesses which do rely on significant state aid should have to give the Govt an equity kicker, in my view.

No doubt these are issues that we'll be discussing for years to come.

De La Rue (LON:DLAR)

Share price: 59p (up 10% today, at 14:47)

No. shares: 104.0m

Market cap: £61.4m

De La Rue plc (LSE: DLAR) ("De La Rue", the "Group" or the "Company") today announces a post period end trading update for the financial year ended 27 March 2020.

This generally reads quite well.

Current trading is as expected;

The Board expects De La Rue adjusted operating profit for financial year (FY) 2019/20 to be between £20m and £25m, as previously guided.

Bank covenants sounds OK;

The Group has operated within its banking covenants for FY 2019/20, including the net debt/EBITDA covenant of ≤3.0 times and expects net debt/EBITDA at the financial year end to be between 2.0 and 2.4 times, a reduction on the 2.72 times ratio at half year 2019/20.

Net debt seems to have come down a lot;

Net debt at the end of FY 2019/20 is expected to be approximately £105m and includes full payment of the annual pension contribution, down from £170.7m at half year 2019/20. This allows the Company to maintain a good level of liquidity headroom under its £275m revolving credit facility, which expires in December 2021.

I doubt whether such large facilities would be renewed, and of course the EBITDA covenant restricts the use of the facility (since drawing down too much of available facilities could then lead to the company breaching a bank covenant). Still it looks a tough, but not disastrous situation.

Coronavirus - they've side-stepped this issue. I would have wanted much clearer guidance on this issue.

If we don't know what impact it's likely to have, then that makes the shares impossible to value;

The Company is monitoring developments related to COVID-19, and actively taking steps to protect its employees in line with guidance from governments. At present, it is too early to quantify the potential impact on FY 2020/21.

I'm sure that all companies are doing internal modelling, to estimate various scenarios. The usual type of thing is to have a base case forecast, then have upside, and downside case scenarios. Companies could, and should, be reporting this to the market. Withholding that information from shareholders is wrong, in my view.

My opinion - there are signs of life here. As I reported on 6 Mar 2020 here, the turnaround looks to be working so far - with a much improved H2 performance. That said, the balance sheet is still very weak. Moreover, we don't know what impact coronavirus is going to have on the group. Given its already precarious state, I really don't want to punt on the shares with no visibility on current year performance. It doesn't have the balance sheet strength to be in a position to absorb more major problems, were they to occur. Hence I feel it's too risky right now. Although from this kind of level, it could be a multibagger if things pan out well.

Quixant (LON:QXT)

Share price: 60p (down 22% today, at 15:07)

No. shares: 66.4m

Market cap: £39.8m

2019 trading update & COVID-19

Quixant (AIM: QXT), a leading provider of innovative, highly engineered technology products principally for the global gaming and broadcast industries, today provides highlights of its unaudited financial results for the year ended 31 December 2019 and a trading update in light of COVID-19.

I last reported on this company here in Jan 2020, when it warned on profits.

The share price has since been badly beaten up on the general market sell-off relating to coronavirus.

Today's update gives us anticipated 2019 results. The key number is $10.7m adjusted profit. That's exactly the same as the figure given in the Jan 2020 update, which is reassuring news.

Net cash was $16.1m as at 31 Dec 2019. As I confirmed last time, Quixant has a strong balance sheet, so it should be able to survive the current crisis.

Outlook - given that there is nothing untoward in the 2019 figures, it must be the outlook comments that have hurt its share price today by 22%.

Q1 performance was robust, but...

· While Quixant has so far managed the supply chain impact of COVID-19 with minimal disruption to customers after February, the shutdown of the gaming sector and many other industries for an indefinite period clearly presents a material uncertainty to the Group's operations

· COVID-19 will therefore have a material impact on the financial performance in 2020 but it is too early to form a view on the expected outcome and we are therefore withdrawing guidance for 2020 and thereafter

That clearly sounds very serious, and shouldn't really be a surprise.

Guidance - at least some indications are given here;

· We have a strong balance sheet with a healthy net cash position and therefore severe downside scenarios suggest the business can operate for at least 6 months before additional measures would need to be taken

o Net cash of $17.7m at 29 February 2020 (gross cash of $18.5m) with undrawn bank facilities of $3.0m

· Dividend suspended until the impact of COVID-19 on the business becomes clearer

The key question from the above, is what are the likely timings of the relevant sectors re-opening for business (e.g. casinos, etc)? Even when they do re-open, will they be spending on capex (new machines)? I somehow doubt it, because casinos are more likely to want to re-build their own cash reserves, before spending on capex. This could leave Quixant facing a very lean year indeed.

My opinion - I don't have any option than to file this in the increasingly bulging "don't know" tray. We have no idea of knowing what revenue/profit visibility is likely to be. Nor how long the famine of orders that seems likely, is going to continue. Cash reserves are strong, so that buys the company time. Although the shares look attractively cheap against historic profits, who knows whether it will be able to survive this current, disastrous, downturn? Therefore, the only logical conclusion at this stage, is to say this share is impossible to value.

That's it for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.