Good morning, it's Paul here with the SCVR for Tuesday.

Futures are up nicely, so we should have a positive day today. There probably won't be much company news today, if so I'll possibly have another hour in bed, it depends what impact the first coffee of the day has shortly.

Timing - I've exhausted the minimal amount of newsflow today, so today's report is now finished. I'm pleased that we have over 4,000 reads of this article at 12:26 - which encourages me that it's worthwhile writing stuff at this quiet time of year. I'll always find something to write about, even if it's something general, or a company that I'd meant to look at some time ago.

Covid-19 deaths

I feel that the reporting by journalists of covid-19 has seemed wildly inaccurate right from the start - giving the impression that we're all at terrible, and equal risk of death. Whereas the published data has clearly shown that is not at all true. This illness overwhelmingly attacks the elderly & sick. Finally, the Telegraph has broken cover, pointing out today;

Almost three times as many under 60s died in road crashes last year as those without health conditions killed by coronavirus, NHS data shows.

Just 388 people under the age of 60 with no underlying health conditions have died of coronavirus in England, NHS data has revealed....

In comparison, during the whole of 2019, 955 under-60s died on England’s roads.

When put like that, it does make the economic (and human) damage caused by lockdowns seem highly disproportionate. On the upside, it should mean that once vaccines are properly rolled out, that everyone not old/vulnerable should be able to get back to normal quite quickly. Press reports are saying that the Oxford/Astra vaccine is about to be approved imminently, and can be rolled out very fast, due to simple storage requirements. If that's correct, then the picture for stock market investors is looking a lot more positive. We just have to get through a few more weeks of awful news about it spreading rapidly (new strain, cold weather), before the tide turns.

Outlook for 2021

Based on information currently available, I think it makes sense for investors to be looking beyond covid, and pricing in recovery. That's happened for a lot of shares already, but there are still plenty of opportunities out there I think. That's because broker forecasts (where there are any) are probably too cautious, often with a slow recovery pencilled in.

The evidence suggests to me that a v-shaped recovery in 2021 is possible, likely even, as pent-up demand is released, by consumers who are cash-rich in many cases (middle class people anyway, not so much the case for lower earners). Some suggestions are that lockdown restrictions could be eased as early as end of Feb 2021, if enough vulnerable people have been vaccinated by then. Easter is an alternative timescale being mooted by Govt. Bravo to all the healthcare workers who are implementing the vaccinations. It's a load off my mind, knowing that my Mum now has some degree of protection. So it's not just the vulnerable who benefit, it's also their loved ones who don't need to worry quite so much.

Many companies have restructured, stripped out a load of costs, and worked out ways to operate more efficiently during this crisis (e.g. using Zoom instead of flying people to see clients in other countries). Therefore, we could see earnings not just recover to pre-covid levels, but rise above in some sectors, perhaps?

Hence my outlook for 2021 is largely positive for equities. In any case, what's the alternative? A bank account paying nothing? Over-priced bonds, where you risk some/all of your capital potentially, for a paltry return? Property - where you have all the hassle of ownership, and managing tenants? To my mind, equities are the only game in town, and if we look hard enough, there are still attractive shares out there.

.

Shearwater (LON:SWG)

Share price: 154p (up 10%, at 08:30)

No. shares: 23.8m

Market cap: £36.7m

Trading update and New contracts secured

This is a new company for me, I've never looked at it before. It seems to have been previously called Aurum Mining, which morphed into a new business in early 2017;

The Company will focus on the acquisition and development of businesses operating within the fields of information security and cyber security, with the aim of building a group of significant scale providing digital resilience solutions to UK based private and public sector organisations.

[Source: RNS 21 Dec 2016]

Interim results (6m to 30 Sept 2020) look a bit lacklusture;

- Revenues down 32% to £11.2m

- Loss before tax of £(780)k - improved from £(1,468)k in H1 LY

- Adjusted profit before tax £365k - the main reconciling item being a £1,050k amortisation charge relating to goodwill on acquisitions - which is fine to strip out, so I can live with the adjusted profit measure

- Underlying EBITDA positive at £1,062k

Balance sheet lacking strength, although not alarmingly so, with NTAV slightly negative at £(127)k. Although I see long-term creditors is mainly £3.2m deferred tax, which can usually be safely ignored. If we strip that out, then NTAV would become positive at £3.1m, which is probably adequate for a small service sector business.

The balance sheet is dominated by intangible assets, relating to acquisitions, which I always tend to write off in full.

Cashflow statement - note that it raised £3.75m equity in the last 6 month reporting period, which was used to pay down debt.

