Good morning, it's Paul here with the SCVR for Friday.

Today I'll be looking at;

Newriver Reit (LON:NRR) - trading update

Quiz (LON:QUIZ) - extension to bank facilities (I hold)

Easyjet (LON:EZJ) - sale & leaseback

Ten Entertainment (LON:TEG) & Hollywood Bowl (LON:BOWL) re-opening tomorrow. (I hold both)

Plus a few other bits & pieces that are outstanding on my notepad.

Today's report is now finished.

.

Newriver Reit (LON:NRR)

Share price: 63p (up c.3% today, at 09:30)

No. shares: 306.1m

Market cap: £192.8m

About NewRiver: NewRiver REIT plc ('NewRiver') is a leading Real Estate Investment Trust specialising in buying, managing and developing essential retail and leisure assets throughout the UK.

Our £1.2 billion portfolio covers 9 million sq ft and comprises 33 community shopping centres, 25 conveniently located retail parks and over 700 community pubs.

We hand-picked our assets to deliberately focus on occupiers providing essential goods and services, and avoid structurally challenged sub-sectors such as department stores, mid-market fashion and casual dining. This focus, combined with our affordable rents and desirable locations, delivers sustainable and growing returns for our shareholders, while our active approach to asset management and inbuilt 2.5 million sq ft development pipeline provide further opportunities to extract value from our portfolio.

I don't cover many property companies here, but we've followed this particular one since it floated in 2016. I remember seeing them at a FinnCap meeting, and liking the value-focused retailers strategy & active management of properties to enhance yields.

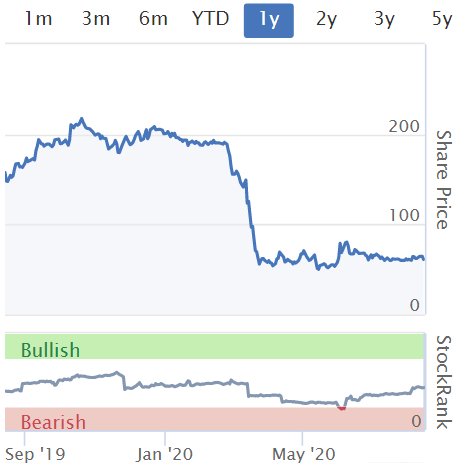

The current share price is at a big discount to last reported (March 2020) EPRA NAV of 201p per share (down 12.3% on LY). The big questions are;

- How much further will NAV decline in future?

- Will that trigger debt covenant issues in 2021 or beyond?

Because I don't have any clear idea on these key issues, I previously sold my holding, and am sitting on the sidelines, until the picture becomes clearer, as mentioned here on 9 July.

Today's update - this comes across positively. Key points, with my comments;

The Company's trading performance in the first quarter ended 30 June 2020 was in-line with our revised expectations as outlined in our Full Year Results on 18 June 2020.

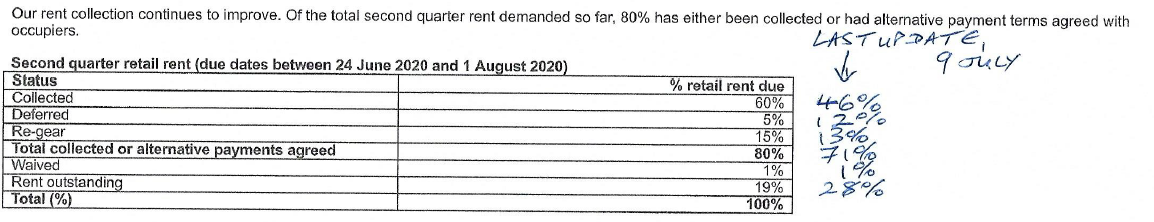

Rent collections - looks encouraging.

June quarter day rents (for c.July-Sept);

To put this into context, rents are arguably voluntary at the moment, since the Govt has frozen evictions until end Sept. NRR's rent collections are well above some other property companies. Why?

Tenant mix - NRR has a focus on value, and essential goods retailers. Many of these are trading normally, hence paying rents normally. It has little exposure to mid-market fashion, and hospitality. Hence a favourable positioning in a time of crisis, as we've seen this year. Hence why NRR is collecting in rents a lot better than the owners of the big, glitzy shopping centres, with sky-high, now unaffordable, rents.

