Good morning, it's Paul here. Here is the usual placeholder, for your early comments, whilst I piece together something vaguely sensible to say during the morning.

Estimated timings - I'm on the late shift today, so will be updating this most of the afternoon - 4pm finish. Today's report is now finished.

Got to say, just 50-60 thumbs ups by lunchtime yesterday after me doing 6 hours work, didn't exactly motivate me to do any more work for you in the afternoon, so I went to the beach instead, and listened to some more of a smashing audiobook, the memoirs ("Winning Against the Odds") of 85-year-old Stuart Wheeler, the founder of IG Index.

I won't spoil it, by giving away some of the hilarious anecdotes - such as gambling with Lord Lucan, overturning a red cross ambulance accidentally, getting shot in the face in Egypt, and numerous other wonderful stories, all told in a calm and quiet tone. It's great fun, if you can plough through the rather slow start. Recommended. Everyone should record an autobiography.

Thanks for all the lovely thumbs ups today, I'll have to produce something decent now!! It really does help motivate the writers here, and yes I know I'm a bit of a muppet over this!

It's another strong day for the markets today. Listening to CNBC, hopes seem to be very high over a potential covid-19 vaccine. This is very much at odds with what the UK Govt has said, and what pretty much every expert in the UK has said. I remain very nervous about everything.

There was also some unexpectedly good economic data in the US yesterday. Or rather, not as bad as expected. The stimulus being thrown at the economy by the US & UK Governments is absolutely mind-boggling. Although it's probably going to need waves of more QE to keep it going. Sooner or later that has to cause inflation. Then we're in a gigantic mess. But people have been saying that for 12 years, and yet everything seems to carry on fine. Everything I previously learned about economics, at school & university, doesn't seem to apply any more.

So it's all incredibly confusing. Are we going into a proper recession, or having a short, sharp, V-shaped recession? Who knows? It's totally perplexing. I can understand why investors are feeling more bullish, given that the economy is cranking back into life. But have investors really worked out the scale of the losses companies are going to be reporting this year? I'm not convinced, as there's so little accurate broker research out there. Well done to the brokers that have issued realistic updates, we need many more. Subscribers need to keep in mind that many of the forecasts shown on StockReports here could be old forecasts pre-covid. Therefore great care is needed to check figures for yourself. Dividend yields are largely meaningless at the moment too. Before relying on the yield, do make sure the company has specifically confirmed it will be paying divis.

All I know is that practically every company update tells us that they've slashed capex, and discretionary spending, stopped pay rises, etc. That's the sort of stuff that causes recessions. Hence on balance I'm remaining on the nervous/cautious side.

I'm wondering if I should relax my caution on balance sheets, because the generous Govt loan schemes are enabling even highly geared companies to tread water. We saw yesterday how Revolution Bars (LON:RBG) (I'm long) has secured enough bank facilities under the Govt's CLBILS to secure its future into spring 2021, even if its bars are not allowed to open at all. Whereas hopefully a phased opening later this year is more realistic.

With the Govt backstopping many businesses with loans, then risk:reward is greatly improved for shareholders. We probably don't have to worry about many listed companies going bust. Maybe Begbies Traynor (LON:BEG) and Frp Advisory (LON:FRP) won't get as much work as they anticipate? Who can say?

Judging by the number of young people on Bou'mth beach again yesterday, I think they'll flock back to bars when allowed. When covid started, I was in London, and people had looks of terror on their faces. This has completely changed. People were behaving normally on the beach yesterday, with hardly anyone wearing masks. Mostly leaving a bit of a gap, but there were some big groups totally ignoring the social distancing rules. So I think there's a good chance that younger people might be prepared to return to shops, bars & restaurants, in reasonable numbers. Will it be enough to make them viable businesses again though? Who knows.

To really get the economy moving, the Govt should just give everyone under 30 a gift of £2,000 each, and tell them not to spend it! That's a pretty much guaranteed way to ensure they'll spend the lot within days!

Boohoo (LON:BOO)

I've started reading the shorting report, written by Matt Earl. My initial impression from the executive summary is that it flags up some interesting points from the annual report, but these are things that are already widely known - i.e. that BOO founder's son still holds a minority stake in PLT. There could be a temptation to boost PLT's profits in order to earn a bumper payday if/when his minority stake is bought out.

I feel that PLT has been a stunning success, and it was bought out originally at an extremely low price (was it £5m, from memory?) which short-changed the founder of it. Everyone has done fantastically well out of BOO shares, so I don't really see the problem if this is recognised with a big payout for the people who built this remarkable business. As long as the figures used to value PLT are realistic, and not inflated with overheads being absorbed in other parts of the business. That is a risk.

I knew the people behind BOO in the 1990s, as they were Pilot's (where I was CFO) biggest supplier. They were very shrewd, and ran a successful fashion wholesale business, importing cheap but cheerful clothing. At some point they figured out that they didn't need the retailers any more, and started selling direct to the end customers through a website. They've not looked back, creating a multi-billion valued business.

