Morning!

If news flow is quiet, I'm happy to take requests for today's report.

Cheers,

Graham

Somebody requested that I do "Rockin all over the world" - not exactly what I had in mind!

Forming a list for today:

- Air Partner (LON:AIR)

- DP Poland (LON:DPP)

- On The Beach (LON:OTB)

- Headlam (LON:HEAD)

- Knights Group (LON:KGH) (from yesterday)

- Belvoir (LON:BLV) (from yesterday)

Finished at 6pm.

Air Partner (LON:AIR)

- Share price: 72.6p (+2%)

- No. of shares: 53.5 million

- Market cap: £39 million

Full year results for year ended 31 January 2020

Many thanks to Tamzin for recording an interview with the CEO at Air Partner. These videos from PIworld are always very professional and high-quality - thanks Tamzin and Tim!

As the name suggests, this is an aviation services group. It does not own any aircraft, it is purely a service provider.

We've covered it plenty of times in the archives, most recently in March. I said "I think the company needs to tighten its belt now, to work its way back towards a more comfortable financial position".

Today's results

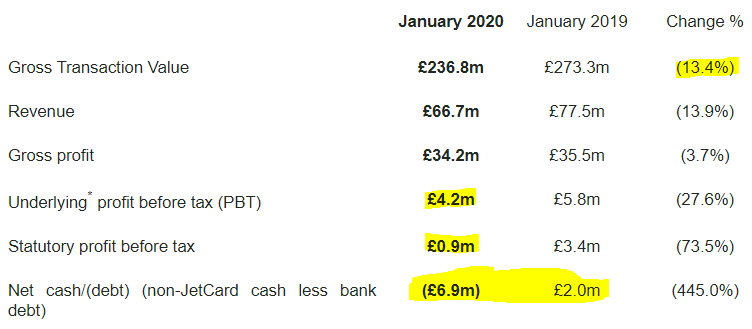

The year to January 2020 was a tough one.

And net cash turned into net debt after a £10 million acquisition:

The results shown above include the input from the acquired business. So the like-for-like (organic) performance is slightly worse, e.g. like-for-like gross profit is down 5.3% (not 3.7%).

The Charter division had a tough year, "impacted by Brexit, late UK election and the lack of a one-off event requiring urgent action".

There is usually some disaster requiring emergency charter services, or a big sporting event like the World Cup, but that didn't happen in this financial year. There was also a reduction in business from a key UK customer.

The goal of the acquisition strategy is to diversify and reduce the group's exposure to the volatility of this Charter division, which is still responsible for most of its gross profits.

Current Trading / Outlook

Disaster certainly struck in the last few months, and the demand for AIR's charter services took off. There has been lots of Covid-related work, e.g. repatriating people (the Evacuation service) and transporting PPE.

Some very positive elements in the outlook statement:

- Strong start to FY 2021 with Q1 delivering unaudited underlying PBT of £6 million. April was the best financial month ever for the company.

- freight activities to remain busy at least for H1 (to the end of July)

- Q2 off to a great start, "strongly ahead of budget in May"

- but visibility after June is "limited", with "significant uncertainty"

Dividend - no dividend, because the company needs to preserve cash. Makes perfect sense.

With visibility so poor, the workforce at AIR (including Directors) have taken a temporary pay cut, until things become more clear.

Their view on the rest of the year is:

Looking ahead to the second half of the year,the Directors expect to see a slowdown in repatriation work and freight charter activity as global supply chains recover. Conversely, Private Jets bookings are expected to increase, as international airways start to re-open, with executives and high net worth individuals wanting to travel in more controlled environments via less busy airports. We have seen some early signs of recovery within Private Jets (as well as Security), but they remain nascent at this stage.

