Good morning, it's Paul here with the SCVR for Thursday.

Timings - mostly done now (14:00), I need a couple more hours to cover everything, so 4pm estimated finish. Today's report is now finished.

Agenda - here's what has caught my eye this morning. There are quite a lot of trading updates, from interesting companies;

Quartix Holdings (LON:QTX) - Trading statement

Sdi (LON:SDI) - Trading update

Gear4music Holdings (LON:G4M) - Trading update

Cloudcall (LON:CALL) - (I hold) - CMD Trading update (and investor presentation on IMC today at 3pm - open to all)

Countrywide (LON:CWD) - Interims & recapitalisation

Trifast (LON:TRI) - Trading update - see tomorrow's SCVR

Frp Advisory (LON:FRP) - AGM Statement - see tomorrow's SCVR

Possibles if there's time: Alumasc trading update, and 1PM AGM Statement

.

I'll probably take a look at the reader comments later today, once I've finished the main report, so please don't get offended if I don't reply.

Quartix Holdings (LON:QTX)

Share price: 335p (up 5%)

No. shares: 47.96m

Market cap: £160.7m

Quartix Holdings plc, one of Europe's leading suppliers of subscription-based vehicle tracking systems, software and services, is pleased to provide an update on trading for the 9 months ended 30 September 2020.

This is the key part of today's update -

The Board is pleased to report that it expects revenue and free cash flow for the year to 31 December 2020 to be in line with current consensus market forecasts, which are shown at the foot of this announcement1.

Adjusted EBITDA is expected to be approximately 15% ahead of current consensus market forecasts.

[1] The Board believes that consensus market expectations for 2020, prior to this announcement, were as follows: revenue: £25.8m; adjusted EBITDA £6.9m; free cash flow: £5.2m.

I’m a bit confused as to why EBITDA is up 15% on forecasts, when revenue is just in line. This is not explained in the announcement, but possibly broker notes might add more colour (see Finncap's update note today, on Research Tree).

My thanks to the company & its advisers for including a footnote, stating what market expectations actually are. This is incredibly helpful, and saves us all a lot of time & avoids confusion. I wish all companies would follow this approach, and thereby be helpful to investors.

Recurring revenues make up the bulk of revenues, and are now running at an annualised rate of £21.9m (up £1.1m this year)

Taxation - will be paid up to date by end of 2020 (re covid Govt support schemes)

Revenue growth of 7% achieved, despite covid disruption - so this company goes on the list of shares which have proven themselves to be safe havens - important if you’re worried about the impact of a second wave.

Growth - this table shows growth per country. Note strong growth in France & USA. If it can gain traction in USA, a massive market, then I could see that driving a re-rating of the shares.

.

Non-core insurance telematics business (low margin) installations fell 49%, with this trend expected to continue. The company’s strategy has been to gradually exit from this market because it’s not very profitable. Generally it’s only young drivers who will tolerate a spy in the cab, because insurance companies force them to. They’re gleefully ditched at the first opportunity, understandably.

Recovery from covid has been better than expected, in terms of new business. The company is reinvesting the benefit of this in extra sales/marketing, and product development. That makes sense to me.

Presentation slides are on the company’s website here.

Valuation - this is the tricky bit. There’s no doubt Quartix is a high quality business, which reliably throws off strong cashflows, which are used mostly to pay divis. So far so good. The only trouble is that it’s looking almost ex-growth from the figures below;

Growth in subscriber numbers is good, but remember that this is a competitive sector, so there’s always downwards pressure on pricing too, which blunts the profit growth.

My opinion - a very nice company, with clean accounts, genuine cashflows, and it even pays a decent divi yield of nearly 4% - very unusual for a small technology company.

The price looks full, but I’m more comfortable with this, given a better than expected update today, and importantly the international growth (esp. USA) which could provide better upside than if the company had remained a UK-centric business.

Finncap has increased FY 12/2020 EPS forecast from 11.6p to 13.1p today (see update note on Research Tree). Its forecast for FY 12/2021 of a fall to 10.1p doesn’t make sense now, so I imagine that’s likely to be raised to maybe 13-15p in due course.

I’m happy to value the share on 20 times my estimate of 15p earnings for 2021, so I get to 300p. The current share price is 335p, so I’d say it’s up with events. However, we’re in a big bull market for growth companies, so it wouldn’t surprise me to see the share price chased higher. 400p looks possible in an exuberant market.

