Good morning, it's Paul here with the SCVR for Weds. Please see the header for trading updates & results that I'll be looking at today.

Today's report is now finished. There's very little small caps news today.

As usual, this is initially a blank post (which we call a placeholder), for you to add your comments from the 7am RNS releases.

Top Tip - if you set a friend/family/your landline as emergency contacts on your mobile, then if an honest person finds your phone when you lose it, they can contact your emergency contacts when not possible to unlock the phone. Struck me as a good idea, so I'm passing it on.

.

Loungers (LON:LGRS)

Share price: 107.5p (pre market open)

No. shares: 102.4m

Market cap: £110.1m

Loungers, the operator of 165 neighbourhood café / bar / restaurants across England and Wales under the Lounge and Cosy Club brands, announces the following update.

- All 165 sites now open

- LFL sales from re-opening (4 July) to now (2 August) slightly negative, at -1.7% - this is really impressive in my view

- Nothing said re costs, profitability, or liquidity

- Fuller guidance to follow in late Sept, with full year results (19 April 2020 year end)

My opinion - this update is light on information, but the LFL sales number is the key one, and that's remarkably good. Given all the distancing restrictions, and lower footfall, to be delivering sales only a whisker below last year, is really outstanding. I see this as strongly bullish for the share price. It's a pity then that it's so illiquid.

There's a very helpful update note on Research Tree, which puts today's news into perspective - namely that LGRS is trading way ahead of industry average data of c.30% minus LFL sales. It benefits from having off-pitch sites, in suburban locations, rather than town centre sites. Also it points out that LGRS sites are outside London, and transport hubs. Therefore its community sites might be a beneficiary from work from home, and benefit from lack of competition.

Overall, very positive. However, the downside risk is that bars/cafes could be forced to close again, as we're seeing in some countries abroad. Therefore I can understand why many investors just want to avoid this sector altogether. My sector expert tells me that Loungers management are the best in the business.

.

.

Lsl Property Services (LON:LSL)

Share price: 209p (up 2.5% today, at 10:53)

No. shares: 102.7m

Market cap: £214.6m

This is a chain of estate agents, surveyors & financial advisers. It's reporting today on H1 2020, being the 6 months to 30 June 2020.

The heading sounds too good to be true, so I'll do some digging to verify this;

LSL reports Underlying Operating Profit 3% ahead of 2019, with strong trading in June and July following resilient performance during the Covid-19 lockdown

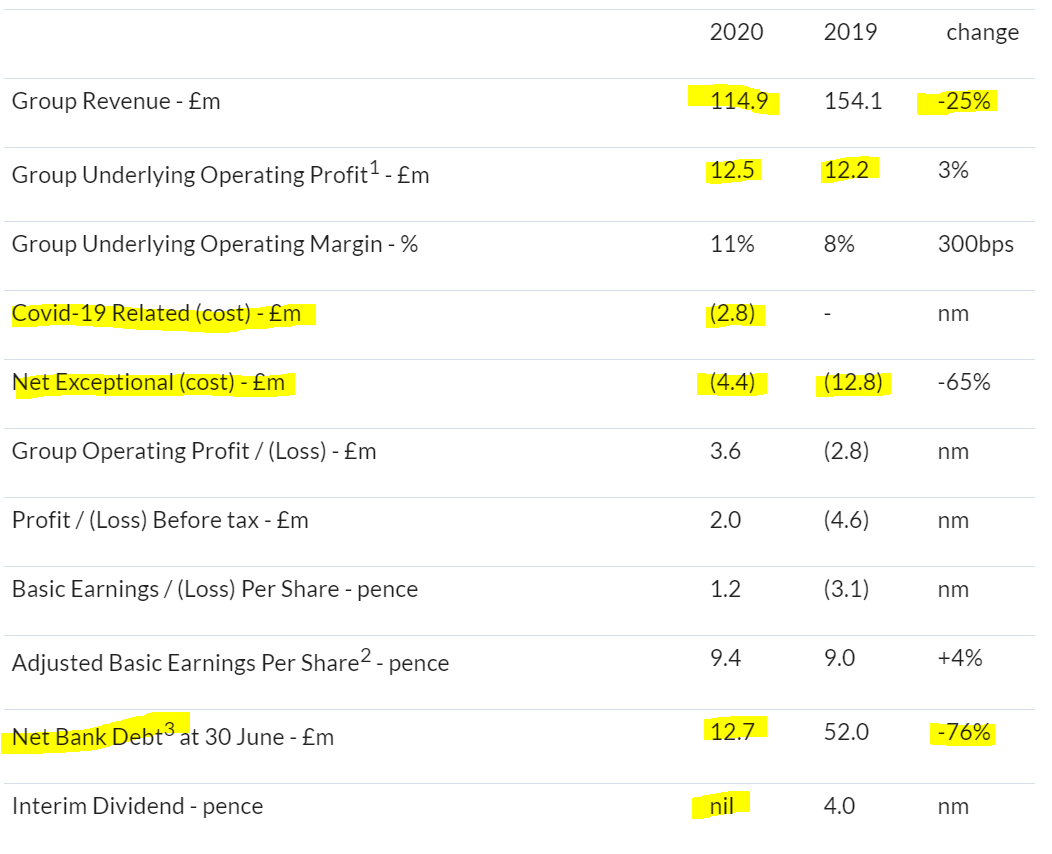

Here is the highlights table, with my comments below;

.

