Good morning, it's Paul here with the SCVR for Monday.

Today's report is now finished.

Today's agenda in small caps is;

Tristel (LON:TSTL) - Final results

Craneware (LON:CRW) - Q1 Trading update

Bioventix (LON:BVXP) - Results year ended 30 June 2020

Before I get onto that, here's the latest episode on the BooHoo saga;

Boohoo (LON:BOO)

(I hold)

The FT, and now other papers, are reporting that PWC is quitting as auditor of BooHoo, over reputation concerns. Obviously, if true, that's bound to have a negative impact on market sentiment, in the short term. Long term, of course, such issues are forgotten when forecast-beating results come out.

BOO has this morning issued a statement as follows;

boohoo, a leading online fashion retailer, notes recent press commentary with regards to its auditor PricewaterhouseCoopers ("PwC"). The Group would like to place on record that PwC is still the Group's auditor at this time. The Group's Audit Committee has recently launched a competitive tender process for the Group's audit, and will update shareholders at its conclusion. PwC signed an unqualified opinion on the Group's 2020 Financial Statements and having served as the Group's auditor since 2014, is not participating in this process.

I'm reluctant to speculate on this, and I'm sure everyone has their own interpretation of it, depending on your underlying view of the company/share. It's possible that some of the press reports, and the BOO statement, could both be true. Some press reports are saying that PWC has resigned (clearly false, because BOO has stated today that PWC remains its auditor at this time). Other press reports are saying that PWC intends to step down (in the future), which of course is entirely compatible with still being the auditor currently.

So it sounds like an orderly process to change auditors. But would BOO really have chosen this particular time, when it's under relentless fire in the press, to voluntarily change auditor? I don't know, but it seems implausible to me. Maybe the auditor said they don't want to carry on, but are happy to hand over in an orderly fashion? Who knows?

Does it matter? Short term, yes, clearly this further impacts already dented sentiment. In the long term it doesn't matter at all. The Telegraph points out that Sports Direct had problems retaining auditors, and had to move down to a second tier audit firm, because of concerns over corporate governance, and an overly dominant Chairman, plus of course scandals over its warehouse & working conditions (which turned out to be largely hot air). Despite this, Sports Direct has been a rare survivor in retailing, as most of its rivals have fallen by the wayside (apart from the phenomenal Jd Sports Fashion (LON:JD.) of course). Who would have thought that Sports Direct could revitalise House of Fraser (or House of Failure as apparently some of its staff used to call it), yet before covid struck that seemed to be underway. The point being that an entrepreneurial business that runs into trouble on governance & press attacks, can be a very successful business.

Therefore, I think how you see this issue depends entirely on whether you're a trader, or an investor. I see this as buying opportunity no.3. It may be disconcerting to endure such wild price movements, but in my experience, the fundamentals always overcome shorter term market sentiment after a while.

If earnings were under pressure, and customers boycotting BOO, then I'd be a seller. The opposite is actually the case. The last update was fantastic, interim results. Revenues up 45%, adj PBT up 53%, and EPS for this year probably now heading for 9p+, brokers upgrading forecasts (but BOO usually beats forecasts often by a lot). Therefore at 270p, the forward PER is probably now under 30. That's such good value for a unique growth company. Look at Asos - much slower growth, very low gross margin, yet on a higher rating than BOO. That's a clear valuation anomaly, in my view.

The key point is that none of the recent attacks on the company make the slightest difference to financial performance. Therefore long term, the share price is highly likely to recover. To me that's an opportunity, whilst of course it's tough to see red on my screen, but that's part of this world. We have to be able to tolerate short term losses, and ride them out sometimes. Or, if you're a skilled trader, then selling at the top, and buying back at the bottom is a great strategy, if you can consistently pull it off. Each to their own.

I think, when sentiment turns, and the sellers are gone, then the rebound could be explosive. We've seen that before quite recently. It also helps that shorters then become forced buyers, which speeds up the recovery. It's a fascinating situation, but it seems very obvious to me that, in say 2-3 years time, BOO is almost certainly going to be a much bigger, much more profitable group. That inevitably means a higher share price. Are people going to be agonising over who the auditor is, in 2-3 years time? Of course not, because it doesn't matter in the long run. It'll be earnings & growth that drive the share price, once all this kerfuffle is forgotten.

.

Tristel (LON:TSTL)

Share price: 510p (up 2.4%, at 10:28)

No. shares: 46.5m

Market cap: £237.2m

Tristel plc (AIM: TSTL), the manufacturer of infection prevention and contamination control products, announces its audited results for the year ended 30 June 2020.

The Group has delivered a solid performance, achieving both growth in revenue and pre-tax profit, coupled with high cash generation.

