Good morning, it's Paul here with the SCVR for Tuesday.

Timing - I've barely paused for breath, and 5 hours has gone! It's amazing how time flies when you're immersed in RNSs and market action. Update at 12:20 - I've got plenty more to do, and want to fit in a walk in the sunshine at some point, so let's say 4pm finish time today. Today's report is now finished.

Lockdown 3 is upon us, which shouldn't come as a surprise to anyone - it was obvious that restrictions would have to be tightened further, so it really shouldn't make much difference to share prices. If anything, it was slightly better than I expected, because the Prime Minister said that the most vulnerable groups should be vaccinated by mid-Feb, add 3 weeks for the vaccines to take effect, which implies an easing of restrictions somewhat possibly in early March? Previously we had been told it would be end March, early April (Easter time). He also talked about schools re-opening in mid-February.

Despite widespread criticism of the Government, the authorities here in the UK have at least so far been highly effective at approving, ordering, and administering, vaccines. Compare that with lamentable progress in France & Germany, where there is uproar at the sluggish, indecisive, and clearly incompetent approach of combining their efforts via the EU Commission (at the insistence of Merkel apparently, who seems to have lost the plot completely, once again putting political dogma before the interests of the people she's supposed to be representing). Leading to Germany, the country which was pivotal in creating the first vaccine, not ordering enough for its own people. Things are going at a snail's (!!!) pace in France too. All rather ironic, given that we were falsely warned that it was supposed to be the UK experiencing shortages of medicine after Brexit! Layers of unnecessary bureaucracy don't tend to make things more streamlined, in my experience. So this seems a good example of where we can do a better job on our own. So well done to the authorities in the UK for being more nimble & effective than the lumbering EU bureaucracy. Sorry if this upsets anyone, but it's clearly true, and the truth hurts sometimes.

In terms of profitability, I calculate that many retailers & hospitality companies would be probably no worse off closed & claiming furlough grants, than open and seeing low footfall. This was confirmed to me by a bars group, which I spoke to last week. They saw little to no difference in profits between trading, and not trading, during the seasonally quietest time of year from Jan-Mar. Hence zero revenues from Jan-Mar inclusive were already planned for, and survivable. Although the same is probably not the case for many smaller, independent competitors. Hence in tough sectors, the companies that survive, should enjoy increased market share, in markets with great pent-up demand, at least for a while in mid to late 2021. A classic case of whether the glass is half full, or half empty.

Another point is that people & companies know the drill now. Companies have proven remarkably adaptable, and many can operate largely as normal, during lockdowns.

Travel companies - I'm intrigued to see that Ryanair is running TV ads promoting holidays, with the strap line: "Just jab and go" (re vaccines). Also it's saying that anything booked now can be re-booked if necessary. I reckon bookings are likely to be strong, as people are itching to go on holiday, I know I am. Air travel doesn't seem to be high risk anyway, possibly because overhead air vents mean that air travels in curtains downwards, and out via floor level, and through filters before being recirculated. I imagine the hanging around in airports is more likely to be risky, than actually being on a plane.

Positive feedback - I received a wonderful email yesterday, from the boss of a city PR firm. He said he really liked my suggested list in yesterday's report, for what needs to be included in current trading updates, and had emailed it round to his whole team. They totally agreed that it was a good checklist, and was already pretty much what they were aiming for. Isn't that great! It's really encouraging that comments here are listened to, at least by some advisers in the city.

.

Saga (LON:SAGA)

(I hold)

Directorate Change

The CEO of Saga's core insurance business has stepped down with immediate effect. That's obviously a worry, as Directors don't tend to step down when things are going well. Although there are reassuring comments in today's statement, e.g.

Euan Sutherland, Group Chief Executive Officer of Saga plc, said:

"Our Insurance business has performed resiliently under Cheryl's leadership despite challenging market conditions and she departs with the business well placed to deliver on the opportunities we have identified as part of our new strategy. I'd like to thank Cheryl for her contribution to Saga and wish her well for the future."

Sir Roger De Haan, Chairman of Saga plc, said:

''I would like to thank Cheryl for her work and commitment and wish her well for the future. We are focused on finding the right individual to replace Cheryl and to continue to drive our Insurance business forward for our customers. Until this appointment is made, Euan and the management team continue to implement our transformation strategy."

.

