Good morning, it's Paul here with the SCVR for Friday.

Timing - today's report is now finished.

Agenda -

Reach (LON:RCH) - Trading Update

Tremor International (LON:TRMR) - Trading statement

Dp Poland (LON:DPP) - Reverse takeover & share dealings re-commence

Scs (LON:SCS) - Very significant major shareholder announced!

J Sainsbury (LON:SBRY) - trading update

Character (LON:CCT) - Freehold property disposal

Pets At Home (LON:PETS) - Good trading update

Marston's (LON:MARS) - Q1 update

.

Reach (LON:RCH)

Share price: 224p (up 28% at 08:45)

No. shares: 312.1m

Market cap: £699m

Reach plc, formerly Trinity Mirror plc, is a national and regional news publisher. The Company is engaged in producing and distributing content through newspapers and associated digital platforms.

[Source: StockReport synopsis]

Good news this morning with a positive update for FY 12/2020 -

Reach plc ("Reach", the Company") today announces that it expects underlying operating profit for 2020 to be ahead of market expectations, in the range of £130 to £135 million, following a record digital revenue performance.

This new £130-135m range is ahead of existing consensus expectations for u/l operating profit of £124.3m . So about 5-9% increase above expectations, coming right at the year end, is very good.

Digital revenue grew by 24.9% in Q4, up from 13.4% in Q3. Print circulation sales were down 11.7% in Q4, an improvement on the 12.6% decline in Q3. These trends contributed to an improved total revenue decline in Q4 of 10.2%, compared with the 14.8% decline in Q3.

That's a good acceleration in digital revenues in Q4, which were +16.2% for the 5 months to 22 Nov 2020, which I covered here on the 27 Nov 2020 trading update.

