Good morning, it's Paul here with the SCVR for Tuesday.

Timing - it's fairly quiet, and I started early, so we should be finished by 1pm. Update at 12:46 - that's it for today, newsflow seems to be quietening down now. Today's report is now finished.

Agenda -

Frasers (LON:FRAS) - Withdrawal of guidance. Tier 4 lockdowns a disaster for non-food retailers, at peak trading time. Read-across to others.

Boohoo (LON:BOO) (I hold) - beneficiary of another lockdown, and in the running to buy TopShop maybe?

Applegreen (LON:APGN) - Confirmation of agreed takeover bid. UK market cheap, more bids to come?

Dfs Furniture (LON:DFS) - I've had a detailed rummage through its half year trading update today.

.

Preamble

There are five number 2's in today's date: 22122020. That sounds slightly rude. To counter the winter blues, I always remind myself that we've seen the longest day night (yesterday) already. From now on, it will start getting light slightly earlier each day, and it won't be long before the sun is streaming through the windows when the 7am RNS starts pinging. There's a cheery thought, which we need to focus on, let's face it. I find the TV news so depressing these days, that I switch it off, and binge-watch DVDs of old comedies like Yes Minister, George & Mildred, or Gimme Gimme instead. It's good escapism, highly recommended. Or play ZZ Top nice and loud!

Mello Monday was a marathon last night, grinding on until 10pm. I had planned to go to ASDA to get my Xmas parsnips at 9pm, but unfortunately that wasn't possible. Let's hope nothing else crops up today, as I don't want to deprive my mother of her root vegetables on Christmas Day.

We saw some knee-jerk price plunges yesterday, some of which made sense, and some of which didn't. I find it's useful to keep some spare cash to hand in the last 2 weeks of the year, because the thin liquidity can lead to quite bizarre price movements, and hence buying opportunities, as we saw yesterday.

.

Frasers (LON:FRAS)

426p (down 10% yesterday) - mkt cap £2.0bn

I forgot to mention this yesterday - the tier 4 restrictions have really clobbered retail & hospitality again. This is their absolute peak trading period, so it's another savage blow to these sectors. Softening the blow considerably, is the continuation of the furlough scheme (until end April 2022), and suspension of business rates. Therefore, it's all about having enough liquidity to survive until (as indicated by Govt) restrictions should be eased at some point in spring, thought to be around early April (Easter).

Withdrawal of guidance - here is the full text of what FRAS (formerly called Sports Direct) said yesterday -

From Sunday 20 December 2020, the Government closed non-essential retail in London, The South East, and East of England with no warning. This has led to virtually all of our stores closing in these areas. Given this is a peak trading period, and combined with the high likelihood of further rolling lockdowns nationwide over the following months at least, such is the uncertainty of when stores can and cannot open that the Board of Frasers Group plc can no longer commit to Frasers Group achieving its publicised guidance of a 20% to 30% improvement in Underlying EBITDA during FY21 and, accordingly, is withdrawing its guidance.

That's all self-explanatory. It's difficult to imagine what a nightmare it must be running retail/leisure/hospitality businesses at the moment. In particular, retailers need to design & order goods well in advance. Store closures happening unpredictably, due to Govt orders, throw everything into chaos, leading to potential over or under-stocking.

Plus we have worrisome global logistics problems. I'm told that this issue is far wider than just Brexit stockpiling clogging up UK ports. Therefore many companies will be finding it difficult, and more expensive, to move supplies around, and get them at the right place at the right time. Hence I think we could see a wave of profit warnings in varied sectors.

As before, it's the companies with a strong online capability, that pick up business when physical retailers are forced to close.

I'm not at all convinced that Mike Ashley's strategy to buy up failed High Street chains is a good one. Hopefully this development might make him think twice about bidding for TopShop? I'd like to see Boohoo (LON:BOO) (I hold) pick up that one, and bolt it onto their machine to drive continued growth.

The march of the online retailers seems unstoppable. BOO is the best one, and currently good value because of ESG fund managers being forced sellers. Once the supply chain issues are resolved (work-in-progress), then all those fund managers are likely to become buyers again, driving up the share price. That's a tremendous money-making opportunity for us, in my opinion, it's my top pick for 2021, and largest personal portfolio position. I'm not going to apologise for banging the drum about what I believe to be a tremendous opportunity. Last time I did that, when it was below 25p, readers here made millions, a very happy outcome.

All the current bad news (rising covid cases, mutation to more easily transmissible, Brexit jitters & possible trade disruption) are all temporary. When we buy a share, we're buying all that company's earnings in perpetuity. Therefore I tend to see short term factors as potential buying opportunities. Prices always bounce back - look what happened this year - the point of maximum fear at end March, was actually one of the best buying opportunities of our lifetimes.

