Good morning, it's Paul here with the SCVR for Monday.

I've done some work over the weekend, catching up on some of last week's backlog, as follows;

Agenda -

De La Rue (LON:DLAR) - Half year results

Carclo (LON:CAR) - Interim results

Tungsten (LON:TUNG) - H1 Trading update (profit warning)

Michelmersh Brick Holdings (LON:MBH) - Trading update

Tremor International (LON:TRMR) - Positive trading update

Victoria (LON:VCP) - Interim results

.

Today's report is now finished.

.

Mello Monday - today!

Yes, it’s that time again. David Stredder’s interesting & enjoyable Zoom investor evenings are proving very popular. Most of the 500 available places have already been filled, with annual passes selling well.

I’ve been asked to appear on the BASH (Buy, Avoid, Sell, Hold) stock discussion panel tonight. Also I’ll be briefly plugging my sister-in-law Lauren’s Christmas harp concerts on there too (see below). There are some really interesting speakers and companies that will be giving presentations.

3 hours might seem like a long time, but the time flies, and of course being at home, we can wander around with headphones on, doing other things at the same time, if we wish. So a really flexible format.

Details & tickets here. NB. Discount code MMStocko21 will get you half price tickets!

Harpy Christmas

My sister-in-law, Lauren Scott, is a professional harpist. As with most other musicians, literally all her bookings were cancelled this year, due to covid restrictions. Christmas is usually her busiest time, with many live performances of Christmas carols & traditional tunes. So Lauren has decided to play live concerts on Zoom instead, for a modest fee.

Here is an example of Lauren playing Xmas tunes. I can’t tell you how relaxing & fun a Christmas singalong to the harp is, as usually my family enjoy this every year in person, but we've decided it's best not to meet up this year.

The harp has a remarkable calming effect I find, as you can tell from this short video of Lauren playing Xmas tunes;

.

.

Please forgive me for plugging a family thing, but I’m sure many of you would really enjoy Lauren's online concerts over the festive season, and it would also help out a self-employed musician who is tremendously talented & experienced, but as with so many people in the arts sector, suffering a major loss of income this year.

I’d personally be so grateful to everyone who signs up (and hopefully spreads the word on social media too), as it helps my family keep the music playing in these exceptionally difficult times, and will bring pleasure to others too.

More details are here, including how to buy tickets, probably too cheap, but we weren’t sure what level to set it at, as it’s a new idea.

You can also “sponsor” a tune, and Lauren will read out your personalised message to your loved ones before playing it live - e.g. dedicate the tune to family that you can’t meet up with this year, and they will hear your message, from anywhere in the world.

I asked Lauren to record her own introduction, here, which explains it better than I did above!

.

There are quite a few backlog items left over from last week, so I’ll rattle through those that look most interesting now.

De La Rue (LON:DLAR)

Share price: 166p

No. shares: 195.0m

Market cap: £323.7m

De La Rue plc (LSE: DLAR) ("De La Rue", the "Group" or the "Company") announces its half year results for the six months ended 26 September 2020 (the "period", "H1" or "half year"). The comparative period was the six months ended 28 September 2019.

De La Rue has been a very interesting, and strong turnaround this year. It’s gone from looking almost bust, to a success story, with lots of costs stripped out, new contracts won, and an equity refinancing completed.

Note that the share count rose substantially, from 114m to 195m shares in issue earlier this year, in a rescue refinancing. Another example of a company with a stretched balance sheet, whose shareholders paid the price, with substantial dilution. With almost twice as many shares in issue now, the share price might struggle to reach previous highs, since that would be almost double the equivalent market cap.

.

A few key numbers;

- Revenue (adjusted) is down 15.1% to £174.7m in H1

- Adj operating profit up 596% to £15.3m

- Adj EPS 6.5p (LY H1: (1.4)p) - a big improvement. If we simplistically double that for a full year, so 13p EPS, then the PER would be 12.8 - looks cheap

- Net debt greatly reduced to 21.6m, vs 170.7m LY - that’s improved from danger territory, to comfortable. I wonder if any tax, or other creditors have been stretched? The main benefit has come from the £100m equity raise in July

- Adjustments relate to the run-off of UK passports contract, and a disposal of the international identity solutions subsidiary

- Huge cost-savings of £36m annualised

Outlook -

"Our two ongoing divisions, Authentication and Currency, are performing well. We are building strong order books and have secured a number of important strategic wins in the first half of the year.