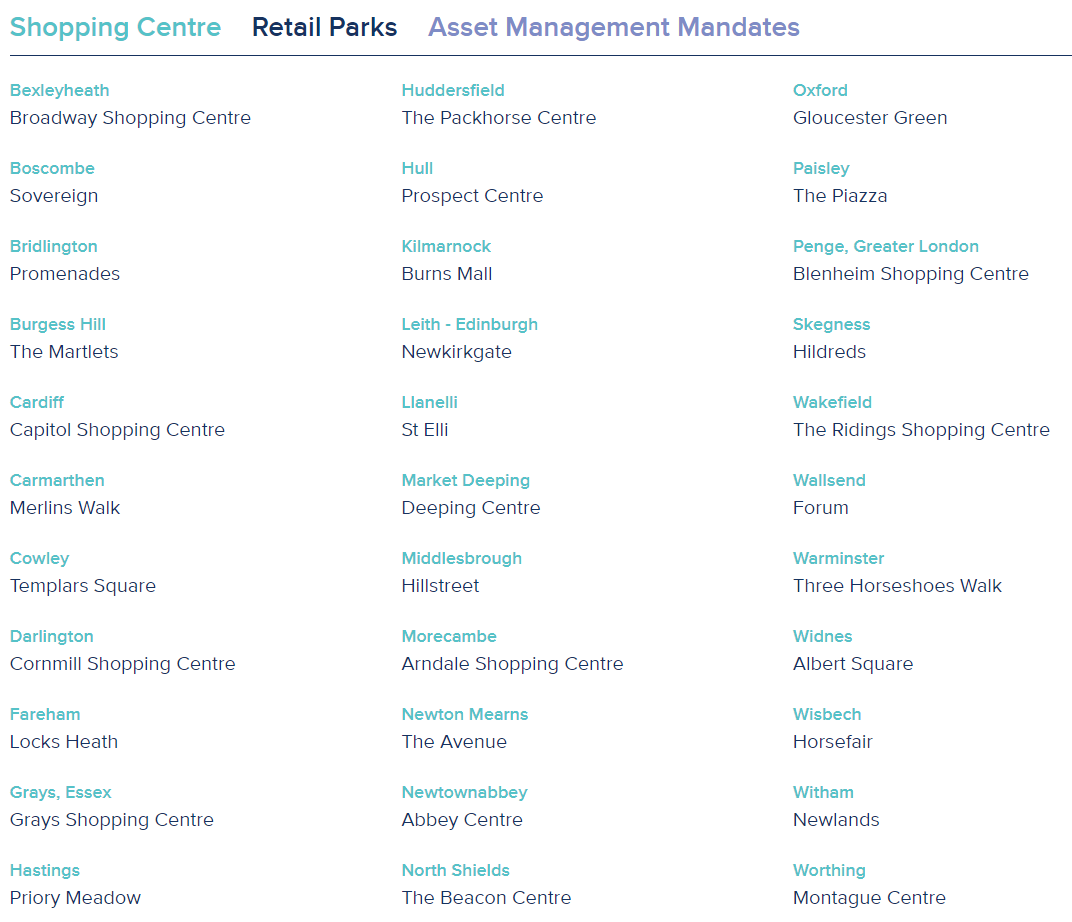

Low rents - NRR owns 33 "community" shopping centres, and 25 retail parks. Looking at the list, these are very definitely not prime sites! But that's arguably a good thing. Rents are dirt cheap, and they have local footfall;

.

.

The Sovereign Centre in Boscombe is walkable from my flat. So I must mystery shop it & report back. Now, where did I put my stab-proof vest? (only joking, it's not quite that bad in Boscombe, providing you avoid the areas where the druggies hang out).

The average retail rent (i.e. excluding the pubs business) is now only £12.48 per sq.ft.. So a 1,000 sq.ft. retail unit (typical for a basic, smallish clothes store, for example) would only have rent of £12.5k p.a. (plus service charge). That's tiny. To benchmark that, in my days as a clothing retailing CFO, from 1993-2002, we would typically pay £75-150k rent for a unit that size, in good town centre locations. Here we are 20 years later, and NRR's rents are a small fraction of that, because its sites are sub-prime in terms of location & footfall.

