Good morning, it’s Paul and Jack here with the SCVR for Thursday.

Timing - update at 13:15 - mostly done for today. The sun has just tentatively appeared, so I'm downing tools now to stretch my legs, as lockdown in foul weather is sending me stir-crazy! Let's say all done for today, but I might cover a few more things this evening, for tomorrow's report.

Paul's Section:

Agenda - I prepared some sections last night:

Craneware (LON:CRW) - trading update FY 12/2020

Getbusy (LON:GETB) - trading update FY 12/2020

Air Partner (LON:AIR) (I hold) - trading update FY 12/2020

On to today's trading updates/results:

Somero Enterprises Inc (LON:SOM) - a sparkling end to FY 2020

Sanderson Design (LON:SDG) (I hold) - Trading update for FY 01/2021 - ahead of expectations

Headlam (LON:HEAD) (I hold) - Strong H2 recovery & resumption of divis

Jack:

Begbies Traynor (LON:BEG) - red flag report

Zotefoams (LON:ZTF) - Operational & trading update

Craneware (LON:CRW)

2240p (up 2.3% yesterday) - mkt cap £601m

20 January 2021 - Craneware (AIM: CRW.L), the market leader in Value Cycle solutions for the US healthcare market, is pleased to provide an update on trading for the six months ended 31 December 2020 (H1 FY21).

“Strong performance”

H1 revenue & adj EBITDA up >5% on LY H1

Customer retention rate above 90%

… building the foundation for a return to double-digit growth in the future.

Long-term visibility of contract revenues

Capitalising R&D at similar levels to prior periods

Cash reserves “healthy”

Good cash conversion

Confident of meeting market expectations for FY 06/2021, with a useful footnote -

1 Company compiled, publicly available market expectations comprises the published estimates of 5 analysts from Peel Hunt, Investec, Berenberg, Panmure Gordon and N+1 Singers. For FY21: Revenue of $74m (range $71.5m to $76m) and Adjusted EBITDA of $25.3m (range $23.7m to $27m)

My opinion - it’s a good quality business, but growth seems a bit pedestrian. Forward PER of 45 suggests investors must see upside against existing forecasts. The share price has done well recently, it looks very expensive now. I’d want much faster growth to justify paying such a high multiple.

.

Getbusy (LON:GETB)

94p (up 13% yesterday) - mkt cap £46m

GetBusy plc ("GetBusy" or the "Group") (AIM: GETB), a leading developer of document management and task management software, is pleased to provide an update on trading for the year ended 31 December 2020.

Strong revenue growth and a robust foundation to scale

I’ve reported on this company quite positively several times in the past, including its last (rather waffly) update here on 28 Sept 2020.

Let me summarise the latest update yesterday -

- Performance has continued to be strong, the company says

- Revenues slightly ahead of market expectations (despite currency headwinds in H2)

- Recurring revenues up 15%

- Customer churn in H2 reduced from H1

- Net cash better than expected, at £2.3m due to early receipt of UK tax credit (plus undrawn £2m borrowing facility) - so liquidity sounds OK

- Diary date - 3 March 2021 for FY 12/2020 results

My opinion - I like this share. It’s got a profitable, cash cow business, called Virtual Cabinet, which is growing, but quite slowly (+6% in 2020). It’s using the cashflow from that, to develop 2 other products. How to value it? Probably on a sum of the parts basis. We’re in a roaring bull market for tech shares, so you could value this share at anything you want. Is the growth exciting enough to get onto a mega-valuation? Probably not, at this stage, in my opinion. Others may disagree.

I need more detail, so will wait until the figures are published in March to look at it more closely, but my view is broadly positive, because it has an established, cash generative division. So there’s a proper business here, plus the more blue sky stuff thrown in as potential future excitement. That’s much lower risk than a heavily loss-making blue sky type of share.

.

Surface Transforms (LON:SCE) - has done a big placing, raising £18.0m (gross) at 50p per share. It’s certainly on a roll. How to value it though? Very tricky.

Innovaderma (LON:IDP) - Many thanks to muzmano for flagging yesterday in the reader comments section, that IDP has got away a £4.0m equity fundraising.

In both these cases, I think they look more investable now that they’re properly funded.

.