It's guesswork with these things, but based on the words above that I've highlighted, it sounds to me as if there might have been a disagreement, or performance issues with the individual, rather than the business.

My opinion - I remain of the view that, with a say 2 year view, Saga shares could significantly re-rate. The recent refinancing provides enough leeway for now, and lockdown 3 makes no difference to the travel division, which was scheduled to start operating again in April/May 2021. Covenants on the cruise ship loans have already been waived until June 2021, so I don't see any issues with debt, which is mostly asset backed anyway, or the £250m medium maturity dated, unsecured, cheap interest rate bond. Hence probably no issues with debt, after the bank debt was sorted with the £150m placing, two thirds funded by the returning former CEO/founder's son, Sir Roger de Haan.

Cruise ship bookings are high, according to a recent Telegraph interview with Saga's travel division head, so once those 2 brand new cruise ships can sail again, then the profits should roll in (£80m p.a. EBITDA forecast by the company, for its 2 owned, brand new, cruise ships, currently holed up in Tilbury docks).

The short term share price is extremely volatile, I've no idea why. We just have to wait for the sellers to finish in due course, then the upside potential could be unleashed. It sounds like the insurance side of the business is going OK, although obviously sales of travel insurance will have been meagre during lockdown. Although motor & household insurance should have benefited from fewer accident & burglary claims, possibly?

.

Boohoo (LON:BOO)

(I hold)

I'm thinking of sending an invoice for my wasted time, to Morgan Stanley. Why are they issuing an RNS literally every morning, notifying of apparently trivial changes to their holding in BOO. It seems to be some swap arrangement, or hedging.

I'm not sure when the next trading update is from BOO, but we can't be far away from it. Further lockdowns can only help online-only fashion retailers like BOO and Asos. Although note that BOO performed very strongly over the summer also, when its competition was able to re-open physical stores.

The trading update today from Next (LON:NXT) (see below), demonstrates again that online is absolutely key for everyone in the sector, apart from Primark.

I do think the last year has changed, probably permanently, shopping habits. I tend to order my bits & bobs from Amazon now, and get a delivery from them almost every day. Books, stationery, household items, etc. Probably the only things I don't buy from Amazon these days, are food, electrical items (where I prefer a trusted brand like Currys, or Argos), clothing (2 or 3 trips p.a. to Primark for 5-10 identical black T-shirts, multi-packs of underwear, etc), and that's about it. The idea of going into town to do general shopping seems irrelevant now.

What are town centres for? Increasingly, just as a meeting place to see family/friends, grab a meal/drinks, possibly browse for new clothes, and that's about it. Most of the shops seem irrelevant now. Going to an out of town shopping centre is more pleasant, as you're not surrounded by beggars and noisy/rowdy youths on skateboards so much as in town centres. Nothing against any of them, but I just don't want to rub shoulders with them, thank you. Many small to medium town centres look dangerously close to a tipping point where there's no future at all, and it might as well be mostly converted to residential, and/or serviced offices.

All of which is great for BooHoo. It's rapidly expanding internationally, doesn't have any legacy stores estate to worry about closing down, and is recovering from ESG problems. A pivotal moment for me, was when the Guardian's latest broadside about supplier factories in Pakistan in late 2020, had only a glancing impact, taking a few pence off the share price, before it rapidly recovered and continued rising. This suggests to me that the supply chain story has finally run its course, and investors remaining in BOO shares seem satisfied with the company's response & its comprehensive remedial measures. Or (like most of the customers) don't really care. Hence the only way is up, in my view, providing strong trading continues, as seems likely. This share is my no.1 long-term share pick. It's probably got the most ambitious, and hardest working management that I've come across, and that permeates throughout the business, with staff also being shareholders.

EDIT: thanks to moolahcoast for commenting below that apparently BOO is scheduled to issue a trading update on 14 Jan 2021. I've not checked that, so assume it's correct. End of edit.

.

Next (LON:NXT)

7488p (up 8.4%) - mkt cap £10.bn

Trading Statement

Always the first retailer to report after Xmas, and with the most comprehensive detail & guidance, this company is such a class act. Its shares recovered well in the tumultuous year of 2020.

Here it is in a nutshell -

In the nine weeks to 26 December, the sales gained in our Online business compensated for almost all

those lost in Retail stores, with total product full price sales down just -0.5%.