Given how low its rents already are, then arguably it should be possible to attract tenants for empty units, with incentives, since these rents are very affordable. Hence I see NRR as in a better position than say Hammerson (LON:HMSO) with its mid-market shopping centres, on much higher rents, which are no longer affordable for many tenants. Plus of course we saw what happened to INTU, with its high end, big rents shopping centres.

March quarter day rents (for April-June) - I was worried that tenants might dig in their heels, and refuse to pay these rent arrears, since they were forced to close by Govt policy. Today we are told;

We have also made further progress in collecting rents for the period from 25 March to 1 June, which we last reported on in our Full Year Results. Rent collected for this period has increased to 57%, from the 52% previously reported, and rent outstanding has improved to 18%, from 21%.

Slightly confusing wording there, it would have been better to put in another table, like the one above.

This shows that it's still a struggle to get tenants to pay up for the period when they were closed. Once the eviction ban ends, then NRR could increase the pressure, and ultimately go legal with tenants that still cannot or will not pay. However, that risks tipping tenants into insolvency. We must bear in mind that current conditions are artificially supported, and without further Govt support, many retailers are likely to go bust later this year, and early in 2021. Many will not be able to afford to catch up with overdue rents, VAT, payroll taxes, etc. Therefore I see this as the calm before the storm. However, this is a highly interventionist Govt, so there's potential for a rent furlough scheme, which has been mooted, whereby Govt would share the pain with landlords, 50:50, or 33:33:34 with Govt, landlord, and tenant. Something will need to be done, as I can't see withdrawal of support, leading to mass unemployment, being politically tolerable.

Re-gears - these are where the landlord & tenant agree to cancel the existing lease, and sign a new, longer lease. That helps the landlord, by propping up its capital values, and I imagine would help the tenant by including an initial rent-free period. In that way rent arrears disappear. Although the risk is that it's a face-saving exercise, which might only defer the insolvency of the tenant.

Disposals - this is important in reducing gearing. and LTV (loan to value), if sale prices near book value can be achieved. Progress is being made here, at decent prices. Although the risk is that the best properties are sold, leaving NRR with the dregs, possibly?

In line with our strategy to dispose of £80 million to £100 million of assets this financial year, we have completed, exchanged or are currently under offer on disposals totalling £52.5 million, a significant improvement on our last reported position on 18 June 2020 of £30.3 million. In aggregate these disposals are in-line with March 2020 valuations. In addition, we are in active discussions relating to a number of further disposals, which we are currently targeting for completion in FY21.

.

Liquidity - as reported previously, there are no immediate concerns here. The potential issues might occur in March 2021, if properties are heavily revalued downwards again. The update today sounds good;

The Company currently has £87 million of cash reserves and £45 million of undrawn revolving credit facilities, providing sufficient liquidity of £132 million. In April 2020, we received confirmation from the Bank of England that we are eligible to access £50 million of committed and available funding under the Covid Corporate Finance Facility ('CCFF'). This facility is currently undrawn, but improves our available liquidity position to £182 million.

Retail portfolio - this is the shopping centres listed above, plus 25 retail parks.

93% (by rent value) of tenants are now trading again, with the remainder expected to re-open soon. This must exclude empty units, as occupancy is "stable" at 93.4% - although I would expect empty units to rise once Govt support schemes wind down.

Footfall - has improved, but is still well below what is commercially sustainable for many tenants. Last week footfall was 32% down on 2019. The average spend per customer would need to be considerably higher, to make that low level of footfall work. A key question, is how much footfall has gone for good (online), and how much might come back, especially if covid is beaten with treatments/vaccines in due course? Nobody knows at this stage.

Tenant insolvencies - so far little impact, only 1.2% of annualised income affected by CVAs/administrations. That's likely to rise, as practically every day Drapers Record's email flags up new insolvencies. New Look is apparently limbering up for its second CVA, and Select its third! I don't know if these are NRR tenants or not, I'm just flagging the reality that for many retailers, a CVA or pre-pack admin is the only realistic way to survive. NRR's focus on value retailers should partially shield it, but it won't escape completely.