"Trading for the financial year 2020/21 has been positive, with the outlook for revenue, adjusted operating profit and net debt for the full year in line with the Board's expectations."

Unfortunately, there’s no footnote telling us what those expectations are. Looking at the Stockopedia broker consensus forecasts, they’ve only got 2 brokers submitting forecasts, which is surprisingly low. Unfortunately that’s been caused by Mifid II, which seems to have been counter-productive, in greatly reducing the amount of research produced.

FY 03/2021 consensus is 11.75p, so the 6.5p achieved in H1 leaves only 5.25p to achieve in H2. Could we end up seeing a beat against FY expectations in due course? If they’re ahead at the end of H1, with upbeat outlook comments, then there's a decent chance of a beat.

Forecasts have come down a lot, which might indicate upside potential as the economy hopefully begins to improve, and maybe normalise as we progress through 2021.

.

.

Tobacco authentication - this looks a very interesting growth area. A friend who is bullish on DLAR, and who normally talks sense, says this could be a decent money-spinner for DLAR in future, as it’s one of only a few companies authorised to do this.

De La Rue is targeting Authentication division revenues of £100m by FY 2021/22, with strong operating margins and strong year-on-year growth in this division during the three-year period of the Turnaround Plan, as more countries adopt tobacco tax stamp schemes to comply with the World Health Organisation (WHO) Framework Convention on Tobacco Control (FCTC).

Covid immunity certificates are another innovative area under discussion with Governments.

Currency printing - DLAR is a leader in this field too, with special polymers. Only 3% of the world’s banknotes by quantity (but 12% value) have moved to polymer. So there’s a big market opportunity as those figures rise.

Cashflow/dividends - some future cash outflows are mentioned in the commentary, for contract rebates, and restructuring costs. However;

… by the end of the Turnaround Plan in FY 2022/23 we aim for the Group to be generating positive free cash flow and capable of supporting sustainable cash dividends to shareholders.

Liquidity - ample. Figures are given on bank covenants too, which also look to have plenty of headroom. Therefore I have no concerns about solvency. It looks secure now.

Pension deficit - has almost disappeared on an accounting basis, due to strong asset prices more than offsetting low interest rates.

The actuarial valuation is rather different - a funding shortfall of £142.6m at 31/12/2019, rolled forward to 30 April 2020 when it rose to £190m - yikes.

However, equity markets have risen a bit since end April (although remember April saw a large bounce from the March lows), so this deficit could come down, depending on how much of the scheme assets are invested in equities.

Deficit funding payments are a hefty £15m p.a. Until March 2023. That’s highly material to the valuation, and when you take this into account, the low PER is perhaps justified.

With interest rates probably now zero for the foreseeable future (maybe even possibly following Europe & Japan into negative rates, who knows?) then investors do need to adjust the valuation to take into account these large ongoing cash outflows.

Balance sheet - looks OK, but when you adjust the pension deficit for what it really is (very much larger than it appears), then the £130m net assets would disappear.

Now that the company is profitable again, and raised £100m in fresh equity, its balance sheet strikes me as adequate. So no concerns overall for me.

Cashflow statement - it’s not really generating any cash as yet, but that’s explained in the commentary. The big items are the equity raise, and use of that to repay debt.

My opinion - I thought it looked cheap until I was reminded of the substantial cash outflows in the coming years in order to address the pension deficit. Sometimes I wonder if some investors might buy into shares like this, thinking they’re cheap, only to then realise how material the cash outflows re pension funding are, some time later?

Overall, the turnaround at DLAR looks excellent, and the company seems to have some really good growth potential in areas like tobacco certification, polymer banknotes, etc.

Therefore I reckon it looks pretty good overall, and I can probably live with the pension deficit, although it undoubtedly limits the upside.

I don’t see any reason to rush in and buy at 166p, because I think there are better upside opportunities with other shares. If it dropped say 20% from here, then I think that would be more compelling.

.

Carclo (LON:CAR)

15p - mkt cap £11.0m

As I’ve mentioned before, several times, we need to be very careful with this one, because its finances are highly precarious - specifically a gigantic pension deficit, and far too much bank debt. Also its aerospace division is not exactly in a buoyant sector (although it is only a very small part of the group)

On the upside, there seems to be a decent business here, underlying EBITDA in H1 being £4.6m (down from £6.3m).

Looking through these interim results to 30 Sept 2020, it strikes me as a very risky situation - this one is for gamblers only.

