Good morning, it's Paul here with the SCVR for Weds. Please see the header above for the companies that I'll be reporting on, driven as always by today's news feed of results, and trading updates.

EDIT: apologies, I forgot to put in the estimated timings - it's 4pm finish today. Edit at 15:34 - today's report is now finished.

We're seeing the usual flow of money from companies to shareholders reverse at the moment. So dividends widely being suspended, and placings coming thick & fast (e.g. Joules, WH Smith, Asos). My worry is that entire sectors need to refinance, and I wonder how much appetite for funding so many companies that shareholders will have?

All the focus on efficient balance sheets, and high ROCE, has turned out to be mistaken - it actually left many companies dangerously exposed, with no reserves to tide them over something unexpected. Maybe attitudes might change towards more prudent balance sheets once this crisis is over?

From what I'm observing, there's a strong case for arranging "rainy day" bank facilities - i.e. having a big bank borrowing facility dormant, then drawing it down in full to provide cash reserves in a crisis. Although there's a cost to that, as banks charge hefty arrangement fees as the price of tying up some of their reserves. After all, we need to think in terms of the possibility of coronavirus coming back again after this initial crisis. Hopefully by then, if a second wave does hit us, there might at least be some kind of treatment available to make it less deadly for older/vulnerable people.

We're still in the realms of having powerful rallies, as is usual in a bear market, but will they stick? I think the market is starting to look beyond coronavirus perhaps, and a resumption of economic activity, but that doesn't immediately change the fact that we're facing utterly dire, probably never-seen-before type of economic data. Also, many companies are going to be reporting unthinkably bad figures for H1 2020. How that all fits together? Your guess is as good as mine.

My worry is that shares which rally strongly with the general market rallies, could end up crashing back down again when the full enormity of trading losses in H1 2020 become apparent. People say they're looking beyond terrible 2020 figures, but in my experience with small caps, bad numbers tend to produce a big drop in share price, even if they were expected. That's because it only takes a handful of small sells to smash small cap share prices. The lack of liquidity can be a killer, but that's also what creates the buying opportunities, selectively. It's amazing how quickly sentiment can change for the better, once prices start rising!

A lot of companies are cutting costs at the moment. The trouble is that, reducing staff, capex, and discretionary spending, all has a wider impact. One company's capex is another company's sales. It's anybody's guess what level unemployment is likely to settle at, once furloughed employees are hopefully put back to work. How many (especially smaller) companies won't be able to resume trading? I suspect we might see many cafes/bars/restaurants/retailers remain closed, as the owners may not be able to finance a resumption in trading. Or it could be the last straw for many, who were only just surviving, and see little point in continuing, with increased unaffordable arrears on rent, etc.. Put all that together, and we have the conditions for a more prolonged recession perhaps?

Cloudcall (LON:CALL)

Share price: 74.5p (before market opening)

No. shares: 38.8m

Market cap: £28.9m

(at the time of writing, I hold a long position in this share)

CloudCall (AIM: CALL), a leading cloud-based software business that integrates communications technology into Customer Relationship Management (CRM) platforms, is pleased to announce its full year results for the year ended 31 December 2019.

This share has held up better than many others in the current crisis. That's probably because its revenues are recurring, and the service is cloud based, hence ideally suited for companies that are letting staff work from home.

The piecemeal fundraisings of the past seemed to act as a permanent drag on the share price (will it run out of cash again? Was the question everyone kept asking). This was resolved with a well-timed big bazooka fundraising in Oct 2019, raising £11.3m - unquestionably more than enough to get them to breakeven & profits. As explained in today's announcement, it also has a very flexible cost base, so can dial expenses up or down, to balance expansion and cash burn at whatever level it wants.

Current trading - no surprises here -

"During the first two months of 2020, trading was in-line with expectations, but with the escalation of the coronavirus crisis in March and particularly since countries have been going into lockdown, we've started to see some new sales opportunities postponing decisions. This has been partially offset by a flurry of orders from existing customers preparing for their staff to work from home, but we expect this to be relatively short lived.

