Good morning, it's Paul here with Thursday's SCVR. Jack is busy with other things today & tomorrow, so it's just me here.

Re-opening day in Bournemouth yesterday wasn't madly exciting. I did enjoy going to my local branch of Revolution Bars (LON:RBG) (I hold) though, for some cocktails, 2 for £10, or £8.50 each, so you're practically obliged to have 2. That reminds me of my favourite joke about cocktails - but it's probably going to offend someone, so I'd better not tell it.

.

Timing - update at 14:48 - I'm working on the OMG section now, which should be up by about 15:30. Today's report is now finished.

Agenda - not a huge amount of interesting small cap results today;

Clipper Logistics (LON:CLG) - interim results (done)

Oxford Metrics (LON:OMG) - Preliminary results (done)

.

J Sainsbury (LON:SBRY)

Has today followed Tesco (LON:TSCO) yesterday, by foregoing c.£450m of business rates relief saying;

Sainsbury's sales and profits have been stronger than originally expected, particularly since the start of the second national lockdown in England and we have therefore taken the decision to forego the business rates relief on all Sainsbury's stores....

As readers commented yesterday, these decisions by Tesco & Sainsburys might be connected to their desire to pay divis, which would look pretty awful if they had just been heavily subsidised by the taxpayer.

... the Board believes that shareholders should not bear the full short-term financial impact this year of the business making the right decisions for customers and colleagues through the COVID-19 pandemic. Therefore, when considering free cash flow allocation this year the Board will prioritise payment of dividends to shareholders over net debt reduction

As a consequence, while we expect to make good progress towards our target of at least £750 million net debt reduction in the three years to March 2022, we now expect to achieve this target by March 2023

I wonder if other supermarkets will follow suit? It will be very difficult for them not to.

Many thanks to Wimbledonsprinter for pointing out in the comments below, that Wm Morrison Supermarkets (LON:MRW) also waived its business rates relief in full yesterday, totalling £274m. These are huge numbers, for businesses to be voluntarily returning to the taxpayer. Would this have happened, say 10 years ago? Probably not, in my opinion. There's definitely been a change in attitude recently, with companies much more sensitive about how they are perceived, and their ESG responsibilities, etc.. I'm all for that, it's a generally very positive thing, in my view. At least it gives me some ammunition to use in my heated debates with anti-capitalist family members on Zoom over Christmas, lol!

EDIT: The Telegraph is reporting that both Aldi and Asda have also said they will repay business rates relief. Waitrose and Marks & Spencer have apparently (so far anyway) refused to bow to pressure. That's probably a mistake, and puts them on the back foot when they have to back down in future, maybe?

.

Clipper Logistics (LON:CLG)

Share price: 510p (up 4%, at 09:58)

No. shares: 101.7m

Market cap: £518.7m

Clipper Logistics plc ("Clipper", "the Group", or "the Company"), a leading provider of value-added logistics solutions and e-fulfilment and returns management services to the retail sector, is pleased to announce its unaudited results for the six months ended 31 October 2020 ("H1 FY21").

Below is the title of the RNS, which certainly motivates me to continue reading! They’re quite good, these little headings that are increasingly appearing at the top of results/trading updates, providing they’re accurate of course, which this one is;

Strong momentum continues driven by the structural shift to e-commerce; upgrading full year expectations

Key points;

- H1 revenue up 19.8% to £305.2m (guidance was “at least £300m” on 20 Nov)

- EBIT is up 21.7% to £20.2m, or +54.3% if one-offs are removed from the comparative number

- Most of the profit is coming from e-fulfillment and returns management - so this share is in a good growth area, a picks & shovels type of investment for eCommerce - a good structural growth sector

- Basic EPS up 40% to 11.2p - this looks positive, as full year forecast EPS for FY 04/2021 is 20.6p. Given that H2 includes the busiest Xmas period, then I imagine forecast EPS is achievable or beatable.

