Good morning, it's Paul here with the SCVR for Thursday.

Today's agenda;

Dunelm (LON:DNLM) - Results 52 weeks to 27 June 2020

Saga (LON:SAGA) (I hold) - Interims

Victoria (LON:VCP) - AGM Statement

Speedy Hire (LON:SDY) - Trading Update

Epwin (LON:EPWN) - Half year results

Estimated timings - I'm running a little late today, got distracted by something, sorry about that. I should be mostly done by 1pm, but might carry on adding sections after that.

Update at 14:21 - SAGA took much longer than expected, so I'm taking a lunch break now, and will resume later this afternoon to finish off the last 2 companies above, and hopefully look at Anpario (LON:ANP) from yesterday too. Thank you for your indulgence.

Update at 15:57 - I'm back, and working on an update to Saga, plus the rest on the list - should be done by 8pm.

Update at 21:02 - today's report is now finally finished!

Dunelm (LON:DNLM)

A quick mention of this homewares retailer, operating from large units in retail parks. Together with a strong online offering, retail parks are the best places to be operating from at the moment - the open spaces lend themselves well to social distancing, and plentiful free parking helps. People seem far more willing to visit these sites than town centres.

Results for the 52 weeks to 27 June 2020 are remarkably good, considering the stores were shut in most of Q4.

EPS is obviously down on LY, but not by much - it reports 42.9p EPS, vs. 49.9p LY. That's astonishingly good in the circumstances.

Online is key too these days, and Dunelm reports a big increase here too, with 27% of total sales online.

Current trading is strong, and management sound confident, but say there is too much uncertainty to be able to give guidance. The final divi is withheld, which seems overly cautious to me, given how well it has traded. Divis are set too resume at the interim stage.

My opinion - a fantastic company, but the shares are so expensive now, that I'm not interested in buying back in (this was one of the shares I bought about a week before the March low, as chronicled here at the time). Even allowing for a recovery to 50p EPS next year, the fwd PER is 28 times. If it out-performs against forecast by say 20%, to achieve 60p EPS next year, then the PER would still be nearly 24 times, which is just too much.

For a retail park homewares company, my pick (on valuation grounds, and strong current trading, and super-strong balance sheet) is Scs (LON:SCS) (I hold). I can buy that on a PER of about 10, so why would I want to buy DNLM on a PER of 28? OK, it's a better business than ScS, but not by that much! Plus ScS should pay much larger divis.

Interestingly, despite publishing remarkably good figures, Dunelm shares have gone down today by 3%, to 1420p, which tells me that the share price is up with, or ahead of, where it should be. Great business though, and it goes on the list of companies that have proven they can sail through a major crisis unscathed.

As you can see, it's had a big re-rating in the last 3 years, which again makes me feel that the price is up with or ahead of reality now.

.

.

Saga (LON:SAGA)

Share price: 15.4p (down 4%, at 11:15)

No. shares: 1,122.0m

Market cap: £172.8m

(I hold)

This well-known brand for the over-50s (that includes me, arrrgghh!! I'm still 25 in my head!) sells motor/home insurance, and has a travel division (tours, and cruise ships).

This £150m equity fundraising announced formally today, was pre-announced on 1 Sept, which I covered here. To summarise that announcement, the former CEO, Sir Roger De Haan is investing £100m as the bulk of a fresh equity raise totalling £150m. Amazingly, he has put in just over £60m of that £100m fresh equity at a premium share price of 27p - highly significant in my view, as a strong indication of his confidence in the company. Sir Roger is returning as the Non-Exec chairman, to oversee the turnaround. This has given me the confidence to buy some shares in the open market after digesting the previous announcement.

Another factor I very much like, is that Saga said it turned away a possible bid at 33p per share - double the current price. If the Chairman thinks it's worth 27p+, and backs that with over £60m, and a bidder offered 33p, then that's telling us very clearly that the share is too cheap at the current price of just over 15p. That's why I've been buying recently. It's now a medium-large holding in my personal portfolio, which I'm disclosing because it might mean I have unconscious bias. It's easy to accidentally gloss over the negatives, if you've decided the potential upside outweighs the negatives. So just to be clear, Saga is troubled, the shares have been a terrible performer, and it has far too much debt. Exposure to the travel sector is clearly another major negative at the moment, with the fixed costs of its cruise ships being a cash drain until cruising can resume in April 2021 hopefully. Over 65% of customers have kept their bookings, so demand is clearly there. When it's safe to cruise again, I reckon these ships will be mobbed, and margins likely to be very good. I see Saga as a nice way to profit from that pent-up demand, without the huge risks of the big cruise operators, that are on (expensive) debt-fuelled life support.

