Good morning, it's Paul here with the SCVR for Tuesday. I'm up early today, to catch up with a couple of stragglers from yesterday.

Timings - looking to finish about 4pm today, but there's plenty up already.

Agenda - as usual, I've selected the results/trading updates which fit my criteria for small caps, and where I know something about the companies. Plus I've included a couple of reader requests. But please bear in mind that I can't cover everything, and getting a deluge of requests every day tends to overwhelm me.

Judges Scientific (LON:JDG) - interim results

Trifast (LON:TRI) - AGM statement (trading update)

Porvair (LON:PRV) - trading update (9 months)

Ideagen (LON:IDEA) - final results

Ergomed (LON:ERGO) - interim results

Tandem (LON:TND) - half year report

If there's time, I might also briefly mention a couple of micro caps

.

Superdry (LON:SDRY)

133p (down 12% yesterday) - mkt cap £109m

Many thanks to a reader who emailed me an up-to-date broker note on SDRY, that was very helpful. I know we're not mean to pass around broker notes, but how on earth can I write these reports, if I can't get access to research forecasts? Actually, I'm probably better off making my own estimates, as the latest broker note doesn't make any sense at all to me.

It forecasts current year FY 04/2021 revenues of £690m, down only 2% on FY 04/2020 actual, reported yesterday. This doesn't make sense, because we were also told yesterday that revenues in the first 20 weeks of FY 04/2021 across all channels, are down 27%. The trend has worsened within that, in that the latest 7 weeks saw a deterioration to -30.3% revenue shortfall against last year.

H1 revenues were £369.1m last year, so if the company ends the half year down 27%, this year we would see an £85m drop in sales to £284m (for H1). That would result in a heavy loss, because last year H1 was only breakeven.

Since the broker is only forecasting a full year drop of £14.4m revenues for FY 04/2021, this implies recouping about £70m of additional revenues above last year's in H2. How likely is that? Last year H2 FY 04/2020 was £335.3m revenues (hit in Q4 by covid, for the last month or so). I make that an assumption that H2 FY 04/2021 would need a +21% growth in revenues, in order to hit forecast. That seems a herioc assumption, even allowing for some catch up in March & April 2021 against comparatives when the stores were mostly shut in 2020.

All of this assumes that there won't be any further lockdowns, forcing more shop closures, something that is looking more of a possibility with each passing day, as covid cases keep rising.

For the above reasons, I reckon my gloomier estimate (where I see a loss of c.£100m being likely for FY 04/2021) look much more prudent than the unrealistically optimistic broker forecast. I'm happy to change my view, if the numbers show that I'm being overly cautious. The interim results should be interesting. All the while, the balance sheet is being eroded. Creditors can only be stretched so far, and I remain of the view that SDRY is likely to need refinancing at some stage.

.

Augean (LON:AUG)

Share price: 165p (down 13% yesterday)

No. shares: 104.5m

Market cap: £172.4m

All I can remember about Augean, is that it's some sort of recycling company, had a very large dispute over landfill tax, and reported stunningly good results while back, and I couldn't work out how it made so much profit. That's why I've always shied away from buying any shares in it.

Augean, one of the UK's leading specialist waste management businesses, announces its unaudited interim results for the six months ended 30 June 2020.

Landfill Tax Dispute - this is still a live issue, and looks material to the market cap. I've no idea what the second bullet point means, but the first one is fairly clear;

.

.

H1 results highlights look pretty decent, considering Jan-Jun 2020 was impacted by covid & lockdown. The business has remained very profitable, albeit down a bit on last year H1;

.

.

Outlook - the most important bit says;

Full year profit expected to be second half weighted with reducing impact of Covid-19 and lower oil price

The Board expects to broadly meet market expectations for the full year maintaining our growth profile assuming no further Covid-19 lockdowns in the second half

That sounds fine to me. Stockopedia shows a consensus of 16.8p EPS for FY 12/2020, which is a PER of 9.8 - seems cheap.

Dividends - Augean doesn't seem to pay there, I'd want to look into why that is, before buying any shares in it.

Balance sheet - looks reasonable. As you would expect, it has quite high fixed assets, and some debt - which is mostly offset by a cash pile. So no problems I can see.

My opinion - I don't understand this sector, and hence it's not of interest to me. I have to understand where profits come from, and this business seems to make far higher profit margins than I would have imagined. Landfill is obviously a regulated sector, and if it's become too profitable, then I suppose the Government might decide to plunder it for more tax revenues? Talking of which, I wouldn't want to buy before the HMRC issue is resolved, over landfill tax.

A PER of just below 10, for an apparently highly profitable business, is a pretty good starting point for further research, if readers want to take it further.

