Good morning, it's Paul here.

I'm writing this first bit on Sunday evening, so that you have something to start reading first thing tomorrow, which I know a lot of subscribers like.

Estimated timings - 13:00 official finish time should be achievable today, as I wrote half of it last night!

Today's report is now finished. I'll put any further updates into tomorrow's placeholder.

Covid/macro preamble

As expected, Boris Johnson's address to the nation explained how the Govt expects to gradually, and cautiously start lifting some lockdown restrictions. I can't help feeling that the Govt doesn't really know what it's doing, and the latest catchphrase seems pointless & incoherent: "Stay alert. Control the virus. Save lives". Absolute nonsense. There again, I wouldn't want to be in a position of power, having to make life or death decisions. It feels like we're being governed by a bunch of PR people, who seem more obsessed with "messaging" than with coherent policy. Hopefully I'm wrong about that.

I finally escaped from London (after about 10 weeks), and managed to return home to Bournemouth on Thursday. Not being keen on using public transport right now, I walked from Moorgate to Waterloo, and was really shocked at just how extreme the lockdown is. Everything was shut, apart from a Waitrose I passed.

Here is Queen Victoria Street, in the heart of the City, at about 16:30 on a Thursday, when it would normally be heaving with vehicles, cyclists & pedestrians;

.

I took this video, showing how the heart of the City (Moorgate/London Wall junction) is eerily missing the usual pedestrians & cyclists;

.

How about Waterloo Station during rush hour looking like this?

.

It was quite nice having a train carriage all to myself though. Although how much is this going to cost the taxpayer, running regular train services, but with hardly any paying passengers? Billions.

.

This all got me thinking that re-starting the economy (words I never thought I'd hear or write) is not likely to be easy, or simple.

I've been building up a long position in Marks And Spencer (LON:MKS) recently, because I think it has the following advantages;

- Sound financing & plenty of liquidity (see recent update)

- Stores trading, which sell food, throughout lockdown

- Online food sales on target to launch this autumn via Ocado - likely to be very successful in my view, and a catalyst for share price re-rating maybe?

- Closure of loss-making stores was going well, pre-covid, with c.20% of sales transferring to nearest remaining stores

- Well publicised problems, but most commentators overlook how cash generative the business is

- Much of its competition in clothes & homewares may not survive the recession, esp. Dept Stores (e.g. Debenhams & Beales have gone bust already)

The negatives are well-known, and I think could be overly factored into the share price perhaps? It's a medium-conviction holding for me, so a middling position size in my portfolio, not something I'll go heavily into.

I went on a fact-finding store visit on the recent gloriously sunny Saturday afternoon. Purchasing some groceries at MKS (Castlepoint branch, near Bournemouth) might have subconsciously been a pretext for taking my soft top Jag for a spin! Despite only the food shops (Asda, Sainsbury and M&S) being open, plus possibly a large B&Q too, I was really taken aback by how empty it was, as you can see;

.

This makes me question how many people have an appetite to go shopping again, even once the non-essential shops are allowed to open again? The all-pervasive mood of fear, created by Govt, and wildly inaccurate media scaremongering, could take some time to recede. Maybe some people have got used to staying at home, and just going out to exercise a bit, and buying what they need on the internet? Retail & hospitality could be very difficult to restart, maybe? Travel maybe even more so? Who knows though, sentiment can be fickle, and none of us know for sure what happens next, it's all educated guesswork.

My weekend trip to Castlepoint did however make me very reluctant to buy into any more retail-focused shares. I'll visit again, once shops are allowed to open again, and compare how many more cars & people are venturing out then. It could go either way - there could be pent up demand, or people could be too terrified still to venture out. I honestly have no idea which is more likely, hence why I'm not keen on making any big bets either way.

Retailers - called phase 2, it sounds like they should be able to re-open from 1 June, with details yet to be announced. If it leads to a large spike in covid infections, then restrictions could be re-imposed. We also have to ask whether retailers will actually want to re-open? In many cases, it might be cheaper to keep marginally profitable or loss-making stores closed, because with limited revenues and extra costs, then it might not be economically viable to re-open some sites. If I were still a retail FD, I'd be drawing up a list of the most highly profitable stores, and only re-opening those, at least whilst the wages furlough payments are flowing.

Hospitality sector - called phase 3, and subject to the virus being under control, then parts of the hospitality sector may be allowed to re-open from 1 July. Annoyingly, at the moment it sounds as if this won't apply to restaurants & pubs.