Although Saga's high debt is a worry, £150m of fresh equity considerably de-risks it. The turnaround potential here looks exciting - Saga has a very successful insurance business (mostly motor and home), plus a travel division (including a small cruise ships operation). Obviously that's struggling, but I see this as a nice way to play the (hopefully) covid recovery in 2021. The combination of a highly profitable insurance business, and a travel business that should recover in due course, looks enticing. This could be a 2-5 bagger if the turnaround works, I reckon. The brand has considerable untapped potential, and is very valuable, in my opinion. If it can become a trusted one stop shop for the over-50s, then all sorts of new products could be introduced.

Share consolidation - one new share will replace 15 existing shares, a cosmetic change which makes the shares look less mickey mouse at just 15p currently. So the new share price will be about 225p (effective from 12 October), but we'll have 1/15th of the number of shares, therefore the market cap and investor percentages of the total are unchanged.

Bank support - as if often the case, the equity fundraising is accompanied by improved banking arrangements;

Conditional on the successful completion of the Capital Raising, the Company has agreed with lending banks to extend the maturity of the £70 million term loan by a year to May 2023 and has also agreed certain covenant amendments that provide additional financial flexibility

... On a proforma basis post completion of the capital raise, the Group will have a strong financial position with significant available liquidity, with approximately £60m of available cash resources, together with £100m of available undrawn RCF that is available through to May 2023.

That looks a comfortable position for the time being, so I don't have any solvency concerns about Saga for now.

There's loads more detail in the full announcement, but I've covered the main points above, so see the RNS for more information.

.

Interim results - are in line with expectations. I don't intend to dwell on these numbers, as this share is all about the turnaround under new management. Obviously covid has had a big impact, which makes the figures unrepresentative of what future performance is likely to be.

There is a video webcast of the results available here. You only have to register via email, then confirm on the email, and login using your email address to watch it. I shall have a gander at this after lunch, and read the rest of the RNSs too.

A few key numbers;