Hawthorn Leisure - this is NRR's community pubs company. This sounds good, I think;

- 90% of pubs now open

- Performance "solid", with LFL sales down only 13-15% since re-opening on 4 July - well ahead of industry average of -27%

- Benefiting from: suburban locations, low overheads wet-led pubs, 86% of sites were refreshed during lockdown, especially outdoor space (70% have outdoor space - many performing well), active management of portfolio by NRR

- Sold 13 pubs & a convenience store, raising £5.1m, but doesn't say how that compares to book value

- Emphasises alternative use value of pubs, which supports book value

.

My opinion - I've gone through it all in detail, and am not quite as positive as I was on first reading the announcement.

Liberum have kindly provided another excellent update note, available on Research Tree. It lowers forecast NAV to 155p, and points out that the current share price of 61p factors in a 33% fall in property values. That might be excessive, given the value-orientated nature of NRR's assets, but who knows? It depends on whether footfall recovers, and whatever happens with covid.

Overall, I'm leaning towards buying back into this one, on a small scale. I'm not convinced of the alternative use value of NRR's shopping centres though. The risk is that they might have to offer longer & longer rent free periods (and reverse premiums) to attract new tenants, thus hurting book values.

Also I'm worried about the impact of a covid second wave. It seems to be popping up all over the place again, although there doesn't seem to be any evidence that shopping centres are a problem. Food processing plants seem to be a bigger issue.

So, lots of unknowns, but I see today's update as encouraging overall. There's no immediate funding issue, and if the economy continues recovering, then the situation might look more positive in 2021.

As you can see below, the stock market remains distinctly unimpressed so far.

.

.

Quiz (LON:QUIZ)

Share price: 7.0p (up 13% today, at 10:06)

No. shares: 124.2m

Market cap: £8.7m

(I hold)

Extension to banking facilities

This is a special situation, and should be seen as high risk.

