Pre 8 a.m. comments

My early bird comments this morning are on Clean Air Power (LON:CAP), which is a share I personally hold, and is currently the strongest performer in my portfolio. It's also the most speculative. I believe in adapting my investing style somewhat to market conditions, and when we're in a roaring bull market like this, then I'm prepared to be more flexible, and consider shares which are somewhere between blue sky and GARP (growth at reasonable price).

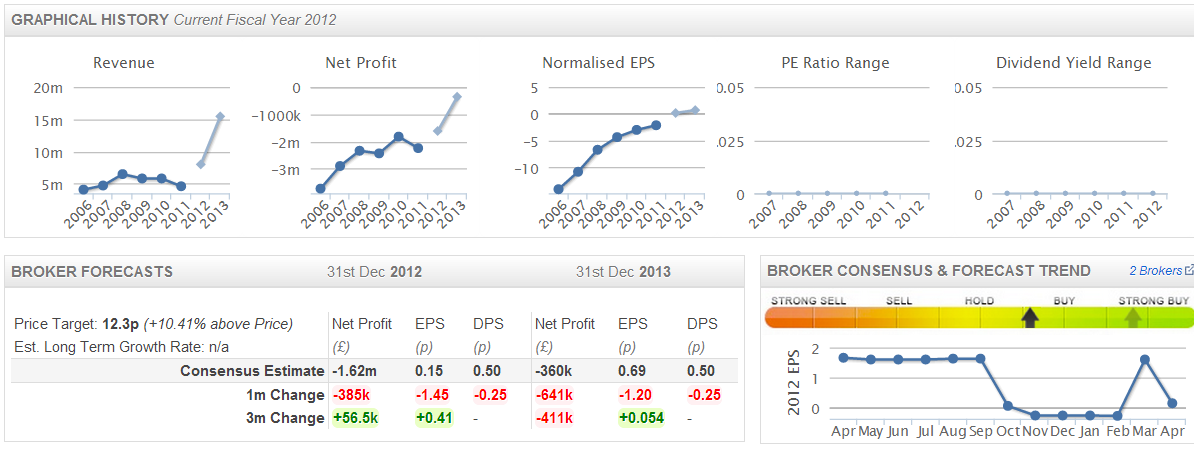

Clean Air Power looks a particularly interesting growth company, and is arguably still quite reasonably priced at a market cap of £19.5m (177m shares in issue, and a current mid-price of 11p).

Note the recent intra-day spike down to 5p, where a major shareholder inexplicably dumped £1m of shares at over 30% below the market price. This gave me an opportunity to double my stake at a buying price of 6p, which I happily did. I'd done my research and knew they had adequate cash resources, so it was a time to be bold, rather than hesitating and finding out the reason for the spike down.

They have burned cash of £50m to get here, and is a company which sells an innovative conversion kit for large road vehicles (e.g. HGVs) which allows them to run on dual-fuel, being a mixture of diesel and up to about 90% natural gas. I was amazed that this is even possible (since diesel engines are normally ruined if you put anything other than diesel in them), but apparently it is.

The diesel is used like a liquid spark plug apparently, to ignite the natural gas, and sophisticated software adjusts the mixture so that the engine always runs safely & without wear & tear. There are even claims that wear on the engine is reduced, since there are fewer abrasive chemicals in the spent natural gas fuel. More details are here on their website, I'm probably not explaining it well, especially at this time of the morning before my first cup of tea!

There is an increasingly large cost saving from running HGVs on natural gas, and the American market is the big one, with cheap shale gas increasing demand,and CAP are launching there in 2014. In the meantime the technology is real, and being installed in vehicles already, so it's not blue sky, it's happening.

Results for the year ended 31 Dec 2012 published this morning show impressive growth, with turnover up 73% to just shy of £8m. Gross margins are down, but gross profit still rose 38% to £3.5m, and due to higher administrative costs the loss before tax remained unchanged at £2.2m.

I would have preferred to see an improving trend in reduced losses, and it looks like they missed consensus forecast by about £600k at the bottom line. Although whether the market will care is another thing? Growth is what it's all about, and that looks set to continue in 2013, with the crucial outlook statement indicating that 150 systems have been ordered so far this year (as opposed to 300 sold in the whole of 2012).

I think I'm correct in saying that CAP systems are being installed by Volvo in new trucks too, but this is referred to as "the OEM manufacturer", and production there has also increased we are told.

Without wishing to upset my friends who are investors in Torotrak (LON:TRK), I think CAP is a far more exciting, and commercially successful opportunity in the automotive innovation sector than Torotrak, and at £19m market cap (less than half TRK's £49m market cap) I think the shares offer much better value too.