Plenty of retailers are showing good online growth, but it's more important to know what proportion of total sales are online - figures that are often hidden, if they're not very good! Next does at least half of its business online now. So you could view it as an online business with a legacy estate of stores, the unprofitable ones are being gradually closed, and rent reductions generally secured on ones which remain open. So the stores are a manageable legacy thing, which just shows how well-managed Next is. None of us know what level physical retailing is likely to settle at in future.

Compare that with how Arcadia went from hero to zero, after being slow to realise the crucial importance of online sales, and ultimately being pulled down by the weight of its physical stores. That, and numerous other problems, such as under-investment, and Green's bullying personal style, which encouraged the best people to leave.

I'm still amazed at how fast retailing has changed, with previous trends greatly accelerated in 2020 due to covid/lockdowns. We should find out very soon where the TopShop brand ends up - BooHoo and Mike Ashley being the front-runners, according to press reports. My worry with Ashley is that he could end up over-paying due to his ego wanting a final victory over his former rival, Philip Green.

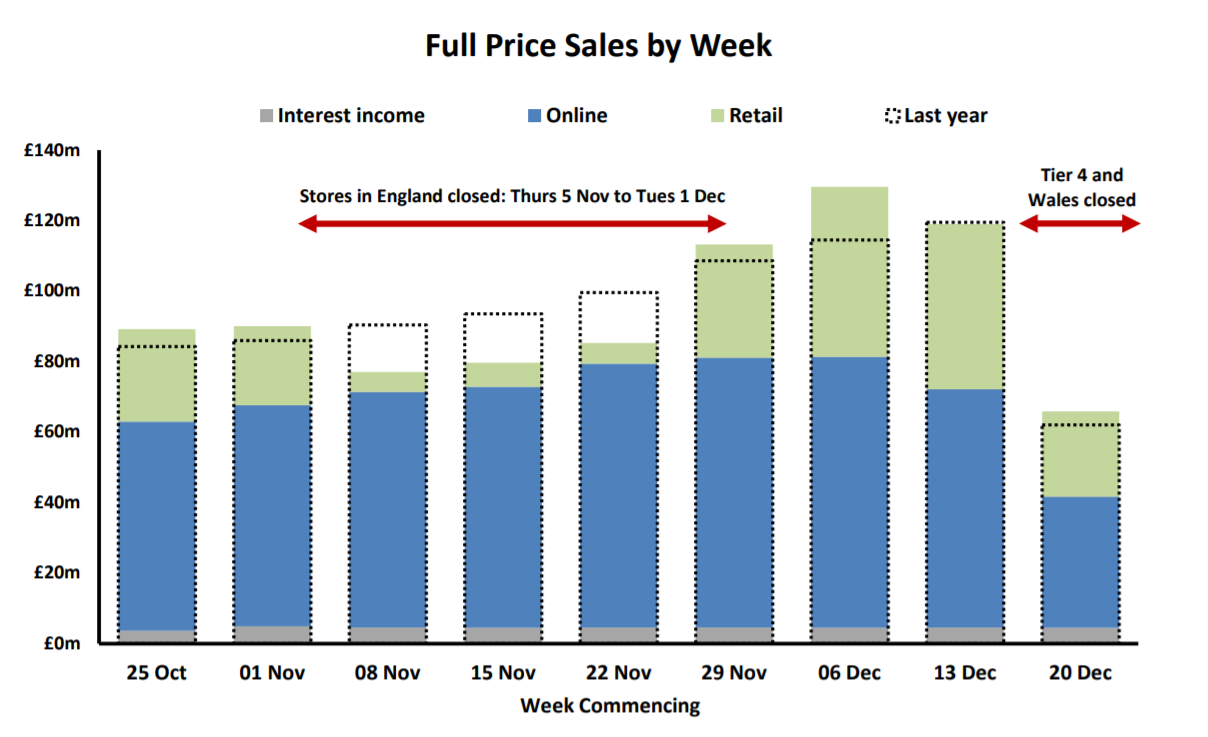

Going back to Next, I love this table, which demonstrates how strong online sales have been, making lockdowns little more than a nuisance. Note also there was some catching up of sales in physical stores briefly, after the Nov lockdown ended. Overall, this is a remarkable performance in my view- a tremendously resilient business in awful circumstances.

.

.