Air Partner (LON:AIR)

(I hold)

70p (up 4% yesterday) - mkt cap £44m

Trading Update

We discussed this one in the comments section yesterday. The company said -

... However, despite global travel restrictions, the Group has performed better than expected and ahead of market expectations. Accordingly, the Board now expects to announce an underlying profit before tax of no less than £11.5 million for the full year.

That sounds amazing, but it’s not telling the full picture. The company made £10.5m in H1. So it’s only forecasting £1.0m in H2.

My opinion - I’ve got a small position in this, and am not particularly impressed with a trading update that I think gives quite a misleading impression on first reading. It was only when I checked the interim results that I realised it was such an extreme H1 weighting.

To be fair to the company though, it had previously emphasised that H1 benefited greatly from one-off covid-related contracts.

Just shows, it’s always important to check the detail.

.

On to today’s news, and there’s lots of it!

Somero Enterprises Inc (LON:SOM)

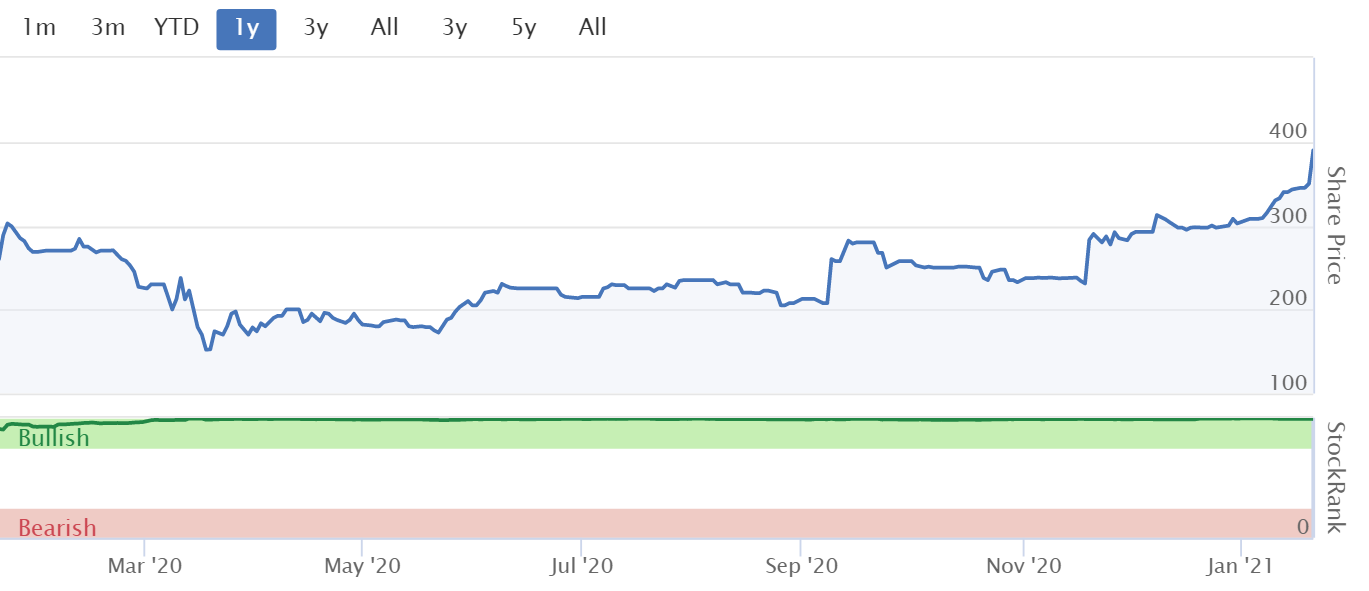

380p (up 9% at 08:18) - mkt cap £214m

This is one of my favourite value shares. It’s a well-managed, cash generating machine, making strong margins, paying good divis, as well as having a strong balance sheet.

Somero® provides the following update on trading for the financial year ended 31 December 2020 (the "Period").

Strong finish to 2020 significantly exceeding previous guidance driven by healthy North American market

It’s had a really good end to the year -

The Board is pleased to report that with strong, profitable trading in the fourth quarter, and in particular December, that exceeded the Board's previous expectations, revenues for the six-month period ended 31 December 2020 significantly increased from H1 2020 and surpassed revenues reported pre-pandemic in H2 2019, driven by robust trading activity in the Company's largest market, North America.