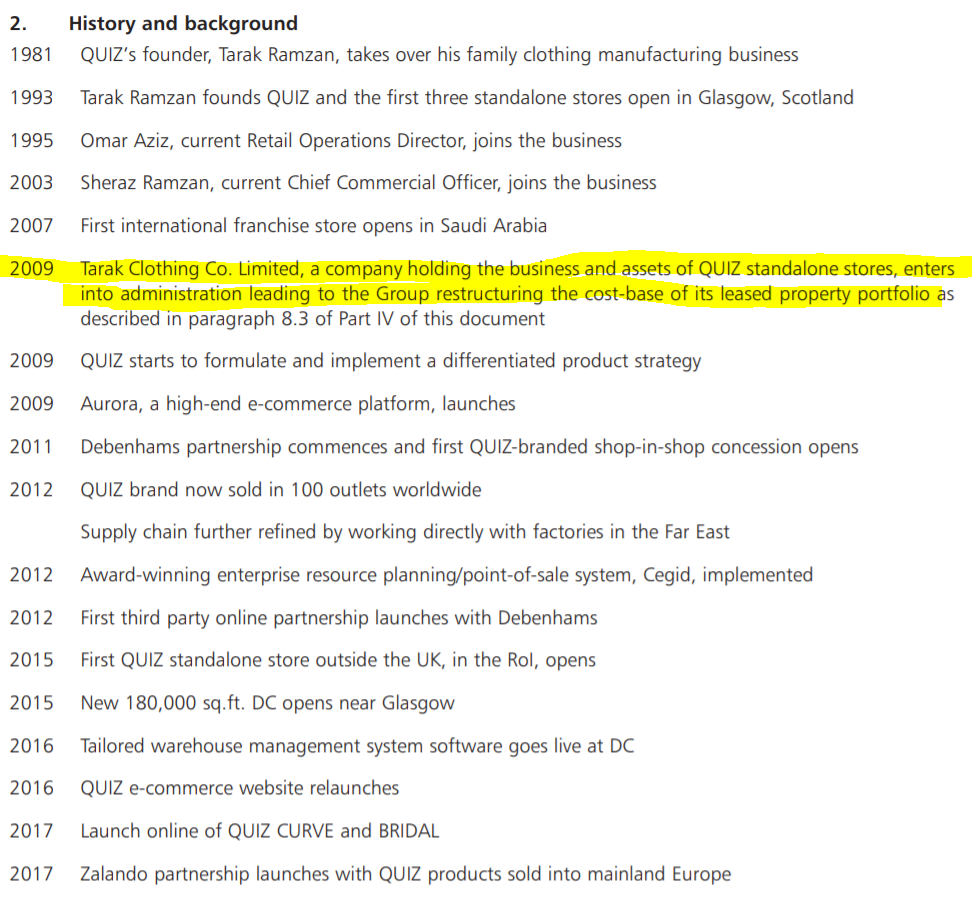

Quiz dismally failed as an IPO, we know all that. It's now a special situation, because the key element is that it has already done a pre-pack administration of its store portfolio. I think the market has not yet grasped the significance of this, namely;

- All lease liabilities are gone, and hence all loss-making shops gone - it can walk away, with no penalty, and at any time it likes, from loss-making sites

- Quiz can cherry-pick the best sites, and do new deals with landlords to continue trading, but only where profitable, and at lower rents

- It can walk away, with no penalty, and at any time it likes, from loss-making sites

- Inventories bought back from the administrator at pence in the pound, hence gross margin will be very high for first few months of resumed trading as this stock is sold (hat tip to my friend Alan for pointing this out)

- Relationships with suppliers trashed, as they've been stuffed with bad debts. Hence new stock intake difficult to fund - may require cash payments up-front

.

Bank facilities - announced today;

- HSBC has extended total borrowing facilities from £1.75m to £3.5m - good news

- Expiry date very short term, at end Oct 2020 - not good news. Clearly the bank wants to monitor this closely, hardly surprising after the company has just done a pre-pack administration

- No covenants - makes sense, as the company is basically re-starting from scratch, in terms of its retail stores (but remember it has an ongoing, significant, online operation too)

- Net cash position at 13 Aug 2020 of £5.7m - looks quite healthy. Combined with bank facilities, that gives headroom of £9.2m, which I think could be enough to re-stock a reduced number of stores, but am guessing there

.

My opinion - even though the market cap is below my usual £10m cut-off point, I'm still reporting on this because I think it could multi-bag, if they pull off a successful recovery from the pre-pack admin. Crucially, they've done it before! As disclosed in the IPO Prospectus, the business had previously gone bust, during the 2008-9 financial crisis & recession. It then went on to be highly successful/profitable, and the founding family banked a ton of money in the 2017 IPO.

Here's the company's history, taken from page 16 of the IPO Admission Document;

.

.

And more detail here, from page 98 of the AIM Admission Document;

.

.

There's no shame in this. Nobody could have expected the financial system to meltdown in 2008, nor policy solutions taking far too long, and wrecking the economy (a lesson learned this time with covid).

In similar (far worse actually, for retailers) situation now, Quiz was quick to realise they couldn't keep paying unaffordable rents on shuttered shops, so they did a pre-pack administration announced on 10 June 2020. This involved;

- Buying back shop fixtures & fittings, plus inventories of clothing, for just £1.3m

- None of the old leases transfer to the new company

- 822 of 915 staff move to the new company under TUPE regulations

- Seeking turnover rents with landlords (New Look is also doing this in its proposed CVA)

In my view, this should be transformational for Quiz, and a much better, more profitable business could emerge, which is precisely what happened after the pre-pack administration done in 2009.

So far, the stock market just hasn't twigged that this is what's happening. Maybe investors think that Quiz has deeper problems, and might end up collapsing completely? But why would it, given that its cash position looks fine?

My opinion - the founding family & related parties still own nearly half the company, and one would hope they feel honour-bound to rebuild shareholder value for outside shareholders (and themselves). Although the current market cap is peanuts compared with the money they withdrew at IPO. So there is a risk that the family might take the company private, on the cheap, but let's hope they have more integrity than that.

This is quite high risk, but in my view, the potential upside here could be considerable, if in say a year's time it has settled down as a smaller retail chain, with all stores on low, or turnover-based rents. That would give a massive competitive advantage.

Plus Quiz has an established online business, operating at a reasonable scale. Its margins are high, so that should give the online business a decent marketing budget to continue attracting customers.

