Good morning, it's Paul & Jack here, with the SCVR for Friday.

Timings - it's Friday, so I'm taking things at a leisurely pace. Finish time estimated at 3pm.

Update at 14:50 - today's report is now finished.

Agenda -

Kape Technologies (LON:KAPE) - interesting, large fundraising at no discount

Renold (LON:RNO) - overlooked trading update from 16 Oct

Minds Machines (LON:MMX) - Jack's contribution, re accounting investigation

Tekmar (LON:TGP) - (I hold) - savage market reaction to a profit warning

Altitude (LON:ALT) - Full year results

I dropped Dp Poland (LON:DPP) from the running order, once I realised its shares are suspended (and it's a complete crock anyway!)

.

In case you missed it, here is the link to yesterday’s completed SCVR, which included a reader request section on Redde Northgate (LON:REDD) - which I (Paul) think might be potentially very interesting, so it’s worth a look, and a debate. I very much want to hear your informed opinions, if you’ve done proper research and have some insights. Hunches, or that you happened to have bought or sold at this or that price, is not of interest!

Good podcast - I really enjoyed this podcast from PIWorld, with Andy Brough and Richard Leonard, hosted superbly by the unflappable, charming, and highly knowledgeable/experienced Tamzin. It felt like sitting in the pub with a couple of experienced old hands, who’ve been in the market for decades, and full of insights. A reminder that mere striplings like myself, who’ve only been doing small caps for 20 years or so, still have much to learn!

Firstly let’s start with a couple of stragglers from previous days;

.

Kape Technologies (LON:KAPE)

Share price: 160p

No. shares: 158.5m (before placing) +59.2m new shares = 217.7m after fundraise

Market cap: £348.3m (after fundraising)

Fundraising

I’ve not looked at this company before, and don’t have a view on it, but a large fundraising caught my eye, so just thought I’d flag it up, as this could be interesting maybe?

Proposed placing to raise $100m - c. £77m, a big fundraising of about 30% of the existing market cap. Use of proceeds is unusual, mainly $72m to buy out the shareholdings of the founders of an acquired business, PIA, which Kape acquired in 2019.

.

.

o c. US$72 million to buy out the equity interests in the Company of Andrew Lee and Steven DeProspero (the "PIA Founders"), the two co-founders of Private Internet Access ("PIA"), a company acquired by Kape in 2019; and

o the balance to strengthen Kape's balance sheet and enable fast execution of further selective acquisitions, building on Kape's excellent M&A track record and continuing pursuit of growth.

The PIA founders have 6.64% of KAPE, which I make £16.8m or $21.7m. So it’s not immediately clear why they are being paid $72m to exit? Could there be some lucrative share options scheme, or similar? Ah, I've just found it, here we are;

On 16 December 2019, Kape completed the acquisition of PIA, a leading US-based digital privacy company (the "PIA Acquisition"). As part of the consideration, Kape issued, in aggregate, 10,500,726 new ordinary shares ("Initial Consideration Shares") to the PIA Founders, with a further 27,994,720 Ordinary Shares in aggregate to be issued to the PIA Founders over a two year period from closing ("Deferred Consideration Shares").

The Company and the PIA Founders have reached an agreement with respect to the sale and purchase of the Initial Consideration Shares and their right to receive the Deferred Consideration Shares, for a total consideration of approximately US$72 million (the "Purchase Agreement").

It just shows that checking the detail on deferred consideration creditors, is incredibly important.

Tax benefit - I’m not sure why this would be, but the company says it will save a lot in tax over the long term from buying out Messrs Lee & DeProspero (an apt surname there lol!)

As a consequence of buying out the equity interests of the PIA Founders, Kape expects to realise an expected tax benefit of approximately US$50 million over the next 15 years.

