Pre 8 a.m. comments

Good morning! I've been busy reading & interpreting the preliminary results for the year ended 31 Jan 2013 from French Connection (LON:FCCN), a share which I personally hold. It's a special situation in that the fashion retailer & wholesaler has been trading poorly for about 18 months, and lousy results were expected (with a loss of £7.5m being flagged in the most recent trading statement).

However, there is no new bad news in the results, with the underlying loss before tax being £7.2m. I cannot find any figures on current trading, but they do say (with my bolding added below);

After a difficult trading year, I am pleased that many of the initiatives we have taken in order to provide a new impetus to sales growth are beginning to show interesting results. While it is still early days, we see some good progress, and I am pleased there is some momentum in the business ...

... Although it is very early days in the new year, we have seen a better performance in UK retail, and we expect this to build as the year progresses.

Also, the all-important cash pile is largely intact, with good control over working capital meaning that the catastrophic fall in net cash which bears were predicting has not happened. They ended the year with £28.5m in net cash (compared with £34.2m last year), and the minimum cash position during the year was £10.6m.

Therefore crucially FCCN still has time to turn itself around, which is the fundamental rationale behind my holding the stock - i.e. I don't know whether management will be able to turn it around or not, but due to the very strong balance sheet, they've got time to attempt a turnaround. Bear in mind that at 25p the market cap is only £24m, so it's trading below its own net cash.

Taking into account working capital overall, FCCN has £93.8m in current assets, and £43.8m in total liabilities, so it has net working capital of £50m, or double the market cap! Remember this measure ignores all fixed assets completely, it's just the net working capital - i.e. items which turn into cash within 12 months at most.

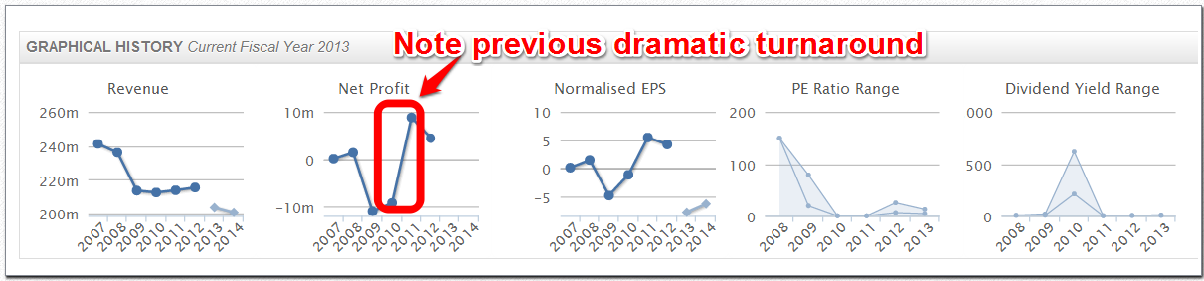

The three year chart above for FCCN shows how the shares languished in 2010, but then began an explosive move upwards in late 2010 from positive trading. Those of us who had seen the signs of turnaround did very well on the shares. Those of us who realised they were fully valued at 120p and sold at the top, did particularly well!

Therefore if FCCN pull off a similar turnaround, then it demonstrates the considerable upside available from 25p - this could be a 4-6 bagger on a decent turnaround, hence my interest in the shares.

I have no idea whether they will pull off such a turnaround again, although with my retailing hat on (I was Head of Finance for a ladies wear chain called "Pilot" from 1993 to 2002) my view is that FCCN are doing all the right things - i.e. getting external talent into the business to revamp product and processes. It really all boils down to getting the product right - if you do that, then it flies off the shelves.

FCCN's main problem is that the product is not good enough, and their prices are too high. Other issues such as a heavily loss-making own store portfolio will largely sort themselves out once the product is fixed.

So I shall be holding my FCCN, and will buy more on any significant dips. Obviously readers should do your own research, and decide for yourself. I never give any advice here, only express my personal opinions.

Sometimes people talk about property leases as if they are liabilities. In my view, this is muddled thinking. A property lease is clearly not a liability, if you trade at a profit from it! Indeed it's actually an asset in that a profitable shop will usually attract a lease premium - i.e. you can sell the existing lease for a capital sum, since buyers can work out if the shop is profitable or not.

