Pre 8 a.m. comments

Walker Greenbank (LON:WGB) is a company that I have liked for some time, and held the shares personally until recently, when I had a general tidy-up of my portfolio to bank some profits & reduce the number of smaller positions. It looks like that might have been a mistake, as WGB have issued good solid results this morning, and the shares look good value again.

It's a British luxury interior furnishings group (brands include Sanderson, Morris & Co, and others), which is trading well, and really should be on a premium rating because of its premium brands value, which should make it an attractive bid target. Also a company in this sector which can trade well in a prolonged economic downturn is clearly likely to out-perform in the more buoyant times which will eventually return.

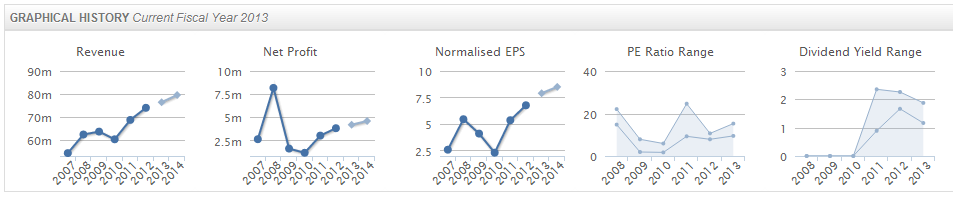

Their results for the year ended 31 Jan 2013 show only modest sales growth of 2.3% (but that masks a very strong performance in the USA, where sales rose 17.6%). Adjusted profit before tax was up 11.7% to £6.38m, and adjusted EPS rose 14.6% to 9.41p.

So providing you accept the adjustments to EPS (which I normally do), then at 100p the shares are on a PER of only 10.6. That looks too low to me, especially considering that WGB has returned to net cash for the first time since 2000, and despite some heavy capex in the year.

The adjusted EPS figure of 9.41p is well ahead of broker consensus of 7.91p, assuming they are calculated on a comparable basis. I would have thought this justifies another leg up in price to 120-140p?

On the downside, their pension deficit has risen to £8.2m, which is not too bad for a company with a market cap of £58m. It looks manageable. The total dividends for the year are up nicely by 23.3% to 1.48p, although that's only a yield of about 1.5%, but it is at least growing strongly.

It should be noted that the adjusted EPS figure excludes the pension fund charge of £704k, so I would make an adjustment the other side, by lowering the PER a notch. Even then, a PER of 13-15 is surely justified here, giving reasonable upside on the 100p share price, to perhaps 120-140p?

The outlook statement sounds solid, and they have exposure to rapidly growing international markets such as China & India.

Post 8 a.m. comments

I'm surprised that the market has had such a subdued reaction to the WGB results, with the price actually down slightly to 98p. Perhaps people were looking for a greater out-performance, and maybe holders who have done well in the past six months just want to bank the profits? I shall be watching closely, and if it comes off some more down to sub-90p, then I'll be considering buying back in.

Although this is not really a good time to be opening new long positions - after the markets have had a significant re-rating, and there must be plenty of people thinking in terms of banking the profits before "sell in May" mentality crops up. I was interested to note that shrewd trader Robbie Burns is planning exactly that - to get out of the market and have the summer off.

My view is that to take advantage of a market sell-off, you've got to have some cash ready & waiting. It's no good being fully invested all the time. So I am only planning to continue holding things that I feel are genuinely still cheap. Everything that looks fully valued to me will be, or already has been sold.

You can check what I currently hold any time on this page on my Blog, which I keep regularly updated. It's not practical for me to report every trade here, as I'm often making adjustments to my portfolio, and in any case this is market & results commentary rather than a tipping service. Please always remember that nothing is ever intended as financial advice or share recommendations, but is just my personal opinion only.

It's really two portfolios - namely my core long term holdings, which in the case of IND I've held continuously for 9 years! Then running in parallel with that are shorter term holdings which might change from one day to another - e.g. I decided to sell Fairpoint yesterday, as the statement from a key shareholder which had backed the original turnaround about them selling out completely made me feel that there's probably not much upside on it (otherwise they wouldn't have sold!).

Next I shall be looking at interim results to 31 Jan 2013 from Utilitywise (LON:UTW). This is an interesting company, whom we met recently at a Mello Central event. They are a consultant who audit the cost of utilities for business clients, and negotiate them better deals, receiving a commission from the energy companies for new business.

A number of us felt that there could be a conflict of interest there - i.e. UTW are paid by the energy companies, and therefore are surely incentivised to place clients where they maximise their own commission, rather than where the client saves the most money.