BOO's profit margins are real. I don't think Matt Earl knows much about the fashion sector, because he questions BOO's high margins versus e.g. Asos. That's not a fair comparison, because Asos is apparently a bit of a shambles internally, and it sells a lot of third-party product. Whereas BOO sources its product directly, thereby gaining the retailer's margin (60%+ before markdown), plus the wholesaler's margin of 20-30%. Put that together, and operating on a test & repeat model (which limits markdown to a far lower level than conventional retailers) and you have a very good business, making high margins. There's nothing suspect about it at all, Matt just doesn't understand the business!

I don't have any position in BOO, but I know the business well, and admire it very much, it's a fantastic business.

His comments on cashflow are fair enough. It's normal to consolidate 100% of a part-owned subsidiary, if the parent company owns over 50%. Then there's an adjustment for the minority interest, on both the balance sheet and P&L. I'm not sure whether you have to include an adjustment on the cashflow statement. He's probably right to flag this as something investors need to adjust for.

Based on my initial scan of the document, I think it flags up some useful points, and potential risk, but there's no smoking gun. Hence why the share price hasn't fallen much. Remember all those shorters have to buy back at some point, so they could get their fingers burned on this one.

BOO response - issued at 9am today, strongly refutes the allegations. It confirms my thoughts above about cashflow being presented in line with accounting standards, fully consolidating PLT, as required. It strongly refutes any under-absorption of overheads in PLT's figures, saying everything is done on an arms length basis. Option to buyout PLT minority stake - valuation will be done by a top 4 accounting firm. Reiterates that the recent £197.7m placing is to be used for M&A opportunities, although doesn't specifically deny that it's purpose might also be to buy out PLT minority stake. ISawItFirst is run by Jalal Kamani (who's a decent guy, I know him) and is a small competitor to BOO in a fragmented market.

I think this response answers the points raised by Matt Earl well, so I don't think he's likely to make much impression on the share price with his report. Crucially, I don't think it undermines the business model of BOO at all, hence shouldn't have any lasting impact in my view. In a way it's a pity the share price hasn't gone into freefall, as I was looking for a buying opportunity in this share.

Here's the running order today:

Walker Greenbank (LON:WGB) Phased return of manufacturing

Hss Hire (LON:HSS) - 2019 results

Sureserve (LON:SUR) - formerly Lakehouse - Interim results

Mears (LON:MER) - Final results

Apologies, I ran out of time & energy, so didn't get round to covering RFX, CTG or TPX.

Walker Greenbank (LON:WGB)

Share price: 38p (up 9% today, at 12:23)

No. shares: 71.0m

Market cap: £27.0m

(I hold a long position, at the time of writing)

Phased Return of Manufacturing

This is a luxury interior furnishings group - wallpaper, fabric, etc. It owns some very well-known brands, and has licensed its back catalogue of designs to, e.g. clothing retailers.

Production is re-starting at its 2 UK factories. This is to meet customer demand. Continuing to attract overseas orders, but no figures given. Accounts for FY 01/2020 and another trading update will be published on 30 June. They've won an award.

Since it doesn't give any indication of how the company is trading, I can't go any further with this. The current broker forecasts are clearly defunct, so should be ignored. WH Ireland and Edison both put out updates on 16 April, but with no forecasts - what's the point of that?!

My opinion - we're completely in the dark here, with no idea how bad the FY 01/2021 figures are likely to be. That's why I've only got a small long position in this share, as the current position is so uncertain. It's likely to survive, so the long-term valuation could end up usefully above the current, bombed out level. Therefore I am happy to hold - although braced for some grim figures later this year. The interims later this year are likely to look awful, as with many companies. So it's a risk that the share price could lurch down again. I wouldn't be surprised if someone bids for WGB at this level, as it would make a nice bolt on acquisition for a larger group.

Maybe lockdown could be a stimulus for people wanting to redecorate their homes? Being stuck indoors all day does make you go slightly round the bend at times, I find. It also means we notice how tatty carpets and curtains are looking. Maybe I should browse WGB's websites, to get some design inspiration?!

Hss Hire (LON:HSS)

Share price: 29p (down c.6% today, at 12:53)

No. shares: 170.2m

Market cap: 49.4m

Here we are at the end of May, and we're still getting results for 2019 - in this case year ended 28 Dec 2019.

25 March 2020 update - which we didn't cover at the time here. Says that most of its UK branches were being closed & staff furloughed. Trading in Jan-late March was in line with expectations, but will have largely ceased trading after that. In talks with banks. Conserving cash.

I'm not keen on the misleading way in which these numbers are presented. EBITDA and operating profit are pretty meaningless at such a highly indebted company. Amazingly, the loss before tax is £(5.8)m, despite adj EBITDA being £63.9m positive! The main culprits are £37.4m depreciation charge, and a huge £22.6m finance charge.

Adjusted profit before tax is £5.8m, which adjusts out a £5.6m amortisation charge (OK), and £6.0m in exceptionals.