When a shop trades badly, then it becomes a liability. But only to the extent of either the future trading losses from that shop (until the date of either lease expiry, or a break clause, if applicable). To give an example, I have a shop which is losing £20k p.a., on which I pay rent of £150k p.a., and which has a lease with 4 years left to expiry. The correct way to commercially view that lease is as a liability for 4 years' worth of trading losses, so to me it is an £80k liability. It would be absurd to regard it as a £600k liability (4 years' rent)! Yet that apparently is what changes to accounting rules will be requiring. Complete nonsense!

An alternative, and equally valid way to measure the lease liability for a loss-making shop is to find out what you would have to pay a new, credit-worthy tenant in a reverse premium, to take the lease off your hands. So if I was able to persuade Tesco to take on my 4-year £150k p.a. lease above to make a new convenience store, and they required a 6-month rent-free period to take an assignment of the lease, then that would make the lease a liability to me of £75k (i.e. 6 months rent). So in this example, I would proabably do the deal with Tesco, and hence exit from my loss-making shop at a cost of £75k (me paying the rent for Tesco for their first six months).

So in FCCN's case, yes they have some onerous leases, which are a big drag on profitability, but;

a) Those losses will dramatically reduce once they improve their product offering, and hence increase sales & margins, and

b) Over time they will be able to exit from loss-making leases through a mixture of lease expiry, and assignments (with hefty exit costs in reverse premiums or rent-free periods to the new tenant).

From what I can tell, FCCN do not seem to have made any significant onerous lease provisions on their balance sheet, which strikes me as odd. They have some seriously heavily loss-making shops in UK/Europe, and yet there do not seem to be onerous lease provisions on their balance sheet. I've just put a call in to the company to ask about lease liabilities, but the Directors are all in meetings, so have left a message. Hopefully I'll be able to report back on this issue later.

Post 8 a.m. comments

Right, let's move on, before I get totally bogged down in & spend the whole day on FCCN!

A share which has been on my watch list for some time, but I do not hold shares in, is Cello (LON:CLL), who have today issued their audited results for year ended 31 Dec 2012.

I find it's a good discipline to always look up the market cap before reading the accounts, so that it's all seen in context. In this case, at 42p and with 82.1m shares in issue, CLL is valued at a market cap of £34.5m, and describes itself as an "insight and strategic marketing group", whatever that means?

Turnover and gross profit are both up, but underlying operating profit is pretty much flat at £7.7m (versus £7.8m last year). Basic underlying (which they call "headline") EPS fell slightly to 6.37p.

I like the increase in total dividends for the year from 1.72p to 2.0p, so the yield is approaching 5%, pretty good stuff.

Note the strong green bars for PER and dividend yield.

Also note the momentum stats further to the left, which show that these shares have (unusually) not had a re-rating yet. An opportunity to pick up a market laggard perhaps?

Net debt has risen by £1m to £8.7m, due partly to a £2m earn-out settlement paid, although there are now minimal future liabilities of this kind.

The outlook statement is solid, and I have not seen any pension issue.

My only criticism of Cello is that they are too upbeat in the way results are presented. So their accounting presentation is a bit on the aggressive side, stripping out everything they can think of to present the highest possible headline figure. In fairness, a lot of companies do this, and it's becoming an area where a new accounting standard is probably needed to introduce acceptable categories, and hence comparable headline figures, rather than each company doing whatever they can get past their auditors.

Also, their narrative talks about this strong balance sheet, when actually it isn't! When you strip out the £72.8m of intangibles, they have negative net assets of £7.2m, which is definitely not a strong balance sheet! This is what happens when you let too many creative people near the annual report, I would prefer they are kept away and the accountants write the narrative!

Those criticisms aside, I like this share, which seems reasonably-priced on a PER of 6.8 times 2012 adjusted EPS. Net debt works out at 10.6p per share, so that looks reasonable to me, and I note that they have plenty of headroom on the bank facility, both in terms of amount and duration.

It's a people business, so unlikely to command a huge rating, but as a cyclical recovery share, which looks pretty cheap at the low point in the cycle, I think this one makes sense, and would be interested in other people's views. I haven't bought any yet, but am tempted, especially considering the 4.6% dividend yield.

OK, that's it for today. I've been through a few other sets of results, but nothing of any interest worth reporting back on. Some interesting comments below, so do please feel free to comment with your views on the companies discussed, it's better if it's interactive.

See you same time tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul holds shares in FCCN only, and has no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.