The reopening is contingent on five main factors being met:

NHS capacity,

Falling rate of daily deaths,

Rate of infection below 1,

Sufficient PPE, and

No risk of a second spike overwhelming the NHS.

Business owners will have noted that the reopening date coincides with the end of the furlough scheme.

[Source: Telegraph]

A lot could happen in the next 7 weeks, so none of this is set in stone. If bars and restaurants are not allowed to re-open soon, then it will be vital for the Govt to extend the furlough scheme for that sector, and introduce the mooted rent furlough idea too. The sector employs far too many people for the Govt to allow it to collapse, so I remain fairly confident more Govt support is likely here.

Share prices remain very depressed in the hospitality sector, factoring in the serious risk which the sector faces.

Another key factor is likely to be what experiences other European countries have. They went into Covid-19 earlier than we did, so we'll be able to follow what they're doing.

Airlines - the latest proposals from our Govt seem to be introducing a 2-week quarantine for everyone arriving in the UK. Horses, and stable doors spring to mind. This is likely to kill off air travel recovery for the time being. I look forward to hearing more details, but my finger will no longer be hovering over the buy button for Dart (LON:DTG) - which is the only airline I would consider buying, due to its excellent track record, and strong balance sheet.

Podcast - I enjoyed the latest PIWorld podcast, with Tamzin interviewing Keith Ashworth-Lord. I've not come across him before, but have heard positive reports. This was an excellent podcast, well worth a listen. Keith comes across as honest, down-to-earth, self-deprecating, and thoughtful. This podcast can be found by searching for PIWorld. The video version is here.

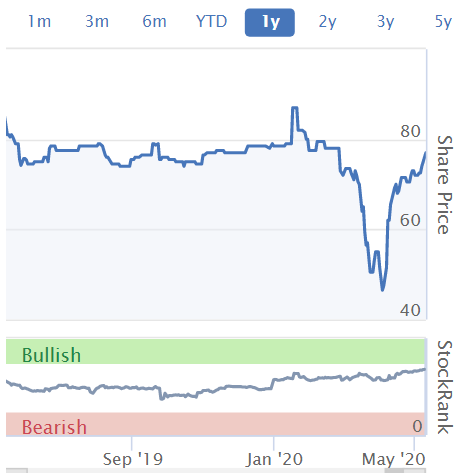

Reach (LON:RCH)

Share price: 76.3p

No. shares: 299.3m

Market cap: £228.4m

This is the newspaper publishing group, formerly called Trinity Mirror. It also has some digital advertising activities. It is on my list of backlogs, which I am hoping to clear this week, now that funerals are out of the way, and I can focus properly on work again.

Reach plc ('the Group') is issuing a trading update for the 4-month period from 30 December 2019 to 26 April 2020 ('the period'), ahead of its 2020 Annual General Meeting today.

This sounds pretty bad to me. I would have preferred a split of the figures pre-covid, and post-covid. Lumping them together doesn't reveal the underlying picture adequately;

Group revenue in the period was down 13.1% with print revenue down 15.8%, while digital revenue grew by 4.7%. Having started the year well, with encouraging digital growth, the COVID-19 crisis began impacting the business from mid-March. Since that time the Group has seen declines in circulation sales, falls in print advertising revenue at a national and local level, reduced printing requirements from third parties, impacts from cancelled events and a reduction in digital yields due to lower advertising demand.

I've looked back at previous trading updates, to try to glean how things were going pre-covid, as follows;

24 Feb 2020 - Final results for 2019 published. Outlook/current trading comments say trading was in line with expectations, but didn't give any figures.

26 Mar 2020 - COVID-19 update - first 12 weeks still in line with expectations, but warns of expected downturn. Again, no figures given.

6 Apr 2020 - another Covid update. Uncertainty. Suspended guidance. Cost cuts, and cash preservation measures taken. 2019 divi cancelled. Pay cuts. Has adequate liquidity.

I can't find any broker research on the company either, so am drawing a bit of a blank here.

All I can really say, is that if revenue is down 13.1% in the 4 month period, of which 3 months were trading normally, then it's obvious that April must have seen revenues down far more than 13.1%. I've done some back of the envelope numbers, and I reckon April might have been down around 34% on prior year revenues. But that's a really crude estimate, due to lack of information. My key assumption is that Jan-Mar might have been down about 5% on LY, but that's a guess. Acquisitions & seasonality could make my estimate wrong.