Cost-cutting means that cash burn will be £250k per month by May 2020. There's plenty of cash in the bank, so that level of cash burn is not a problem.

My opinion - there's not really a lot of point in me going through the detail of the 2019 results, which look to be in line with expectations.

I think it's safe to say that growth is likely to be impacted in 2020, so this year might produce similar numbers to 2019 maybe? Then hopefully a resumption of growth in 2021.

Overall, I think CALL looks a modestly priced growth company, so am happy to continue holding. There's plenty of cash on the balance sheet, and it seems to be coping fine with the current coronavirus crisis. Its product is well suited to the new world of working from home, being cloud based.

.

D4T4

Share price: 175p (up 14% today, at 12:15)

No. shares: 40.3m

Market cap: £70.5m

D4t4 Solutions Plc (AIM: D4T4, "the Group", "D4t4"), the AIM-listed data solutions provider, provides the following trading update for the year ended 31 March 2020.

Nice clarity here -

Group revenue and adjusted pre-tax profit are expected to be £21.7 million and approximately £5.0 million respectively.

There's a useful one-pager available on Research Tree, which says that revenue is down 14% on prior year, and adj profit down 17%. It ascribes this to the ongoing process of switching from one-off licence fees, to SaaS, which as we know hurts short term profitability in exchange for better quality recurring long-term revenues (up from 30% to 46% of total revenues).

The above update looks to be a considerable miss against previous forecasts of £26.5m revenues, and £6.4m adj profit. Something that's nicely glossed over in today's update! With forecast slashed today, the results statement will be able to say that expectations have been met! Whilst the reality seems to be that it's fallen a long way short of the previous forecast.

New contracts - this sound encouraging -

Despite the current extraordinary circumstances caused by the outbreak of COVID-19, the Group made further significant commercial progress in the final quarter with a number of new contract wins with both new and existing clients. They include three major new contract wins: one with a global telecommunications company headquartered in APAC and two within the banking and financial services sector in the Americas. These have been secured since the update provided on 14 January 2020.

Importantly, its staff are working from home - a big advantage of a services business as opposed to one handling physical goods.

Outlook - is surprisingly good. If companies can still sell services in the current market, then I think that's highly impressive -

... Despite the backdrop, and at the time of writing, we are upbeat about our prospects as we continue to see good levels of sales activity amongst both existing and potential new corporate clients."

Cash position - this sounds rather worrying -

Additionally, D4t4 has modelled and stress-tested forecasts under a range of disruption scenarios and the Board is taking all sensible measures to preserve cash. D4t4 has also agreed the provision of additional liquidity with its bank to support the Group if required.

What I don't quite understand, is why the company might need to increase bank facilities, when it says elsewhere that year end cash rose to £12.7m? Seems odd.

Dividend - is under review, as with many companies at present. The yield is only just over 2%, so divis here are a nice to have, rather than a core reason for buying this share.

My opinion - I can see why the share price has risen 14% today, as this is a surprisingly good update in terms of outlook & current trading.

However, the fly in the ointment is that profit forecast for FY 03/2020 has been considerably reduced today. This is supposedly due to the shift to SaaS, but as MrContrarian points out in his excellent morning snapshot, this was an already known factor. So why have forecasts been sharply reduced for this already-known factor? That really doesn't stack up.

When the numbers are published, it could be a sobering moment, when people see that actually profit has fallen considerably. Today's update puts a terrific PR spin on things, glossing over a negative (profit miss) into a positive (strong current trading).

Adj EPS is now forecast to be 11.2p, giving us a PER of 15.6, which looks about right to me.

Churchill China (LON:CHH)

Share price: 1375p (up 4% today, at 13:06)

No. shares: 10.96m

Market cap: £150.7m

Further to the trading update issued in relation to summary level results and COVID-19 on 24 March 2020, Churchill China plc (AIM: CHH), the manufacturer of innovative performance ceramic products serving hospitality markets worldwide, is pleased to announce its Preliminary Results for the year ended 31 December 2019.