Impairments and other exceptionals

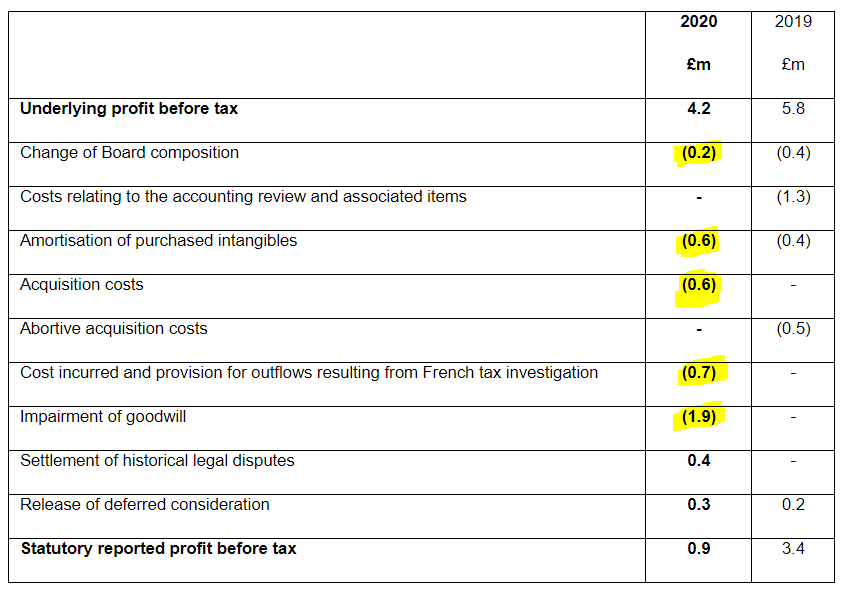

The statutory result for FY 2020 is quite poor, after several "non-underlying items":

Versus an underlying PBT of £4.2 million, these are material items.

It can of course be argued that these are reasonable, e.g. for a successful acquisition, the upfront acquisition costs of £0.6 million are no big deal.

The £1.9 million goodwill impairment struck me as rather large, so I dug into the footnotes.

It turns out that the impairment is at SafeSkys, an acquired company offering "wildlife hazard management" for airports, i.e. preventing bird strikes.

SafeSkys has experienced some delays and its expansion plans have been curbed. Since it's not expected to generate the cash that was expected when it was acquired, it needs to be written down.

Note that there is still £8.6 million in goodwill on the balance sheet. Plenty more scope for writedowns if acquired companies don't live up to expectations.

Indeed, there is £3.6 million of goodwill associated with the Redline acquisition alone, and it sounds like it has failed to live up to performance expectations in the period immediately following its acquisition. If it doesn't bounce back over the next 6-9 months, I'd expect more impairments next year.

My view

There is plenty to like here, in particular the spectacular Q1 performance that is likely to evolve into a terrific H1 result.

Against that, the lack of visibility is important - earnings are riskier than you'll find at other companies.

The heavy exceptional items, both this year and last year, are also of some concern. Not everybody feels the same way about this, but I really do prefer seeing "clean" accounts. Remember that AIR revealed a multi-million pound accounting error in 2018.

The balance sheet could be stronger but is likely to be strengthend by the excellent H1 result, the cancellation of dividends in the short-term and other measures.

On balance, I suspect that the prospects for shareholders are likely to be favourable. The current valuation appears to price in the low visibility and the other negatives I've mentioned.

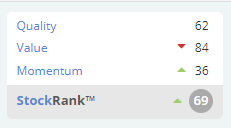

StockRanks also lean towards a bullish outlook:

DP Poland (LON:DPP)

- Share price: 8.5p (unch.)

- No. of shares: 254 million

- Market cap: £22 million

This is Domino's Pizza in Poland. It's of interest to me since I still own a tiny stake in DP Eurasia NV (LON:DPEU), which is active in Russia and Turkey (maybe not worth anything, but we'll see).

DPP has been listed since 2010 and is yet to demonstrate that it can make a profit. This has resulted in highly dilutive fundraisings. It's been a very bad investment for almost everyone, except those who were lucky enough to flip it between 2014 and 2017, or if you bought in at the recent lows.

Results to December 2019 are very much historic at this point, but for what it's worth here they are. They were in line with expectations:

- revenue +16% to 69 million PLN (about £14 million)

- system sales (includes sales by franchisees) +13%

- still loss-making at an EBITDA level. The EBITDA loss is only a little better than last year at £1.8 million.

- net loss of £3.4 million, also a little better than last year.

Operationally, we have a continuation of store growth (from 63 to 69) and of the trend for delivery orders to go online (to 82%from 77%). Most stores are owned and managed by DPP itself, instead of being sub-franchised.

Guidance - none for this year.

Covid-19 - everything at DPP is still open and operational.

Dine-in restaurants are permitted to open in Poland this week (wow!). So the competition from dine-in food is back.

Customers can avail of contactless delivery and carry out.

Nice comments on the Polish economy - some are forecasting it to have the lightest recession in the EU.

Like-for-like system sales are up 3%, despite not doing any TV advertising in 2019. Would otherwise have been up 5%-6%.

Franchisee performance was "mixed" - this is a worry. DPP has hired an Operations Director with experience at McDonald's to help the franchisees.

Food aggregators - working with two aggregators, which it describes as "search engines for food"!

FD's comment on Covid-19: "the Group should derive some benefit from these unfortunate circumstances".