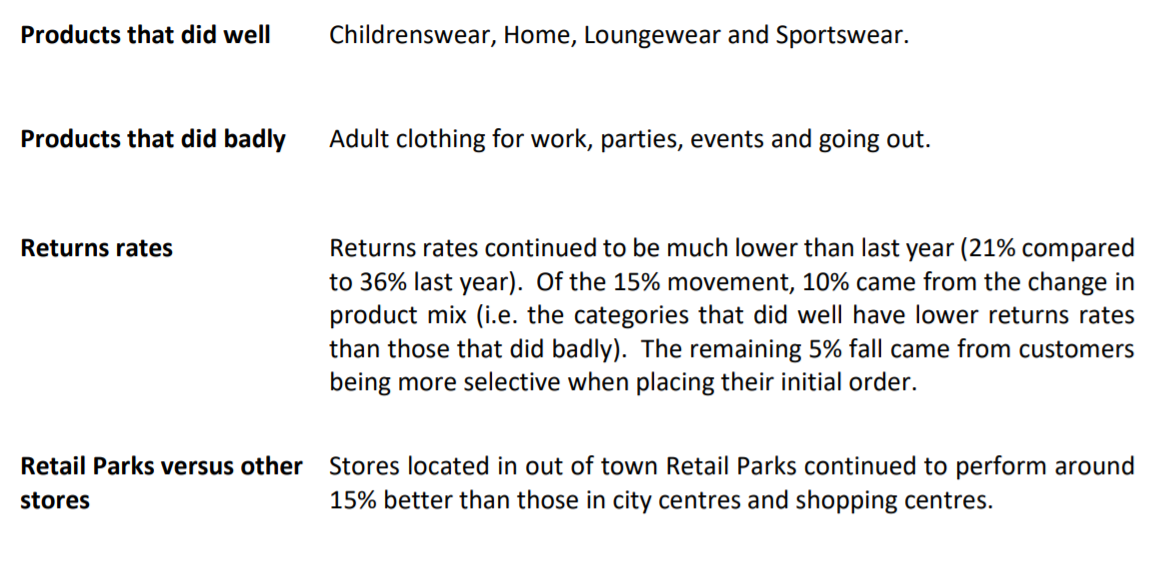

These comments below are all useful, and likely to have read-across for the sector generally.

.

.

Impressive growth in customer numbers online, up 24.1% to 8.2m

Receivables book (customer credit) shrank about 18% in the first half, but has since risen again in Nov & Dec. Defaults remain low, which is clearly encouraging. It's important to remember that Next has a receivables book which offsets its net debt. That's important to take into account, if you're calculating enterprise value.

The customer receivables book was £1,055m at end Dec 2020, and net debt is forecast at £625m a month later. So that's a very healthy position, where we can safely disregard net debt altogether in my view, because it's not far off twice covered by customer receivables.

Boxing Day sale (peak trading) impacted by lockdowns. Half the surplus stock will be cleared online instead, but incurring £5m additional costs. So it could be worth us all checking out Next's website, to see if we can pick up some bargains! I do quite like their stuff. Although what is this awful menswear trend to dress up smartly, but not wear any socks?! Put some socks on man, nobody wants to see your bony, hairy ankles!

Property provisions - an additional £40m provided for, since assumptions about stores performance were too optimistic.

Logistics problems - there are currently logistics issues globally, with container and air traffic. I've heard from numerous sources that rates have shot up, containers are in the wrong places, etc. This might have been worsened by pre-Brexit stockpiling, but I'm told it's a much wider problem than that, which could take months to be resolved. This is what Next says, which ties in with that. I wonder how many other companies will blame this factor in their forthcoming profit warnings? -

In addition to the closure of shops, the pandemic has adversely affected the flow of container traffic

from the Far East. At present many of our deliveries are running two to three weeks late and we

expect this level of disruption to continue into the new year. Our stock levels are currently down

-10% versus two years ago (January 2019). We expect stock levels to steadily improve and return to

more normal levels by the end of March.