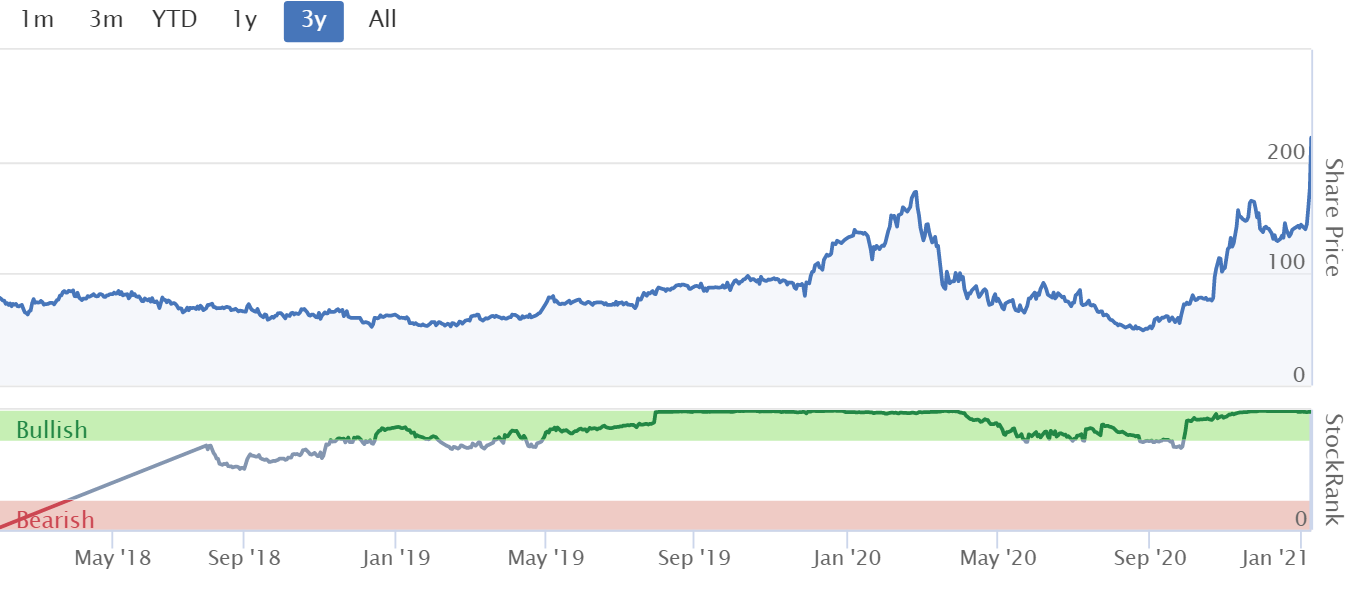

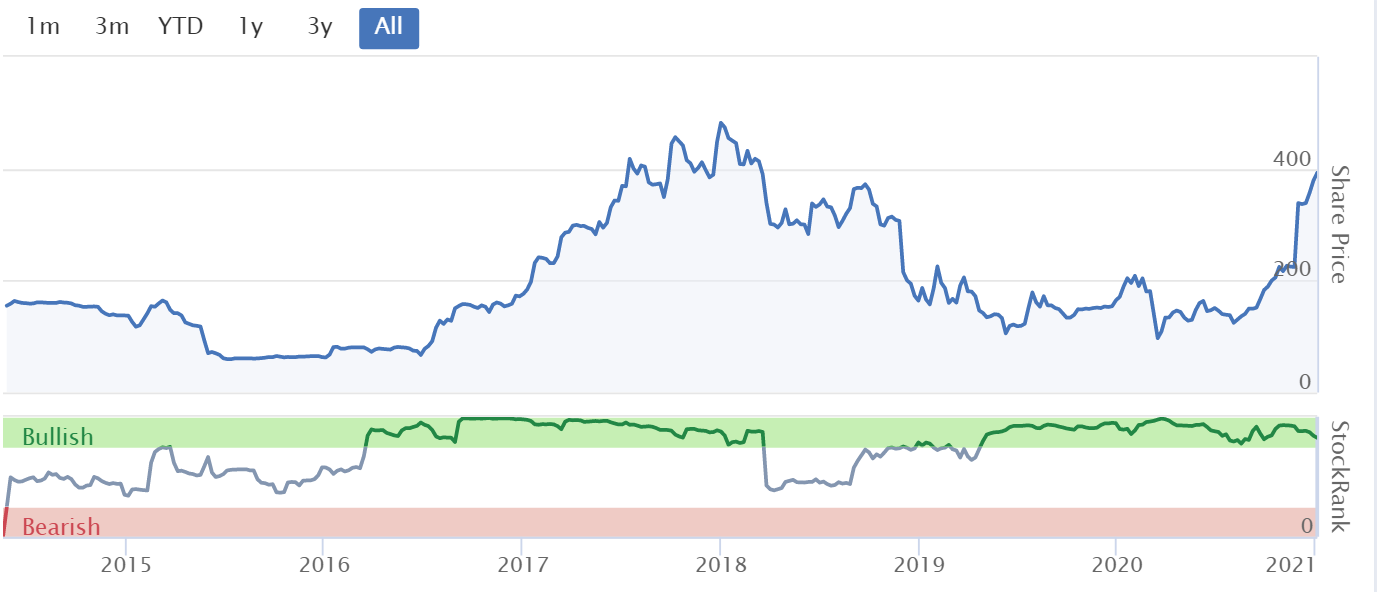

Although overall revenues are still falling fast, reinforcing the fact that the main business (newspapers) looks moribund long-term. There's been a surge of investor interest in the digital side of the business in the last year, as you can see from the share price.

Digital strategy - is to persuade customers to sign up (now at an impressive 5m customer registrations), which enables Reach to track user activity on its website, and thereby better target advertising.

Pension deficit - is not mentioned today.

Its giant pension scheme liabilities are a major worry, and highly material to the share's valuation.

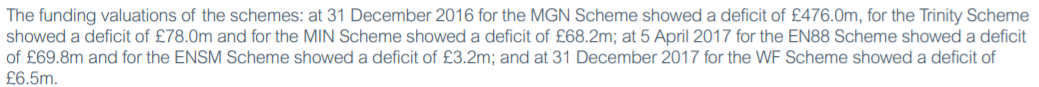

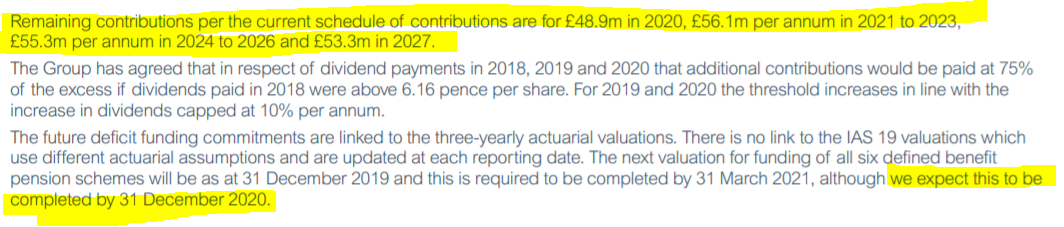

In the most recent annual report for 2019, the actuarial deficits totalled £701.7m - an enormous liability. Remember that deficit recovery payments are based on this figure, not the much smaller accounting deficit. From page 113 this is the breakdown of that £701.7m total deficit -