Cash was £3.6 million at year-end 2019. Operating losses, capex, etc. used up most of the funds raised in early 2019.

My view

Reports from DPP (and DPEU) are always very clear and management always seem very straightward and earnest.

The problem is that it just can't make money.

Food inflation and labour inflation are cited as factors. The Polish minimum wage increased by 5% in 2018, then 7% in 2019, then 20% in 2020 (sequentially, not cumulative).

Going concern statement includes a material uncertainty:

We believe that we have enough cash to last us for at least another year, based on the slowly improving outlook that we are seeing today. Should, for any of the above reasons that not prove to be the case, we would explore alternative financing arrangements including new equity, bank borrowing, asset financing and factoring.

...the above scenarios suggest that our going concern assumptions could be incorrect. Auditors have drawn our attention to the material uncertainty with respect to this assumption in their audit report.

That's enough to keep me away from this share - another fundraising is easily possible. The dilution will keep on coming.

The good news is that if the company keeps growing, it might eventually record a positive adjusted EBITDA.

Back-of-the-envelope calculations suggest to me that if revenue grew another 20% and gross margins were flat, it could get to breakeven. The mix between corporate-owned and franchised stores would play a big role in that.

Overall, I have no hesitation in staying away from this one. I don't hate it enough to get the bargepole out - I still think it has potential. But it always looks too early to get involved.

On the Beach (OTB)

- Share price: 256.25p (-0.6%)

- No. of shares: 131 million (pre placing)

- Market cap: £336 million (pre placing)

Covid-19 Trading and Financing Update

Proposed Placing of Ordinary Shares

This holiday booking website has sold 26 million new shares at 257.5p.

This is 19.9% dilution to raise £67 million in gross proceeds.

- New share count: 157 million

- Implied market cap: £403 million

The founder-CEO is putting £1 million in. It's not enough to prevent him from being diluted but it's a nice gesture. Other insiders are putting in for token amounts by comparison.

Let's see what the trading update had to say:

- Board thinks vast majority of booking taken in H1 (six months to March) for H2 (six months to September) will not happen.

- Material exceptional charge of £35 million to reverse revenues from those H1 bookings.

- H2 performance will depend on length of travel restrictions.

Net debt at the end of April was £10 million and will not be affected by the revenue reversals (since customer monies are ringfenced).

The total banking facilities available are now £75 million, including £25 million from the government's Coronavirus Large Business Interruption Loan Scheme, which restricts the payment of dividends.

Placing Rationale

It wanted more funds for a variety of reasons, mostly positive-sounding, e.g. "increase marketing spend" in a recovery, "capitalise on commercial opportunities", "protect its strong market position".

My view

I don't see why it needed funds, though coming from a net debt position I can also understand why it would want some increased flexibility.

Fixed costs for all of FY September 2019 were just £9.7 million - that's why I say it might not have really needed the cash injection.

The bank lender, Lloyds, had agreed to reset covenant tests up to and including June 2021. So the risk of a covenant problem was low (assuming Lloyds remained comfortable).

With all of this extra cash, OTB won't have any worries at all. It has a warchest to spend on marketing, on acquisitions, or to fund losses if the skies remain closed for a long period of time.

There is no doubt in my mind that this is a better-than-average business. Note the very high QualityRank of 94. It's not in the top-tier but it's the type of stock which can fit in a quality-oriented portfolio.

And now is an interesting time to research it. OTB was awfully expensive in 2018/2019 but now offers an interesting proposition to those with a 3-5 year time horizon.

Headlam (HEAD)

- Share price: 305.5p (-0.8%)

- No. of shares: 82 million

- Market cap: £310 million

This floorcovering distributor is slowly re-opening.

...the Company has taken a demand-led and phased approach to reopening its UK operations, providing its customers with limited delivery services and a collection service for pre-ordered products that was initiated during April 2020.

All the "principal distribution centres" are open now, albeit in a limited way.

Over the last week, UK revenue has been running at 29% of budget.

Continental Europe revenue, on the other hand, is now running at 75.5% of budget. France has opened up and I think most European countries are moving on or have already moved on from their most draconian lockdown measures.

Inventories - existing inventories are being used (£136.7 million), and purchases are only being made to match specific orders.

Headroom - £70 million headroom on facilities worth £110 million. Covenant tests with Barclays and HSBC have been revised.

My view - Headlam shares usually look quite cheap - at the end of the day, it's not the most glamorous company out there. If boring is good, this is excellent.

Knights Group (KGH)

- Share price: 377p (-0.8%)

- No. of shares: 82 million

- Market cap: £310 million

Full Year Trading and Dividend Update

This is a large legal and professional services group that has been listed for two years.