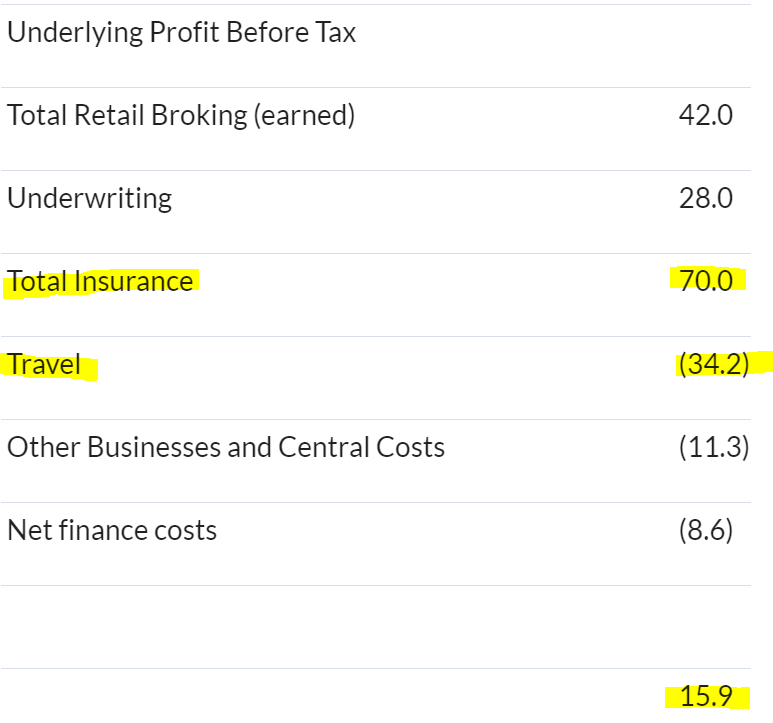

Underlying H1 profit of £15.9m, down 70% on LY

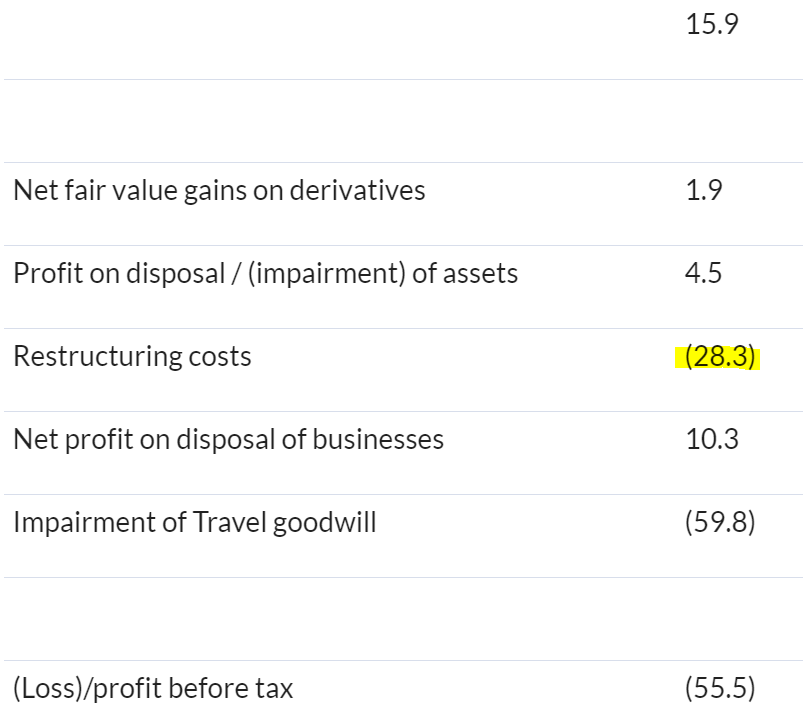

Statutory loss of £(55.5m), so a big difference from the underlying profit. £60m goodwill write-off makes up the bulk of the difference, which is fine I'm not bothered about goodwill, as I ignore it anyway.

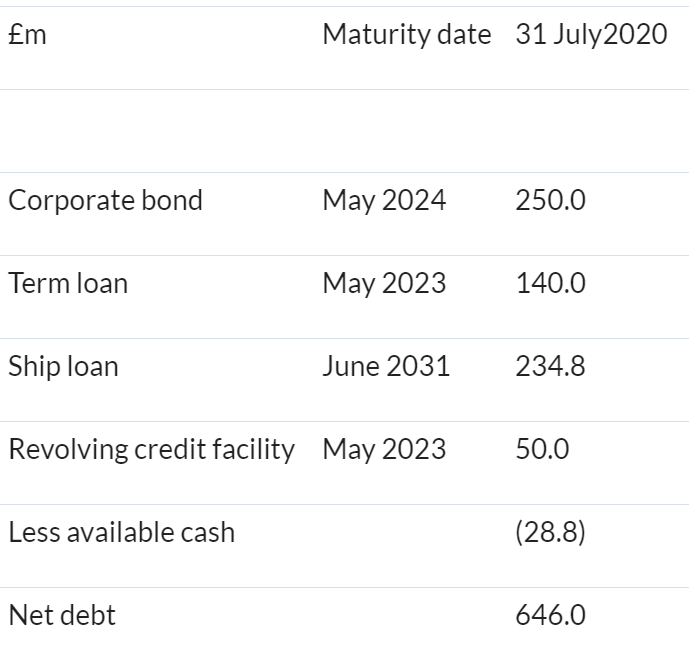

Net debt (adjusted) of £410.7m, not including the debt funding of its cruise ships. Clearly it is over-indebted, hence the equity fundraising being done.

Travel division is expected to burn cash of £6-8m per month in H2. That's an important disclosure, and I see that as a manageable level of losses for now. Remember the insurance division should generate cash, to fund or part-fund travel losses.

There's a nice table here, giving the breakdown of the £15.9m underlying profit, which demonstrates that the profitable insurance division is nicely supporting the losses in travel. It doesn't take a genius to work out that when travel returns to profitability, this should be a very strongly profitable group. Remember these are only half-year numbers too;

.