Digital - page views up strongly in April, to 1.74bn (up 57%)

April trading - oh no, I should have read the whole RNS first, because it actually gives the drop in revenues in April - I've just wasted half an hour trying to estimate it! The actual fall in April revenues is 30.5%. I'm rather chuffed that my rough estimate of -34% was in the right ballpark! Maybe I'm learning from reading a few more chapters of the brilliant Super Forecasting this long weekend!

This sounds nasty;

While in some areas we have recently seen a stabilisation in trends, circulation remains significantly below pre-COVID-19 levels and advertising remains very challenging and uncertain, with regional advertising particularly impacted.

Pension funding - trustees have agreed a 3 month deferral of contributions.

Liquidity - looks OK for the time being;

The Group continues to have access to sufficient liquidity. Net cash surplus as at the 26 April 2020 was 33.2 million reflecting the proactive steps taken to conserve cash. This represents a cash balance of £58.2 million less £25.0 million which has been drawn down from the Group's revolving credit facility of £65 million, which is available until December 2023.

Anyone buying or holding this share, would need to ascertain the bank covenants, and whether they're likely to be breached. That said, the bank facility is relatively small for the size of business, and I can't imagine why the bank would be difficult. Worst case scenario, it might need to do a say 10-20% equity raise, which shouldn't be a problem. Hence I believe shareholders probably don't need to panic at this stage.

Future profitability - if we work out what a 30% drop in annualised revenues would be, it's about £98m in reduced gross profit (assuming the same % margin as 2019), which wipes out about two thirds of profits - from £153m in 2019, down to about £55m. It probably won't be that bad, as sales might start to recover somewhat as 2020 progresses, and more cost-cutting could be done. Still, given the large payments needed for the pension scheme, this would probably mean divis in 2020 are not going to happen, and may not necessarily resume to much in 2021 either.

The company doesn't give any updated guidance, saying the situation is too uncertain, but there's no doubt profits will be sharply reduced this year. I wonder if people stop buying newspapers, will they necessarily resume doing so post-covid??

While revenue performance for the year is expected to be significantly impacted by the COVID-19 crisis, the cost mitigation measures introduced will partially protect profitability levels and cash generation.

Given the continued uncertainty about the severity and length of the crisis, Reach continues to suspend guidance. We came into this crisis with a robust financial position and continue to run an efficient business.

Pension scheme - nothing more is said about this, but it's a big issue, as it's so large. With interest rates now at rock bottom, that causes pension scheme liabilities to increase. Also, it might have taken a hit to the pension scheme assets, from stock market falls. Hence investors really need to carefully asses the costs & risks here.

My opinion - I'm not interested in buying at this stage, because figures for 2020 are likely to be dire, and I'm not convinced that business could necessarily be rebuilt to the previous level. Hence in future, a much higher proportion of the group's cashflows could be consumed by the pension scheme, leaving its dividend paying capacity potentially much lower. That makes this share a lot less attractive than in the recent past. Hence not for me.

.

Elecosoft (LON:ELCO)

Share price: 77p (up 4% today, at 09:45)

No. shares: 82.2m

Market cap: £63.3m

Elecosoft plc (AIM: ELCO), the construction software specialist, is pleased to announce its results for the year ended 31 December 2019.

I have a positive impression of this company, but haven't looked at it since Aug 2019. Therefore, to catch up today, I'll look first at its update on 7 April, then move on to today's update. After all, in theory the share price should only move on new, or revised information. Therefore we need to know what info was already out there, before looking at what has changed, if anything, today.

7 April 2020 Trading Update - summarising;

- Results for 2019 "significantly higher" than 2018 - this had previously been announced on 21 Jan.

- Net cash of £1.1m, improved from last year net debt of £(1.8m)

- Q1 2020 traded well, but expecting disruption from Covid-19

- Moved training & consultancy services online, instead of face-to-face

- Staff moved to home working - dealt with significant increase in demand for training & support services, at lower cost - this sounds positive

- Conserving cash, and passed divi

- No guidance on 2020 performance, due to uncertainty

Overall, that strikes me as a strong update in these difficult times.

.

11 May 2020 Results for FY 12/2019 - brief comments, since these are now historic & times have changed.

Revenue up 14% to £25.4m, of which 57% recurring (good)

Adj EPS up 7.9% to 4.1p - a PER of 18.8 (looks about right to me)

Covid comments - this bit below is concerning. What are they referring to? Customers needing more time to pay, or going bust, perhaps?

We consider that Coronavirus will inevitably place pressure on our cash resources and our finance colleagues will be assessing the potentially beneficial impact of Government actions to provide financial support in those countries in which we have a presence and will also be considering ways to conserve as much as possible of our existing cash resources...