CAP has enough cash for the time being, following a Placing last autumn, with £3.2m cash in the bank at 31 Dec 2012. I hope that will be enough to take them to profitability, but with sales growing this strongly another small fund-raising could be done without difficulty, so doesn't worry me.

The market loves growth, and I wouldn't be surprised to see CAP shares rise strongly in the next few months. Double or triple the current price looks a possibility to me in due course, so I shall be sitting tight.

Post 8 a.m. comments

Mr Market doesn't seem to like the results from CAP so far, with the shares down 12% at the time of writing to 10p - perhaps some punters were hoping for something more exciting in the outlook? I haven't read all the narrative yet, so will peruse that in more detail before deciding whether to have another top-up. The market cap is now down to £17m which looks pretty attractive to me for something showing such strong growth, and the excitement of the USA launch in about 12 months.

The price move has happened on less than £100k worth of shares traded, so could easily reverse today - sometimes the reaction of small, short term traders first thing, can be incorrect and provide a buying opportunity - I tend to find that the first hour of the day is when the best buying/selling opportunities usually occur.

Moving on, I'll have a look at Universe (LON:UNG) next. It's a Southampton based company whose main activity seems to be payment and loyalty card systems for petrol stations. We met management at a Mello Central event last year. I've tended to be a bit sceptical about this company in the past, as it doesn't really seem to go anywhere - serving a small niche, and eking out 0.5p EPS (or thereabouts) most years. There's no dividend. You look at it, and think will it still exist in 10 or 15 years time? Why is it Listed?

It looks like some of these concerns are being addressed, with new management introduced in 2011, delivering pretty good results for the year ended 31 Dec 2012. They also disposed of the loss-making manufacturing division in Dec 2012.

With 188m shares in issue, and at 5.5p currently, the market cap is £10.3m.

That looks about right to me, given operating profit up 27% to £1.2m, and profit before tax on continuing operations of £1m. EBITDA is higher at £2.1m, but they capitalise development spending, so EBITDA will therefore overstate performance as it's ignoring a load of costs.

Basic EPS is 0.7p, so that gives a PER of just under 8, which I can't get excited about for a small, mature company that doesn't pay a dividend. They have a development plan to introduce new products & go for new markets, which sounds potentially interesting, but that all takes time & money of course.

For the time being then there's nothing here that floats my boat, either on valuation, or growth potential. The shares have done very well indeed since Jan 2012, so if I held I'd be inclined to bank the profit & move on.

Capital Gains Tax & ISAs

Obviously I can't give any financial advice in this column, it's just personal opinion always.

However, if you haven't already consulted your tax adviser, then this would be a good time to review your portfolio with them for tax planning purposes. The tax year 2012/13 ends at close of play tomorrow night, so it's a good idea to look at whether you've used up your CGT-free allowance.

Or, if you have large realised gains already, then those can be mitigated or eliminated by realising losses on other holdings that have currently unrealised losses on them. It all needs careful handling, as there are special rules on selling & buying back (bed & breakfasting), hence why specialist advice is needed. A spread betting or CFD account can provide useful strategies to legitimately provide flexibility around those rules though - e.g. by shorting a share you hold physcial stock in, to lock in a sell price now, without actually crystallising any tax liability, then reversing the transaction in the new tax year, etc.

Anyway, I'm not a tax expert, so professional advice is always needed. I just want to flag up that we are almost at the tax year end, so investors need to act now, or miss the deadline. The same applies for using up your ISA allowance too.

Tax selling might also provide some buying opportunities today & tomorrow, so I'm keeping my eyes peeled for bargains!

More company comment

Printing.com (LON:PDC) have issued a rather mixed & vague trading statement, saying;

...trading has continued to be difficult. Encouragingly however, sales volumes through the Company's new online and template initiatives have shown significant growth, albeit with an increase in marketing expenditure.

The problem with that statement is that it doesn't put it into the contect of performance versus market expectations. Hence investors will tend to assume the worst if an accurate steer is not given. Unsurprisingly, the shares are off 8% at 19.3p currently.

The dividend yield is now about 13%, which is unrealistically high, so a dividend cut must surely be on the cards here. I would never buy any share just for a high dividend yield without first having ascertained whether that level of dividend is sustainable.

I think they probably missed their chance to build a bigger business, and are now just one of many printers competing online.So it doesn't interest me.

Regards, Paul.

(of the shares mentioned today, Paul has a long position in CAP, which he increased this morning at 10p, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.