Good morning! It's Paul & Jack here with the SCVR for Monday. Many thanks to Jack for doing the heavy lifting on small caps today, freeing me up to write/think about fashion eCommerce! Much appreciated.

Timing - today's report is now finished.

Agenda - starting with big news on the rapid move of fashion brands online.

Paul:

Boohoo (LON:BOO) - acquiring intellectual property (only, not shops) from Debenhams administrator

Treatt (LON:TET) - upside case, after chat with Lord Lee

Asos (LON:ASC) - in discussions to buy some Arcadia brands

Jack:

Sopheon (LON:SPE)

H & T (LON:HAT)

.

Mello Monday - tonight from 6pm

A quick reminder that this popular, fortnightly, online investor event is coming up later today, from 6pm. More details here - as usual, a very good line-up, including our own Jack, who’s back by popular demand!

Lord Lee is doing a talk about how the current rules on takeovers need urgent reform. I totally agree with him, and think we should all get behind this ShareSoc campaign to push for more transparency. In particular;

Joint Press Release from ShareSoc & UKSA on behalf of individual investors

ShareSoc and UKSA recommend The Takeover Panel:

- Review their current rules, which disadvantage individual shareholders and all those who are not privy to a potential bid.

- Sets out a clear and orderly framework for takeovers, including measures to ensure fairness to shareholders and other stakeholders.

- Consider issuing Panel guidance for assessing when talks are serious, so that announcements can be made with the usual caveats – “talks are that an early stage”, “no certainty that a bid will be made”, et cetera.

- Tighten the interpretation of what behaviour is acceptable – and, in particular, review the case of Signature Aviation and Blackstone.

.

Boohoo (LON:BOO)

(I hold)

Exciting news late last night, as the FT reported that Boohoo (LON:BOO) (I hold, as do many Stockopedia subscribers) is apparently buying the Dedenhams brand & online presence, for £55m. NB it is not buying the shops. This is potentially interesting on a number of levels. Firstly, it means the BOO group (already 9 brands) is spreading its wings into a much broader demographic, not just fast fashion for young (mainly female) customers. Secondly, I seem to recall (from when it was listed) that Debenhams focused heavily on online, and some archive material on its website suggests that in 2018, online sales (inc VAT) were over £500m. If BOO is buying something that size as a bolt on, then it could be material to its growth.

Press reports suggests there's a fair bit of interest in TopShop, with Asos (LON:ASC) mooted as the front-runner there, to protect its existing supply arrangements with Arcadia, possibly?

I see BOO has just put out an RNS I'll read it quickly & update this in a few minutes. If you're not interested in BOO, then skip this bit. That's why we put everything into sections with a heading.

"Development of online marketplace and extension of target addressable market"

My summary of key points in the announcement;

BOO confirms it has paid £55m to buy the intellectual property assets of Debenhams from the administrators. NB this does not include any shops, stock, or financial services. So it's a completely clean deal, with no legacy issues being taken on by BOO.

The main asset is a top 10 UK website, with 300m UK visits p.a.

"Fantastic opportunity" to grow customer demographic, and into new product areas (e.g. beauty, sportswear, homewares) - which was indicated as a strategic aim in the last BOO results webinar

Marketplace - this is key. DEB's existing website is a platform for many brands (a bit like Next's website), which BOO is acquiring and planning to expand into the UK's largest marketplace. Maintaining & expanding existing brand relationships, plus adding its own brands to DEB marketplace

DEB is continuing to liquidate its stock via shops & website. BOO will then relaunch DEB sometime in Q1 FY02/2022 (i.e. Mar-May 2021)

Financial impact - no effect on FY 02/2021 figures. "Modest start-up losses" expected, sounds fine to me.

Webcast - we can tune in to this at 08:30 -

Audio webcast: https://webcasting.brrmedia.co.uk/broadcast/600add34efe97358c10a2491

Zeus broker update note is available on Research Tree. It's been super-conservative in assuming only £55m revenue benefit, and breakeven profit, in FY 02/2022.

Directorspeak- Mahmud Kamani, Executive Chairman commented -

"This is a transformational deal for the Group, which allows us to capture the fantastic opportunity as eCommerce continues to grow. Our ambition is to create the UK's largest marketplace. Our acquisition of the Debenhams brand is strategically significant as it represents a huge step which accelerates our ambition to be a leader, not just in fashion eCommerce, but in new categories including beauty, sport and homeware."

My opinion - this looks an excellent deal, and should significantly boost future growth, on top of the existing strong organic growth - last reported at 35% of the 40% total revenue growth, despite there being no Christmas parties to sell dresses for.

BOO is buying a significant-sized marketplace website, with a large number of existing customers, for a relatively small amount of money. Therefore, logically the share price should respond positively to this news. However, we already know that the stock market does not behave in a rational way towards BOO, you only have to look at the chart to see the mad gyrations in price, so the share price could do anything in the short term!