It has been very acquisitive and this shows in 40% revenue growth for FY April 2020.

Organic revenue growth is more modest but still encouraging at 10%.

Underlying PBT for the year is £13.5 million (the statutory result will be much lower due to adjustments, I think).

Covid hit trading in April:

...the Group felt the impact of the lockdown in April due to the economic environment and a stalling of activity by other (counterparty) law firms during April which resulted in short term disruption to the Group's ability to transact on behalf of its clients.

Working from home for everybody will continue until September at the earliest - that's a lot of spare rooms to be used!

Instructions are down 20% but importantly there are signs that conditions have "stabilised".

There are benefits from diversification, as KGH sees:

"...higher levels of disputes and employment work mitigating a reduction in corporate transactions and marginally lower levels of activity in certain areas of the Group's real estate work."

Year-end net debt is £16 million, less than 1x underlying EBITDA and only a small premium to underlying PBT. Of no concern, then.

Headroom is £24 million on £40 million in facilities.

Dividend is cancelled. Maybe a 50% cut would have been fairer? Though the yield was quite low anyway.

My view - this is taking a hit from the weaker economy but seems strong enough to weather the storm.

Personally, I don't get the £300 million market cap - the market is clearly very supportive of the acquisition strategy.

Belvoir (BLV)

- Share price: 126p (-3%)

- No. of shares: 35 million

- Market cap: £44 million

This is a property franchise group - it can be compared with Property Franchise (LON:TPFG) (the two companies nearly merged a few years ago).

In yesterday's AGM update, it reported that Q1 (Jan to March) was "strong and in line with management expectations".

At the end of April, Belvoir investigated the standing of the agents in its network. It turned out that 95% of franchisees in the Belvoir network had paid their rent on time as of the end of April - much better than the Board had expected.

April's completed transactions were around a third of usual levels. These were transactions which had already been agreed prior to lockdown.

The overall April performance, including a strong result from remortgages and insurance sales, was "significantly stronger than had been anticipated".

Thanks to the reopening on the housing sector, franchisees are working from their offices again, carrying out viewings, etc:

Feedback to date suggests that the pipeline of agreed house sales has held up well and that there is a pent-up demand from tenants looking to move.

Net debt is £7 million. BLV is still generating cash,

Guidance - I consider this to be a big green flag in the current circumstances, when a company is still able to give guidance. It helps that 61% of gross profit comes from lettings.

Whilst it is still too early to predict how the housing market will be affected during the remainder of the year, the Board is confident of achieving its revised forecasts for 2020.

My view

I owned shares in TPFG until recently, and I like this sector. BLV's apparently strong performance through the crisis confirms for me that this is a very robust business model.

Anglo Asian Mining (AAZ)

- Share price: 131.5p (-6%)

- No. of shares: 114.4 million

- Market cap: £150 million

I know nothing about this company at all. But if you want me to write up something about it, I guess I will!

Anglo Asian Mining PLC ("Anglo Asian" or the "Company"), the AIM listed gold, copper and silver producer focused in Azerbaijan, is pleased to announce an update of the Company's ongoing growth and exploration strategy.

Azerbaijan. I have an idea about where that is on the map. Let's check.

Hmmm. Can't say i know it well. I do know something about Baku - Garry Kasparov was born there (though he identifies as Russian).

Highlights of the updated company strategy from AAZ:

- increase production and mine life at existing discoveries

- seek long-term upside from exploration sites and other concessions

- evaluate other opportunities, both within and outside Azerbaijan

I don't understand much of the terminology so I'll skip that.

The full-year results published earlier this month indicated that gold production would decrease slightly in the current year.

Balance sheet net assets were recorded at $109 million, or $89 million if I deduct intangibles.

That's a lot smaller than the market cap, but the rising price of gold probably makes these numbers defunct? Gold is up 36% in USD over the last year.

Bank borrowings are negligible.

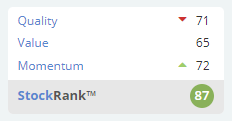

StockRanks give it the thumbs up:

I don't know what to make of it but good luck to all holders.

In politics, Priti Patel has announced a 14-day quarantine period for visitors to the UK from anywhere except the Republic of Ireland. During those 14 days, visitors are allowed to do almost nothing.

The new set of rules will be reviewed every three weeks.

Tourism was already on its knees but is now clearly impossible while this rule is in force, and people will be extra-nervous to book flights.

Business will suffer too, to a lesser extent. Most meetings are happening online now anyway. But work that needs to happen in person is not going to happen.

Interesting times.

I hope you enjoyed today's report.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.