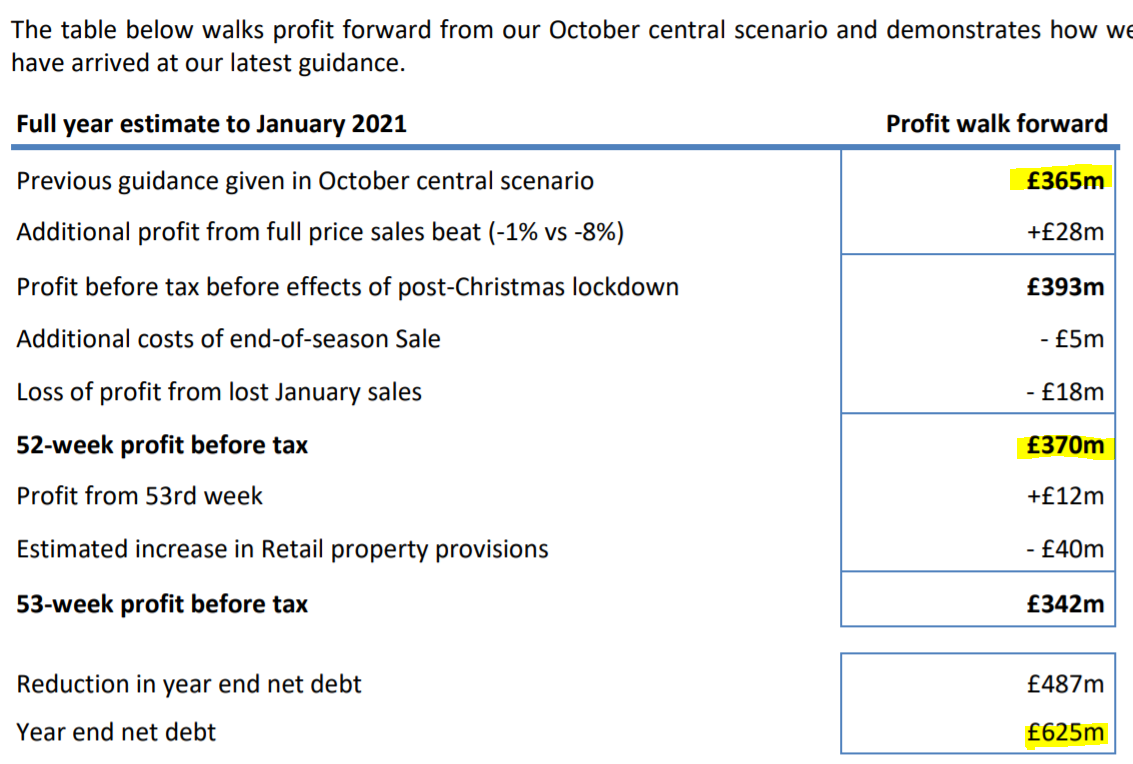

Guidance - the all-important bit. There's a lovely table below, called a profit walk forward. It's a bit like a profit bridge, but laid out vertically instead of horizontally -

.

.

The way I read the above, it seems to be saying that guidance for FY 01/2021 profit has only gone up slightly from £365m to £370m. Which raises the question, why is the share price up 8% today? Maybe the market was expecting worse?