There’s a big increase in forecasts for 2020, which is remarkable since it comes at the end of the year -

As a result, the Board is pleased to report that it now expects to report revenue of approximately US $88.0m for the Period, significantly ahead of market expectations of US$ 80.0m, and annual adjusted EBITDA of approximately US$ 26.0m, also significantly ahead of market expectations of US$ 21.0m. These estimates remain subject to any audit adjustments.

Net cash - also stronger than expected, at $35.0m (guidance was $26.0m) although a one-off boost of $5.0m is mentioned. This will trigger a supplemental dividend.

New products - 3 have been launched, and generated £7.0m revenue in 2020, which seems good at 8% of total revenues for the year. Rapid market acceptance, helped by customer-centric product development strategy.

Growth Y-on-Y has all come from USA, its largest market. With more economic stimulus & Govt infrastructure planned by the new Biden administration, then I assume this market should remain strong. Somero confirms 2021 is looking good -

Our positive view of US non-residential market conditions remains unchanged as we enter 2021 based on consistent customer feedback indicating extended project backlogs that carry well into 2021.

China - poor. The company still isn’t gaining traction in this big market.

Europe & RoW - modest improvement in H2, but below 2019. Lockdown tighter than in USA (I heard something similar yesterday from another, unconnected company in a Zoom)

Outlook -

- Confident about new products

- Recruiting more sales & support staff - necessary to drive long-term growth

- “Meaningful” increase in operating costs in 2021

- Modest financial growth in 2021, offset by cost increases - sounds like they’re guiding for flat profitability in 2021 (but will probably beat guidance,as they tend to under-promise)

- Lingering uncertainty of covid-19

With a combined view of all these factors, the Board expects 2021 will be another profitable year with healthy cash generation, modest revenue growth and EBITDA comparable to 2020 due to the aforementioned planned investment in resources for future growth.

My opinion - a terrific company. See Finncap’s update note this morning, either on its own research portal, and Research Tree.

FY 12/2020 forecast is now 33.2c, at £1 = $1.37 that becomes 24.2p

PER is 15.7, not expensive for a company of this quality, particularly as it is sitting on surplus cash too.

Note the StockRank is jammed on maximum - don't think I've ever seen one like that before!

.

.

Sanderson Design (LON:SDG)

(I hold)

115p (up 9% at 09:03) - mkt cap £81.6m

This wallpapers & soft furnishings group has been a quiet star in my portfolio lately - seemingly going up a bit every day, on no news, so perhaps someone might be accumulating stock in the background?

I see from the RNS that the Employee Benefit Trust has recently bought 50k shares at 88p, for the CEO’s bonus. Given the positive trading update today, I don’t begrudge her a bonus at all!

Also note from the RNS that the biggest shareholder in SDG, Octopus, has recently increased from 11.99% to 12.33%

Trading Update today

Dec 2020 better than expected - monthly sales +15% Y-on-Y [year-on-year], up from +7% in Oct/Nov

Jan 2021 - started well, but “tempered” by lockdown 3

Manufacturing division has performed better, sales up 33% in Dec 2020, and still performing well in January

PBT FY 01/2021 not less than £6.3m Operational gearing & cost savings have helped

This performance in both brand product sales and manufacturing has resulted in revenues being ahead of Board expectations and which, owing to the Group's operational gearing and the cost savings already implemented, has translated largely into profit.

Balance sheet “remains robust” - often companies that claim to have a strong balance sheet actually don’t, so this can be an amber flag. I’m happy to report that SDG does indeed have a robust balance sheet, I’ve double-checked back to the interims. There is a pension deficit, but not large, at £9.2m.

Outlook - ongoing uncertainty.

My opinion - I’m wishing I’d bought more of these, having been bullish about it for a while. Looking back at previous comments here, note that:

9 Nov 2020 I covered an announcement for a licensing deal with Next (LON:NXT) . There have been previous licensing arrangements, e.g. with H&M for clothing ranges. It occurred to me that SDG would make a good acquisition for Next, to gain exclusive use of its extensive back catalogue of designs.

21 Dec 2020 - a positive trading update, I reported on it here.

Today’s update gives us specific profit guidance, which is very helpful. I’m really impressed with £6.3m profit guidance for FY 01/2021, that’s considerably more than I was expecting, given what a turbulent year it’s been.

Note that H1 was only just above breakeven, at £0.4m adj u/l PBT. Hence H2 has been a bumper half, at £5.9m profit. Who would have predicted that? Even if it includes catch-up revenues/profit, that’s a good thing - i.e. it means sales were just deferred, not lost. Encouraging for the current lockdown.