.

What I like about this, is that investors don't have to worry about Saga going bust. Whereas if we invest in a pure play cruise line, or airlines, etc, then insolvency is a serious threat. Plus with airlines, the lucrative business travel market might have been permanently damaged, because people are now working around long haul business trips, using Zoom, Teams, etc. instead.

Where adjustments to profit are large, as in this case, I like to check what they are, and consider how reasonable they are. Generally speaking I'm happy with adjustments which strip out genuine one-offs, in order to show the underlying performance of the business. If you prefer to value the business on the statutory numbers, then that's your prerogative. We're presented with both figures and the breakdown of it, so everyone should be happy.

.

.

Of the above, I'm happy with everything, although have highlighted the very large restructuring costs. There can be a temptation for excessive provisions to be made, and then benefit future profits as they are released. That's a general point, I'm not saying Saga has done that. It's a generic risk though, hence it's always sensible to ask the company what these costs are, as £28.3m is a lot, and that's cash going out of the door, I imagine.

Total debt is a bit scary, but has long maturities, so shouldn't be a problem to refinance, and reduce from cashflows, once the travel business is operating again (in my opinion). Note that bonds are an important part of the financing. It could be worth a look at the bonds as a potential, safer investment, if you don't fancy the higher risk equity;

.

.

Pension scheme - is in a small accounting surplus. Triennial valuation in progress, so the actuarial valuation could result in recovery payments, I haven't looked into this in any detail yet.

Going concern note - interesting reading. There's a "material uncertainty" conclusion, but only because the fundraising hasn't completed yet. Therefore barring some unexpected calamity with the fundraising (highly unlikely as the newswire is saying that it's a done deal - the company should update us later today), this material uncertainty would disappear. It's fine then overall, I don't have any concerns over solvency for the next couple of years.

Balance sheet - is quite complicated, given that both insurance and travel companies have lots of debits & credits all over the place. I like to keep it simple - NTAV is negative, at £(218.6m) - clearly a weak balance sheet, as everyone (including the company) acknowledges. The equity raise will boost NTAV by £140m (after insanely high £10m of fees for the suits - daylight robbery!), taking pro forma NTAV to a less poor £(78.6m). Overall, I think the equity fundraising makes this share investable now, whereas I wouldn't have touched it otherwise.

My opinion - I've covered this in a fair bit of detail, because I think it could potentially be a very good turnaround from here. This is a fundamentally very good business, with a very valuable brand. If new management can sort it out, with the founder's son now a major shareholder & the new Chairman, then I see this possibly doubling or more from the current level.

The downside risks are covered above, but personally I don't think it's anywhere near as risky as the market is currently assuming with such a low market cap. Covid is not likely to last forever, and with probable vaccines & continued improvements in testing (which could see every passenger being screened before embarking), then I think it's reasonable to believe that the cruise & holidays businesses could begin recovering in 2021. That's not guaranteed though, hence why the shares are low.

The equity fundraising shores up the balance sheet for now, so personally, I see risk:reward here as potentially good - i.e. more upside than downside, hence why I've bought the shares after the fundraising was announced earlier this month.

UPDATE at 15:58 - Results of Conditional Placing

The deal has gone through as expected, although the unexpected (at least by me) bit is the price - it's been done at just 12p, a 20% discount. Why?! This is ludicrous, since 2/3rds of the £150m fundraising is being bankrolled by the incoming Chairman (son of the founder, and a former CEO). So only £50m was needed from external investors, which should have been a quick & easy fundraise, at a premium even (since Sir Roger is paying 27p for £60.5m of his new shares).

I think the advisers have done a shockingly bad job here, and they're taking £10m in fees as well, which is 20% of the money not pledged by Sir Roger. This also reflects very badly on SAGA's CEO & CFO, who've been fleeced by the suits I'm afraid, ultimately costing shareholders money.

I know it's a lot of time & effort to produce a prospectus (out tomorrow morning), but £10m fees, really?!

This doesn't really affect existing shareholders, because the Record Date is close of play last night, so anyone holding then is eligible for Open Offer shares at 12p. That applies to spread bets too, which mirror the underlying market position. Although since the announcement of the 12p placing/open offer, the share price has actually firmed up a little, and is about 15.4p at the time of writing, so anyone who did buy today can sell at around breakeven now, if they want to. So overall, no harm done.