From the same page we are also reminded that huge cash payments are ongoing into the pension schemes. The latest three yearly pension scheme actuarial valuation sounds as if it's imminent, which is crucial information. Ultra low interest rates are likely to have swollen the liabilities, but investment returns may have boosted assets. The problem is that the deficit is the difference between two multi-billion numbers, so can be very volatile. I'd want to see this latest pension scheme information before buying any shares in Reach, because the numbers are so highly material.

The downside risk is that, once no more cost-cutting can be done, then the pension schemes could swallow up all future profits before long.

.

My opinion - this share is very difficult to assess, because we don't have full information about the digital side of the business. Where is the profit coming from? Newspapers or websites? I can't value the share without that information.

The bull case, about Reach morphing into a major digital advertising platform does sound very interesting. I'd like to see much more specific figures on this before buying into the story. Hopefully forthcoming 2020 results might give us more detailed information. It needs to split out profitability between the declining print business, and the growing digital business. Without that information, valuation is just guesswork.

I'll go through the 2020 results in detail when they're issued.

The increased 2020 profit expectations reported today is clearly good news. How much of that is down to cost-cutting, and how much to digital growth? We're not told.

Share price up 28% at 08:46 today seems a tad overdone to me. But we are in a bull market! If market sentiment detaches from fundamentals, and just rates it as a mini Google or Facebook, then the sky's the limit. So I can see the speculative appeal of this share.

.

.

EDIT: See Research Tree for an interesting update note from N+1 Singer. The forecast section is interesting, as it shows the split between print & digital revenues (but not the profit split unfortunately). What it shows is that rising digital revenues don't manage to fully offset falling print revenues in 2021 & 2022. Therefore overall group revenues fall in the forecasts.

This results in adj operating profit forecast to move like this;

2020: £131.6m

2021: £133.0m

2022: £135.1m

Hence not much movement in profitability at all, despite increasing digital revenues. EPS is static at around 33-34p EPS over the next 2 years forecasts.

So you could argue that digital growth is just offsetting print decline, leaving no overall change. It's difficult for me to get excited about that. Especially as the enterprise value (including actuarial pension deficit) is well over £1bn now.

Tremor International (LON:TRMR)

Share price: 439p (up 17% at 09:01)

No. shares: 133.3m

Market cap: £585.2m

Tremor International Ltd (AIM: TRMR), a global leader in video advertising technologies, provides an update on trading for the year ended 31 December 2020.

Tremor ended 2020 with a flourish. How about the following for outstanding clarity - giving us the previous guidance, and new guidance, with specific figures. If only all trading updates were presented in this format, for all companies, life would be so much easier -

The Company's record revenue and profit growth in the second half of 2020 continued through to the year-end, with trading in the month of December at a record high and materially exceeding the Company's expectations.

Therefore, Tremor expects trading for the year ended 31 December 2020 to be ahead of the ranges outlined in its most recent trading statement on 30 November. These were revenues, net revenue* and Adjusted EBITDA in the ranges of $390-400 million, $171-175 million and $50-52 million respectively.

Tremor now expects to report revenues of $404-408 million, net revenues of $179-181 million and Adjusted EBITDA of $58-60 million for the year ended 31 December 2020.

In addition, the Company had net cash at 31 December 2020 of c. $96 million (30 June 2020: $78 million).

This trading performance demonstrates a 72% growth in revenues for Q4 2020 compared to Q4 2019 and 50% growth in the second half of 2020, compared to H2 2019…

A growth table shows stunning growth in “PMPs” (whatever that is), and in 2 other categories, all showing >100% revenue growth.

Outlook comments sound very positive too -

The board and management of Tremor believe that the growth demonstrated in the second half of 2020 is set to continue through 2021, despite the ongoing uncertainty and impacts relating to the COVID-19 pandemic. It is clear that Tremor's strategy to focus on video, data and Connected TV - which is complemented by its end-to-end technology platform and broadened geographic footprint - is coming into fruition. The business is now fully integrated and set to deliver sustained growth.