Everything has changed because Governments don't just sit on the sidelines and watch, as economies crater. They print money, and flood the economy with support schemes. This makes recessions short, and far less harmful. It doesn't matter what our opinions are on the wisdom of this, I'm just pointing out what is actually happening. Therefore, if we have a messy Brexit, Rishi just prints another £50-100bn of QE, and creates a business support scheme for companies impacted. Remember that 90% of UK companies don't export to Europe, and WTO tariffs are very low for most sectors (cars & food being the high tariff items). So I'm not particularly worried about things. Press reports indicate that giving away our fish again could clinch a deal. Surely that can be done in a face-saving way, enabling both sides to claim victory?

.

Applegreen (LON:APGN)

505p - mkt cap £614m

This is a petrol forecourt retailer in Ireland & the UK.

The founder shareholders who own 41.3% of APGN, have formed a consortium with Blackstone Infrastructure Partners, to buy the rest of this company, in an agreed cash bid.

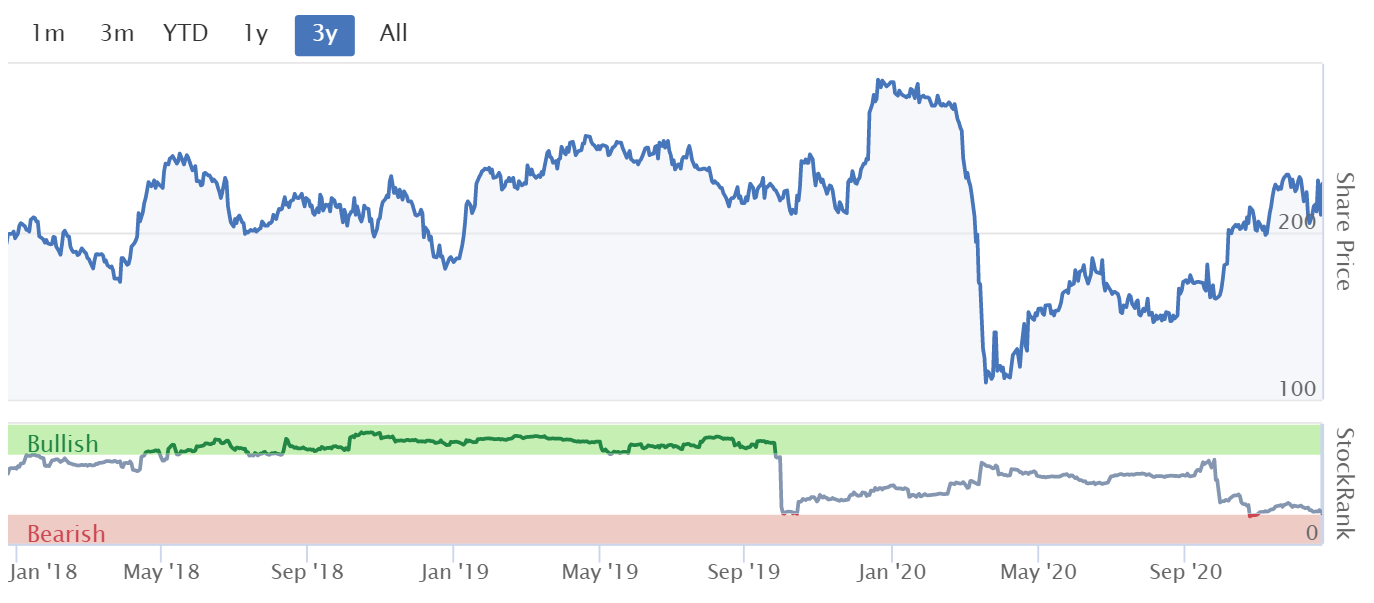

The price is 5.75 Euros per Applegreen share. It was pre-announced, as you can see from the chart below. It's a healthy premium, of about 50% of the previous share price.

.

.

The world is awash with cheap money, due to QE. Therefore it stands to reason that some of it finds its way into bidding for cash generative listed companies.

Fund manager Gervais Williams said last night at Mello Monday, that he's very bullish on UK equities, and think it will be the best performing stock market over the next 2 years, with valuations very attractive. If it doesn't re-rate, then I expect a tsunami of takeovers, he said. That seems to already be happening, there have been lots of takeover bids recently, lending weight to his argument.

In a way, I think it's a pity that good companies are cherry-picked from the stock market. Let's hope brokers get their act together, and start floating some decent new companies, in stead of the usual speculative junk.

.

Dfs Furniture (LON:DFS)

230p (up 10%) - mkt cap £597m

DFS Furniture plc, the market leading retailer of living room and upholstered furniture in the United Kingdom, today announces a trading update for the first twenty-four weeks of the financial year to date, ending 13 December 2020.