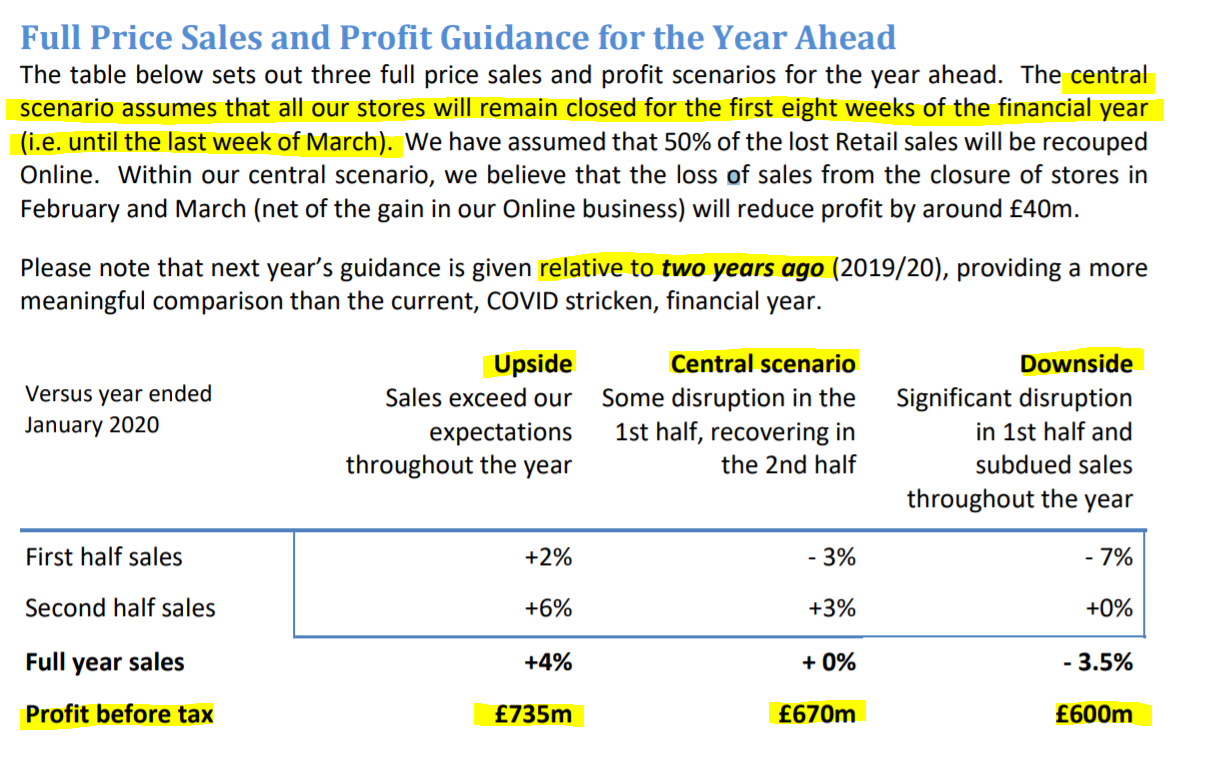

Guidance for next year - more important, given that the current financial year has nearly ended (remember that Next uses a 31 January year end - sensible, as it's a quiet time of year to do stock-taking, etc).

If only all companies reported with this level of clarity, it's a joy to read this -

.

.

Many companies do this internally - i.e. have a base case (most likely outcome) forecast, then an upside and a downside scenario. This is what I did in my CFO days (1993-2002) for a much smaller fashion retailer. I would plug the upside & downside scenarios into my giant spreadsheet model of the business, and see how the monthly balance sheet & cashflows were impacted. This is a vital way of forecasting & avoiding or planning for cashflow crises (which I often had to deal with!).

Next takes the bold step of publishing these forecasts, above. This is such a great way of managing investor expectations. As a result, even if the macro picture deteriorates for whatever reason, Next shareholders can consult the previous guidance, and know what to expect in terms of lower profits. That avoids people over-reacting, and panic selling, so it's good for the share price.

A great friend of mine, who is a PR guru, always tells me that good PR is not about constantly talking things up. It's actually about managing investor expectations well. Next are the masters at this, and I'd really like to see all companies adopt this approach of giving the market guidance with 3 possible outcomes. Surely that's far more logical & intelligent, than trying to give one specific number for profit guidance, when there are so many uncertainties?

Giving a range of forecasts is also very much better for investors, than just saying it's too uncertain, and not telling us anything! That's atrocious actually, and companies deserve to be given a hard time when they completely withdraw guidance.

Every time companies update the market, they can then adjust the range of forecasts up or down as appropriate, and the range should logically narrow as the year progresses.

.

Brexit - here's another area where all the dire warnings we've been bombarded with since 2016 have turned out to be complete baloney! (as I had been saying all along, before I got banned from Twitter) -

.

Valuation - my view is that Next usually under-promises and over-delivers. So looking at the FY 01/2022 guidance above, I'm thinking in terms of somewhere between base case & upside case, let's say £700m PBT. Take off 19% corporation tax, gives us £567m PAT. Divide that by 133m shares in issue = 426p forecast EPS by my calculations.

The share price is whipping around a bit, but currently at 7344p. That gives a PER of 17.2

That seems priced about right to me. You could argue that a business which is mostly an online portal, for its own and others' fashion brands, should be on a higher PER. However, some of the profits still come from the declining physical stores, which is inevitably likely to act as a drag on group profits. Hence overall profitability is held back, and EPS growth has basically been nothing in the last 5 years. Does that justify a rating about 17.2? Arguably not.

On the other hand, we're in a raging bull market, where investors easily get over-excited about growth businesses buried within a bigger group - e.g. look at the excitement that has emerged about Reach (LON:RCH) - one minute it's a moribund newspaper business, the next minute investors are talking about it being a growth digital advertising platform, comparable with Google! OK I'm exaggerating for effect there, but it's to show that sentiment can change. That's probably the upside with Next - strip out the stores altogether, and you can show a decently growing online business, that maybe should be valued on a crazy growth multiple?