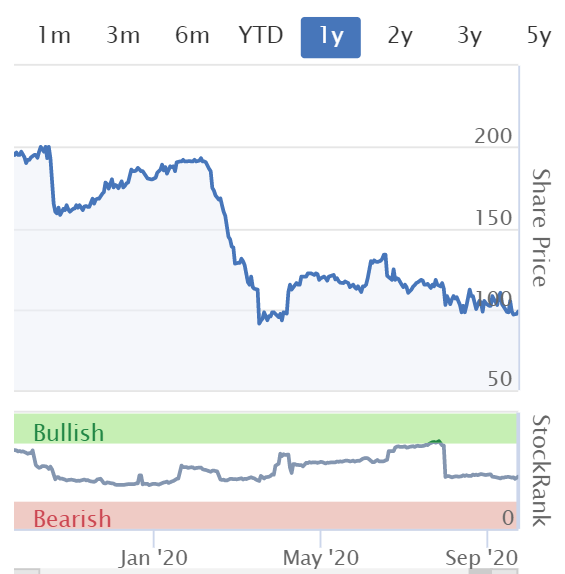

The StockRank turned from very positive to very negative, see below, which seems an unusual move.

EDIT: Thanks to subscribers davidjhill and Berksbee, who have both added interesting points about Augean in the comments section below. That helps to fill in some of the gaps in my knowledge, so much appreciated! We like it when readers share your knowledge of companies here, to add to the group's understanding of things. End of edit.

.

.

Judges Scientific (LON:JDG)

Share price: 5220p (up 2.4%)

No. shares: 6.28m

Market cap: £327.8m

Judges Scientific, the group focused on acquiring and developing companies in the scientific instrument sector, announces its Interim Results for the six months ended 30 June 2020.

It's important to remember that we're looking at accounts which have inevitably been impacted by covid. Taking that into account, the numbers from JDG look reasonable;

Revenues down 6.8% to £37.4m in H1 - but this is helped by acquisition(s), organic revenues were down 12%

Earnings also took a hit from covid, with adj EPS down 22.5% to 84.2p

Interim divi is up 10% to 16.5p, but that's only 20% of earnings, and very small in yield terms, so I can't get excited about it being raised by 10%

Adjusted net debt is modest, at £3.9m

Balance sheet - adequate, but NTAV is small, at £5.7m (NAV: £31.0m, less £25.3m intangibles)

Order book - this is a concern. The commentary says that management believes orders have been deferred rather than cancelled, which I'm sure is true, because I trust management at Judges, based on their excellent track record. But the organic order book was down a lot, 17%, in H1, and has shortened to 10.8 weeks. Order intake in H2 is also down. So there must be a risk that the company might not be able to fully rebuild the order book, hence we could be seeing some profit impact of covid being deferred, possibly?

Outlook - cautious confidence in meeting full year expectations. Note below how expectations have been lowered, and we're now looking at about 150p for FY 12/2020, giving a PER of 34.8 - that's too expensive for me. We're being asked to pay up-front for a substantial recovery in future earnings, above the c.150p likely for this year. I don't find that an attractive proposition. I'd rather pay maybe 20 times for this year's earnings (c. £30 per share), then make a profit on the company recovering to higher earnings in future. How does it make sense to pay a £22 premium on top of that, in the hope of future earnings recovering?

My opinion - a nice, well run group of companies, but the current valuation looks too high for me. Particularly, as we could see ongoing impacts from covid - the budgets of universities are mentioned in the narrative as being under pressure, which could perhaps make it difficult to rebuild the order book? Given all the uncertainty out there, I cannot see why we should be paying top whack for anything right now.

.

.

Boris Johnson speech re tighter restrictions

I've just watched the Prime Minister's statement to the House of Commons, re the introduction of tighter restrictions to stem the spread of covid. It's pretty much as trailed by the media, with no shock or unexpected measures. Therefore I couldn't think of any particular repercussions for shares. The sectors under pressure (bars, restaurants, travel, live events, etc) are likely to remain under pressure, so the stock market has probably already priced-in slightly tighter restrictions.

The main thing from our point of view, as investors, is that I didn't see anything in today's announcements which would do fresh harm to the economy. Hopefully it might go some way to reducing the spread of this disease, whilst still allowing life to carry on for the vast majority who are not under any serious threat from it.

They probably got the balance about right, I'd say. So nothing for me to rant about. Back to results statements then.

.

Trifast (LON:TRI)

98.5p (up 1.6% today) - mkt cap £121m

Leading international specialists in the design, engineering, manufacture and distribution of high quality industrial and Category 'C' components principally to major global assembly industries

FY 03/2020 was challenging, but maintained revenues > £200m, and a 9% operating margin.

Fundraising done in June 2020.

Q1 (April, May & June) saw a "meaningful reduction in revenues", with an improving trend moving into Q2.

H1 revenues "slightly ahead of base case". Base case is full year revenues 16% below last year - so this is far from good.

Activity & pipeline encouraging.

My opinion - I'd like to see the numbers before forming a view on this, because revenues don't give us the full picture. Operational gearing can mean that profits fall a lot greater percentage than revenues. Interim results come out on 24 Nov 2020, so I'll review those at the time.

Note that the share price here has remained depressed. I suspect that the forthcoming interim results could look very weak, because a 16% full year drop in revenues, suggests that H1 could be a good bit worse than that, and I note that the company is coy about giving us detailed figures today.