Net debt is down a bit, but still too high, at £24.4m (excluding lease liabilities)

Pension deficit has shot up from £37.6m at March 2020, to £58.1m at Sept 2020. This was caused mainly by the reduction in discount rate from 2.3% to 1.5%, used to value liabilities. This is another good example of just how toxic pension schemes can be at the moment, with just a small change in assumptions causing chaos to the balance sheet here with Carclo.

My opinion - I cannot see any value in the equity here. It looks as if all the group cashflows will probably be needed to feed the pension scheme, and gradually reduce excessive bank debt. What’s left over for shareholders? Probably nothing, as no divis can be paid before July 2023 under a funding agreement.

Shareholders need to pray for a dramatic improvement in trading. Then there could be leveraged upside on the equity. Without that, this looks a zombie company, whose cashflows are needed to feed the pension fund, and keep the bank at bay. Once it's stable enough, an equity fundraising looks inevitable, to reduce debt.

Very high risk.

.

Tungsten (LON:TUNG)

28.6p - mkt cap £36.1m

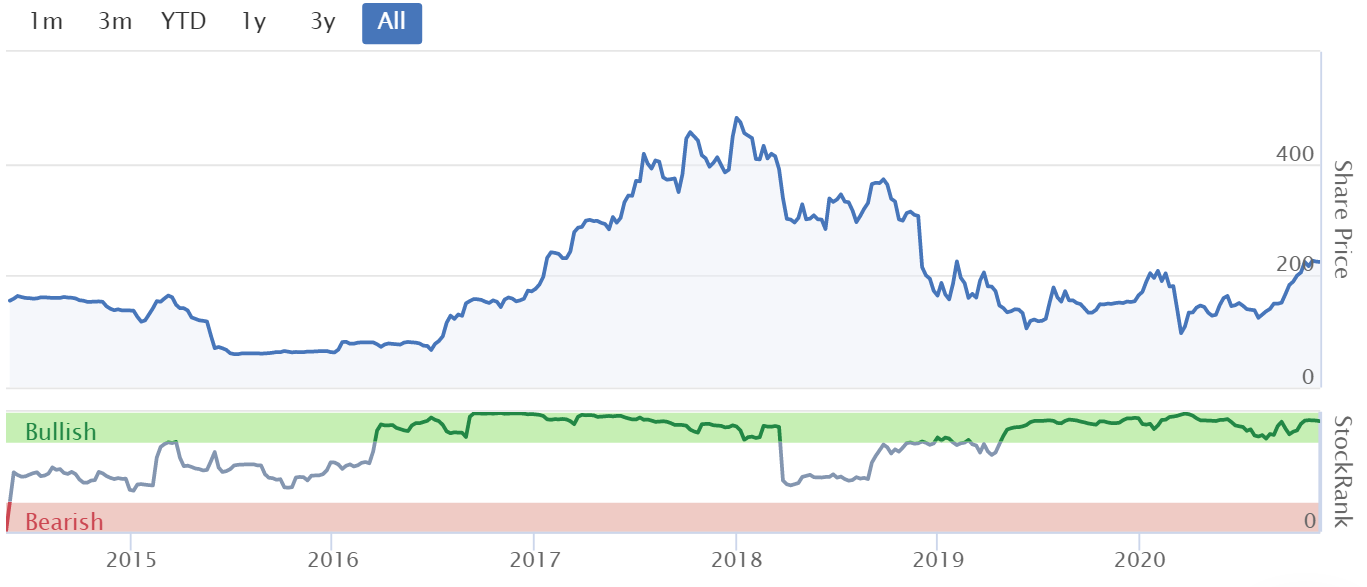

How about this for a dismal track record;

.

This invoicing software company has a 30 April 2021 year end, so it updates us on performance in H1 to Oct 2020.

Key points;

- Challenging market conditions due to covid

- Transaction volumes down 7% in H1

- H2 expected to also see reduced transaction volumes

- Longer sales conversion cycle, expected to continue. 4 new clients won in H1

- Guidance - revenues for FY 04/2021 expected to be similar to FY 04/2020

- H1 revenues expected to be £18.0m excluding TNF, whatever that is. Please would RNS writers include a footnote for every abbreviation used!

Profit warning -

Underlying adjusted EBITDA is now expected to be not less than £3.2m, materially lower than previous guidance.

Adjusted EBITDA was £2.7m last year, FY 04/2020. Note that TUNG capitalises about £2.8m p.a. in development spending, so in the real world, it’s trading around cashflow breakeven at best.