My opinion - I've been keen on Next for years now, because it proved so effective at moving physical sales online, and effectively managing down its store network in a disciplined way. It's a superbly run business. Although I do wish Lord Wolfson would stop appearing on Question Time, and being so careful not to offend anyone, that he says nothing of any significance.

The only reason I won't be buying any Next shares, is because I think the valuation is probably about right now. It's a terrific share to buy on market meltdowns though, as it always recovers.

.

Intercede (LON:IGP)

Share price: 92p

No. shares: 50.5m + potential dilution from convertible loans

Market cap: £46.5m

(I hold)

Convertible Loan Notes (CLN) - conversion to equity

Michael Tee asks in the comments below what this is all about, so I thought it would be useful to do a general recap on Intercede's convertible loans.

Today the company announces that a holder (Harwood Capital Nominees) of £100k convertible loan notes has decided to convert the loan into 145,322 shares. These newly created shares will be tradeable on AIM, like all other existing shares, from 8 Jan 2021. A few points;

Good to see Harwood Capital is a holder - they're well known shrewdies

It's not clear whether Harwood intends keeping the newly issued shares, or selling them in the market for a profit?

I don't know whether Harwood holds any more CLN or not - I'm not aware of the company having disclosed, or being required to disclose, the names of holders of CLNs, other than Directors, who hold 1m CLNs (Jacques Tredoux - a Director, and major shareholder), and 50k CLNs held by the CFO (source, page 20 of 2020 Annual Report - just do a CTRL+F search for "convertible" and it brings up all the detail).

Important to note that the CLNs can be converted into shares at a fixed price of 68.8125p, and at the option of the CLN holder (i.e. not at Intercede's option). Therefore, if the share price moves significantly above the 68.8125p conversion price (which it has done recently), then CLN holders are more likely to convert into shares, which would then show them an instant profit on paper. Whether they could cash in that profit is difficult to say, as the market is thinly traded in IGP shares. It depends entirely on whether there are any buyers in the market or not.

Alternatively, holders of the CLNs can opt to hold to redemption date of 29 Dec 2021, whereupon Intercede will have to repay the CLNs which have not been converted into shares, in cash.

£5.05m originally borrowed using the CLNs, £4.495m issued in Jan 2017, and £510k issued Aug 2017

CLNs are quite expensive to fund - 8% interest, payable quarterly, so a £400k p.a. interest cash cost. That will disappear after Dec 2021, boosting profits by £400k p.a., since the loan notes will either convert into shares, or be repaid in cash, clearly a positive development.

NB Intercede has enough cash to repay all CLNs in full, if required. In practice, the company is anticipating a mixture of conversions & repayments, which I think is ideal - as the balance sheet will be strengthened by the CLNs disappearing, funded partly by new debt issuance, and the cash pile

Maximum potential dilution is £5.05m CLNs, divided by 68.8125p conversion price (fixed), so 7.34m maximum number of new shares - quite significant, but not ruinous dilution, at 14.5%. I'm guessing that perhaps about half the CLNs might convert, which would dilute existing shareholders by just over 7% - no big deal.

None of this is new by the way, apart from Harwood converting a small amount. I don't recall seeing any other conversions being reported, I think this is the first one.

My opinion - how this pans out depends on what the share price does - i.e. CLN holders are more likely to convert & be tempted to sell for a profit, the higher the share price goes. The logical thing to do, is to sit tight, to keep their options open until expiry near end Dec 2021. Therefore I assume anyone converting now probably intends selling their new shares.

The share price could be hit, if CLN holders convert, and then sell aggressively into a thin market. So we could see the share price fall towards the 68p conversion price, if the newsflow from IGP is lacklustre.

There again, if the trading updates & results are strong this year, then there could be backed up demand for IGP shares, and anyone who converts could sell easily, without hitting the share price. In this type of situation, potential buyers can notify the house broker that they want to buy, when any larger blocks of shares become available. Then the house broker matches up buyers & sellers. I did that several times in the past when trying to liquidate large positions without smashing the share price by selling in dribs & drabs in the market. Brewin Dolphin were very helpful in this regard, when I was unwinding my notifiable stake in IndigoVision, years ago. The trick is not to sound desperate to sell, and say you're not really bothered about selling or not. Even if you're backed up against the wall, with multiple margin calls! I remember in the 2008-9 crisis, I actually placed a lot of my illiquid spread bet positions with sellers, through the house brokers, so that the spread betting companies could sell at a reasonable price, incurring a smaller loss for both me & them.