Although on reflection, I should have more heavily emphasised that the price of the deal wasn't firmly set. Apologies for that. I did point out here on 1 Sept that the fundraising price was to be "15p or less", but should have emphasised that today. It didn't occur to me that the company & its advisers would offer a discount on the fundraising, when they clearly didn't need to. Anyway, there we go.

Open Offer - is 5 new shares for every 9 existing shares, priced at 12p. Maybe they discounted the deal in order to motivate people to take up the open offer?

.

Victoria (LON:VCP)

Share price: 327p (down <1% at 13:29)

No. shares: 125.4m

Market cap: £410.1m

AGM Statement (trading update)

Victoria PLC (LSE: VCP) the international designers, manufacturers and distributors of innovative flooring, is pleased to announce the following trading statement ahead of its AGM to be held later today.

Trading is going well;

Trading has continued to be resilient since it last updated the market in July and demand has recovered in all its principal markets. This is reflected in the Board's view that consumers are prioritising spending on improving and refreshing their homes following the lockdown. The Group continues to carefully manage expenses and cash flow to ensure it maintains its strong balance sheet given the current economic conditions.

No figures are given, but the above is encouraging. I like the whole area of home improvements, as a good & resilient place to invest. Being stuck up at home, and with plenty of homeowners benefiting from low mortgage rates, and surplus cash from not going abroad, not commuting, etc, it makes sense that people are revamping their homes. I think that also provides an important psychological boost, in improving well-being, in what has been a harrowing year for all of us. My parents generation used to talk about where they were when President Kennedy was shot. Their parents swapped war stories. For us, I think covid & lockdown could be the big topic for discussion for years to come. People & businesses have proven remarkably adaptable, and generally I think we have pulled together. Massive Govt support when needed is also a strong indication for potential future problems also being fixable, in my view. So strangely, I actually have less anxiety about the future now, having been through (or rather, still in) covid.

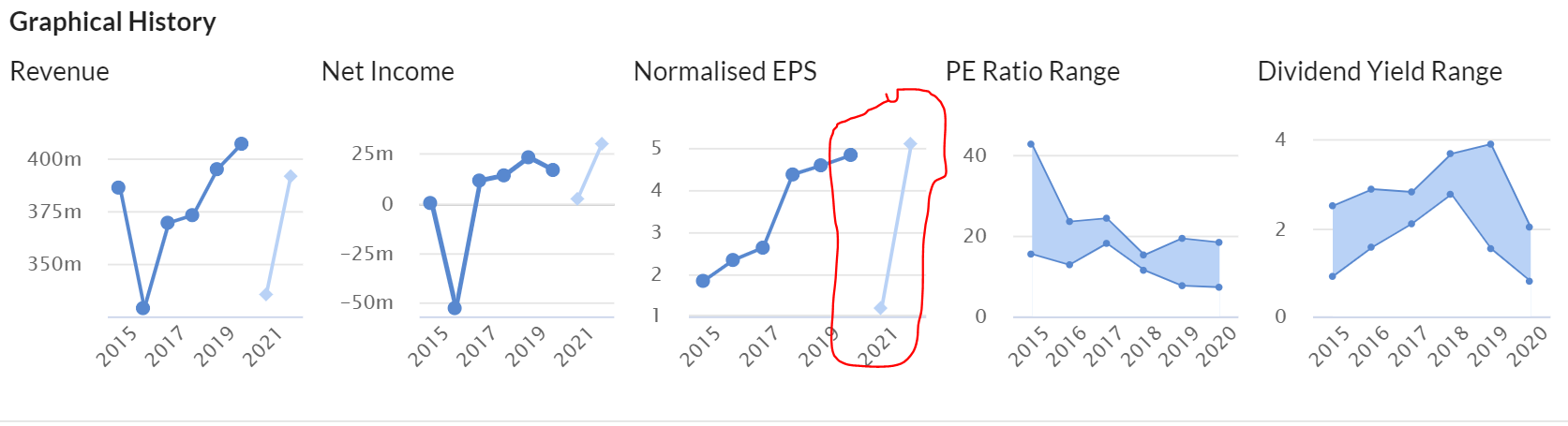

Victoria has a end March 2021 year end. It's a pity today's update doesn't give us any guidance on how the company is performing versus market expectations. As you can see, forecasts have come down a lot, so it looks like they have been adjusted for covid impact, enough, or too much, we don't know.