These numbers look really good, I'm impressed. A few key figures;

Revenue up 21% to £31.7m - so quite a small company, given its £237m market cap

Very strong gross margin of 80% - indicates pricing power, and operational gearing is high - i.e. increased revenues feed through mostly to increased profit

Depreciation/amortisation charge is up a lot - mainly due to a new £692k charge relating to leases - the curse of IFRS 16 strikes again!

Adjusted EPS is up 11% to 12.35p - PER of 41.3 - yikes, that looks very expensive. That goes up to 44.8 if you use unadjusted EPS of 11.38p. This is a good company, but it's priced to perfection.

Dividends up 12% to 6.18p - a yield of 1.2%

Net cash £6.2m

Balance sheet - I have reviewed it, and it's excellent, this company is very solidly financed. The strong performance through covid, and a very strong balance sheet, make this a very resilient company, if the covid situation worsens again.

USA market entry is still in the regulatory approvals process, taking a long time.

Hospital surface disinfectant products have grown strongly, boosting the results. This is interesting, with the commentary saying it's a "key focus" for the future. Obviously very relevant to covid.

Cashflow statement - all looks in order. This is a genuinely good, cash generative business. I can't see anything wrong in the figures.

My opinion - a very nice set of numbers I like the look of this, it's a company I've followed for years.

The only query is over the very high valuation. The current price anticipates considerable future growth. Are you happy paying up-front for that?

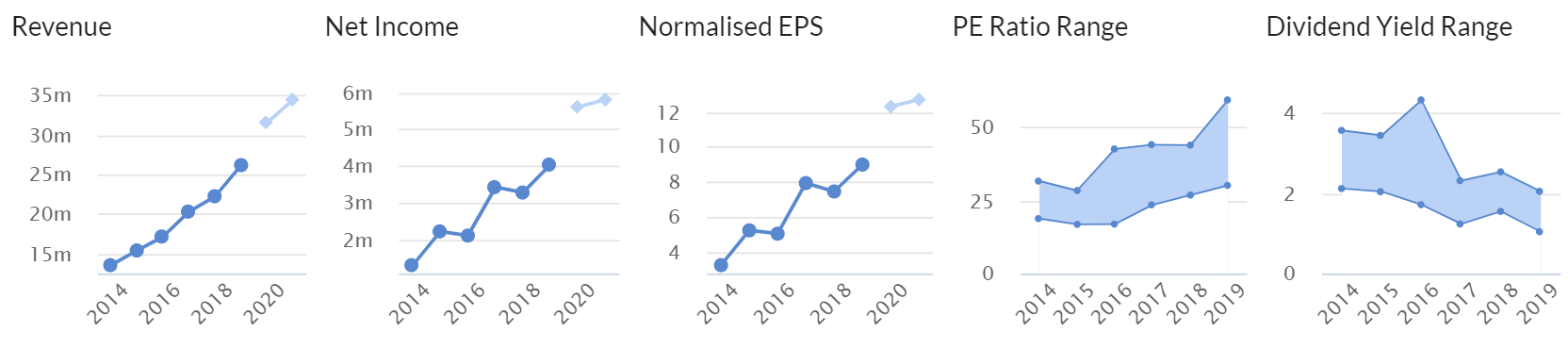

As the Stockopedia graphs below show, Tristel has established an excellent track record of rising revenues & profits over the last 6 years. However, the shares have steadily become more expensive on a PER basis, and the dividend yield steadily falling. So a fair bit of the share price rise has been due to PER multiple expansion, which can be a one-off gain, or even go into reverse. Therefore, for the share price to continue rising, it's going to need earnings to take up the strain, and rise faster.

.

.

It's very difficult to know when to sell a share like this, that has strong momentum.

.

.

Craneware (LON:CRW)

Share price: 1550p (up 3.3%, at 11:29)

No. shares: 26.8m

Market cap: £415.4m

I reviewed Craneware's results for FY 06/2020 here on 20 Sept 2020. The outlook statement then indicated that Q1 (July-Sept 2020) was improving, with early signs of sales cycles slowly normalising. Let's see how that compares with what it says today.

Craneware (AIM: CRW.L), the market leader in Value Cycle software solutions for the US healthcare market...

Today it says;

Ahead of the AGM, the Company is pleased to confirm a return to strong sales in the three months ended 30 September 2020 (Q1), in line with the outlook released at the time of the Final Results.

Sales in Q1 are ahead of the strong comparator Q1 of the prior year.

The Company continues to see substantial new opportunities entering the sales pipeline and while cognisant of the ongoing pandemic, the Board is confident in the continued resilient performance of the business and looks forward to providing a further update at the time of the AGM.

