Good morning, it's Paul here with the SCVR for Friday.

Timings - TBC

Sorry I didn't manage to finish off yesterday's SCVR, I seem to feel permanently exhausted at the moment. Maybe I'll ask Jack to give me a day or two off next week?

The big news today is;

Boohoo (LON:BOO)

358p (up 10%) - mkt cap £4.4bn

(I hold)

Why is this fashion eCommerce business in a small caps report, newbies might ask? We've followed this share very closely since it floated, because I knew the original wholesaling business from my former employer being a major customer of theirs in the 1990s. Hence the potential of selling direct to the end customer was obvious to me. I, and many readers here, collectively made many £millions from the point where I was raving about it at c.25p per share, all the way up (although I personally sold out ridiculously early, worried about the valuation being too high!). I still haven't learned the lesson to ignore valuation when you find something exceptionally good. Right or wrong, that strategy of ignoring valuation is the one that has worked in recent years. Sooner or later it's likely to go disastrously wrong, but who knows when?

Back to BooHoo. There have been repeated allegations of malpractice (poor working conditions & low pay) in its Leicester supply chain, which combined with a duff shorting dossier from Shadowfall (Matt Earl), has caused the share price to be volatile. I was waiting for a nice buying opportunity in BOO, as I've become more & more convinced of the bull case, as it hoovers up more & more brand names on the cheap, and repeats the same formula to build them up strongly as internet-only businesses, using the BOO infrastructure. That opportunity came in July 2020, with repeated (essentially the same as before) allegations that BOO's suppliers (NB not BOO itself, as all manufacturing is outsourced) were cutting corners, not just with the fabric! I know a lot of readers joined me, buying recently from 209p upwards, and we've cleaned up. So well done to everyone who had the nerve to buy when the share had just been in freefall. And many thanks to the shorters, and so-called ethical funds selling out cheaply, for providing us with this marvellous opportunity.

The independent report commissioned by BOO from a lawyer, was I thought due to come out on 28 Sept, but it seems to have come out early today. My thinking was that the report would possibly contain stuff that might be damaging to BOO in the short-term, so I reduced my position size from humungous, to just large, safety first. The idea was to side-step any spike down in price on publication of the report, and to give me funds to buy another dip.

That plan didn't work, as the report has come out a working day early, and the market seems to like it. That's triggered a rally in the share price this morning, which was not how I imagined things might work. So a bit of a missed opportunity, and I'm kicking myself for not having held my nerve fully. Still, it remains a big holding for me, and with this supply chain issue now probably dead & buried, in terms of stock market impact then I'll be able to buy the dips in future with more confidence.

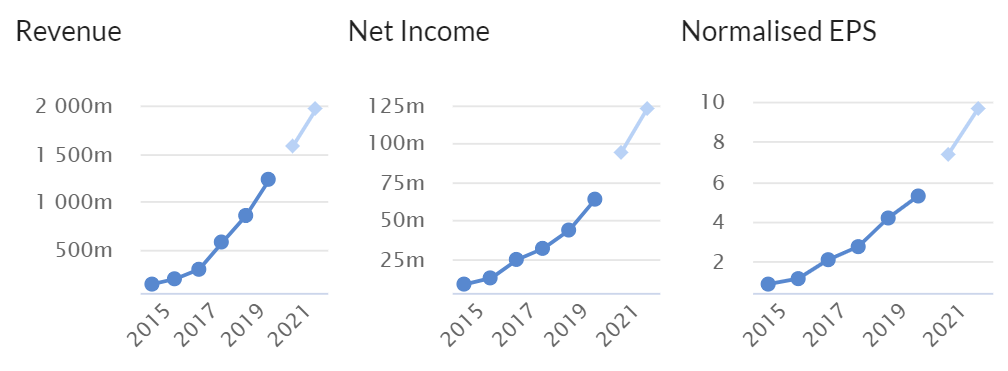

BOO really is a remarkable business. Just look at the EPS growth (below), which is ongoing of course, because more brands are being added. I think this could become one of the world's largest fashion businesses long term. They're just good at everything, and it has the laser focus of being a family business, driven by passion.

.

.