.

It’s surprising that the share price has traded sideways, in a wide range, for the last 5 years. This reflects the point I made above that there hasn’t been any profit growth over that period.

.

.

Sdi (LON:SDI)

Share price: 68.7p (up 6% today, at 10:32)

No. shares: 97.8m

Market cap: £67.2m

SDI Group plc, the AIM quoted Group focused on the design and manufacture of scientific and technology products for use in digital imaging and sensing control applications, is pleased to announce an update on trading for the current financial year ending 30 April 2021.

One-off orders related to covid have given a boost to two of the group’s subsidiaries;

Given the very positive level of sales at Atik and MPB and the cost savings effected in the other businesses, the Board now believes that the Group is likely to achieve sales and profit before tax broadly at the levels budgeted for this financial year before the onset of the pandemic, and therefore above current market expectations.

The Board stresses that the incremental sales at Atik and MPB are the result of one-time contracts related to the COVID-19 pandemic and expects them to be completed well within the current financial year.

Consequently, the Board's view on the Group's 2022 financial year is unchanged….

Our other businesses, which have all remained operational throughout the COVID-19 pandemic, have seen customer order patterns showing a return towards normality.

That’s well explained, and I applaud the company’s openness for explaining the one-off nature of those contracts, thus keeping investor expectations grounded.

Outlook - add this share to the list of things that have proven resilient to covid/lockdown;

"Our business model has proved resilient, and we expect to exit the pandemic even stronger than when we entered it."

My opinion - clearly this is a good update. Finncap has today raised FY 04/2021 EPS forecast by 15%, to 4.2p. However, this is due to one-off contracts, so shouldn’t really alter the valuation of the shares much, if at all.

Current forecast is for a slight fall in EPS the following year, to 4.1p.

Given this group’s good track record, and high profit margins, I would be inclined to value it on a PER of 20. That implies a share price of just above 80p. The current price is 68.7p, therefore I think it still looks reasonably priced, despite a strong share price performance.

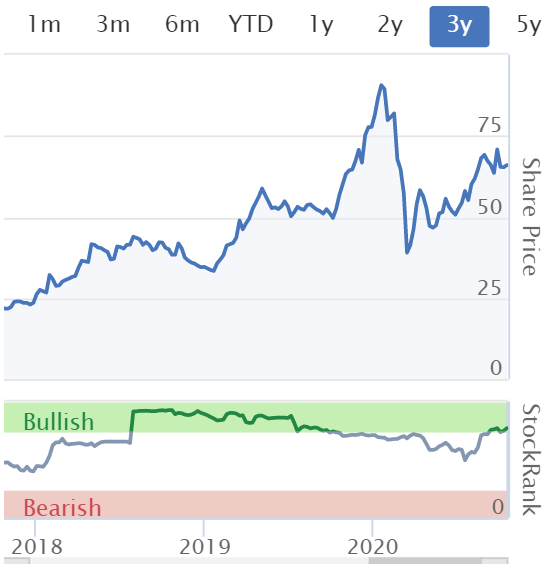

Shareholders have tripled their money in the last 3 years - very nice indeed! There are no divis, but who cares when you've seen that level of share price growth? Note that the Stockopedia computers really like it too, with a StockRank almost constantly in, or near, the green zone.

.

.

Gear4music Holdings (LON:G4M)

Share price: 705p (up 2%, at 12:42)

No. shares: 20.95m

Market cap: £147.7m

Gear4music (Holdings) plc ("Gear4music" or "the Group"), the largest UK based online retailer of musical instruments and music equipment, today announces a trading update for the six months to 30 September 2020.

We have yet another strong trading update today, this company is really on a roll. Expectations are upgraded again;

… the Board is confident that results for the full financial year will be ahead of previous consensus market expectations

We’re not given a footnote to tell us what market expectations are, which wastes time for everyone who reads the announcement, as we then have to look up expectations, and not everyone has access to that information, or the data is often different on different financial websites.

Stockopedia is showing just above 21p EPS, which looks too low to me, it could be that an out-of-date forecast might be pulling down the average possibly? When I last looked at G4M here on 1 Sept 2020, I estimated that EPS for this year looked to be heading for 25-30p. Today’s update reinforces that my range of estimates looks realistic.