I remain of the view that ESG sellers have created a series of wonderful buying opportunities for a spectacularly good growth business.

.

.

For me, the short term price is just background noise. The key thing is that BOO probably has the hardest working & most capable, experienced & ambitious management/team in the sector. I see it as a major, international, long-term winner. This deal puts another piece into the jigsaw. Very good news in my view.

Zeus forecast is for 11.68p adj EPS for the new financial year that starts shortly, FY 02/2022. Therefore at 345p per share, the valuation is a PER of 29.5 - that is stonking value, for a share which has achieved this growth, with lots more to come.

The DEB deal should considerably accelerate future years' growth, but as usual, it's likely to take c.2-3 years to bed in the acquisition & get it growing to its full potential.

.

Treatt (LON:TET)

To follow up on this one from last week. Very much a company I've liked a lot, for years now (see the archive here), although I'm getting increasingly worried that the share price might be running away with itself.

I had a quick chat with Lord Lee over the weekend, a renowned investor, who has held Treatt since 1999 and has been publicly very bullish about the company for many years. He's delighted with the share price rise, and thinks it's justified for the following reasons;

He's always seen it as a one-off company, with nothing similar in the UK market

Valuation should be based on larger, international competitors, and other businesses (he mentioned Guidavan a Swiss competitor), where a PER of 30 or even more is the norm, in a low interest rate world we have today

Treatt is attracting international investor interest as it grows, who are prepared to pay a higher price than UK investors

Still very confident in the company's outlook, and TET is by far his largest personal holding (c.40% of his portfolio!), it's been a 30-bagger for him! Demonstrates benefit of holding winners for the very long-term

Ideal investing scenario is to find shares that not only grow earnings strongly, but also benefit from an upward re-rating of the PER - double benefit makes this very lucrative

Encouraging that the company put out an out-perform statement relatively early in the financial year - often a very good sign in his experience

Move to new UK premises not happened yet - Bury St Edmonds, due to happen later this year (summer?) - should drive efficiency gains/margins. Also new facility in Florida. Should help reinforce credibility with larger customers, when they see the new facilities scale & modernity

Strong market growth in some key categories that TET supplies, e.g. hard seltzers, flavoured tea, citrus, reduced sugar, etc

Experienced - the company has been around for c.70 years, so really knows what it's doing, very good management

My opinion - Lord Lee made a very good case for the share price rise & high valuation being justified. I certainly wouldn't bet against Treatt, a company I've always liked & seen potential in. The valuation remains too high for me though, I wouldn't be interested in buying at this price. There again, I can see why existing holders, sitting on a nice profit, might well be inclined to top slice a few, and run the rest for the long-term.

I hope that gives a bit more balance, as I focused perhaps too much on the high valuation alone last week.

Incidentally, Lord Lee talked me through his new campaign to improve company disclosures re takeover bid approaches. This is a really good idea, and I urge everyone here to check out what he's saying, and get behind it.

.

Asos (LON:ASC)

5030p (up 5%, at 09:17) - mkt cap £5.0bn

Continuing the theme of fashion eCommerce, Asos has also issued a brief update.

Statement re media speculation

- Asos says it’s in “exclusive discussions” with the Administrators or Arcadia re acquiring TopShop, Topman, Miss Selfridge, and HIIT (never heard of it) brands.

- Compelling opportunity to acquire strong brands.

- No certainty of a transaction at this stage.

- If it goes ahead, acquisition would be funded from cash reserves.

My opinion - Asos already sells Arcadia brands, so this looks like a deal at least partly motivated by protecting its supply for popular selling brands.

Apparently, back in the day, Philip Green used to rant about online fashion never working, as people want to try on the product & feel the fabric, and that Asos would never make any money with a 40% returns rate, and to stop nicking his best staff! Actually, on the penultimate point, he wasn’t far wrong, Asos has indeed struggled to make a decent profit margin, but seems to have finally got somewhere in the last year.

Hence very ironic that his best brands have ended up being bought by Asos, following his own dismal failure (hubris-fuelled). I’m glad BOO didn’t chase after these Arcadia brands at the hundreds of millions price tag that the press have been mooting, which looked too high for somewhat jaded brands that arguably had their heyday in the 90s & noughties.

Today’s news from both BOO (I hold) and Asos, is a stark reminder that retailing is moving online at pace. Talking to family & friends recently, we all agreed that buying clothes online feels normal now. If you stick to your favourite brands, then the garment fit isn’t a problem. I’ve updated my wardrobe recently from Next, Gap, and Joules (I hold), and everything fits like a glove, I never have to return anything.