On the upside, this has seemed a well-run group i the past, so I have no reason to believe it won't recover fully in due course.

.

.

Porvair (LON:PRV)

500p (up 1.8%) - mkt cap £230m

Porvair, the specialist filtration and environmental technologies group, today issues a trading update for the nine months ended 31 August 2020.

This update stands out for a lack of information. Consider this;

Revenue for the nine-month period was 2.5% lower than the same period in 2019 (2.2% at constant currency1) despite the Covid-19 landscape.

The Group remains profitable and cash generative.

The first sentence above is fine - the covid/lockdown period seems to have only had a modest impact, with just a 2.5% drop in revenues vs last year.

The second sentence strikes me as rather ridiculous. In H1 Porvair made £8.8m profit on £73.2m revenues. So to say that it "remains profit & cash generative" tells us nothing! Of course it will still be profitable/cash generative, but how much? That's what we need to know. Is it trading in line with market expectations? Nothing is said about that.

Revenues - note £73.2m in H1 was up 2% on LY.

H1 + Q3 is now down 2.5% on LY.

I've crunched the numbers, and assuming an even seasonal pattern of revenues, I reckon this means Q3 was down c.12% on Q3 last year - that's quite a big miss on revenues. It's obscured by quoting the year to date figures.

Net cash of £0.4m looks fine

My opinion - I would have liked to see more open disclosure of the poor Q3 performance, rather than burying the bad news in YTD figures.

The broker consensus revenue forecast shown on Stockopedia is for a near 8% fall in FY 11/2020 revenues, so it looks as if a soft Q3 and Q4 was already baked into the pie. In which case, why didn't the company comment on performance vs market expectations?

If companies are going to issue trading updates, how about making them useful, and clear?

This is a decent, high quality business, but I'm not sure the premium rating is justified, because growth has gone off the boil, due to the macro picture & covid. Aviation must be a drag on Porvair' performance, as I seem to recall it makes special filters for aircraft.

The forward PER is over 20, for a business that might take a while to recover to previous peak earnings. That doesn't seem particularly attractive to me. At best, it's probably priced about right, or maybe a bit too high still?

.

.

Ideagen (LON:IDEA)

197p (flat today) - mkt cap £444m

Ideagen PLC (AIM: IDEA), a leading supplier of Integrated Risk Management software to highly regulated industries, announces its audited final results for the year ended 30 April 2020.

These accounts are not the simplest to go through, as Ideagen has been highly acquisitive in recent years.

Revenue is up 21% to £56.6m, some organic, and some acquisitions.

Adj EPS is up 12% to 5.36p - giving a very aggressive valuation of 36.8 times PER. I can't get anywhere close to that valuation to make me want to buy this share, but that's what the market values it at.

Net bank debt is £16.8m, which doesn't look excessive, given the reliable recurring revenues, and low customer churn. It's a resilient business, with covid apparently not having much impact.

EBITDA & cashflow - there are so many adjustments to these figures. See note 4. The way I look at things, it is genuinely cash generative, because the £11.3m amortisation charge relating to acquisitions, is, in my opinion, a valid adjustment.

Capitalised R&D was £3.9m, so that's about a quarter of the cash generation. Hence we can disregard EBITDA.

Balance sheet - as mentioned before, I appreciate that software groups with reliable cashflows paid up-front by customers, can stretch their balance sheets without necessarily causing problems. In this case, NAV is £76.9m, but being acquisitive, the balance sheet is top-heavy with £113.8m intangibles. I would write off all of that, to arrive at NTAV negative at £(36.9)m. Because it keeps making more acquisitions, then I can't see this changing any time soon. There was an equity raise to help pay for some acquisitions a year earlier.

Working capital looks weak, but that's because a £25m bank loan is shown in current liabilities. That doesn't seem to tie in with a 2023 expiry date of bank facility, so I'm not sure what it's doing in current liabilities?

It looks as if the bank facility has been doubled in size since year end, which I think is starting to look too much debt, and a placing would now make sense to moderate the bank debt, and strengthen the balance sheet.

The Group has sufficient liquidity and funding facilities. As at 30 April 2020 the Group was £25 million drawn down against its total Revolving Credit Facility ("RCF") of £40 million (which is in place until March 2023) and had cash on hand of £8.2million.

Since the year-end, the Group acquired Qualsys Limited. The initial £14million consideration paid at completion was funded via a further drawdown of the RCF.

In September 2020 the RCF facility was extended by £10million to provide additional headroom. This Group's facilities are subject to certain financial covenants.

On the upside, there is now no further deferred consideration to be paid - something important to check at acquisitive groups.

My opinion - in a covid world, this type of recurring revenue business deserves a premium price, because it's resilient whatever happens to the economy.

What I don't like is the balance sheet, with negative NTAV and (in my view) debt which has gone too high since the year end. I just like more conservatively financed balance sheets, a purely personal preference.

Personally I wouldn't be interested in buying this share unless it was under a quid, and the balance sheet was more robust. I don't suppose David Hornsby will want to talk to me again.

.

.

work-in-progress

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.