I can’t find any broker coverage (grrrrr! Why do they make it so difficult for us?). We create the liquidity & set the share price, so it drives me mad that some brokers actively withhold information from us. Instead giving privileged info (sourced from, confirmed with, and paid for by the company!) to their broking clients only, hiding behind regulatory rules as the excuse (which don't seem to stop other brokers keeping us informed). It’s very wrong, the whole system needs a big shakeup.

Working on what I’ve got, the StockReport shows broker consensus of £2.8m net (i.e. after tax) profits, and 5.28p EPS.

The company today says £6.3m pre-tax profit, so take off my estimate of corporation tax at 19%, gives £5.1m net of tax earnings - that’s 82% above consensus!

Working out EPS, take my £5.1m net profit, divide by 71.0m shares in issue = 7.2p EPS which is 36% above broker consensus. I’m not sure why this is so much lower than the 82% mentioned above. Maybe some broker figures are out of date, or withdrawn? Or it could be to do with tax?

At 115p/share that gives a PER of 16.0 times - good value, considering how terrible market conditions have been.

Given that it’s cut costs, then it’s likely earnings should rise in future, which would bring down the PER maybe even into single figures.

Looking good, I think the fundamentals justify the strong recovery in share price, and looks like there could be more to come, taking a medium term view. I tend to think 2-3 years ahead with most of my investments, I’m not a trader. So I’ve got no idea what the shorter term share price will do, and that doesn’t matter to me. I’ll be buying more of SDG, if there’s a significant pullback.

Dividends - not mentioned today, but given strong trading, I imagine we should be back on the dividend list later in 2021, another reason to sit tight I think.

Looking at the long-term chart, it's on a very strong recovery trajectory at the moment, but still well below its heyday share price of c.200p. The share count has gone up from 62m to 71m over the past 5 years, which is only 15%. Therefore the historic chart is still a fairly good indication of what the upside might be. With cost-cutting done in 2020, maybe profits could exceed previous highs? That's an interesting prospect with lots of companies that were forced to restructure due to covid - maybe laying the foundations for a better business, not just recovering to previous levels of profit? Time will tell on that, but it's an interesting investment theme generally at the moment.

.

.

Headlam (LON:HEAD)

(I hold)

398p (up c.5% at 12:24) - mkt cap £340m

Headlam Group plc (LSE: HEAD), Europe's leading floorcoverings distributor, is pleased to provide a trading update in respect of the year ended 31 December 2020, and ahead of announcing its final results on 9 March 2021.

This is another of my favourite value/recovery shares.

The appeal is that it seems obvious this company should get back to pre-covid profitability (maybe higher?) fairly easily, and then it’s likely to be producing c.40p+ EPS, and paying out over half in divis. That’s a future PER of 10, and a yield of about 6%, a very attractive proposition in a low interest rate world. Plus it has a smashing balance sheet, with tons of freehold property (c.£100m from memory) thrown in.

As an aside, I like to segment my portfolio, and allocate some of it for value shares, most for GARP & turnaround companies, another pot for growth companies, and finally a bit of fun with one or two mad speculative things too.

There’s no firm rule that we have to stick to one strategy, it’s our money, we can do what we want with it after all.

So HEAD is in my value pot. There’s also some growth potential, from market share growth, and some interesting ideas I think management could be toying with, about pivoting more towards eCommerce. Although they sounded unsure about this in a webinar last year.

They’ve given it a short summary, which are becoming more in vogue these days - and are quite useful I find, when they’re strictly factual, to save time when we’re under time pressure from 7-8 am -

Strong and sustained recovery maintained through the second-half

Intention to reinstate dividend

Good recovery in H2:

Whilst trading in Q2 2020 was significantly impacted by COVID-19, trading in the second-half was characterised by a strong and sustained recovery to 2019 levels. Accordingly, total revenue for the full year was only 15.3% below the prior year at £609.1 million, compared to 30.6% below for the first-half….

In the second-half, residential sector revenue was up 8.8% against the prior year compared to a decline of 17.8% for the commercial sector, albeit this still represented a strong recovery from the 34.4% decline seen in the first-half.

UK residential sector performed “exceptionally well” - compensated for weaker commercial sector. No surprises here, we already knew people are revamping their homes

European businesses did better, with revenues only down 4.1% on LY in 2020

Underlying PBT towards the top of the £14-16m range which was indicated on 19 Nov 2020 trading update - encouraging, but not earth-shattering.