Above all, the lesson for the future, is to just ignore the bears - without exception, they don't understand the business or the sector, I've found. This includes anyone who thinks the PER is too high. The point is that BOO normally beats forecasts, and growth is open-ended due to international expansion running rapidly, and more & more brands being bought up cheaply (it now has 9 brands). Therefore a high PER historically, soon becomes quite low after a few more years' growth & out-performance.

As mentioned previouly, I think EPS could rise in the next few years to c.50p 20p, so put that on a PER of 40-50, and I have a price target of 800-1000p. It's currently 360p. There's no reason to believe that 1000p would be the peak either, I see that as a staging post on a long-term journey that could take it higher still, if the growth continues. Now the group is so diversified with many brands, it's difficult to see what could seriously derail the shares in future.

Here's a link to the full supply chain report, published today, and BOO's response. Since the share price has settled up, then I'll park this, and read it over the weekend. From a quick skim, the key point seems to have been that BOO was previously (before July's allegations) actively trying to improve conditions in its supply chain. Therefore that makes it look genuine, rather than allegations which implied it was ruthlessly taking advantage of workers. That makes it a lot easier for funds to hold the shares - with ethical considerations neutralised, hence selling pressure on the shares has probably now gone, and everyone can instead focus on what a fantastic growth business BooHoo is.

EDIT: some excellent reader comments below on BOO. In particular thanks to MrC for a nice summary. It's quite critical of BOO, but the problems seem to be in the process of being fixed.

.

** BREAKING NEWS **

Revolution Bars (LON:RBG)

9.5p - mkt cap £11.9m

(I hold)

Statement re press speculation (possible CVA)

Here is the announcement in full, which has just come out;

Statement re press speculation

Further to the continuing challenging trading environment and exacerbated by the further COVID-19 related restrictions announced by the Government earlier this week, the Board of Revolution confirms that it has been working with advisers to assess various strategic options for the Group.

The Board is currently evaluating the potential impact of the latest developments on the Group's business before deciding what the next steps should be. One of the potential options being explored is a reduction in the size of the Group's estate by the implementation of a company voluntary arrangement ("CVA").

No decisions have yet been made and there is much further work to complete before the Board decides on any appropriate course of action.

Revolution has a strong balance sheet following the £15m equity fundraising and the extension of its banking facilities announced in June but the Board believes that the long term nature and potential impact of the latest operating restrictions means that it must consider all necessary options to ensure that its business remains viable.

.

I'm pleased to hear this, as the same thoughts were starting to go through my mind. Why keep paying full rent, when operating conditions are so far below usual, that the business would struggle even to breakeven? Particularly as the Govt has indicated this week that restrictions could be in place for 6 months, and that even further restrictions could be introduced.

There have been incidents where people failing to socially distance in pubs has caused covid outbreaks, hence why bars seem to be in the Govt's sights as places to restrict further, e.g. the 10pm closure time announced this week.

Personally, I would prefer it if RBG goes the whole hog, and does a pre-pack administration, which is the cheaper, but more brutal option. Whereas a CVA is more costly. Ultimately though, both achieve the same aim of getting rid of all the loss-making sites, and reducing rents on others. Business can continue as normal during a CVA, and trade creditors are not usually affected.

My opinion - if RBG can do a CVA, that would enable it to reset all rents to an affordably low level. This would be a far better situation than the one we currently have, where shareholders are funding the landlords.

Reading the "Propel" daily email (many thanks to the reader who flagged this up to me, it's very useful), we are seeing CVA and administrations occurring every day from many hospitality sector companies. As mentioned here before, I'm coming round to the view that this is the only way forwards for struggling retailers and hospitality companies. The lease liabilities have to be jettisoned, otherwise businesses are just not viable.

My main worry about RBG doing a CVA (or other) is that it could need another equity fundraise, which inevitably would be likely to occur at an even lower price (e.g. 5p?). I've changed my mind on this. Crunching the numbers, I estimate that RBG could probably proceed with a CVA without needing another equity fundraise, but this might depend on the bank giving covenant waivers, so it cannot be ruled out.

So a positive development I think, as a much better & more profitable business would emerge from a CVA. But in the short term, there is a worry about how it would be funded? Looking forward to 2021, once restrictions are removed, and assuming RBG has ditched all the loss-making sites, and has new, low rents on everything else, then this would become a fantastically profitable business. It's the path of how it gets there, that is problematic.