- Clipper has 52 sites in UK/Europe, 14.5m sq.ft., so this is a substantial operation

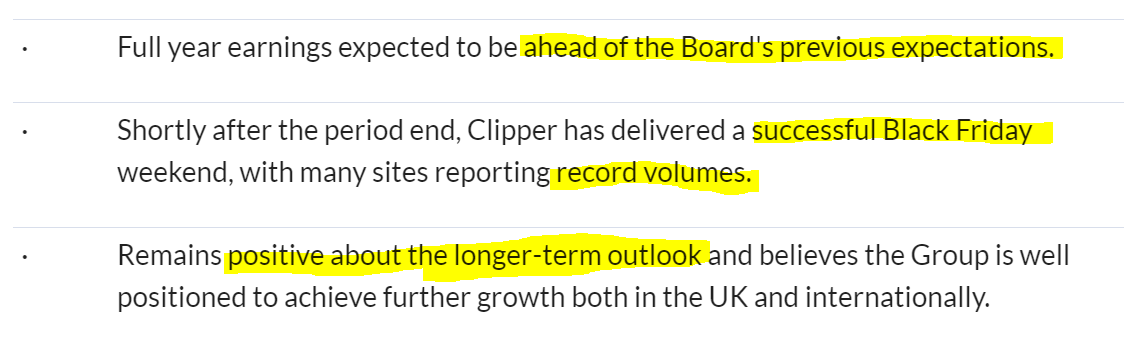

Outlook - this sounds good, particularly ahead of expectations. Although the last bullet point emphasising longer-term can sometimes be code for short-term challenges, or it might not be, so that’s a tad ambiguous. New contract wins with well-known brands augurs well for future growth.

.

.

Balance Sheet - quite weak, but that probably doesn’t matter too much because logistics companies tend to operate with a favourable working capital cycle. A big advantage here is that, as a fairly new company, Clipper doesn’t have legacy problems e.g. pension deficit.

NTAV is slightly negative, at £(2.1)m - not ideal, I would prefer the company to pause dividends, to build up a tougher balance sheet, given that we’re living in uncertain times, where there could be bad debt risk from conventional retailers.

The large lease asset/liability entries on the balance sheet from IFRS 16 can be safely ignored I feel, because warehouse leases are not a problem in the way that retail property leases are.

Cashflow statement - has been rendered almost meaningless by IFRS 16. Cash generation looks gigantic, but then we find a £23.7m outflow called “Repayment of lease liabilities” near the bottom. Overall, cash generation is used mainly for capex, divis, and debt reduction.

Valuation - I cannot find any broker updates unfortunately. I reckon we can probably raise the existing consensus up from 20.6p to maybe 22-23p. That would put this share on a FY 04/2021 PER of 22-23, based on a share price of 510p. That strikes me as a fair price for a good growth company, in a growing sector.

My opinion - decent results, an upgrade to full year expectations, and a fair valuation - so this looks good to me.