I've just checked, and we didn't seem to cover here the update on 24 March.

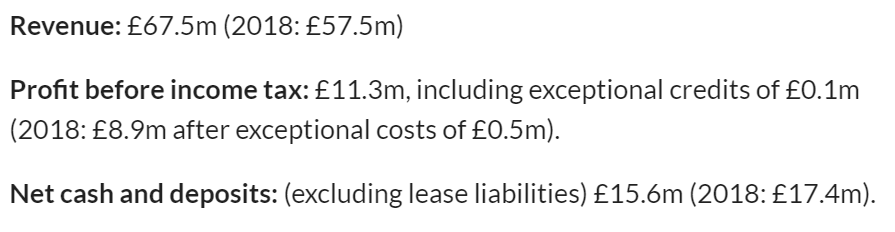

This is what was said on 24 March, for FY 12/2019 results -

[source: RNS dated 20 March 2020]

The reported figures today are the same as the above, so no surprises there.

In terms of EPS, it's up 17% to 81.7p, an impressive result. At 1375p, the PER is 16.8 - not expensive for a company which has demonstrated impressive long-term growth. However, there's little doubt in my mind that the 2019 earnings are likely to be a peak, possibly for several years, who knows? That may not bother you, if you're expecting a V-shaped economic recovery. Personally I don't think it's likely to be that good, and we could have a protracted slowdown. Hence why I'm cautious.

CHH mainly supplies restaurants/cafes with crockery. As we know, that's probably the sector under the most pressure at the moment. Despite Govt schemes, I imagine there's likely to be a huge wave of insolvencies. On the other hand, as Langton Capital (brilliant sector experts) point out, when a bar or restaurant goes bust, who is the landlord likely to let the site to? Answer - another bar or restaurant that will gratefully take over the existing fitted out unit. Hence sector capacity may not decline that much - same sites, different operators. New owners may decide they want new crockery, as the previous operator would probably take the old crockery with them. Therefore, my best guess is that CHH might see a temporary downturn, but then see sales recovering. Who knows? What does the company say today?

Manufacturing operations temporarily shut

... Our exposure to the hospitality industry will undoubtedly impact our performance in the immediate future, but we have implemented appropriate actions to substantially reduce the cash cost of our operations in the short term...

CHH points out that most of its costs are variable, which is a good thing. Victoria (LON:VCP) said something similar in its recent Covid-19 update, and this is something that I think investors should focus on. Operational gearing is working in reverse at the moment, so we want to avoid companies with high fixed costs, as they're going to suffer the worst profit pain from temporary shutdowns. Or at least we need to be realistic about the profit impact of shutdowns, which I think may well surprise many investors on the downside. I get to some pretty horrific numbers when I've tried to estimate the profit impact for retail/hospitality type shares.

Outlook - this is not satisfactory. Companies should by now be giving a range of possible outcomes. They've got that information internally, so it should be shared with the owners of the company -

As a result of the evolving COVID-19 position and consequent lack of forward visibility, no formal guidance will be given on future financial performance at the present time. We intend to reinstate guidance as soon as practicable and, in the meantime, will continue to update investors as appropriate.

My opinion - this is an excellent company, but I feel the recent rebound in valuation has moved risk:reward from attractive, to unattractive.

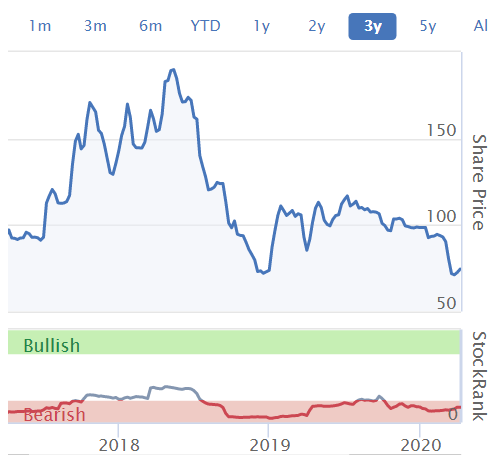

Looking at the chart, the smart money was buying this near the end of March, and is probably selling now to not so smart buyers (no offence to any readers who are buying now!). Why would I want to chase the price any higher, given that there is probably lousy news on profits in the pipeline for 2020, and possibly even 2021? That doesn't make sense to me.