Net cash - £50.5m at 31 Dec 2020, which includes a £12.0m boost from deferred VAT (thank you to the company for this transparency - if only all companies were this open).

Average net debt - again, an excellent disclosure, all companies should report average daily net debt/cash, which is far more meaningful than a snapshot on one day, which can easily be manipulated. The figures are:

H1 avg net debt £35.3m

FY avg net debt £8.6m

That seems to imply that the company was running in net cash on average throughout H2, to have pulled up the full year average to not far off breakven.

There’s also tons of liquidity on largely undrawn bank facilities - so it looks very strongly financed.

Dividends are being reinstated, although initially just a “nominal” amount (what’s the point? Maybe just to get back on the dividend list, so that income funds can remain invested?)

Another divi is expected to be declared in Sept 2021.

Capital allocation priorities - this is a really interesting disclosure, and I think demonstrates that the company is well managed, with a logical strategy. I’d like to see more companies publish their strategies in this way, because it shows they’ve thought about what level of financial reserves are necessary to cope if another pandemic were ever to happen:

As signposted in the November 2020 Trading Update, listed below, in order of priority, are the Board's Capital Allocation Priorities including targeted parameters:

1. Maintain a strong balance sheet, with targeted average net debt² during a financial year of not more than 0.75x EBITDA, unless exceptional or unforeseen circumstances prevail.

2. Investment, both opex and capex, in the core distribution business to optimise performance and growth.

3. Provide income to shareholders through a bi-annual ordinary dividend distribution paid out of cash with a target cover ratio of 2x earnings for the combined pay-out, and an interim and final dividend payment split of approximately 1/3 : 2/3.

4. Consideration of investment in acquisition opportunities aimed at growing the Company's core market position, including extending the product portfolio and weighting in certain customer segments.

5. After applying the priorities and parameters above, return any surplus cash to shareholders. The Board will keep under review and determine at the appropriate time the most effective method of returning surplus cash, including consideration of special dividends and share buybacks for cancellation.

The Board will review these priorities on a regular basis.

Current trading -

- Jan 2021 - seasonally quietest month. Revenue is down -5.1% vs LY - that’s fine, considering lockdown 3 is underway.

- Remaining fully open throughout lockdown 3

- Efficiency projects underway are being accelerated - more details to follow

- Brexit - very limited disruption to date

My opinion - what a superb update - full of the facts & figures that investors need. This gets a 10/10 score from me. It gives me so much more confidence in a share, where management report openly & honestly, like this. Honesty is always the best policy, in the long run, as it builds trust & hence shareholder loyalty, hence ultimately a better outcome for everyone.

Obviously the 2020 figures are not how we should be valuing the share, because it’s such an aberration. 2021 consensus forecast seems to be for about 28p EPS, for a PER of 14.2, but I’d say that looks too cautious, so personally I’m valuing this share on my own forecast of 40p EPS as mentioned above. Maybe it won’t get all the way there in 2021, but it should in 2022, or exceed it, given the efficiency gains being worked on now.

As before, this share gets a solid thumbs up from me. Despite a decent recovery, it still looks good value in my opinion, plus lovely divis to flow again over the next few years, I reckon. This is an ideal share for a SIPP in drawdown, in my view - generating a fairly reliable dividend stream (albeit paused in 2020).

.

.

Jack’s section

Begbies Traynor

Red flag report

The recent acquisition made by Begbies Traynor (LON:BEG) of CVR Global appears to have moved the shares and the stock does look attractive based on forecast earnings growth:

So this insolvency and restructuring specialist might still be worth looking into despite the strong share price performance already - but it’s Begbies’ most recent Red Flag Report covering the health of UK business in general that we’re covering today.

With the country once again in lockdown, it is no surprise to hear that 630,000 UK businesses are now in significant financial distress. This 13% increase from Q3 to Q4 marks the ‘largest numerical quarterly increase since Q2 2017’.

It’s a 27.5% year-on-year increase in 'significant distress’ since Q4 2019, with London experiencing a 33% increase in that same time period. Northern Ireland was also hit hard, showing the sharpest deterioration with a 40% increase since Q4 2019. This has likely been complicated by post Brexit border complications.

Against a backdrop of generally favourable share prices, these are very sobering statistics.