.

Today's update -

New contracts secured by Brookcourt with multinational investment bank

Shearwater shares were suspended for a while in 2018, whilst this "transformational"acquisition (£30.3m - almost as much as the current market cap) was implemented. Brookcourt is a cyber security solutions company. A placing & open offer was done at 3.6p per share. A 1 for 100 share consolidation was implemented in 2019.

What's that old stock market saying? Sell a consolidation, buy a stock split? Something like that. It makes sense, because share consolidations are only usually done by poorly performing companies, who are embarrassed that their share price looks mickey mouse, at a few pence, or even fractions of pence. Whereas shares that go awkwardly high, and are split, are obviously things that have been very popular with investors & done well. Although as with all stock market adages, sometimes they work, and sometimes they don't.

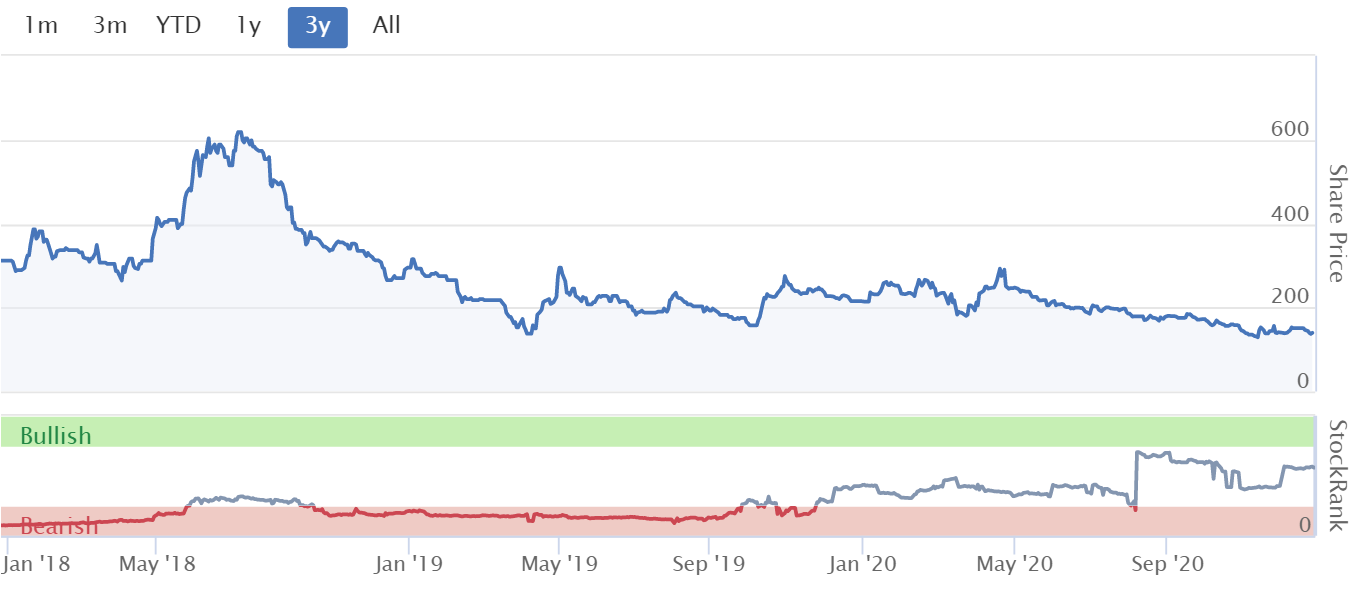

As you can see from the 3-year chart below the excitement over the Brookcourt (sounds like a block of flats) acquisition left investors nursing a hangover;

.

.

Despite this fall in price, the market cap of £36.7m doesn't look a bargain, for a group that's not really making any significant profit.

Shearwater Group plc, the organisational resilience group, is pleased to announce a trading update for Q3 FY2021 to date. The Group also announces a number of contract renewals and new wins for its group company, Brookcourt Solutions Limited.

Surely they could come up with a description of the group that makes more sense than "organisational resilience group" - that could mean anything! Not a good start, if a company can't even explain what it does, in plain English.

Trading update - for FY 03/2021 to date - this sounds pretty good -

Further to the Group's recent interim results announcement, Q3 trading has continued to be buoyant with recognised revenues for October and November 39% ahead of the same two months in the prior year, as previously announced delays in recognising secured orders have come through in the current quarter.

Strong momentum has continued into December. This has materially reduced the year-on-year revenue deficit reported for the first half and the Group continues to track in line with profit expectations for the full year.

Unfortunately, we're not give a footnote to explain what those profit expectations are.