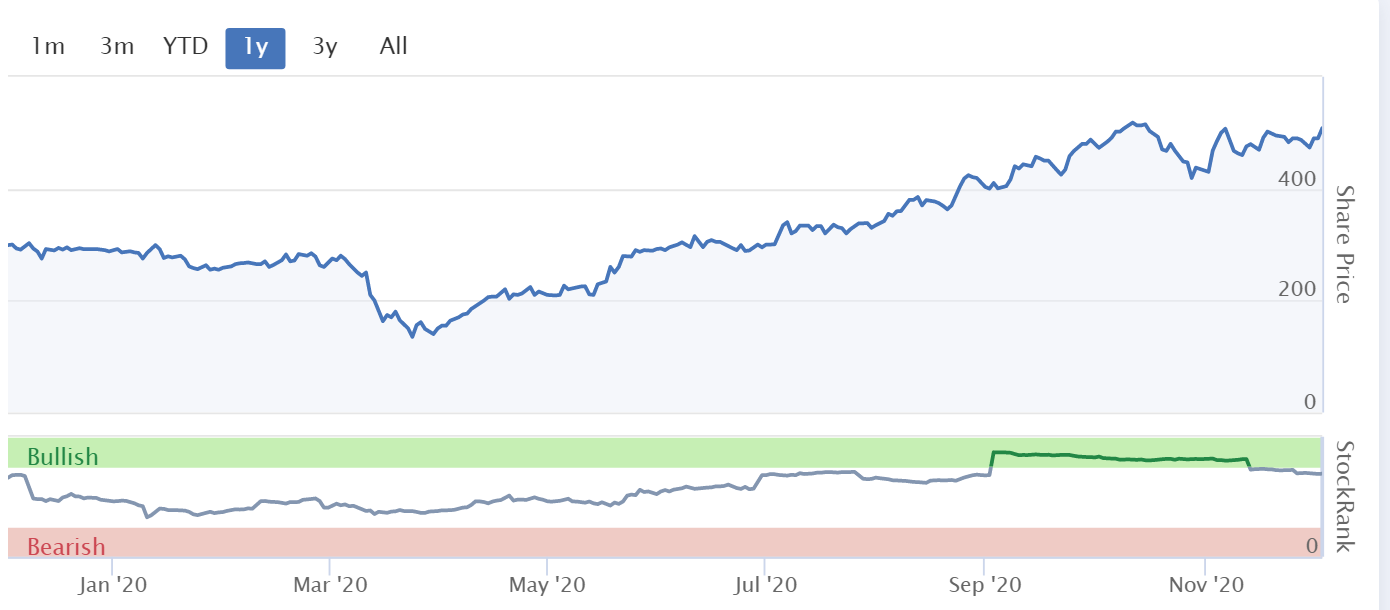

Even though the share price has risen a lot this year, I think it’s justified by the strong fundamentals and decent outlook. It might have been boosted this year by covid pushing more sales online, and Govt PPE contracts, but there’s no denying the Clipper is operating in the right space for long-term growth.

The StockRank system approves of it too.

.

.

Oxford Metrics (LON:OMG)

Share price: 90.5p (up <1% at 14:25)

No. shares: 125.7m

Market cap: £113.8m

Oxford Metrics plc (LSE: OMG), the international software company servicing government, life sciences, entertainment and engineering markets, announces preliminary results for the financial year ended 30 September 2020.

I last looked at OMG here on 3 Nov 2020, with its trading update for FY 09/2020. That update guided £30.3m revenues, and £2.5m adj PBT (almost all that profit generated in H2), and £14.9m cash with no debt. Let’s see how the actual figures compare;

Actual numbers today;

Revenue £30.3m - in line

Adj PBT £2.6m - slightly better than £2.5m guided, could be rounding, so basically in line

Dividend 1.8p - same as last year

Net cash £14.9m - in line

Adj EPS 2.05p - down 48% on last year - a PER of 90.5p/2.05p = 44.1 - therefore the market is clearly expecting earnings to rise in future

That’s all as expected, but obviously not a good year, being 48% down on the prior year’s earnings.

Pandemic -

Although the pandemic has caused short-term sales delays, particularly in the USA, it has also accelerated positive market drivers, which will underpin our future growth.

Outlook comments sound generally positive -

As we enter a new financial year uncertainty remains as the pandemic continues. That said, both of our divisions have started the year well, and the combination of our robust financial position and a tailwind from structural growth drivers puts us in a strong position both to navigate any further challenges that may arise and bring forward our growth plans."...

Yotta's ARR sales pipeline is healthy and we anticipate further ARR additions of at least £1.0m, a stable cost base and a full year of profitability...

Balance sheet - receivables look too high, at £9.2m (compares with full year revenues of £30.3m).

Pots of cash, £14.9m and no interest-bearing debt, a very secure position. The group has firepower for acquisition(s) which could be a good use of this surplus cash.

NAV of £30.7m becomes NTAV of £20.2m, if I write off intangible assets and deferred tax liability (which usually relates to intangibles).

Overall then a very healthy balance sheet.

Cashflow statement - good operating cash generation of £6.27m, but note that below this line it capitalised £2.5m (called purchase of intangible assets), which is probably development spend. Then £2.25m was paid out in divis, resulting in a £1.1m increase in the cash pile. So it’s reasonably cash generative, but not quite so impressive when you take that capitalised dev spend into account.

My opinion - neutral. I can’t see anything compelling in these numbers, and the outlook whilst generally positive-sounding, doesn’t sound exciting enough to make me want to pay such a high PER. A roughly doubling of earnings is arguably already priced-in. So where’s the upside buying now?

I think it’s the sort of share where you would need to really dig deeply into the products, and what their future potential is. There’s not anything clear in the current numbers or outlook to make me want to dig any deeper.

.

.

All done for today. See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.