In the short term, CLN conversion (and possible sales) could add to share price volatility this year. But ultimately, the amounts are so small, that the increased liquidity could attract bigger buyers. Anything could happen in the short term, but it's clearly the underlying performance of the business that's likely to drive the share price.

Once we're into calendar 2022, then IGP won't have any interest-bearing debt, hence a £400k p.a. interest charge will disappear, boosting profits. That's certainly helpful.

.

Surface Transforms (LON:SCE)

Share price: 53p (up 4%, at 15:33)

No. shares: 154.9m

Market cap: £82.1m

Trading, OEM Pipeline & Operations Update

Surface Transforms (AIM: SCE), manufacturers of carbon fibre reinforced ceramic automotive brake discs is pleased to provide an update on trading for the year ended 31 December 2020, OEM pipeline, operations and increased Knowsley footprint revenue capacity.

Revenues in line with previous guidance, at just £2.0m (barely moved from prior year) - for an £82m market cap company! Clearly this is a share price resting entirely on considerable future growth expectations.

Cash - looks very tight. With such a big market cap, a top-up placing for a few million quid looks a good idea, and would not dilute much -

Cash as at 31 December 2020 was £1.1m (2019: £0.8m) and to this cash sum can be added an estimated £0.6m tax credit, expected to be received in July 2021. Other interest bearing loans and asset finance totalled £0.5m (2019: £0.6m).

Progress with OEMs - confident of its products being "nominated" on further vehicles in future, with existing & new customers. I wonder if nominated is any different to specified? I'm wondering if the SCE products are standard fit, or a premium-priced extra? Do any readers know? "Carry over" of existing product approvals sounds good.

Operations update - machines being commissioned for volume production in Q2 2021. Like MrContrarian below, I am perplexed as to why the company mentions the appointment of a Human Resources manager. To me, that simply emphasises how small the company is.

Production capacity - will reach £20m in Q2. That's 10x existing revenue, so sounds quite exciting in terms of scaling up, providing that capacity can be fully utilised. Upping capacity further to 5 "cells" would increase capacity to £75m sales p.a. (previous guidance of £50m).

Higher average selling prices anticipated.

My opinion - neutral, as I don't know anywhere near enough about the company's future potential to make a judgement. The market cap of £82m looks nuts based on historic numbers, obviously, I'm sure nobody would disagree with that. However, shares don't value the past, they value the future. If SCE can get anywhere near the revenue figures talked about in this RNS, and assuming it makes decent margins, then this could be very exciting. Plenty of people seem to believe that, given the high valuation.

FinnCap forecasts show £7.3m revenues in FY 12/2021, and £12.5m in FY 12/2022. That's way below the capacity figures mentioned by the company today. Forecast profits are breakeven in 2021, and £2.1m in 2022. Bulls are obviously betting that revenues would be a lot higher than that further out.

Looks potentially interesting, but it would require a lot of work to understand what barriers to entry there are for competitors, and how much demand there is likely to be, etc. I'd be worried that it's not another false dawn, as we've seen over the last 18 years as a listed company.

.

I'll leave it there for today. A polite request - before posting indignant comments, would readers kindly scrutinise what I've actually written, and not a completely made-up version of your own making. For example, I did not heap praise on the Government above. I praised "the authorities" (meaning civil service, NHS, Govt, etc) specifically over the vaccination programme only. I didn't mention anything else at all re their handling of covid.

Hence some of the responses from readers were totally irrelevant, because they were responding to something imaginary! I chose every word carefully, because I'm making quite precise, factual points, and how they relate to the valuation of shares. So please do carefully check that you've correctly understood what I've written, before firing off an irrelevant reply. This is not Facebook or Twitter!

Similarly, the dire predictions about Brexit have, to date, been proven completely wrong. That matters because it affects how we value shares. So when Next said today that Brexit has not, and is not expected to impact its business, that's important information which we need to be aware of. OK, I reported it with a hint of glee, because it's nice to be proven correct on a contentious issue. But I'm not going to hold back in flagging important information, just because it might upset the emotions of people who have been wrong on this issue for the last few years, as things have turned out.

That's it for today then. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.