.

.

With businesses generally recovering, I'm increasingly coming round to the view that we should be valuing shares on normalised earnings in future years, rather than current year forecasts. In this case, looking at the above graph, if I were considering making a long-term investment in Victoria, then I'd base it on the company probably getting back to 50p EPS at some stage in the next year or two. Hence on that basis, the PER looks quite low, at 6.5

However VCP carries a heavy debt load, although this is nice secure debt, in bonds with medium maturity, and no covenants. Hence no bank manager whims to worry about there. Hence I'm not worried about solvency, but am just pointing out that the net debt needs to be taken into account in valuation.

When last reported net debt was £365.9m - that's a lot, and not far behind the market cap of £410m - hence why the PER is low. Debt of that size is expensive too, costing c.£25m last year in interest, or about a quarter of operating cashflow.

My opinion - this is a very cash generative group, and with trading recovering, I'm more inclined to have a dabble here than previously. Debt is high, but it's secure - being bonds - therefore before maturity, the company should be able to build up cash for repayment of at least some of it, but in practice would probably refinance the debt in due course. The only worry is if credit conditions are bad (e.g. another credit crunch) when the bonds need to be refinanced. Overall, I'm not too worried about this.

Overall, I think it looks potentially interesting.

.

Lunchtime now, I'll be back later this afternoon to look at 3 more companies on the list, EPWN, SDY, and ANP.

Epwin (LON:EPWN)

Share price: 75p (down <1% at market close)

No. shares: 142.9m

Market cap: £107.2m

Resilient performance ahead of earlier expectations; optimistic for prospects in H2

Epwin Group Plc (AIM: EPWN) ("Epwin" or the "Group"), the leading manufacturer of low maintenance building products, supplying the Repair, Maintenance and Improvement ("RMI"), new build and social housing sectors, announces its half year results for the six months to 30 June 2020.

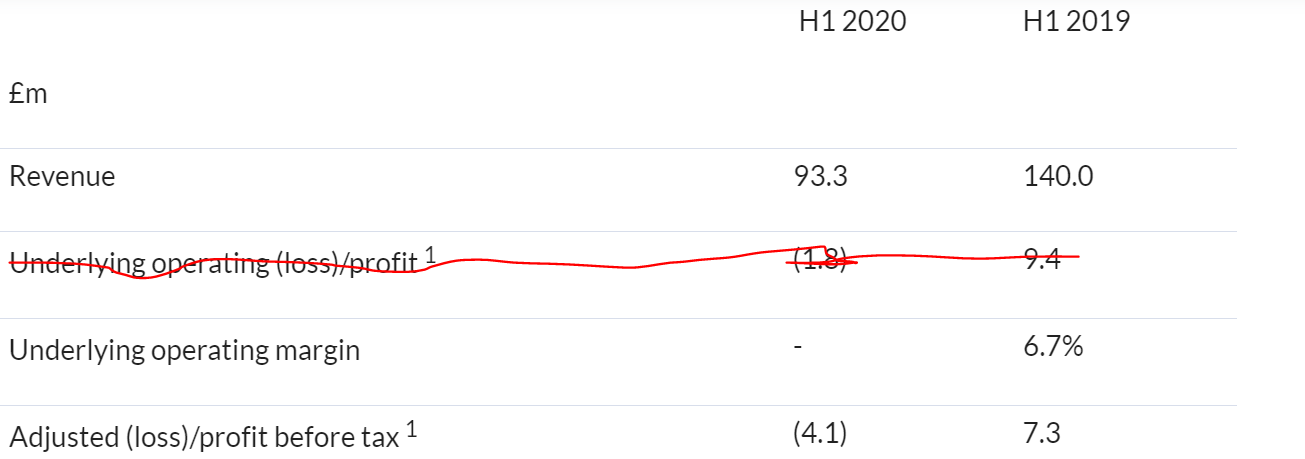

Epwin has taken a hard knock from covid, as you can see below. I've crossed out operating profit, because since IFRS 16 has messed up company accounts, it's now largely meaningless, in my opinion - because some of the rental costs for properties now (wrongly I feel) have to be included further down the P&L, within finance costs (or shown as a separate line in this case, on the P&L, which is a good way of presenting it)

.