My opinion - these figures look fantastic. This is not a sector I understand, so am neutral on this share.

My main concern is whether these fabulous figures are sustainable or not? We’ve seen in the past how, in this type of business, big profits can be made, but then just as quickly disappear, when things like Google algorithms are changed in some way.

Therefore I think investors need to properly research how the company specifically makes money, and consider whether that is sustainable or not. It’s no good asking companies themselves, it’s much better to get some kind of third party, sector expert views from outside the investing community.

Director selling is something to watch too, which has been substantial at this company.

Overall, I’m happy to pass on this share, as I don’t properly understand it. As the chart shows, the company's track record is mixed. It might be the type of boom & bust company where it could make sense to top slice some profits & run the rest for free?

With a big cash pile, dividends should be back on the agenda.

.

.

Dp Poland (LON:DPP)

10p - shares resumed trading today

Hopes that this company could replicate the success of Dominoes Pizza, but in Poland, didn't work. So instead of admitting defeat, after many years trying, and racking up heavy losses, a creative solution has been found.

DP Poland is being combined with another Polish pizza chain, called Dominium, almost doubling the number of stores.

I'm not convinced that merging a basket case with another business, even a good one, will result in a good combined business. Therefore it's of no interest to me.

If the combined group does manage to achieve profitability, then at least it will have plenty of tax losses from DPP to utilise, assuming they have a similar corporation tax system in Poland to the UK system.

.

Scs (LON:SCS)

205p - mkt cap £78m

(I hold)

A lot of my shrewd investor friends are in this stock, which attracted me to buy some last year too, after doing my own research of course.

This week, a not only shrewd, but omnipotent investor joined our ranks ... God!

The Church Commissioners for England have just announced a new 3.0% disclosable holding in ScS.

A nice soft ScS settee is certainly more comfortable than a wooden church pew. Maybe that was in the back of the Commissioners minds?

More seriously though, I'm not concerned about the latest lockdown, because ScS quickly recouped lost sales last time, and also sells online. Plus the lead times from ordering to delivery are enough to mean it continues generating sales (recorded at time of delivery to the customer, I understand) even though showrooms might be closed.

It still looks cheap, and has a super balance sheet, because it sits on customer cash deposits for a while, before having to pay its suppliers. Hence very favourable working capital cycle, and it didn't need to raise any fresh equity during 2020, unlike larger competitor DFS which paid for its weak balance sheet by having to dilute shareholders almost 20% during the crisis.

These things matter, because we cannot assume covid-19 is a one-off. Something similar might happen again. Hence companies need to repair their balance sheets, and keep much higher levels of cash reserves than might have been the case pre-covid.

Business models are not as strong as we thought, and in vulnerable sectors like travel/leisure, retailing, and hospitality, nobody can assume any more that revenues will flow uninterrupted forever. That means a sea change in attitudes is needed. Instead of clamouring for resumption of divis, shareholders should probably be encouraging companies with weak balance sheets to retain more cash, to reduce balance sheet risk in future.

.

J Sainsbury (LON:SBRY)

242p - mkt cap £5.4bn

Just a quick comment, so I can close another tab on my browser, left open from earlier this week.

Mkt cap of £5.4bn seems very modest, for such a huge business. I do wonder if it might become a bid target, e.g. for an overseas bidder that wants a ready-made, large UK outlet for its own products? I don't mean replacing the existing products, but finding a bit of space in SBRYs stores for complementary products, sold at high margins. That could make sense maybe.

Things that stand out from SBRY's Q3 update published yesterday, are;

Strong Xmas sales, LFL up 9.3% (excl. fuel)

Argos also did well, up 8.4%

Digital sales now 44% of the group total - that's a massive amount, which would have been unthinkable a few years ago. I wonder if many people might continue shopping online, having been initially forced to do it due to lockdowns?