Cost-cutting has been done, expected to reduce annualised savings of £4m in future. Very sensible in the circumstances

Net cash - remains tight, at £1m (£3m cash, less £2m borrowings)

Outlook - hopes that transaction volumes will improve

My opinion - you really do have to be an optimist to own this share, given its track record. Fair enough, this year has been really difficult because of covid.

TUNG has been able to cut costs, so I don’t see any risk of insolvency for the time being. Maybe someone might come along and buy it, who knows? Software companies sometimes attract generous bids, for their recurring revenues, client relationships, cross-selling value, and removing costs. As a standalone business though, it’s very difficult to see much value in Tungsten. It’s not really convincing as a covid recovery share either, because it was trading poorly before the pandemic too.

.

Michelmersh Brick Holdings (LON:MBH)

111p - mkt cap £104m

As with so many cyclical companies, this has had a big surge on the recent good news re vaccines.

Although it’s not much more than a blip on the 3-year sideways chart;

.

.

This is the problem with markets in the last few years. Investors want growth, not value. So traditional companies making bricks, are not likely to excite people enough to generate much upside at the moment, or ever.

I like value shares that churn out cashflow, and pay great divis, but the divis here seem lacklustre.

Trading update

Michelmersh Brick Holdings Plc (AIM: MBH), the specialist brick manufacturer, today announces a trading update ahead of its final results for the year ended 31 December 2020.

This bit below sounds encouraging, and could have good read-across for the whole housebuilding sector, as things seem to be getting back to normal. Albeit boosted by the temporary Stamp Duty reduction;

Trading performance of the Group has been resilient since June 2020 and this has continued through November. Current production capacity is back in line with pre-Covid levels and Group turnover for the months of July to October was 7% ahead of the equivalent period in 2019. The Board now expects that underlying revenue and profit for the Group will exceed market expectations for the 12 months ended 31 December 2020.

We’re not told by how much it will exceed market expectations, nor what market expectations are!

Furlough funding of £0.5m is being repaid to the Government.

I still don’t know the full reasons why some companies are repaying furlough monies. Is it a social conscience, a legal requirement, so they can pay divis without a backlash, to generate positive PR? I have no idea. But it’s surely a good thing that some companies are repaying taxpayer support, well done to Michelmersh, whatever the reason(s)!

Net cash - strong cashflow in recent months. Net cash will be positive at 31 Dec 2020, versus net debt of 6.5m at 30 June. Very good.

Dividends - 2.25p will be paid in June 2021, wrt. FY 12/2020.

My opinion - a good solid company. Looking at forward earnings, and asset backing, the current price strikes me as fair. Hence I cannot see any reason to rush out and buy (or sell). I think this is possibly the type of share to vaguely monitor, and buy on any big sell-offs, on the basis that it should recover whenever something goes wrong either internally, or on the macro side of things. Bricks are always needed, after all.

.

Tremor International (LON:TRMR)

Share price: 293p (up 27% at 12:23)

No. shares: 133.2m

Market cap: 390.3m

Tremor International Ltd (AIM: TRMR), a global leader in video advertising technologies, provides an update on trading for the year ending 31 December 2020, following a period of record revenue and profit growth.

It’s achieving strong organic growth -

Tremor continues to drive substantial customer momentum in the second half of the current financial year, demonstrating strong organic growth despite the impact of Covid-19. Revenues generated across October and November 2020 were the highest in the Company's history. Overall, it is anticipated that the Company will now achieve 37-43% revenue growth in the second half of 2020, compared to H2 2019.

Substantially raised guidance for FY 12/2020 -

US dollars | Revenues | Net revenues | Adj EBITDA |

Oct 2020 guidance | $340-360m | $30-36m | |

New guidance today | $390-400m | $171-175m | $50-52m |

.

That’s a 55% increase in guided adj EBITDA, taking the mid-point of each range. That strikes me as a highly impressive rise, given that it’s coming near the end of the financial year. At this late stage of FY 12/2020 I would expect tweaks to guidance, not a >50% increase!

The share price has responded very positively, up 30% as I type this at 08:44, the day’s biggest riser at the moment. Well done to shareholders!

What’s caused this strong growth? It seems to be 3 particular services, see this table, showing stunning growth;

.

It says the current growth trend is set to continue. If so, then it sounds like things could get exciting here.