Surely these options should have already been explored, and action taken? It sounds as if the company might be behind the curve.

Dividend - no final divi, as previously announced, so no surprise here.

Balance sheet - not great, although software companies often function fine with negative working capital, because some customers pay up-front. However, I've recently read from another software company that some customers are switching from annual to monthly payments, thus squeezing the cashflow of the software company. This is a risk for many software companies at present.

NAV is £17.9m, less intangibles of £15.6m goodwill, and £7.2m other intangibles, and NTAV is negative, at £(4.9m) - this is not ideal as we go into a recession, but it's not a disaster either. It might require a modest top-up placing if the bank gets jittery, but that would only be under 10% dilution, so not really a serious problem.

Overall then, I can live with this balance sheet, even though I would prefer to see it strengthened to at least NTAV of zero.

Cashflow statement - this is a genuinely cash generative business. Post tax cash generation was £5.3m in 2019, and £4.2m in 2018. After that, it spent £1.2m and £1.0m respectively on capitalised development spending, which looks reasonable to me.

Note that £7.2m was spent on an acquisition in 2018, funded by a new £6.0m bank loan, and £2.1m equity fundraising.

All in all then, the cashflow statement looks clean to me, with no funnies.

My opinion - the company seems to be entering a more uncertain phase, for obvious macro reasons. Management sound cautious about the outlook, and I can see why - despite strong recurring revenues, it looks vulnerable to a fall in licence sales. These were £6.0m in 2019 and £5.5m in 2018. The figure for 2020 could be a lot lower, as many companies are slashing their capex, which would include software purchases. If licence sales say halved in 2020, then that would wipe out most of its profits. Therefore the downside risk is that 2020 could be a really lousy year. People say that the market already knows this, but my experience with small caps, is that when lousy figures are released, it only takes a handful of small investors to panic sell, and the price can easily drop 30%.

Given that uncertain outlook, and profits/cashflow which are inevitably quite geared to licence sales, combined with a valuation that has sprung right back to where it was pre-covid (how on earth does that make any sense?) then I'll pass on this one. It's a smashing company though, and will remain on my watchlist. I just don't find the valuation at all attractive currently, given the significant uncertainty, indeed high likelihood of 2020 results being poor, due to the macro situation. To my mind, the valuation looks too high, given the bigger picture risks.

.

.

Cerillion (LON:CER)

Share price: 288p (up 6% today, at 11:38)

No. shares: 29.5m

Market cap: £85.0m

Cerillion plc, the billing, charging and customer relationship management software solutions provider, today issues its interim results for the six months ended 31 March 2020.

This is another software company that I have a positive impression of. See the SCVR for 25 Nov 2019 here, for my review of its results for FY 09/2019, plus a few notes on my telecon with management, which went well - I came away with a favourable impression of this company. The share price has risen 50% since then, so it's another one which I should have bought, but didn't. Never mind. Graham originally flagged it up here some time previously, as a company he also likes.

Interim results look really good. I won't go into all the detail, but things that stand out are;

- H1 revenue up 46% to £10.2m - mentions 5 major new contracts (previously flagged)

- "Back order book" up 57% to record £24.2m, presumably this reflects the big new contracts, and will be spread over several years I imagine

- Adj pre-tax profit moved from a small loss, to a much improved £1.7m for the half year (I'm happy with the adjustments, which are reasonable)

Net cash up 86% to £4.8m

Dividend - small, but is being increased by 9% to 1.75p - a clear positive signal, as many small caps are passing divis to conserve cash & reflecting the uncertain outlook, not so with Cerillion

Outlook - is strong. Well positioned to deliver full year targets - very rare right now! Big lumpy contracts has worked well for Cerillion right now

Sales pipeline - strikingly large, at £120m (up from £101m LY) - OK a lot of pipeline opportunities fall through, but even so, that's a big pipeline!

Balance sheet - looks good. Although note the unusually high lease liabilities. Does it need all that office space, now work from home is becoming normal?

Cashflow statement - looks fine. Note it capitalises about £0.8m p.a. in development spend, which seems reasonable.

My opinion - this is excellent, my positive view from Nov 2019 is reinforced further, with strong H1 results, and more importantly, positive outlook.

This has all been reflected in a more expensive rating - now at nearly 22 times current year forecast earnings. However, given how well the company is performing, and that it has today confirmed expectations for this year, and the strong order book, I think this valuation is justified. Hence I remain positive, and wish I held this share! Well done to holders.

That's all for today, see you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.