A Cenkos note from Nov 2020 indicates forecast revenue for FY 03/2021 flat vs LY at £33.0m, and decently positive adj EBITDA of £3.4m, reducing to an adj loss before tax of £(1.1)m. I'm struggling a bit to decide which figure to latch onto for valuation purposes.

My opinion - this looks a good update today, with delayed contracts seemingly returning. I like the area of cyber security, as it's so vital for all companies to secure their systems and data, and we read about hackers breaching systems almost every day.

As it's the first time I've looked at this company, and I don't really understand what it does, then I can't really offer an opinion on it. A contract win announced on 10 Oct 2019 looks impressive - an £8.5m contract with "one of the UK's largest telecommunications companies" seems to offer strong validation of the services provided by Shearwater.

It could be worth doing some more digging on this one, perhaps?

.

Ilika (LON:IKA)

Share price: 252p (up 25%, at 12:17)

No. shares: 138.6m

Market cap: £349.3m

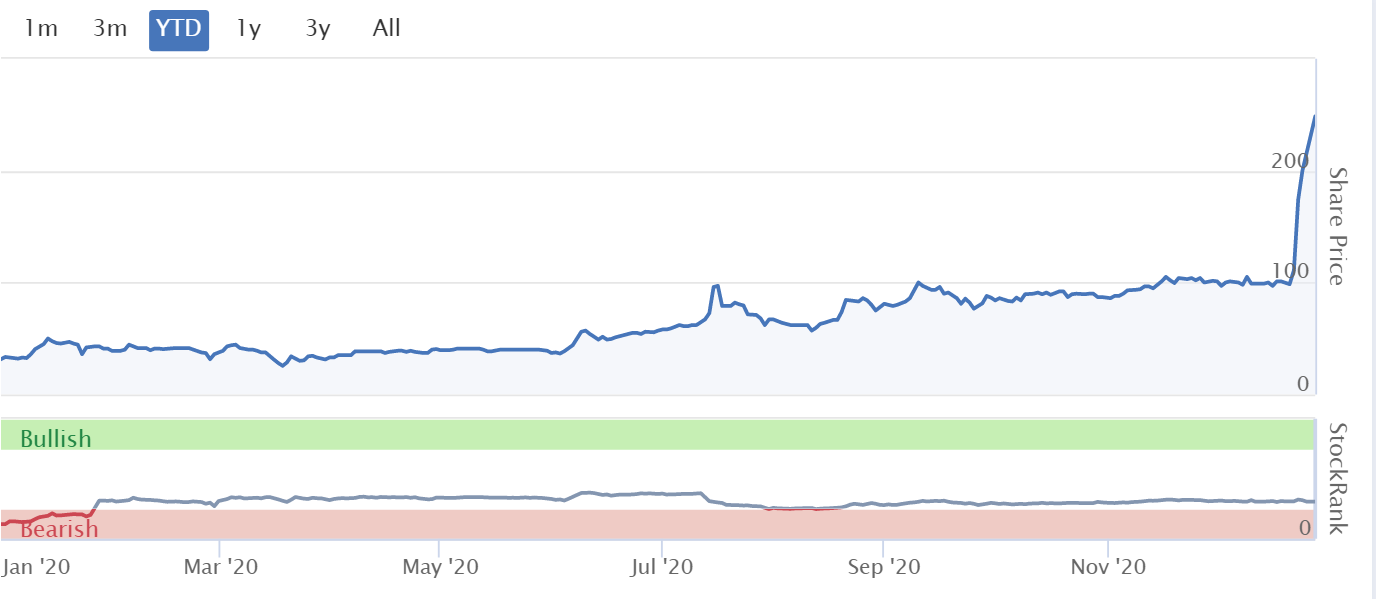

This share has been in a vertical move upwards in the last week or so, as you can see;

.

The company issued the following statement at 10:04 today;

Statement re Share Price Movement

The Board notes the recent rise in the Company's share price and the growing interest in solid state batteries in the media in recent weeks regarding their future potential in automotive applications. The Company reiterates its guidance set out in the announcements dated 11 and 24 November 2020. In particular, whilst the Board is confident about the prospects for the Company's Goliath larger format batteries, mass market commercialisation is dependent on further technical development and successful manufacturing scale-up.

The interim results for the period ended 31 October 2020 will be released on 14 January 2021.

The way I read that, it seems to be pouring cold water on the huge rise in share price, saying basically that there's no new information.

My opinion - this has speculative frenzy written all over it.

Good fun, if you can time your entry & exit points to perfection.

.

All done for today! See you tomorrow.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.