Virtual demo - I have no idea what services Tremor offers, so this online product demo might be worth attending, to learn about the company;

Tremor will also be demonstrating the capabilities of its cloud-based platform on a finnCap Tech Virtual Demo for Institutional Investors on Wednesday, 9 December at 3.00 p.m. UK time. Please contact IR@finncap.com if you would like to join. This will be recorded and subsequently available to all investors at Tremor's Investor Relations website and https://www.finncap.com/sector-expertise/technology

My opinion - none, as I don’t understand the business at all. The only thing I would caution, is that in the past the bumper earnings generated in this sector have tended to be transitory. Google or someone else suddenly changes an algorithm, and that clobbers earnings at companies which were milking it in some way. Or regulations change, switching off a cash cow.

Therefore, my main worry here would be whether Tremor’s profits & growth are sustainable? Substantial Director selling can often be a good indicator that they’re probably not, so that’s worth checking out. The huge growth that seems to have appeared from nowhere, in its 3 new product areas almost looks too good to be true. If profits appear so quickly, as if by magic, then again, how sustainable are they likely to be?

On the plus side, there’s a brief update note out this morning from Finncap, which points out that Tremor is priced at, “a vast discount to its US peers”. The broker has a 700p price target on it.

Must admit, I’m tempted to take a small, speculative punt on Tremor.

The company seems to have been able to reinvent itself, after things went wrong before.

.

.

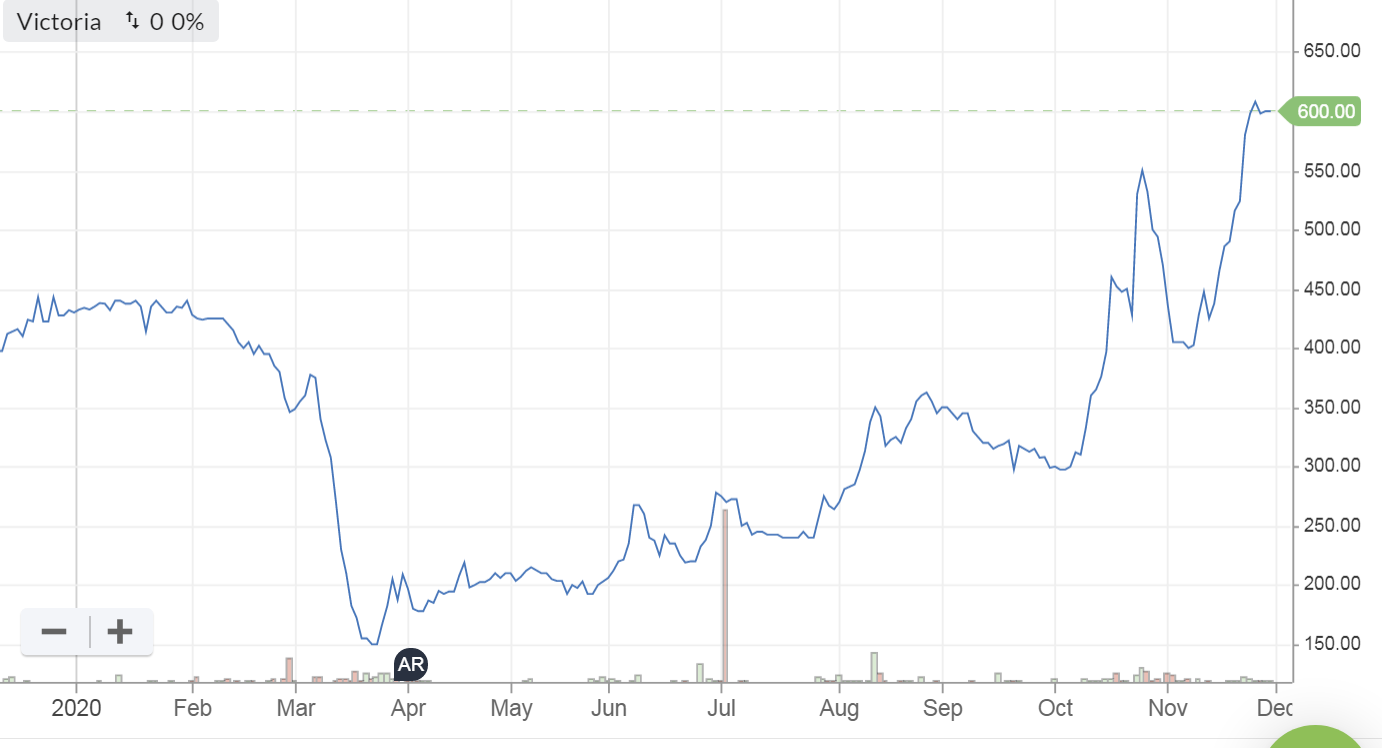

Victoria (LON:VCP)

Share price: 610p (up 1.7%, at 09:54)

No. shares: 116.85m

Market cap: 712.8m

Victoria PLC (LSE: VCP) the international designers, manufacturers and distributors of innovative floorcoverings, is pleased to announce its interim results for the 27 weeks ended 3 October 2020.

