Pre 8 a.m. comments

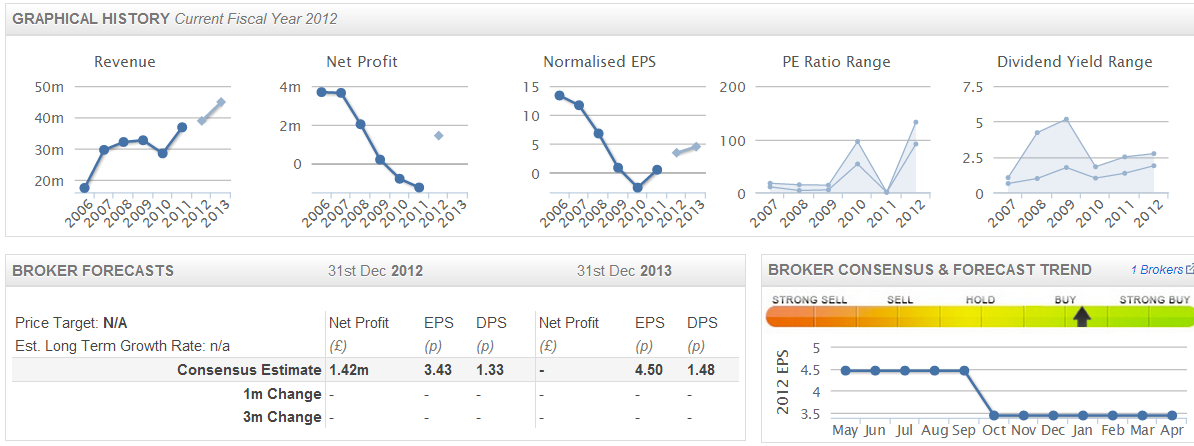

So far, it's a very quiet morning for results. I shall be looking at Bond International Software (LON:BDI) results for the year ended 31 Dec 2012. I held shares in this company a few years ago, but sold out after poor performance. Profits have fallen every year in the last four, indeed it was loss-making in 2010 and 2011. I also didn't like their aggressive accounting treatment of capitalising development spend, then presenting profit figures excluding amortisation, which seemed to totally ignore development costs - hardly reasonable.

Bond is a software company in the payroll and HR area, operating internationally, with it's biggest markets being the UK and USA.

At 45.5p per share, and with 36.6m shares in issue, the market cap is £16.7m.

I like the presentation of the P&L, where profit is clearly shown both before and after amortisation of development spending, at £5.4m, and £2.8m respectively. Then a third profit figure after amortisation of goodwill from acquisitions is also shown at £1.2m, then exceptionals of £475k take us to an operating profit of £676k, then we fall again to a profit before tax of £558k, and there is an income tax credit (probably due to R&D tax credits I would assume) of £393k taking earnings to £951k for the year.

So really there's something for everyone in there - take your pick from six different profit options, where the largest is almost ten times the smallest! To my mind, the profit measure which best shows underlying performance is the £2.8m operating profit after amortisation of development spending, but before amortisation of goodwill. That is up 7% against last year, on turnover down 3%, so a reasonably sound performance in my opinion.

EPS on the same basis is 6.19p, putting them on an adjusted PER of 7.4, which looks good value to me. It looks like a significant beat against expectations of 3.4p EPS, although I can't tell what basis the forecast is calculated on. Although most brokers usually quote adjusted EPS as the key forecast figure.

The crucial outlook statement reads well, with the key sentence saying;

"all three divisions have had a strong first quarter, delivering profit ahad of the same period last year".

Notably, the final dividend has been increased by 50%, to 1.8p. There is no interim dividend, so 1.8p divided by the share price of 45.5p gives a dividend yield of 4%, which is pretty respectable especially since such a big increase suggests management are pretty confident about the future.

I like the fact that recurring revenues now represent 67% of total revenues. Like most other software companies, BDI had been gradually changing its business model from one-off licence sales to SaaS - software as a service. That makes profits less volatile, so is good for investors.

Here is the three year chart, showing how BDI shares have under-performed the small cap index:

A £6m loan facility with Barclays has been agreed on similar terms to the existing one.

The balance sheet overall is not as strong as I would like, with current assets of £12.9m, and current liabilities of £13.4m, so a small deficit there of £0.5m. Normally I like to see a fairly good surplus on current assets, as it brings financial flexibility and downside protection. Bond also has long term liabilities of £2.9m, but it's mainly deferred tax which I don't usually worry about.

Personally I think they should have probably just maintained the dividend, and retained more cash in the business to strengthen the balance sheet.

The cashflow statement is the only negative part, with £3.6m operating cashflow all used on development spend (purchase of intangible assets), so the dividend was effectively paid from increased bank borrowings. Not ideal.

Overall though, I think these results are likely to be well received, and it seems likely that BDI shares will be near the top of the daily percentage risers list today.

Post 8 a.m. comments

Thorntons (LON:THT) has issued a positive Easter trading update, which states that;

...the Board now anticipates that the pre-exceptional Profit Before Tax for the 52 weeks to June 29th 2013 will be ahead of the current market expectation of £3.1 million.

However, we remain cautious of the prevailing economy and its continuing impact on consumer expenditure.

The shares have edged up 2p to 72p this morning, which with 68.4m shares in issue puts their market cap at £49m. Given that there is also a big debt pile, last reported at £17.5m on 12 Jan 2013 (which would be a seasonal cash peak), and an extraordinary bank facility of a whopping £57.5m, then I would say that the business is not generating anywhere near enough profit to make this a comfortable financial position.

Their turnaround strategy does seem to be working though, but it needs to go a lot further in raising profits before they are out of the woods, in my opinion. So no likelihood of a dividend for some time, and the probability of an equity fund-raising must surely be high?

