Good morning, it's Paul here with Friday's SCVR.

Today's report is now finished, due to lack of relevant announcements.

Pubs and restaurants seem to be seeing a surge in demand, thanks to the Eat Out to Help Out Govt discount scheme. Industry data suggests that sales were up 70.9% in the first 3 days of the scheme (food up 114.3%). I decided to mystery shop/dine Wildwood, in Bournemouth, a pre-covid favourite of mine, on Weds earlier this week. I couldn't believe how busy it was - packed downstairs, and a good smattering of groups upstairs too (which is usually empty). I asked the waitress how business has been, she replied, "very busy, every day, since we re-opened on 18 July". Isn't that surprising? She said the Govt scheme has helped, but it was busy already. Bournemouth generally was busy with people at about 6pm, although being a seaside town, and the weather being pleasant, and people not going abroad, then perhaps those factors help. It looks very mixed anyway - central London is still almost deserted, but by the looks of it seaside/holiday towns are doing alright. I'm going to mystery shop Franco Manca for lunch today!

.

Scapa (LON:SCPA)

Share price: 91.6p (before market opens)

No. shares: 186.9m

Market cap: £171.2m

Scapa Group plc is a diversified Healthcare and Industrial company focused on bringing best-in-class innovation, design and manufacturing solutions to its customers...

Scapa's year end is 31 March 2021. Hence Q1 update today covers April-June 2020.

Scapa has delivered FY21 Q1 revenues in the three months to 30 June 2020 well ahead of its COVID-19 scenario plan. Trading in both divisions has also continued to improve into FY21 Q2 to date. Scapa acted swiftly to implement structural costs changes across the business in response to the impact of the COVID-19 pandemic on the reduction in product demand, as well as ensuring variable costs were closely managed to match the new demand levels.

The combination of the better than anticipated business performance in FY21 to date, early cost intervention measures and continued improvement across both divisions mean the Group's outlook on full year trading profit is trending approximately 10% ahead of market expectations.

That's great, but it's a pity the company fails to provide a footnote detailing what market expectations are, which is best practice being followed by some companies and not others. Anything that helps investors quickly understand the picture should be provided. We have to look at lots of these updates between 7-8am, so wasting time having to look up forecasts (if they're available at all) is not helpful.

Never mind, the key point is that the company is trading surprisingly well. I say surprisingly, because the share price has been very weak since the refinancing, which (wrongly) lead me to surmise that the company must be trading badly, hence I ditched my shares a while back when a margin call forced me to cut back on a few things where I had limited conviction, such as this. That probably means I'll miss out on a rise in share price today. Oh well.

Liquidity - sounds OK;

Working capital management remains strong, with adjusted net debt¹ at the end of FY21 Q1 of £18.4m (including net proceeds of £31.6m from the equity placement in May 2020), compared to the FY20 year-end position of £54.4m.

There's an omission here too - we're not told how much the company has benefited from deferral of payroll taxes, VAT, etc. If the company has not taken advantage of such schemes, then it should have said so.

My opinion - good news on trading, but we're not told how much net debt has benefited from stretching creditors such as tax.

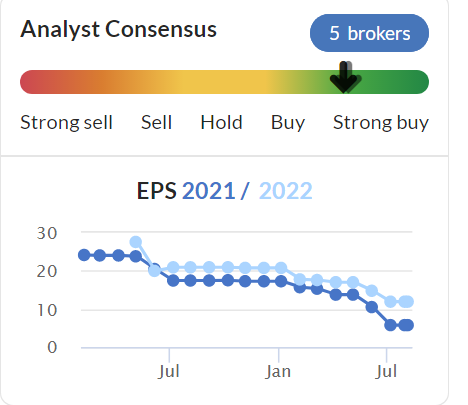

I can't find any recent broker research on it. The broker consensus graph on the StockReport here shows a steep decline in forecast EPS, so it looks as if these figures might have factored in covid, hence we can probably rely on the numbers below. The current year forecast FY 03/2021 (the darker line for colour-challenged readers) is 5.5p EPS, recovering to 11.9p the following year, PERs of 16.7 and 7.9 respectively. We're told today that the company is trading c.10% ahead of the forecast it gave at the time of the fundraising, which I assume brokers will have reflected in their forecasts. So that means maybe 6p earnings this year FY 03/2021? Then some recovery is likely next year, once the impact of covid washes out.

Overall - an encouraging update, and this share looks cheap to me. There is an unresolved legal action underway, with a former major customer, which makes me a bit nervous though.

I see that Stockopedia has saved the comment I added to SCPA's chart back in March. That's a really neat feature! So I could add more comments as time goes on, and build up a nicely annotated chart with major events noted. Although I have to say, I find the chart draw tools very difficult to use, I'll have to read the instructions properly as they're not at all intuitive to me.

.

.

UPDATE: I see that SCPA's share price has shot up superbly today, up 39% to 127p at the time of writing, 11:37. It's perplexing that the share price has previously been so soft, when the company was trading well. Just goes to show I suppose, that the market doesn't always know what's going on. What a pity, as I did some good research on this, and was right about it being cheap, but didn't have the courage of my convictions. Anyway, I hope some readers made a few bob on it.

.

I know that a lot of readers are coining it in on Boohoo (LON:BOO) at the moment, so that's wonderful news. Hopefully readers are recouping the losses from Revolution Bars (LON:RBG) which has been a bit of a disaster. Oh well, some things work, others don't.

.

Purplebricks (LON:PURP)

EDIT: I don't take much notice of Director buys, unless they're a £6-figure sum. One has just popped up in a stock where I've recently taken a small opening position, Purplebricks (LON:PURP) as follows;

Director/PDMR Shareholding

Purplebricks Group plc (AIM: PURP), a leading UK estate agency business, has received notification that Senior Independent Non-Executive Director Simon Downing purchased 500,000 shares of £0.01 pence each at a price of 57.5p per share on 6 August 2020.

That's £287,500 purchase in the open market. Pretty impressive.

Here's Monday's SCVR, where I reviewed its results, and concluded there might be speculative upside on this share.

Just thought I'd flag this, as it's not often we see Director buys in small caps of that size, which might be a positive sign.

There's nothing else of interest to report on today. The sun's out, it's a glorious day, I expect many readers are sitting in your gardens, laptop next to you, hitting the space bar a few times every 10 minutes to make it look like you're working! I'm going to down tools, as there's nothing else to report on. I've got family visiting tomorrow, so need to clean the flat, and pop to M&S for some ready prepared food.

Enjoy the weekend!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.