I think the £8.7m mkt cap looks much too low, given the recovery potential from having done a pre-pack administration. But we'll have to wait and see if things do pan out positively, or not. Nobody outside the company really knows what's going on (same with most shares actually), so it is educated guesswork at this stage.

.

Easyjet (LON:EZJ)

570p (down 6.6%) - mkt cap £2.61bn

Travel shares are getting whacked again today, probably on news of France being added to the UK quarantine list, due to rising numbers of covid cases. I think this reinforces how completely uncertain everything is with this sector. Airlines & cruise ship operators are bleeding cash, as so many costs are fixed.

One way to raise cash is to do a sale & leaseback of aircraft, which is what Easyjet has done. Apparently this was previously announced, and today has completed, raising £608m, for 23 aircraft. Some financial details are given.

The reason I mention this, is that I saw a piece on CNBC recently, from an American company which specialises in taking the other side of these transactions (not with Easyjet, but with other airlines). He basically said that airlines are desperate for liquidity, anywhere they can get it, and the sale & leaseback arrangements are extraordinarily lucrative for the lender, at a return on capital as high as 17-18% for the most wobbly airlines.

Therefore, I think investors should celebrate the improved liquidity, but work out the actual cost of these deals. A sale & leaseback of assets can keep a company going, but if done on adverse terms in a crisis, could prove extremely costly in the long run - meaning that profits may never recover to pre-covid levels, even if customer demand does (and who would want to bet on that at the moment?)

To be clear, I'm not suggesting that Easyjet's deals are bad (or good), I don't know. It's just to flag up the risk with airlines doing sale & leaseback deals in order to survive. The terms could be unfavourable. If covid drags on for a long time, we could be looking at a situation where the equity of airlines & cruise ships could be worth little to nothing, as debt ranks ahead of equity remember.

Or it could all straighten itself out next year, if the scientists deliver a vaccine. We don't know.

Key point - sale & leasebacks are not necessarily a good thing, if the borrower is desperate.

.

By the way, if you're wondering where the cruise ships have gone, apparently it's too expensive to keep them in dock, so some of them are bobbing around in Bournemouth Bay, and all along the south coast apparently! With skeleton crews. One entrepreneur locally is even selling boat tours, to visit & circle the dormant cruise ships. Apparently the captain of one cruise ship has made a 6-foot styrofoam or wood hand, which he waves at the tourists as they circle his ship in their smaller boat! (Source; the internet, so it must be true!)

I took this photo last night, from Bournemouth beach. There are 3 cruise ships there, and it's amazing how much they move about in a day - must be anchor drag, hence why they need to be crewed & have engines running, so they can adjust their position to stop them washing up on the beach (which would be quite a sight!). I did wonder if we might get to a point where some desperate owner might do an insurance job?

.

.

Ten Entertainment (LON:TEG)

128.5p (up 3% today, at 13:07) - mkt cap £87.8m

(I hold)

Re-opening of 35 (bowling) centres

Good news here, it's re-opening nearly all of its 10-pin bowling centres tomorrow morning at 10am.

Key points in today's commentary;

- Ample space for social distancing

- Ordering of food & drink on new web platform

- 6,000 people registered for free NHS bowling - clever move, as good PR, but the company could counter criticism by replying: if the NHS staff think it's safe, then who are you to disagree?!

- Sanitising & distancing measures put in place go beyond Govt guidelines (cleaning their balls after every use!), alternate lanes not in use

- Emphasises focus on families & children (30% of visitors are kids)

- Praises extraordinary levels of support from Govt

.

My opinion - I've got modest long positions in Ten Entertainment (LON:TEG) and Hollywood Bowl (LON:BOWL) - because of the size of these sites, I'm more confident that social distancing can be done well, but we'll have to wait and see what happens. I suspect consumer demand could be strong.

.

Larger rival Hollywood Bowl (LON:BOWL) (I hold) hasn't put out any update today, but did say on 31 July that it was expecting to re-open on 15 August also, following a Govt-inspired delay from the original 1 August re-opening date. Its shares are up 8% today, which is nice. I've just checked its website, which confirms that BOWL's centres are also opening tomorrow, 15 August.

That's probably enough for the day, and the week. Thanks for reading & commenting, and have an enjoyable weekend!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.