.

I'm not sure that's a "resilient performance" as trumpeted in the RNS summary above. Revenues are down 33%, and it's swung from a healthy profit, into a loss. Is that resilient? Not really, in my view, but that's subjective. I'd say Dunelm's performance is resilient (as mentioned above - profits taking a small dip due to covid.

It's been a bad, but not disastrous half year, due to covid. Fair enough, let's move on.

Current trading - positive commentary, but July & August 2020 are only marginally up, at 2-3% LFL. Not really any sign of pent-up demand there. One division is up more, but that therefore means everything else must be down more than the 2-3% improvement on LY revenues.

Outlook - the key bit says;

As previously stated, the impact of COVID-19 will inevitably have a material impact on trading for the current year as a whole, however, at this stage the effect is anticipated to be less than the initially expected, with the Board expecting significantly improved performance in H2.

That's OK I suppose, but I'm getting the feeling that this announcement has been over-PR'd.

H1 was pretty awful, so I would expect a significant improvement in H2, because the economy has opened back up again.

Divis - suspended for now, but positive noises made about resuming in future.

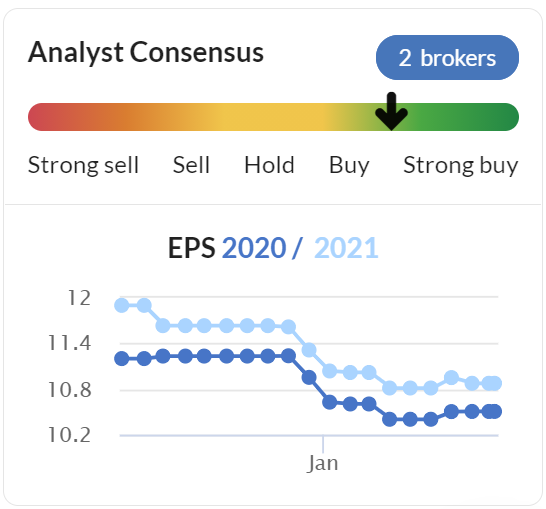

Forecasts - the broker consensus has come down, but nowhere near enough, given that H1 was loss-making, therefore I am ignoring these figures;

.

Balance sheet - looks reasonably OK, but not strong, with NTAV of £9.4m.

Bank debt is very high at £65.3m in long term creditors, but that's because the company seems to have drawn down borrowings, as an insurance policy, and is sitting on a cash pile of £48.0m.

Receivables are down 39%, which I would expect from the reduced H1 revenues. But trade creditors are almost identical to 12 months ago, at £61.6m. That suggests to me some creditor stretch - maybe deferral of VAT? Doing a quick CTRL+F search for "VAT", the narrative confirms that the March 2020 VAT liability was indeed deferred, but doesn't give us the amount - a glaring omission, investors should be told what important one-off gains have been made, because that VAT has to be paid in March 2021. We don't know if it's £1m or £10m, or somewhere in between? Similarly, the company says it took advantage of the furlough scheme, but doesn't provide the number. This is an annoying lack of transparency. Do let me know if the figures are given, as I might have missed them.

My opinion - I can't get excited about this. It seems as if the recovery is underway, but seems a little anaemic. I'd rather concentrate on companies where trading is roaring back, and pent-up demand is taking current trading way above last year. That's not the case here.

I imagine that this share might recover next year, but I can't see much of a catalyst for it recovering this year. Therefore, I'd rather concentrate my money into other shares with more obvious recovery potential.

Don't get me wrong, I cannot see any particular reason to avoid EPWN shares, it's just not clear that the upside is enough, or imminent enough, to make me want to put money here, and miss better opportunities elsewhere.

.

.

Speedy Hire (LON:SDY)

Share price: 54p (up 3%, at market close)

No. shares: 527.0m

Market cap: £284.6m

Trading Update (AGM)

Speedy, the UK's leading provider of tools and equipment hire, and services to the construction, infrastructure and industrial markets, provides an update in advance of its Annual General Meeting later today.