Trading update included within the placing announcement -

Kape announced its interim results for the six months ended 30 June 2020 on 15 September 2020. In the three months to 30 September 2020 (Q3), Kape's trading was at the upper end of management's expectations. User growth in the Privacy division continued to ramp up, reaching a run rate of 14 per cent. annual growth during Q3 2020. The Company also successfully launched several product development initiatives and experienced continued strong user retention. Revenues for the year ending 31 December 2020 are expected to be between US$120-123 million, with adjusted EBITDA in the same period expected to be US$35-38 million.

Support of major shareholder - of the $100m fundraising, the major shareholder seems to be underwriting most of it;

The Company's majority shareholder, Unikmind Holdings Limited, has entered into a subscription agreement with the Company, pursuant to which it has agreed to subscribe in the Placing for shares worth up to US$72 million at the Placing Price (the "Subscription Agreement"), although this figure may be reduced depending on demand generated in the Placing.

PrimaryBid - there’s a separate raising through this platform.

Result of Placing & Retail Offer - this was published on Thursday morning. It’s been upscaled from $100m to $115.5m. The price is 150p, a negligible discount to the market price when it was announced - a strong sign.

The major shareholder bought 28.5m shares in the end, and now has 65.0% of the total - good or bad? You decide.

My opinion - none, as I don’t know anything about the company. However, this fundraising looks noteworthy, because it is;

- Large relative to the size of company

- Negligible price discount, so clearly strong demand - the roadshow must have been convincingly good

- Major shareholder standing its corner

- Buying out holders of rights to future shares, suggesting that maybe the company thinks its shares are likely to rise?

- Sexy, tech sector

I’m just flagging it, as something that readers might want to look at, if you understand this sector, which I don’t. It smells good to me, for the above bullet point reasons.

For more information, see a recent PIWorld video results presentation here.

I’d like to see proper numbers, not EBITDA numbers, when they are issued.

As others have commented, Israeli/international tech businesses can be a hot spot of expertise & innovation, so they’re worth looking at with an open mind, I reckon.

.

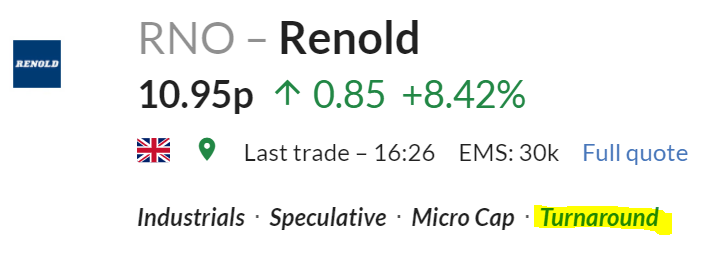

Renold (LON:RNO)

11p - mkt cap £24m

(I hold)

A tiddler that put out a trading update last week, 16 Oct 2020, which we overlooked at the time, due to being busy.

Renold, a leading international supplier of industrial chains and related power transmission products, today issues a period end trading update covering the six months ended 30 September 2020 (the 'period') ahead of announcing interim results on 11 November 2020.

Renold delivered a resilient performance in the first half despite its markets being significantly impacted by the Covid-19 pandemic. The business remained profitable throughout the period and achieved a significant reduction in net debt of £10.2m to £26.4m (FY 2019/20: £36.6m), despite sales revenue down 17% on the prior year, at £82m.

The Group continued to benefit from a combination of improvement in the strategic cost base and the productivity gains made in recent years, together with tactical short term cost saving measures. These enabled the Group to achieve a positive operating margin for the period.

Reflecting the impact of global shutdowns and lower levels of demand across a number of the Group's markets, order intake in the period was down 21% year on year to £76m. However, trends through the period end suggest that order intake should continue to slowly improve, albeit at levels below the prior year in the near term.

Whilst considerable uncertainty remains, Renold benefits from significant geographic, customer and sector diversification. The Group's ongoing focus on cost control, operational efficiency, productivity, and cash management is helping to offset the subdued demand and should enable the Group to make continued strategic progress in the second half.

My opinion - I last looked at Renold here on 24 July, and am thinking along the same lines today. It’s a lowish conviction, small long position in my portfolio - mainly because I think it might be potentially interesting in the future, but don’t have enough information to commit to a full sized position at this stage.