Business rates relief - I'm still scratching my head over this, in that SBRY voluntarily handed back the business rates relief, which was not required. Tesco was the first to do this, IIRC, but SBRY followed shortly afterwards, I recall, maybe even the next day. This is hugely material to profits -

We now expect, after forgoing business rates relief of £410 million, to report underlying profit before tax (UPBT) of at least £330 million in the financial year to March 2021 (financial year to March 2020: £586 million)

Put another way, UPBT would have been at least £740m, but SBRY gave up over half of that voluntarily, £410m, as a gift back to the taxpayer. I find that absolutely remarkable. The cynic in me says there must be more to it than just doing the right thing, as the associated PR benefit. Some readers suggested that the Govt might have made it clear a windfall tax would be imposed if they didn't surrender the taxpayer support over business rates. That does sound credible to me.

Wafer thin profit margins - it's a business generating revenue of nearly £30bn, so the £330m profit margin is tiny in percentage terms. That's worth pointing out to anti-capitalist family members, which I often do!

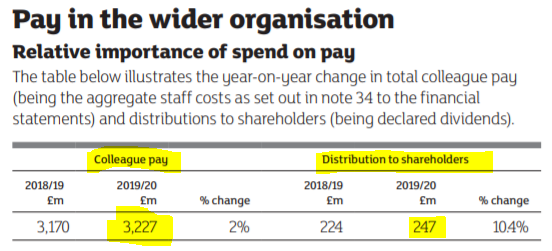

As an aside, I thought it would be interesting to work out how much SBRY pays its staff, and compare that with shareholder payouts. Happily, this information is already provided in the 2019 Annual Report - as follows -

.

As you can see, staff pay was over 13 times the amount paid to shareholders. Again, worth pointing out to anti-capitalists. That said, I do feel a lot more needs to be done to rein in executive greed, so pay at the top end is very much a big issue.

My opinion - I wouldn't normally be interested in supermarkets, but maybe it's time for a fresh look? Covid seems to have been a double-edged thing - extra sales, but increased costs.

.

Character (LON:CCT)

421p - mkt cap £90m

A favourable, albeit not financially material announcement came out yesterday.

CCT has sold an overspill warehouse for £3.5m. Book value was £1.44m, so there's a worthwhile profit on disposal, and a boost to cash reserves, and balance sheet overall NAV.

I think it also suggests that the accounting generally at CCT is probably quite conservative.

.

Pets At Home (LON:PETS)

446p (up 7% at 13:07) - mkt cap £2.24bn

I like to look at as many retailing trading updates as I can, at this time of year, as it's my sector specialism & can give insights into other areas in small caps.

This update is for FY 03/2021 to date.

Trading has been excellent recently -

... momentum has accelerated across all channels during our third quarter, with "high-teens" Group LFL sales growth during December.

Classed as "essential" hence can continue trading through current lockdown.

Profit guidance raised -

... we now anticipate full-year underlying pre-tax profit, including the previously announced repayment of business rates relief of £28.9m, to be at least £77m2

2. In our H1 FY21 results on 24 November 2020, we anticipated FY21 Group underlying pre-tax profit on a post-IFRS16 basis to be £93.5m including business rates relief. On 4 December 2020, we announced our intention to repay the £28.9m of rates relief received

That works out as raising guidance from £64.6m previously, to "at least" £77.0m now - impressive.

My opinion - the share price has doubled in recent months, so it's on a punchy valuation that reflects strong performance, in my view. Too expensive now at 446p, in my opinion.

.

Marston's (LON:MARS)

79p (up 6%, at 13:27) - mkt cap £500m

Q1 Update

This is another pubs group, following on from similar-sized Mitchells & Butlers (LON:MAB) yesterday. MAB said that its cash burn would deplete cash reserves rapidly in the coming months, and that it was exploring equity fundraising. The Telegraph helpfully pointed out that MAB is lucky to have 2 very wealthy major shareholders backing it, likely to be supportive.

MARS is in a better position. Oct-Dec 2020 trading was obviously "materially disrupted" with covid restrictions, and all its pubs are now closed.

Expects re-opening to occur in March 2021, at the earliest. Some of the previous restrictions may remain on re-opening.

JV with Carlsberg gave it a £233m cash injection, impeccably timed!

Liquidity looks fine - plenty of headroom, so it is implied that it should not need to do a placing.

CEO implores the Govt to extent business rates relief, and VAT cut.

My opinion - neutral, as I haven't done enough research to form a view either way. Given its superior liquidity position, I would gravitate towards MARS ahead of MAB (which needs more equity raised).

.

That's it from me today, and for the week.

Have a lovely weekend, as best you can.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.