Balance sheet - this is where it falls apart. NTAV (after deducting £160.4m intangibles) is negative, at £(81.4)m

There's way too much bank debt. Is that problem? If they can get the Govt to guarantee 80% of it, then no. Otherwise, yes.

Current trading - 9 weeks of April-May revenue is c.40% below normal., with an improving trend. I'm confused by that, as I thought it had closed most of its branches. Hence trading at 60% of normal levels, strikes me as surprisingly good.

Guidance - none, due to uncertainty. More likely that the figures look so bad, they don't want to publish them.

Bank - has headroom of £66.7m, which looks OK. Exploring Govt-backed funding schemes.

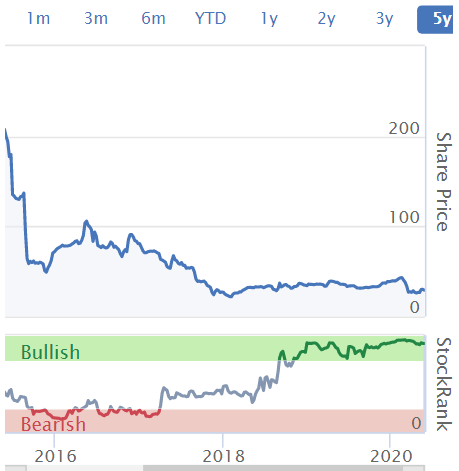

My opinion - the equity looks very high risk, due to balance sheet weakness. I don't see enough upside potential to make me want to take the risk of a possible total loss. At some point HSS will need to strengthen its balance sheet. It was completely irresponsible to float this business when its finances were in such poor shape. Still caveat emptor. I'm amazed anyone touched this at IPO. Those that did were quickly punished by the market for their stupidity. I'm surprised that the StockRank system turned so positive on it from Sept 2018.

.

Sureserve (LON:SUR)

Share price: 45p (up 6% today, at 13:38)

No. shares: 159.1m

Market cap: £71.6m

Sureserve, the compliance and energy services Group, is pleased to announce its interim results for the six month period ended 31 March 2020.

This group used to be called Lakehouse. I vaguely remember meeting management a few years ago, after something had gone wrong. The share looked very cheap, but as you can see below, it's never really recovered from the previous fall.

.

.

The narrative explains what the company is doing to get through the covid outbreak - e.g. furloughing some staff, cutting costs, etc.

Cash - this sounds encouraging;

I would also like to thank Peter Smith, our new Chief Financial Officer, and his team for their excellent work managing our working capital and thereby reducing our debt from £12.9m at the end of March 2019 to £3.5m at March 2020.

Furthermore, at the time of writing, the Group is debt free with a modest net cash balance.

Outlook - sounds OK to me, since the profit warning is understandable in the current circumstances;

We also take comfort that we have a strong order book of £323.7m.

The Group's financial position is now better than it has been for many years and we believe that, with a highly competitive cost basis, we can gain market share as we emerge out of what has been a most difficult time for the UK economy.... whilst our results will fall short of our original expectations for the year, we believe that the second half will show further progress."

It has an H2 bias to profits anyway.

H1 figures are up against last year, but it's only making a small profit margin: £3.4m adj PBT on £109.6m revenues, is only a 3.1% profit margin.

Balance sheet - adequate, but not strong.

NAV is £46.5m, deduct intangibles of £43.8m, and NTAV is a modest £2.7m

The customer base sounds financially stable, being public sector, housing associations, etc. Therefore bad debts may not be a problem.

My opinion - this sector doesn't interest me at all - I don't want to own shares in a low margin contracting business.

However, if you do invest in this sector, then this company looks OK. I'm not sure why it has a stock market listing though?

Mears (LON:MER)

Share price: 169.25p (up c.3% today, at 15:56)

No. shares: 110.5m

Market cap: £187.0m

Mears Group PLC, a leading provider of services to the Housing sector in the UK, announces its audited financial results for the year ended 31 December 2019.

Results for 2019 look OK, nothing special. Adj profit before tax is up 1% to £37.3m, on revenues up 13% - so a reduction in % profit margin.

Interestingly, it reports average daily net debt - that's a far better way of reporting debt than a snapshot on one day (year end), which is very easy to manipulate down. I would like to see all companies report average daily net cash/debt, that should be a mandatory disclosure. It's £114.4m average daily net debt here. The year end figure for net debt is £51.0m.

The accounts seem very complicated, it would take a long time to go through all of this properly, which puts me off a bit. I like to invest in things that are simple to understand.

There's a large pension scheme, with a small accounting surplus.

Outlook is "very unclear".

Covid - some work has been deferred. Furloughed some staff. Bank has offered greater facilities if needed. No divi.

Balance sheet - is weak, with too much debt (as the Chairman admits in his commentary).

NTAV is negative, at £(32.7m)

My opinion - it's too complicated, the outlook unclear, and I don't like the weak balance sheet. So not for me.

That's all I can manage today. Thanks for your support, much appreciated.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.