It’s fine to be unsure about things, actually it’s good to be unsure, if the facts & outlook are not clear.

I see some potentially promising signs here though, so am keeping an eye on Renold.

It's interesting that the Stockopedia computers have picked up on the turnaround potential here. Although I heard a McKinsey advertisement today say that 70% of turnarounds fail, based on their research, a thought-provoking point, and sounds about right to me. Mothercare springs to mind!

.

.

** This next section contributed by Jack **

Minds Machines (LON:MXX)

Share price: 4.50p (+9.22%)

Shares in issue: 902,033,984

Market cap: £40.6m

(Jack writing)

Statement re: Contract, Investigation & Board

Minds Machines (LON:MMX) owns and operates a portfolio of top-level domain assets.

It focuses on website addresses based around geographic domains (e.g. ‘.london’), professional occupations (e.g. ‘.law’), consumer interests (e.g. ‘.fashion’), lifestyle (e.g. ‘.yoga’), outdoor activities (e.g. ‘.fishing’) and other more generic names.

On 9 October the group announced a formal investigation into revenue recognition regarding a contract. This had no cash impact but damaged the share price, which dropped nearly 50%.

Today the group updates on that contract investigation and concludes that revenue has been incorrectly recognised.

Cash of $1.125m was received in connection with the specific contract and revenue of $938,000 was recognised in FY-2019. Any cash sums initially received should have been classified as a deposit against future sales and then recognised as revenue as the partner made sales to end-users. It booked sales too early.

To date, the partner has made $201,900 of end-user sales under the contract (as opposed to the $938,000 recognised).

In addition, the investigation has identified two additional contracts entered into in FY-2019 totaling $790,000 where receipts were incorrectly categorised as revenue.

Perhaps the shares are up today because the CEO and CFO have both resigned with immediate effect. Guy Elliott, Non-Executive Chairman has agreed to assume the role of Executive Chairman on an interim basis and former COO Tony Farrow is the interim CEO.

Bryan Disher, independent Non-Executive Director will assume the role of interim CFO.

The group’s proposed tender offer of £3m has also been postponed.

Conclusion

Clearly MMX is trying to draw a line under an accounting issue that has harmed its credibility and damaged trust with shareholders. The investigation has led to another two incorrectly recognised contracts.

It looks like the auditors, Mazars LLP, totally missed this in its auditing of revenue recognition. It’s approaching the 9th year that Mazars has acted as Independent Auditor here, so I wonder if other contracts were missed in the past?

And you might expect existing board members to have discussed such policies, yet they continue to be appointed in interim roles. I note that FY19 was ‘the first year the Group has presented an Audit Committee Report. In future the content and detail of the Audit Committee Report may be expanded, and formal procedures will be put in place to assess the effectiveness of the Audit Committee’s role.’

Clearly this is needed.

In fact, the chair of the Audit committee is none other than Bryan Disher, who has been appointed the interim CFO. Just as a reminder, this committee meets throughout the year to discuss the quality of the company’s financial reporting, and its internal control environment including internal control over financial reporting...

MMX is cash generative but corporate governance questions remain, in my view. I don’t agree with the market today on this one. It’s a big stock market, with lots of companies to invest in - so why go near one that can’t keep on top of its revenue recognition?

Good luck to holders, anyway - perhaps this really is drawing a line under the issue.

.

Tekmar (LON:TGP)

Share price: 42.5p (down 41%, at 12:40)

No. shares: 51.3m

Market cap: £21.8m

(I hold)

CEO’s Review, Trading Update & Change to Year End (profit warning)

There’s been a brutal price fall on this profit warning, it was down over 50% earlier this morning, and has recovered a little to down 40% at lunchtime. Also noteworthy is the huge volume, and number of trades today. This is normally thinly traded, due to it being a micro cap, and about two thirds of the shares being locked up with major holders;

.

.