Outlook - still trading strongly at the start of H2;

Strong growth in sales and gross profits has continued during October, and preparations for what we expect to be a busy peak trading period are well advanced.

My opinion - this is a lovely situation, where sales are growing very strongly, up 42% in H1, and gross margin is usefully up 330bps to 28.5%. That is a potent mixture, for a geared benefit to the bottom line. Especially as costs have been tightly controlled, and marketing spend is substantial but falling as a percentage of revenues.

Clearly the business must be benefiting from people spending more time at home due to covid but even so, the rise in profitability from the revised strategy to focus on margin ahead of revenue growth, is delivering superb results.

The share is quite pricey now, but performance fully justifies that, in my opinion. I remain positive on this share, and think it’s likely to be a very much larger business (nearly half sales are already international, remember, so not just a UK business) in 5 years’ time, and the share price would probably be a lot higher by then too. An excellent company. I don’t currently hold, having sold too early. However, I’ve had 2 large profits from this share over the years, so am very grateful to management and their team, for having delivered superb results for investors.

.

.

Cloudcall (LON:CALL)

94.5p (up 2%) - mkt cap £36.5m

(I hold)

Company presentation, with Q&A, is on InvestorMeetCompany at 3pm today.

... robust recovery from the initial COVID-19 impact earlier this year, with the Company's growth indicators expected to normalise back to pre-COVID-19 levels by early next year….

"We have seen the Company's growth metrics continue to improve during Q3 and into the start of Q4 2020. An accelerating lead flow driven by our ongoing commitment to investment in partnerships and marketing has been feeding a strong sales process and excellent demonstration to sales conversion rates which has in turn been driving new customer wins. In Q3, we saw a record demonstration to sales conversation ratio of approximately 56%, up by approximately 50% from pre COVID-19 levels

That demonstration to sales ratio of 56% strikes me as remarkably good. As management explained on the last, very interesting webcast, if they can get in front of the customer to demonstrate the product, then they usually buy it. Hence the strategy is to do more product demos!

… Furthermore, I am delighted to see that our existing customer base are beginning to buy more, which further demonstrates that CloudCall's offering remains highly compelling in both an office or working-from-home environment. Both of these factors combined means we remain confident in our ability to return to historic levels of growth next year."

We’re hearing this sort of thing from so many companies at the moment, that I think it’s a time to be bullish about small cap shares which are saying this sort of thing. The TV news tells us that world is ending, on a daily basis, but that’s not reflective of what’s happening at many listed companies.

Revenue guidance - this is helpful;

Whilst the broader global economic backdrop remains challenging as a result of COVID-19, given these improving metrics, the Company confirms that it now expects full year revenue for the 12 months to 31 December 2020 to be ahead of expectations and will be in the range £11.5m to £12.0m.

Stockopedia is showing consensus already at £11.6m, so the update doesn’t seem to be indicating much more than that. The company is still heavily loss-making at this stage.

A new market is being entered, for property. Until now, CALL has focused mainly on the recruitment sector. That’s good news. Management is ambitious about growth, but of course that comes at a price, with heavy cash burn to date.

Before the COVID-19 pandemic, we held an ambition to reach a £50 million revenue run-rate within 5 years (2025) and now that we've returned to growth following the initial impact from COVID-19, we've set ourselves the same target to achieve this by 2026.

My opinion - it’s taking longer, and costing much more, than originally planned, but I reckon CALL is getting there gradually. This update today is reassuring.

Something urgent has cropped up, so I have to park things for now, and head back to Bournemouth. I'll aim to do some more updates later, but it won't be until this evening I'm afraid. Apologies for any inconvenience.

All sorted now, so I can carry on writing more sections.

Countrywide (LON:CWD)

165p (down 10%) - mkt cap £54m

I’ve not looked at this estate agency business for a while, but have been reading Graham’s notes here from its trading update on 26 June 2020.

Half Year Report today, here are my notes;

Big beneficiary of Govt support schemes (furlough, business rates relief, deferred £44.6m taxes), and leniency from most landlords.

As a result, the Group traded positively at the adjusted EBITDA level and had strong liquidity through COVID-19….