There's also a £31m pension deficit, so in my opinion risk/reward for investors is all wrong here, and there are better opportuniities elsewhere. Although it's pleasing to see a traditional High Street operator survive against the odds.

Ridiculously wide small cap spreads (again!)

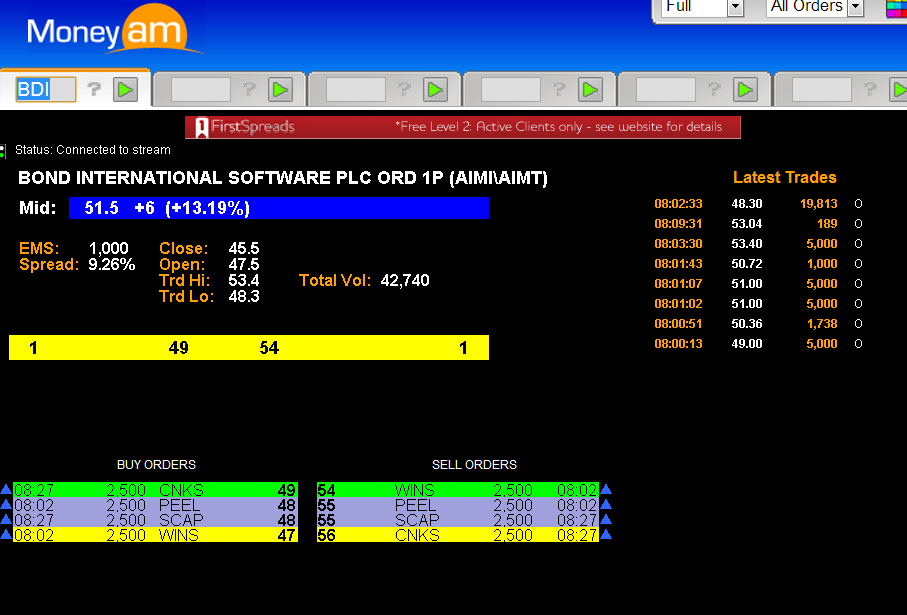

Going back to the positive results from Bond International Software (LON:BDI) mentioned in my pre 8 a.m. section above, I note that only 22,927 shares have traded (less than £12k worth!). How can this be? It's because the market makers are as usual deterring people from transacting by quoting a ridiculously wide spread, at the moment the touch is 49p Bid, 54p Offered, a spread of a ludicrous 10.2%! Check out the Level 2 price quotes (courtesy of Money AM):

However, 49p Bid and 54p Offer are NOT the actual market prices. On ringing my broker, I discover that the best bid price is actually 50.5p in size of up to 15,000 shares, and the best offer price is 52.95p for 2,500 shares or 53p for 10,000 shares. So that means the real touch is actually 50.5p Bid, 53p Offer in 10,000 shares. That's a spread of 5%, which is still pretty awful, but it's half the quoted spread of 10%.

What a completely dysfunctional system! Instead of showing their best prices, the market makers actually conceal their best prices from investors, thus deterring us from trading!

As a simple first step surely it would make sense for them to publish their best price quotes fully, which would clearly encourage far more people to transact? More liquidity would then narrow spreads further, and unlock many small cap shares which are currently frozen in a vicious circle of illiquidity and hugely wide spreads.

As a second step, why can't they open up the order book to all investors, give us Direct Market Access (DMA), and let us leap-frog the market maker quotes and put our own orders on the order book, like we can do with larger shares?

The LSE and market makers are really not doing anyone (including themselves!) any favours by maintaining this antiquated SEAQ system for small caps. And SETSqx doesn't really work as a half-way house, with its 4-times per day auctions, as most people want instant execution through online brokers, and brokers don't want to be fiddling around with auctions when they're only getting a tenner in commission for the trade.

Please reform the system LSE?! Think how many more IPOs there would be, and fewer de-Listings, if the markets for micro caps were opened up and their shares became liquid? I would happily pay a small levy to the LSE of a pound or two on every trade, if I was able to do it through DMA, so they need to explore other revenue models such as this.

They're doing the same on Vianet (LON:VNET). The shares are showing signs of life, but a 5p quoted spread of 91p Bid, 96p Offer, is putting people off. It just strangles liquidity to have a spread that wide. You cannot make a market unless you hold some stock! So this neutral book nonsense that market makers have adopted is doomed to failure, as they squeeze liquidity out of the system. Open it up to private investors, and we'll provide the liqudity ourselves!

Market makers are needed to provide some basic price stability on quiet days, but overall they seem just a massive impediment to a liquid market in small caps.

Some more company news

Inland Homes (LON:INL) have issued a land update, stating that they have increased their share of the West Drayton project to just over 72%. Directors stated at the last AGM that this project is worth 5p after tax on top of Inland's stated NAV.

They have also sold their stake in Howarth Homes for £1.4m. The market seems unimpressed, with the share marginally lower at 26.25p mid price. It's getting within range where I would consider buying back in, although I feel more comfortable not having money invested in a company where I have major concerns about the temperament & attitude of the Directors.

I've kept a couple of hundred quid's worth just so that I can attend future AGMs and pull the Directors up on their excessive remuneration again, if nothing has been done to address the concerns aired last year.

As an aside, my hedging strategy (long Gold, and Index Put Options) has collapsed in ruins, so I've given up on those, nursing a hefty loss. Don't think I'll bother trying to hedge in future, I'm so rubbish at it.

That's it for today - there's nothing else in terms of company news that falls within my remit, a very quiet day today.

I'll be back as usual tomorrow, just before 8 a.m.

Regards,

Paul.

(of the shares mentioned today, Paul has a long position in VNET, a very small long position in INL, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.