Given that 5.4m shares have already printed today (at 12:51), over 10% of the company, plus any delayed prints for larger trades that might appear at the end of the day, then it looks as if at least one institutional holder must be liquidating their position in the market, and it looks as if private investors might be buying up the stock. That often happens when small caps disappoint - institutions dump their holdings, and there’s a shift in ownership towards private investors. This type of situation can be a buying opportunity sometimes, because exiting institutions have to force the price down very hard, in order to attract enough buyers to clear them out. Then once the big sellers have gone, the price is free to recover at least somewhat. Therefore I have to decide whether to top up my position, or not. Or whether to sell up & move on. Or do nothing. It’s only a tiny position in my portfolio anyway, I bought at about 110p, thinking it looked good value, and based on previously upbeat management outlook comments. So I'm not very happy.

Looking back, I reviewed the results for FY 03/2020 here in early August. Re-reading my notes, the figures were OK, and the outlook comments seemed really upbeat. Which does raise the question as to why performance has suddenly deteriorated, and can we trust management commentary? Or is the new CEO kitchen-sinking expectations to set the bar low, and blame problems on previous management? Who knows. Outside investors never really know what’s going on in any company. Only insiders know the true picture, in my view.

CEO Review - is ongoing, results to be announced with H1 report on 1 Dec 2020. This is focused on profitability, through cost savings & efficiency gains. Sounds good to me. Although this sort of reorganisation usually involves some up-front costs, and exceptional write-offs.

...Alasdair and his executive management team are currently working through the details of a business reorganisation which will deliver operational cost savings and further integration efficiencies across the Group, putting the business on a stronger footing and in the best position to grow profitably in the expanding global offshore energy markets.

Trading for the 6 months to 30 Sept 2020 -

During HY21 the Group has experienced some short-term delays in contract awards and sales order intake as a result of the COVID-19 disruption. This has resulted in revenue in HY21 being 10% lower than HY20.

Notwithstanding the disruption to project timings, the visibility of the project pipeline is strong and opportunities in the offshore energy market continue to grow and the focus is now on positioning the Group to maximise on this potential.

That’s a bit disappointing, but does it justify the company halving in value? Seems rather extreme.

Competition - new entrants emerging. This may have spooked some investors, as this could put downward pressure on future pricing & hence margins;

The long-term structural growth prospect of the global offshore wind market is now attracting new entrants and the Group is seeing increasing competition in Tekmar Energy's core market for TekLink. However, through ongoing investment in product development, its new Generation 10 product will help the Group retain its strong market position. Generation 10 will be launched in Q1 2021 and provides a more tailored solution to meet the more demanding requirements of future projects.

Guidance remains withdrawn - not helpful. I would prefer a range of possible outcomes, rather than no guidance at all;

Whilst the Board remains confident that the future of the business remains strong, due to the ongoing impact of COVID-19, the directors consider it prudent to continue to refrain from providing financial guidance for FY21 until patterns of demand stabilise.

Change of year end - the reasons given are logical, but the timing is terrible. Nobody bats an eyelid at year end changes when a business is going well. But to coincide with a profit warning, does raise suspicions with some investors.

The Board believes that it is in the best interest of the Company and shareholders to change its accounting reference date and financial year end from 31 March to 30 September.

The seasonality in the Group's core markets creates a peak of activity around the current financial year end and short-term delays to contracts can have a significant effect on the Group's full year results. Moving the year end to 30 September will allow the management to focus its full attention on the business during its busiest trading periods and the provision of financial results at a more normalised period end.

We’ll now get an 18-month financial “year”, to 30 Sept 2021. I really dislike year end changes, as it messes up the comparability of numbers in the historic tables of multi-year information, such as the StockReport. Although if the year end is causing operational problems, then I can see it makes sense to change it.

My opinion - the share price fall looks overdone. However, I’ve decided not to buy any more, because I’ve got better opportunities on my buying list in larger, more liquid things, where I have higher conviction.

I imagine the high StockRank will lurch down, although there’s only 1 broker covering it, and they might suspend forecasts, in which case the StockRank computers won’t realise that forecasts need to be reduced. This is where manual intervention can be helpful in unusual times like this - i.e. you cannot rely entirely on an automated stock selection system, when forecasts are wrong, or out of date, or withheld completely due to chaotic & unpredictable macro conditions.