.

How come underlying operating profit is up 3%, if H1 revenues are down -25%? As footnote 1 explains, it's because £13.8m income is included from the furlough scheme, plus a load of other costs are stripped out;

1 Group Underlying Operating Profit is before exceptional costs, Covid-19 related costs, contingent consideration, amortisation of intangible assets, share-based payments and includes £13.8m of amounts receivable pursuant to the Coronavirus Job Retention Scheme and utilised to pay employee salaries for those placed on furlough (as set out in Note 6 of the financial statements). Segment Underlying Operating Profit is stated on the same basis as Group Underlying Operating profit.

Therefore I'm largely taking these H1 figures with a pinch of salt. It's not reflective of how the business would operate normally, hence best disregarded in terms of how we value the business on future performance.

Current trading/outlook - of more importance. More evidence that the Stamp Duty holiday has turbocharged the property market;

Current trading conditions are extremely encouraging, with strong front-end metrics in all three divisions. The introduction by the Government of a Stamp Duty Holiday for properties up to £500,000 is expected to provide further support to the principal markets in which the Group operates.

Further out, the company refuses to give guidance, due to uncertainty over covid. Although the Directorspeak sounds bursting with confidence, so a bit of a mismatch there. I really think companies should be resuming guidance now, it's been too long to opt out of informing investors about the future prospects. There's no reason at all why companies cannot give 3 scenarios, depending on how the future virus develops. Many have adapted to working from home, etc, so even if we have a bad second wave, then companies should be able to tell investors how that would impact their results. It's not right to leave investors completely in the dark, after all they own the business! Edit: I've just found the going concern note, which does give scenario planning details, and saying there would be at least 12 months liquidity under a negative scenario. Good stuff.

We've heard from other property companies recently, that the residential property market is recovering strongly. Although it does take time for the sales pipeline to rebuild, with enquiry to completion taking c.3 months.

Divis - no interim divi this time, but it sounds like they want to return to paying divis in future.

Net Debt - good transparency here. The reported net debt of only £12.7m (down from £52.0m a year earlier) was clearly boosted by tax deferrals. The company discloses just how large this temporary benefit has been;

Net Bank Debt reduced between the end of Q1 and the end of Q2 2020, with careful cash control and cash conservation as well the receipt of Coronavirus Job Retention Scheme payments. The Net Bank Debt position was further reduced by payment deferrals put in place to conserve cash, mainly in relation to tax payments due, with deferrals agreed with HMRC. Adjusting for Covid-19 related payment deferrals, the underlying Net Bank Debt position at 30 June 2020 was approximately £45.6m, with notional adjusted gearing2 at 1.12 X Adjusted EBITDA1, and representing a fall on the equivalent position in 2019.

That's highly material. LSL has therefore deferred £32.9m in mainly tax payments. That's all going to have to be paid in due course, with 31 March 2021 being the very latest to catch up with VAT. Hence when valuing this company, we must use the £45.6m adjusted net debt figure, and not the artificially low £12.7m net debt.

Balance sheet - it's got through the covid crisis, so how do the finances look now? Pretty awful, is my view. This is a weak balance sheet. NAV: £141.9m, but it's stuffed full of intangibles, totalling £188.4m. So NTAV is negative, at £(46.5m).

As business returns to normal, cash will be sucked into trade receivables, and more cash will disappear paying down the bloated trade & other payables, leaving it much more heavily dependent on bank debt.

Therefore, I imagine an equity fundraise is quite a high probability here. That's not necessarily a problem though. With a £215m market cap, and a hole in the balance sheet of about £40-50m by my assessment, that would only be about 20% dilution - not ruinous by any means, and if it makes the balance sheet strong enough to withstand future problems, then it's worth doing.

My opinion - the big question is how to value this share? I think it's fair to ignore 2020 results for valuation purposes, providing they're not horrendously loss-making, which shouldn't be the case here. Maybe we should look at 2019 results instead, and value the share on a moderate multiple of that? Taking 2019 adj EPS of 28p for the full year, put that on a multiple of 10-12, and we get a price target of 280-336p per share. That's usefully above today's price of 209p per share. Hence on this valuation basis, which you may not agree with, this share looks quite good value.

Although I wouldn't be interested myself, because it fails my balance sheet testing.

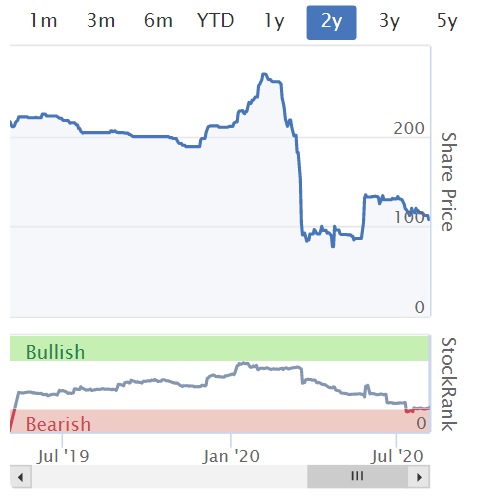

The chart looks encouraging to my untrained eye;

.

.

I'll leave it there for today, as there's very little small cap news of interest today.

I've got to pick up the XJS from the repairers, it's finally got through its MoT, and had the handbrake rebuilt, so I'll be mobile again, hooray!

See you tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.