I’m not sure why it’s a 24 week period, instead of 26 weeks. Anyone know? The full financial year is FY 06/2021.

Lockdown - manufacturing & deliveries are continuing, despite tier 4 restrictions. 65 out of 212 showrooms are currently closed.

As we’ve also seen with Scs (LON:SCS) (I hold) this sector benefits from the lead times - customers pay up-front and receive their furniture later. So even if showrooms close, the business continues working through the order book, plus online sales.

Sofa Workshop has been sold, so is stripped out of the figures. That’s fine.

H1 sales up 19% vs LY - impressive. Bear in mind this will have benefited from pent-up demand lost in H2 of FY 06/2020, kicking in to boost H1 this year. It’s still good though.

Online up 76%, but that means nothing as they don’t provide the actual numbers. It could be small, or large, we’re not told. Lots of companies do this, and it’s really not good enough. Investors need to know what percentage of total sales are online, in order to understand how resilient the business is, and whether it’s moving with the times.

Q2 “resilient to date” despite showroom closures. Order intake down 5% vs LY - good, considering showroom closures in that period. DFS claims market share gains, and notes that consumers are spending on their homes, a trend we’ve seen mentioned by lots of other companies (e.g. Sanderson Design (LON:SDG) (I hold) yesterday).

Guidance - this is impressive in the circumstances -

Subject to the extent of enforced showroom closures and based upon cautious order intake assumptions, we expect full year Profit Before Tax and Brand Amortisation will be within the upper half of the current market forecast range**

** Consensus Profit Before Tax and Brand Amortisation median forecast for the 52 weeks to 27 June 2021 of £101.7m on an underlying IFRS16 basis with a range of £81.2m to £118.0m. This is comparable to the -£63.1m underlying pro forma result as reported for the 52 weeks to 28 June 2020.

Hoorah for the explanatory footnote above! Well done to DFS & your advisers.

Balance sheet - is terrible in reality (badly negative NTAV), but the company says it’s robust -

Robust financial position; Closing interim*** pre IFRS 16 net debt expected to be between £40-50m, a reduction over the 26 weeks of over £115m

How much has the company flattered its net debt through creditor stretch? We’re not told - key information missing. It vaguely says net debt is “supported by associated working capital inflows”. That could partially refer to increased customer deposits though.

I’m not happy about that. If we’re not given full information, then it feels like we’re having the wool pulled over our eyes. Trading updates should not be PR opportunities with highlights cherry-picked, they should give full information.

Bank facility - I’m not happy with DFS’s balance sheet, but clearly its banking syndicate is, so my opinion doesn't matter!

- £225m bank facility is extended from Aug 2022 to Dec 2023.

- Option to extend (but requires mutual agreement) for another 2 years beyond that.

- Bank covenants unchanged (not stated today what they are).

- Temporary ban on divis & acquisitions will be (when?) lifted.

This is good news - the banking facilities are being normalised, which indicates to me that the bank is now comfortable with DFS again, which justifies the 10% share price rise today.

Supply issues - interesting that DFS mentions “ongoing disruption at The Port of Felixstowe”, a point I mentioned above. We’re likely to see more companies flag this problem. DFS also mentions problems with foam availability in Europe. This doesn’t seem to have affected financial performance in H1 though, I wonder if it might hurt H2? Issues like that always get resolved, so it’s only a temporary problem that logically shouldn’t impact the share price much, if at all. However, markets are not always logical, so this issue might cause price volatility if it worsens.

Lead times are affected -

We have prudently planned for the risk of an exacerbation of current port congestion and delays and we are grateful for the patience that our customers have shown in the face of currently extended fulfilment lead times.

Brexit - has made (undisclosed) preparations for no deal. I know some investors are panicking about no deal, but I’ve not seen anything from the small caps I cover to indicate any serious concerns. Companies are mainly just saying it’s uncertain, and they have made contingency plans, such as building up buffer stocks.

NB. DFS says that under WTO rules, there are no tariffs on importing upholstered finished goods. Not clear whether there would be tariffs on other products (non-upholstered), such as tables?

Forex hedging is in place for 18 months - a good idea in uncertain times.

Outlook - (below) sounds good in the circumstances. If a company is having problems, it’s much better that is related to fixable supply issues, rather than a lack of demand.

Our expected full year financial out-turn is underpinned by revenue growth in the financial year to date and the current strong order bank position, which is currently approximately £200m higher year-on-year on a revenue basis. Therefore, subject to the extent of enforced showroom closures and based upon cautious order intake assumptions of -15% for the second half of the financial year, we would expect that full year Profit Before Tax and Brand Amortisation would be within the upper half of the current market consensus range**.