No numbers at all in this trading update! That's a bit threadbare, but I suppose indicating that Q1 revenues are up on Q1 LY is better than nothing.

Valuation - I can't find any broker research, so am largely in the dark. The only way I can think to value the company, is to start with the 51p actual EPS for FY 06/2020, and then make a guess as to how the current year might compare with that.

Given that Q1 is up on last year, and the outlook comments sound quite positive, then I'd probably make a guess that EPS might be 55-60p this year, possibly? At 1550p per share, that work out as a PER for FY 06/2021 of about 26 - 28 - not exactly a bargain, but software companies with lots of recurring revenues, and long-term customer relationships, do tend to command a premium price.

My opinion - there's not enough information available for me to have any confidence in how to value this company.

It's an interesting company though, and seems to be on an improving trend, after setbacks last year. Potentially interesting, if more information & guidance becomes available in future.

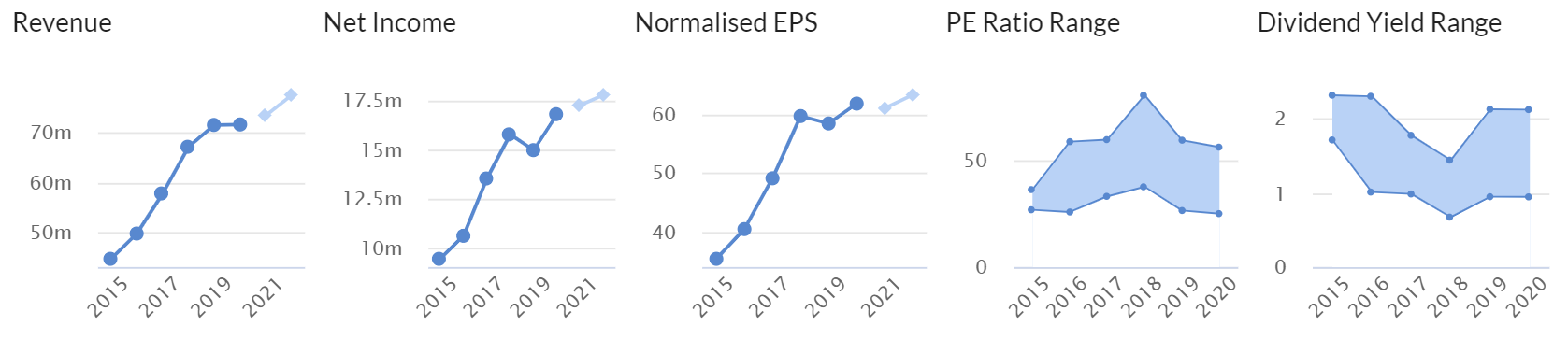

As I queried last time, it is starting to look ex-growth from the graphs below. I'd want to see evidence that growth is resuming to get interested in paying a high PER for this. It would be interesting to rummage around on the internet, to see if we can find any feedback from clients, and what the actual users think of this software, and how it compares with other software available for American hospitals. Is it a fragmented market, or not, etc.?

.

.

Bioventix (LON:BVXP)

Share price: 4250p (up 2.4%, at 12:22)

No. shares: 5.2m

Market cap: £221m

Results for the year ended 30 June 2020

Bioventix plc (BVXP), a UK company specialising in the development and commercial supply of high-affinity monoclonal antibodies for applications in clinical diagnostics, announces its audited results for the year ended 30 June 2020.