Splitting ‘significant distress’ out into industry groups, no prizes for guessing that hotels and accommodation increased by 32% (5,659 - Q4 2019, 7,494 - Q4 2020). But financial services has also been hit hard, up 38% (12,587 - Q4 2019, 17,423 - Q4 2020), as has real estate and property services, where the number has risen by 39% (53,224 - Q4 2019, 73,952 - Q4 2020).

On the whole, every one of the 22 sectors monitored by the Red Flag Alert research exhibited an increase in significant distress, with 18 sectors experiencing double digit increases.

On the one hand this is expected, but on the other it is still quite something to actually read.

What’s more, there is probably a backlog. The coronavirus pandemic has limited the number of CCJs3 and winding up petitions being issued against indebted companies and there has been a ban on winding up petitions for Covid-related debts.

Julie Palmer, Partner at Begbies Traynor, said:

Although the Government has extended its Covid-19 financial support, this simply won't be enough for thousands of businesses who likely will not survive in the interim. Although the UK's announcement of a trade deal with the EU and the roll-out of Covid-19 vaccines offer some light at the end of a very dark tunnel, the situation is going to remain bleak over the next quarter and beyond.

Conclusion

There’s a lot of pain out there, and we have at least one tough quarter ahead.

But we deal with publicly listed companies - you have to be of a certain size to reach that status. And when you get there, you have greater access to liquidity and funding. Note the recent placing by JD Wetherspoon, for example.

That option is not open to everyone. It’s quite possible the severe stress being felt by many business owners up and down the country will simply not be fully reflected on the stock market.

These sectors are complex systems so mapping out exactly how the dominos will fall, and how things will look after, could be a wasted task.

But an underlying truth to all this is that the best operators strengthen their market position in weak markets, so perhaps focusing on how quality operators are taking advantage of current events, and what that implies in the medium term assuming an eventual normalisation of society, is a good way to go.

Zotefoams (LON:ZTF)

Share price: 420p (up 1.9% at 09:22)

Shares in issue: 48,301,234

Market cap: £203m

Operational and Trading Update

Zotefoams (LON:ZTF) is a ‘world leader’ in cellular materials technology.

The claim does seem to be backed up by strong H2 momentum ‘resulting in record six-months sales’, although a quick look at the share price chart suggests it has not all been plain sailing here given that the shares are still below their highs.

Breaking this performance down into ZTF’s business units, HPP sales increased by over 10%. Here footwear sales grew strongly, up 65% and now making up 25% of group revenue. Foam revenue to the aviation market was down c50%, while sales of its T-FIT technical insulation grew modestly.

AZOTE polyolefin sales were in line with last year, although a decline of 20% in sales to its traditional markets was offset by project-related PPE sales to UK government programmes, which has now ended. The group does add that there was a ‘notable recovery in demand from these sectors in the fourth quarter’.

MuCell Extrusion sales declined by over 40%, mainly in equipment, impacted by the travel restrictions imposed by COVID-19 and a refocus of management time towards its ReZorce® mono-material barrier packaging technology.

ZTF concludes that ‘operational performance has been strong and, consequently, adjusted profit before tax and exceptional items for the year ending 31 December 2020 is anticipated to be at the top end of market expectations.’

The kickstarting of long term investment is encouraging and the group has commissioned its third foam manufacturing factory, in Poland, for early February. This completes the planned spending on major capital projects and increases group capacity, so it paves the way for a potential step change in production and cash generation.

And a quick look at the Financial Summary shows that ZTF could do with that step change - it has been burning up cash on these capex projects:

Conclusion

The improving backdrop means ZTF can reinstate investment into its ‘long-term growth drivers’, which were prudently put on ice. Solid cash generation has also returned net debt to EBITDA ‘closer to 2x’.

But that implies that leverage has recently been uncomfortably high for an organically growing small cap. This alongside long term investment being paused raises the question of whether or not trading was a little bumpier through the lockdowns than management are letting on.

It’s just a hunch for now, and this has undoubtedly been a tough period for many, with severe trading disruptions across the majority of sectors.

That aside, the introduction of the third factory in Poland will mark the end of a significant capex programme, so it’s possible in the near future holders will see a step change in production capacity and free cash flow generation.

One to watch on that basis, but at current levels and with risks remaining (albeit, hopefully, reducing), I am waiting for signs of that organic free cash flow generation.

All done for today! See you tomorrow.

Best wishes, Paul & Jack.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.