As manufacturing operations, (both internal and those of certain suppliers) are running close to capacity, port delays appear likely to persist, and lead times are above average, the benefit of any second half order intake outperformance may shift increasingly to H1 FY22.

My opinion - this is a commendably detailed update. I’m going to award it a B+. It would have been an A, but key information on creditor stretch (deferred VAT, etc) was not provided. It might be that the company is up-to-date with its creditors, but it needs to say so either way. Apart from that, it’s very good - especially the footnote explaining what market expectations are, that’s so useful, thank you.

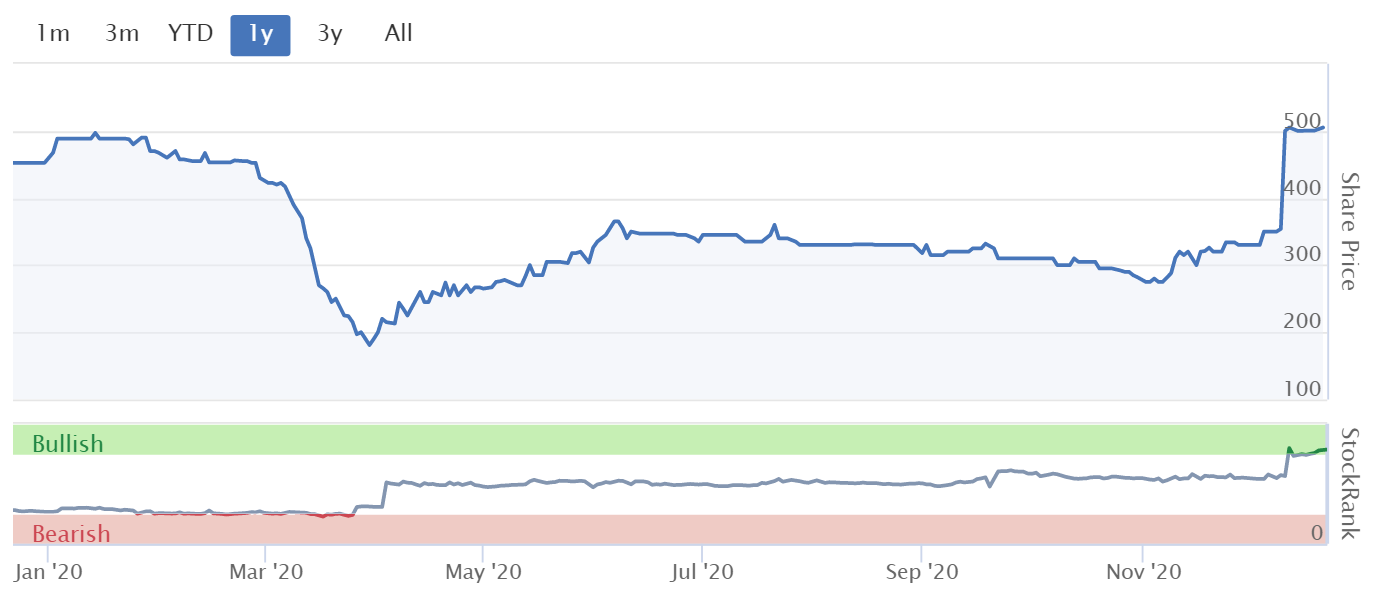

As you can see from the chart below, the share price has recovered to where it was before the short-lived Boris bounce in Dec 2019. Does that make sense? Given that DFS is trading well, and home furnishings are a booming sector right now, then it probably does.

.

.

Share count - this is a key point, of general application. When looking at the chart, and comparing it to pre-covid prices, we must check whether the share could has gone up. Many companies raised fresh equity during the crisis, especially ones with weak balance sheets. DFS share count was about 220m pre-covid, and is now 258m, about 17% dilution. Therefore the same share price as before would actually be a 17% higher market cap, which may not be justified.

Personally, DFS’s awful balance sheet is a deal-breaker, hence why I would not invest here. I can get the same upside from Scs (LON:SCS) (I hold) with a bulletproof balance sheet. Note that SCS did not need to raise any fresh equity, hence no dilution. Hence balance sheet strength is really important, but often overlooked.

Covid should have taught companies how fragile their business models actually are, hence much greater financial reserves are needed - equity, not debt. Covid showed that companies with inadequate financial strength become financially distressed, and had to raise fresh equity at the worst time & price, in order to avoid insolvency. For this reason, I would want to see DFS, and other companies with negative NTAV, rebuild their balance sheet strength so that they could cope with any future pandemics. Has that lesson been learned? Doesn’t sound like it has, reading today’s update.

Overall then, it’s trading well, but the weak financial structure puts me off.

.

All done for today! See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.