In the past, CVAs have often just deferred insolvency of failing businesses. However, the covid situation is different. Demand is being artificially suppressed by Govt mandate. Therefore bars are struggling to survive due to this one-off, external factor, not because there was anything wrong with the business prior to covid. This makes the rationale for doing a CVA much stronger, and points to it being a long-term solution, rather than a short term sticking plaster.

.

Warpaint London (LON:W7L)

Share price: 67p

No. shares: 76.7m

Market cap: £51.4m

This is a straggler from my backlog, these results came out on Weds.

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands is pleased to announce its unaudited interim results for the six months ended 30 June 2020.

Just to recap, we're going through a unique period where businesses have been often badly impacted by covid/lockdown. Therefore it doesn't make much sense to value companies on a multiple of their 2020 earnings. So we need a different approach. If I think a business is likely to recover in 2021, then I'll probably look back to 2019 pre-covid earnings, and value the business on a sensible multiple of those historic earnings. Alternatively, if there are broker forecasts, then I'll look to 2021 forecasts, but place a low reliance on them, because so many broker forecasts at the moment seem to either be far too optimistic, or far too pessimistic.

Analysts generally have not done a good job in 2020 so far, but I suppose we can't blame them, because so many companies have withdrawn guidance - itself incredibly unhelpful. At times of crisis, we need profit guidance more than ever, not to have it withdrawn. Guidance doesn't have to be exact, but a range of possible outcomes is fine.

Anyway, with the absence of reliable guidance for many shares, I am currently looking for;

1) H1 losses, or reduced profits, in 2020 being tolerable - i.e. not so bad that the company would struggle to recover.

2) Balance sheet strong enough to allow the company to survive & recover, without needing to do an equity fundraising, and

3) Current trading improving strongly (not just bumping along the bottom).

If a company results ticks those 3 boxes, then I would consider a purchase, if the valuation is attractively low.

Onto the H1 results, here are my notes of the key points;

H1 revenues down 29% to £13.5m (split UK down 12%, international down 40%)

Gross margin up a whisker, at 35.1%

Adj operating profit just above breakeven, at £0.4m (LY: £1.3m) - this looks OK to me, so ticks my box no.1 above

Loss before tax is £1.48m, but this is mostly caused by a £1.22m amortisation charge which I am happy to reverse out, so in effect the business lost about £0.2m in H1 - about breakeven, which is fine.

Dividends - this is really positive, for sending a signal about management confidence - the interim divi of 1.5p is maintained, plus an additional 1.3p is being paid, which is the deferred final divi from last year. Talk is cheap, but resuming divis at a meaningful yield, is strong

H2 sales recovering well, but still below pre-covid level, "steadily approaching" it.

Guidance - very pleasing. The company gives us a P&L update to end Aug 2020 (8 months) - revenues £22.8m, which seems to show £9.3m revenues in just July & August. Let me check that, it seems too high. No, I think that's correct. There seems to be a strong H2 seasonal bias to revenue & profit, judging from last year's numbers.

Full year guidance is given too, very helpful indeed, everyone should do this. Revenues expected to be £37m, and >£2.0m in adj operating profit. That's a long way down on £5.6m LY. Poor, but not disastrous, is my judgement for 2020.

Balance sheet - is excellent, the company is very well financed, shareholders can sleep soundly at night, even if conditions worsen in the coming months.

My opinion - the forecasts shown on the StockReport look too high, so are likely to come down, to tie in with the revised guidance given today. Therefore we need to ignore the forward-looking metrics like PER and yield, for now.

I think Warpaint seems to have coped quite well with the crisis this year. It has a very strong balance sheet, is paying divis again, and business is recovering.

What it lacks is brand appeal, and performance in the past has been a bit erratic. Hence why the shares have languished. The valuation looks about right to me at the moment. The downside is nicely protected by strong finances. There could be future upside if a more consistent growth track record could be established.

Management came across well in a recent results video presentation - down to earth, with lots of skin in the game, the type of people I like to back. Overall, I think this is quite interesting, as something that might re-rate in the future, if they come up with some better product. In the meantime, it's trading OK, and paying divis. Quite a nice risk:reward balance. Mildly positive, is my overall view.

.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.