.

Robert Walters (LON:RWA)

Share price: 396p (up 8% today, at 15:01)

No. shares: 76.1m

Market cap: £301.4m

Q1 is the 3 months to 31 Mar 2020. Revenues are down 11%, from this recruitment group. Only partially affected by the coronavirus in this period, so I expect the current figures are worse.

Seamless move to home working for its employees.

Cost reduction measures have reduced costs by 15%, including Director pay cuts of 20% - bravo to them. Recruiters have flexible costs, hence can up or downside according to need. Hence this sector might be worth looking at, possibly? Although the IR35 issue that we've discussed here before, has largely put me off this sector. Although with this share, you do get a wide gheographic spread - e.g. it mentions that Japan is its most profitable market, has proven "extremely resilient".

Cash position - blimey this sounds good, I shall have to look closer -

Strong balance sheet with net cash of £109.8m as at 31 March 2020 (31 March 2019: £59.5m). The Group also has a £60m committed loan facility due for renewal in 2023. The cash position has benefited from a strong focus on cash collection and the ability to defer cash outflows in some countries...

Balance sheet - taking a look at the 31 Dec 2019 balance sheet, it's strong overall, with NTAV of £147.2m.

However, the cash pile is slightly more than completely offset by a corresponding creditor, called deferred income & accruals. Therefore it seems likely that arrangements with customers result in RWA receiving cash up-front to some extent, giving rise to the large cash pile. In other words, it's not as good as it looks.

Note also fairly hefty lease liabilities, for all those (empty at the moment) offices. If staff can work from home, why are they necessary now?

Outlook - bad, but we're not telling you how bad, is the short version! Here's what they say -

... we are expecting the second quarter to be more challenging. The picture across the globe is changing hour to hour and day to day, so it would be imprudent to attempt to give accurate forward guidance on expected full year trading at this stage.

My opinion - I like the wide geographic spread of activities, which helps spread the risk. Also, this is a long-standing operator, with a strong brand name. Do I particularly want to own shares in a staffing company? Not really, but it depends on the valuation. The current crisis is providing us with the opportunity to move up the food chain in terms of quality of investments - i.e. some mid caps are becoming small caps, and decent quality companies are now priced as if they were poor quality. Hence I can see some attraction to this share.

The balance sheet looks strong enough to withstand the crisis without a fundraising, in my opinion.

Overall, I'm not going to chase the current share price any higher, but will add this to my watchlist as something to look at more closely if we see a double dip back down to previous lows.

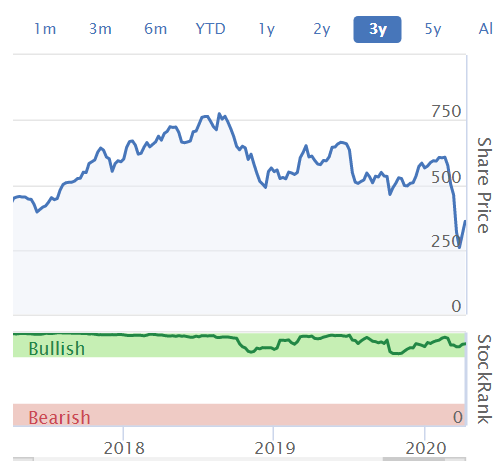

Note how so many share prices look similar at the moment! Panic sell-off, followed by strong rebound -

.

Sorry I didn't get round to looking at On The Beach (LON:OTB) today - maybe tomorrow?

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.