Group income from continuing operations was £173.8 million (2019: £241.6 million); the Group continued to trade profitably with adjusted EBITDA(1) of £14.9 million (2019: £19.2 million(2)) in spite of loss of tenant fees of £8 million and COVID-19

That’s quite impressive, given what a calamitous period this has been with covid & lockdown.

Given that we know the property market seems to be recovering, stimulated by the Stamp Duty reduction, then it’s reasonable to assume business here should be recovering too.

Net debt - it’s good that the company fully discloses the short term benefit of tax deferrals, this is essential information that all companies need to disclose, even if it’s small to nothing;

As at 30 June 2020, the Group's net debt(3) was £47.3 million (FY 2019: £82.9 million) against available liquidity of £135 million. The underlying net debt, after adjusting for HMRC deferrals, was £91.9 million. Net debt/adjusted EBITDA(3) was 2.1x (FY 2019: 3.4x)

Exceptional items - once again are huge, as in recent previous years. This time it’s a £51.8m charge. This is mostly goodwill write-offs, but note the £3.2m wasted on fees re merger discussions with LSL.

Outlook - this is a cop out, they should be able to give guidance at this late stage in the year.

Current trading remains buoyant, with positive performance indicators across the Group. The Government's stamp duty holiday for properties up to £500,000 provides further stimulus to our principal markets. However, it is still too early to assess the long-term impact of COVID-19 on the economy, and specifically housing transactions and, as a result the Group is unable to provide guidance for the full year ending 31 December 2020.

Cashflow statement - gross cash has risen from £18.2m to £76.8m in the period, but this has been driven by drawing down £25m on its RCF bank facility, and the £44.6m taxes deferred. The taxes will have to be repaid by end March 2021, I think is the deadline, so this cash liquidity should be seen as temporary.

Borrowing facilities - an interesting topic, given that CWD has a weak balance sheet. However, the news today on a recapitalisation means that I don’t need to cover the now historic position. This is interesting below - maybe the debt fund put the company under pressure to recapitalise (and thereby ensure they get paid 100p in the pound, rather than a discounted figure in the event of insolvency?). I wonder what haircut (if any) the previous debt holders took, to exit their risk?

Since 30 June 2020, the composition of the Group's lending syndicate has changed and is majority owned by a specialist debt fund who have been part of the facility since September 2018, now controlling 79.5% of the Group's facilities.

Going concern note - I’ll skip this, because a recapitalisation is being done.

Balance sheet - NAV is £53.7m. I usually write off intangibles, which total £181.8m. That gives a very weak, negative NTAV figure of £(128.1)m. That’s clearly a bad position to be in, completely dependent on continued bank support. Hence it comes as no surprise that the business is being recapitalised.

Recapitalisation - in a separate RNS, titled Strategic Investment by Alchemy. Key points

Fully underwritten equity fundraise of c.£90m

If the Proposed Transaction is approved and implemented, Alchemy will hold between approximately 50.1 per cent. and 67.7 per cent. of the Enlarged Share Capital, depending on the results of the Open Offer and Tender Offer.

66,684,215 New Ordinary Shares at an issue price of 135 pence

There are 32.76m shares currently in issue, so this deal more than triples the share count, to c.99.4m shares, considerable dilution for existing holders.

... in urgent need of recapitalisation to reduce its net debt and lessen its exposure to its lenders.

I’ve been pointing this out for years!

There’s also a tender offer at 180p;

... an opportunity for Qualifying Shareholders who do not wish to invest further to tender their shares by participating in the Tender Offer

Revised bank facilities have been agreed, “covenant-lite”.

My opinion - this deal at long last makes Countrywide investable for me, although it doesn’t completely fix the balance sheet, which will still have negative NTAV. Insolvency risk is now largely removed, since once Alchemy has refinanced it, its shareholding would be too large for it to walk away.

There’s a chance that Alchemy might take it private at some point perhaps?

With the share price currently at 165p, it’s possible that the tender offer at 180p might be supporting that price in the short term. I’m happy to leave any clever arbitrage trades to traders. Personally I’d like to wait for the dust to settle, and look at it again once the fundraising deal has been done & dusted.

This deal greatly improves Countrywide’s prospects from precarious, to a more stable footing.

Note that of the £90m being raised, a staggering £8m is going in fees, despite Alchemy underwriting the deal.

.

All done for today. See you tomorrow, which will be up early, with few catchup sections.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.