As I would expect, business is recovering as the economy opens up again;

Revenue has continued to improve over recent months as customers have returned to work and activity levels have increased... UK and Ireland core hire revenues for September to date are c.8% lower than the prior year.

Group revenues, pre disposals, for the year to date are c.23% lower than the prior year.

SDY has a 31 March year end, and I think lockdown started in late March, therefore almost all the covid impact would have hit the current year, FY 03/2021. Therefore, that YTD figure should steadily improve later this year, but it sounds like they're not likely to recoup lost sales, so a poor overall result seems likely for FY 03/2021.

Cost-cutting has seen 13 depots permanently closed, and staffing reduced, costs will be booked as exceptional.

Liquidity - details given, sounds fine to me. Tax deferred will be paid by 30 Sept 2020.

Guidance - remains suspended due to uncertainty. Boo, hiss!

Graphical history - as you can see from the Stockopedia graphics below, the broker consensus is that the current year is basically a write-off, then next year FY 03/2022 rebounds fully to historic levels of earnings. That's possible, and the PER would then be about 11, if that scenario pans out.

.

.

My opinion - I can't see enough upside potential here to get me interested. It might do alright, and recover more, but hire companies don't tend to attract high PERs at the best of times. There could be better opportunities elsewhere maybe?

.

Anpario (LON:ANP)

Share price: 420p

No. shares: 23.1m

Market cap: £97.0m

Anpario plc (AIM:ANP), the international producer and distributor of natural animal feed additives for animal health, nutrition and biosecurity, is pleased to announce its interim results for the six months to 30 June 2020.

I've looked at this company several times over the years, admiring its cash-rich balance sheet, and decent profit margins. However, the lacklustre growth made me question why it was valued like a growth company. That might be about to change, as H1 results are showing good profit growth.

H1 main points;

Revenue up 13% to £16.17m - I think that's all organic growth, I can't see any mention of acquisitions.

Gross margin is also up, leading to a rise in gross profit by 20%, to £8.5m

Profit before tax is only up 6% to £2.4m, due to adverse forex movements, which are stripped out of the adjusted profit numbers - that's OK I think, as forex movements are swings & roundabouts to me, so adjusting them out does show a smoother, more underlying view of profitability.

Adj EBITDA is up 24% to £3.4m

Adj EPS is up 34% to 11.74p. It looks as if there might be a slight bias to H2 seasonally, so I'm guessing full year adj EPS might be something like 25p perhaps? At 420p per share, that makes the PER about 16.8 - which seems quite reasonable, given that the company is now demonstrating some decent organic growth.

Balance sheet - is just stunning! I get joy from seeing a balance sheet like this.

NAV is £36.5m. Deduct £11.6m intangibles, and NTAV is £24.9m -which is a lot, for a relatively small company.

Working capital is really strong: current assets of £25.4m, includes cash of £13.2m. Current liabilities are only £4.0m, and long-term liabilities only £1.7m.

There's therefore stacks of surplus capital in the business, and it could easily make acquisitions of say £10-20m without breaking into a sweat. Not bad for a company valued at £97m, the cash is material to the valuation, and is hidden upside I think.

Acquisitions? It sounds like something might be brewing on this front;

Our strong balance sheet provides Anpario with the resources to expand our global reach and to undertake earnings enhancing and complementary acquisitions which may arise in these uncertain times.”

Outlook - I particularly like the bit about online & direct marketing - that could be a precursor for further growth, which is what I'm looking for;

Looking forward, we will continue the on-line and direct marketing tactics that produced such a strong first half performance. Additionally, we will be able to build upon new business gained from those competitors unable to supply during lock-down. As a result, we remain confident of continuing the profitable development of the Group.

.

My opinion - this looks good. The broker consensus forecasts look too low, so there might be an opportunity here to buy at a multiple that is quite reasonable, if you adjust the forecasts to something more realistic.

I only review the numbers here. The clever bit is for you to do - i.e. looking at the products, and understanding its markets, and what the growth potential is. I haven't got a clue on that side of things, but it's ultimately what drives the share price in the long-term.

From my review of the numbers, it gets a thumbs up. Many thanks to the readers who so politely nagged me to look at this, it was worth it!

Phew, bit of a mammoth session today, but I finally got through the list.

See you in the morning!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.