This share has enjoyed a strong rebound in recent weeks, along with almost everything else of a cyclical nature.

The headlines for this RNS motivate me to read more;

Strong Post-Lockdown Recovery and +300bps Margin Growth

Current Trading Significantly Ahead of Market Expectations

These interim results include at least 2 months of lockdown, and the recovery period afterwards, so I’m not expecting great figures.

In the circumstances, these figures look resilient -

.

.

As a general point, we should remember that covid lockdown trading will usually include substantial help from Govt schemes - e.g. furlough, business rates holiday, tax deferral, possibly grants & loan guarantees, and equivalent schemes in overseas operations.

Net debt - whilst still rather too high for my liking, bear in mind that 3.3x EBITDA is not outrageously high. Also it is covenant-free bonds (July 2024), so very much safer debt, than bank debt. A very smart move by the company as it turns out, with lucky timing just before covid hit.

Post lockdown - record performance, with +9.2% LFL revenue growth. This mirrors what other companies in home improvement have been saying - that lockdown has triggered a surge in households wanting to spruce up their homes.

Margin improvement of 300bps described as “unprecedented”, due to efficiency gains implemented last year

Substantial investment by Koch Industries (a large US based conglomerate) - previously announced, this is just a reminder. Could this be a precursor to a full takeover bid, I speculate?

Outlook - ooh look at this, it's rather good!

Although erratic government actions make it difficult to provide formal guidance, the Board does expect the full year outcome to be well ahead of current market expectations.

The strong demand we are currently experiencing for our products is expected to continue due to consumers prioritising spending on their home environment, supported by some of the highest household savings rates on record. As a result, meaningful organic growth is expected to continue into the New Year.

Pity we’re not given a footnote to tell us what market expectations are. It really does help when companies provide that information. I’m told that some brokers push back against this idea, which is awful in my view. Why on earth wouldn’t you want investors & potential investors to be given helpful facts?

Acquisitions - a worked example is given for how Victoria has theoretically got the flexibility to finance acquisitions up to £700m, based on an acquisition multiple of 7x EBITDA, partly funded using debt, and earn-outs. This looks credible. Victoria has been highly acquisitive before, and it seems that's set to continue.

Adjustments to profit - this is mostly reversing out amortisation of acquired intangibles, i.e. goodwill, so that’s absolutely fine by me, I think valuing the share using a multiple of adjusted earnings is sensible.

Finance costs - debt interest is quite considerable, consuming not far off half of the adjusted operating profit, worth bearing in mind.

Balance sheet - relies heavily on bonds to finance the business. Some figures;

NAV: £261.7m. However, if we remove the £433m intangibles, then NTAV is negative, at £(171.3)m. Deferred tax liabilities seem to be mainly related to intangibles, judging from note 19 in the last Annual Report, so I’ll remove that too, which takes NTAV to £(101.3)m - not good, but bulls would argue that the business generates enough cash to make that a tolerable position.

I think given its resilient performance through covid/lockdown, then the debt is more tolerable that I previously thought. Also, as mentioned above, it’s very well structured, as covenant-free bonds. The only risk is if the July 2024 refinancing date happens to coincide with a major financial crisis.

Working capital - looks very healthy, with a Current Ratio of 1.94. The business is funded by long-term creditors, of £661m, which includes lease liabilities & deferred tax.

Overall, I would much prefer positive NTAV, and less reliance on debt. But the way things are structured, is deliberately designed to leverage the upside for equity. Providing nothing serious goes wrong, then the risk is probably tolerable. The structure has proven itself well during the intense stress of covid/lockdown, which bolsters my confidence.

My opinion - it’s all pretty impressive in my view. Victoria has really proven the resilience of its business model, and that gearing can work, if it’s structured carefully, i.e. not subject to the whims of bank managers, or external events triggering covenant breaches.

Presentation slides for today’s interims can be found here.

I think the recent strong recovery in share price is fully justified. Unfortunately, I didn’t quite muster the courage to buy near the recent lows, which is a pity, but there we go. The current share price looks about right for now, so I’m not going to chase it any higher.

.

.

That's it for today. See you tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.