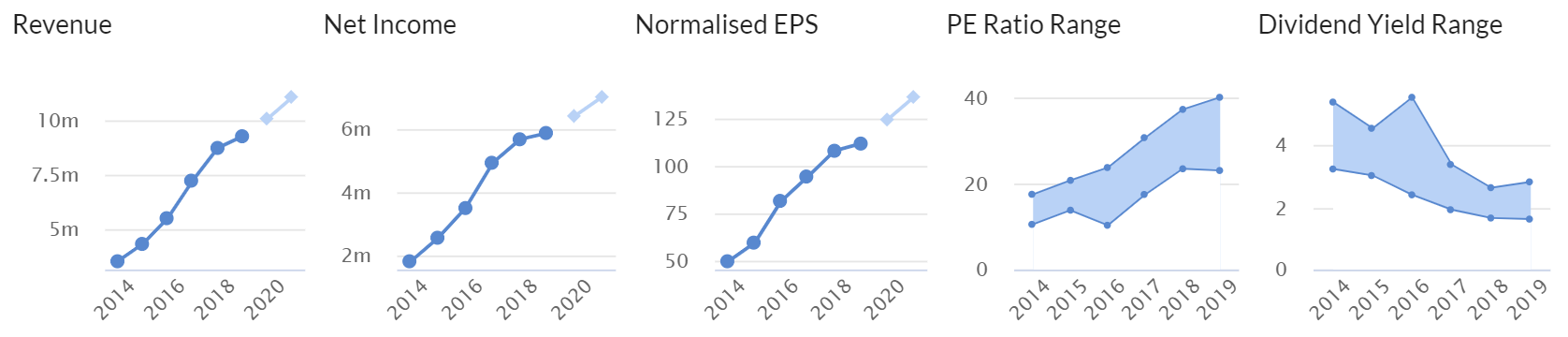

This is a remarkable little company, that generates a huge profit margin, and has achieved decent growth, as you can see from the graphs below. Although note that PER multiple expansion has also been a contributor to share price gains. Can that be maintained, or extended further? Who knows, that's down to stock market sentiment.

.

Look at the stunningly high profit margin below, this is even higher than Rightmove, and is extremely unusual - a profit margin of 79.8% after all costs (but before corporation tax). Astounding! How is this possible? Niche products, with long lead times, hence little to no competition. Plus low overheads. I've always wondered how sustainable this is, but so far, it has been more than sustained.

.

.

Balance sheet - small, but very strong, with surplus cash. No issues here.

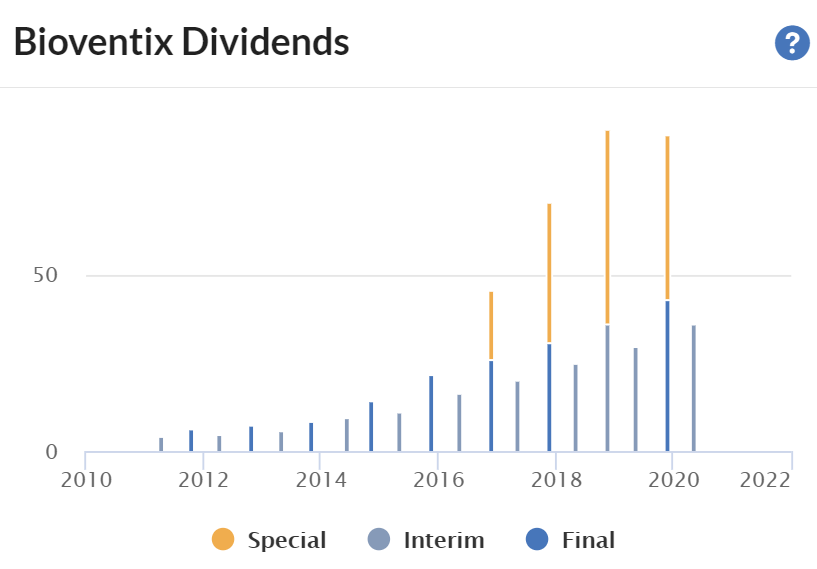

Cashflow statement - very simple. It generates lots of cash, and pays out most of it in divis.

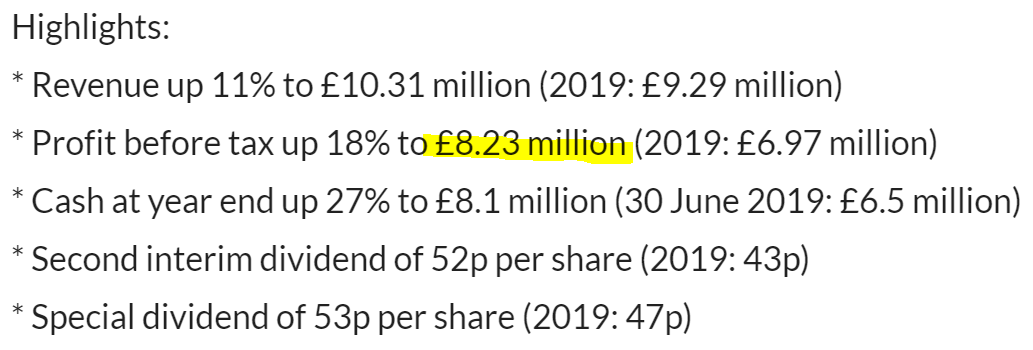

Note the growing importance of special divis;

.

.

My opinion - neutral, because I don't have the specialised knowledge to assess the company's products or outlook. It mentions new products delivering additional shareholder value from 2025-2035.

The StockReport is showing a forward PER of about 30, which doesn't seem excessive, given the unique nature of the company, its stunningly high profit margins, great cash generation, strong balance sheet, and superb track record.

People who did their research properly on Bioventix, and had the patience to ignore short term market noise, have done very well here, and deserve a virtual, socially-distanced, pat on the back!

.

.

I'll probably leave it there for today. Thanks for dropping by!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.