There again, it's a B2B situation, where everyone are grown-ups, and should know what they are doing. I've used a utility consultant like this before, and was very happy to authorise their invoices for payment, as every one saved us money overall in lower energy costs. So my personal experience is that clients tend to be happy with the service in this sector.

The biggest risk to their business model is, in my opinion, if the utilities companies decide to change the way they operate, and cut out the middle-man.

At 91p per share, Utilitywise (LON:UTW) has a market cap of £57m.

You can see that it scores highly on some of the Stockopedia growth & value bars (remember that these work like traffic lights, with green being best, red being worst, and are shown versus the sector, and the market as a whole).

Note also the very strong green bars in the "quality" section, showing a high Return on Capital, and a very strong operating profit margin.

That could be good, but also presents a danger, that the profits being made might be unsustainable, if competition erodes them, and/or if the deals offered by utility companies become less favourable.

Their interim results look pretty good - turnover up 40%, and adjusted profit before tax up 50% to £2.1m.

They also confirm that the company,

...remains on track to achieve full year targets.

It had a period end net cash position of a very healthy £5m. There is a 0.8p interim dividend, not terribly exciting.

So it all looks pretty good, but somehow I'm not convinced. Something just doesn't feel right to me about this one, and cannot put my finger on why? Although one reason might be the £10m that Directors banked from selling shares in it last year at 75p - that doesn't inspire confidence.

I can't find any more interesting announcements this morning, so thought I would circle back to a company which was overlooked in the tsunami of 31 Dec 2012 results which we had in March and early April.

It's a company called Pilat Media Global (LON:PGB). The shares are 37p, giving a market cap of £23m.

It's an Anglo-Israeli software company, whose Integrated Broadcast Management System (IBMS) is used by many big name TV companies globally. Their website is here.

It was flagged up to me by a friend, who bellieves (and I agree with him) that the market cap of £23m is seriously cheap. To start with, they have almost half the market cap in net cash, of £10.7m at 31 Dec 2012. It's not clear what they intend doing with that cash, but it clearly gives them great scope of do share buybacks, pay a special dividend, or make a decent sized (relative to them) acquisition.

Secondly, they have recently reported operating profit before intangibles amortisation of £2.8m (up 17% against prior year). This was due to a particularly strong Q4, with some good deals closed. On the downside their results are lumpy, as recurring revenues seem to cover the overheads, but they need a few big contract wins each year to generate the profits.

Furthermore, whilst there is a £1,065k annual amortisation charge, this relates to historic development spending, and there has been further such spending capitalised in either of the last two years. Hence it is valid (in my opinion) to ignore this non-cash item, and focus instead on the £2.8m pre-amortisation profit figure.

Shares are concentrated in the hands of two large shareholders, one of which tried to buy the company a few years ago, but was thwarted. So it seems an unusual situation with the largest shareholders not apparently seeing eye to eye. Although to my mind, that's probably a better situation for minority shareholders than if they were acting in concert?

The outlook sounds excellent, as follows;

Pilat Media is in a very healthy position. It has a strong balance sheet with significant cash resources which it expects to grow as operating profits are expected to improve. The Group's pipeline of revenues from existing clients already enables revenues in 2013 to reach over 80% of the 2012 level. The Group is involved with several additional opportunities already in advanced procurement phases where Pilat Media is well placed to win, although timing can not be reliably predicted. These can potentially make a significant contribution to the 2013 revenues. OTTilus also provides the Group with an opportunity to expand into new markets as well as enhancing its offering to existing clients. The Board therefore looks to 2013 as another year of significant improvement in both market position and financial results.

So whilst the dual Listing (Israel, and AIM) is not ideal, it's a proper company which has built up a £10m cash pile in the last four years from nothing, and seems to have genuine global reach.

They had a large bad debt last year, which is unnerving in that their implementations take years sometimes, and can lead to large debtors building up. A dispute arose in 2011, and was settled with a substantial write-off in Pilat's books. That to me indicates a lack of financial control, so one hopes they have learned from that experience and better match cash collection to work done.

When you look at the valuation ex-cash though, it looks remarkably good value to me, hence why I've picked up a few shares in it myself. I don't usually invest in overseas companies listed on AIM, but a dual listing for a proper, profitable company with substantial net cash, is something I can live with.

There is a nice, decent sized recent contract win too, here.

Of further interest, and impossible to ignore the very upbeat tone in the last couple of minutes, is a recent audio interview with the CEO, Avi Engel, eight days ago, here by BRR Media.

I would be very interested in your views on this one, so please comment in the comments below.

That's it for today, I'm off into the City to meet the management of an interesting AIM company, so will report back in due course if I like it.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in IND and PGB, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.