.

.

Altitude (LON:ALT)

Share price: 11.25p (down 4% today, at 14:13)

No. shares: 70.1m

Market cap: £7.9m

Unaudited full year results and operational update

As you can see from the chart below, this share has failed to live up to the expectations of creating an online portal for the promotional goods sector in the USA. Is it a busted flush, or could there be an opportunity here? Let’s find out!

.

.

Note that the StockRank system was very sceptical about this share, even during the boom times when lots of private investors piled into this share, thinking the future was bright. StockRanks are usually low for jam tomorrow type of shares, and personally when I ignore a very low StockRank, I usually end up regretting it! What a low StockRank is telling us, is that there’s little to no support from fundamentals, and the share price is therefore based on hype. Occasionally a share like this does deliver, and becomes a multi-bagger though, hence why it’s interesting having a look at the more credible-sounding stories.

Altitude Group plc (AIM: ALT), the operator of a leading marketplace for personalised products, is pleased to announce its unaudited results for the 15 month period to 31 March 2020….

This period is largely pre-covid, so the numbers are academic now, but just for the record;

- Revenues £8.3m (up 188% due to an acquisition called AIM)

- (Heavily) adjusted operating profit of £461k

- Loss before tax of £(2.7)m

- Plus a £(3.3)m loss from discontinued operations

Balance sheet at 31 March 2020 - looks reasonably OK, providing there are not more heavy losses which could tip it into a more precarious position. As at 31 March the figures look OK, with NAV at £9.1m less £5.9m intangibles, giving NTAV of £3.2m - this includes net cash of £2.35m

Going concern note - says that on base case forecasts, things will be OK. On a more severe downside scenario, the business would need to raise more cash, hence there’s a material uncertainty over going concern. This is a big red flag, and means this share should be seen as particularly high risk.

The Directors consider that such a severe yet plausible scenario indicates the existence of a material uncertainty which may cast significant doubt on the Group's ability to continue as a going concern.

Outlook comments;

Due to the uncertainty it remains too difficult to quantify our short-term profitability whilst the restrictions due to the pandemic continue and the rate of prospective market recovery remains uncertain and therefore we remain unable to give guidance at this time.

The Group has recourse to substantial mitigating factors not currently included in the forecast model which supports the adoption of a going concern basis of preparation.

We remain excited and confident in the prospects for AIM Smarter and we believe that some of the practices and learnings from this period will make us stronger in the future. We have maintained our AIM distributor member base throughout this period representing circa. 8% of the US promotional products market and we believe that as soon as Covid-19 is behind us we will rebuild our revenues and profitability quickly.

My opinion - I looked briefly at promotional products company 4imprint (LON:FOUR) in the comments section below. It shows that demand is still weak, but is steadily improving. Therefore there seems good evidence that this sector is indeed recovering, which I imagine would also help ALT.

I’m not fully convinced that ALT’s business model is any good. Therefore we’re having to assess what impact & recovery potential there might be from covid, but also whether the business has good potential or not. I don’t have enough reliable information to form a judgement on that.

Also, the uncertainty over whether it has enough cash to survive, and the lack of guidance in today’s update, is too much for me. I feel at this stage it would just be a punt, not a reasoned decision, to buy this share. So I’ll pass. I’d be more inclined to have a punt once it’s done a placing, to remove the insolvency risk.

.

It's been a bumpy week, so I hope you're not too stressed out!

We have the US Presidential election to entertain & enthrall us next week.

Plus the worsening covid situation. I was hopeful when UK deaths reduced down to single digits per day a few weeks ago, but am sad to see them now back up to a hundred or more each day. It's a huge quandary as to what Govt policy should be, and how to handle this. I certainly wouldn't want to be in a position of having to make such big decisions, hence why I temper any critical thoughts I might have of decisions & decision-makers.

Let's enjoy the weekend!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.