So where does that leave conventional retailers? In a tight spot. As mentioned here many times before, I’m really only interested in looking at retailers which have successfully transitioned online. The rule of thumb for me, is that they should be achieving at least half of all sales online by now. Joules (LON:JOUL) is a good example of that, where I’m buying the dips, to gradually build up a medium-sized, long-term position. Given that so many have failed, or look close to failure, I really think it’s best to resist the urge to bottom fish in apparently cheap things like Mothercare (LON:MTC) or Works Co Uk (LON:WRKS) both of which I’m highly sceptical about.

As regards Superdry (LON:SDRY) and Ted Baker (LON:TED) I reckon the jury is still out. It's not clear to me that either can run fast enough to avoid being engulfed by the tide. If they fail, then the brand value would probably end up paying off creditors, not shareholders.

The other theme that’s interesting is this marketplace idea. Boohoo (LON:BOO) (I hold) mentions this as a key reason for it buying Debenhams IP. It’s looking increasingly likely that fashion brands will be congregating on marketplace platforms, maybe as even their most important outlets in future, as physical stores (esp Dept Stores) wither away gradually. Therefore owning one of, or the biggest marketplace, is the big prize for the future - and likely to drive some mega valuations. I'm toying with the idea of buying back in to Next (LON:NXT) on this basis.

Next (LON:NXT) has a very successful fashion marketplace for other brands. Others are Debenhams (shortly to be part of BOO), Marks And Spencer (LON:MKS) seems to be tentatively going down that route too. I’m not convinced by Mike Ashley’s strategy to concentrate on physical stores at Frasers (LON:FRAS) but it could have merit as the last man standing in the High Street, bullying landlords into giving him selling space very cheaply, or even free?

What about Amazon? They’ve never “got” fashion, so I don’t see that as a threat now, but who knows about the future?

Even tiny Joules (LON:JOUL) has its own niche marketplace, called Friends of Joules.

For me, BOO remains the stand-out opportunity here - superb growth, which if anything could be about to accelerate, and at a reasonable PER under 30 (based on Zeus estimates for FY 02/2022). BOO would probably be worth double the current price, if it were loss-making!! Look at the insane valuations on FarFetch and TheHut. Call yourself a “platform” and operate at a loss or breakeven, and £7bn seems to be the starting point for valuation!

Jack's section

Sopheon (LON:SPE)

Share price: 865p (unchanged at 08:33am)

Shares in issue: 10,202,888

Market cap: £88.3m

Sopheon (LON:SPE) provides software and services for Enterprise Innovation Management solutions. It helps clients to optimise their own investments and, in a sense, adds value to other companies by making sure those companies’ internal investments add value to the firm. It does so with software such as the regularly updated Accolade system.

One reassuring (but hard to quantify) characteristic of this tech stock is that Co-founder and long time executive chairman Barry Mence retains a large stake in the company.

Sopheon has a long history as a software company, stretching back into the 1990s but consistent leadership has seen SPE remain at the forefront of its niche.

The group fell from favour slightly in 2019 as the shift to recurring SaaS revenue (and, hopefully, greater customer lifetime value) came at the cost of a drop in nearer-term sales.

Management says trading has rebounded since and resumed an encouraging trajectory - but the share price performance has failed to match management’s tone.

Trading update for the year ended 31 December 2020

Running through the key points:

- SPE expects full year revenue of c$30m, in line with 2019,

- Annual recurring revenue (ARR) will rise from $15.9m to $18m, although gross retention was down from 94.2% to 91.5% due to ‘challenging market conditions for some customers’,

- The above coupled with a ‘substantial order book’ means revenue visibility over 2021 is up to $22m (2019: $18.9m),

- Total contract value (TCV) of signed SaaS business grew 274% year on year, with new wins included global brands such as DuPont and LG, alongside previously announced Mondelēz and Orion,

- Six of the new customers had initial deal value at $1m or more, compared to just one in 2019,

- Adjusted EBITDA will fall from $6.4m to $5.6m,

- Net cash will rise from $19.4m to $21.6m

Conclusion

Sopheon's Chairman, Barry Mence said: "We believe we have a substantial opportunity ahead of us, and our strong balance sheet gives us the confidence to maintain ambitious investment plans through the pandemic and beyond."

On that note, the direction of travel at Sopheon certainly sounds positive - although the speed of progress might be frustrating for some. High relative valuations generally imply an expectation of good absolute year-on-year growth.

No doubt the top line has faltered in recent years as a result of SPE’s shift to a SaaS model FY20 is expected to be $30m, on a par with $2019:

But Sopheon is winning big, high quality customers and is well positioned to benefit from the accelerated trend towards greater digital presence in a post-Covid world. It seems more likely than not that the group will grow sales in the years ahead, in my view.

As ever with cash generative, net cash, high ROCE SaaS software businesses, conventional relative valuation metrics are high - but then there is also the c$21m net cash position to account for as well.

If you dig deeper into the company it can be hard for the outsider to get a proper feel for just how the group’s products work.

But Sopheon is winning big contracts from well regarded clients. Both ARR and TCV are growing. It faces into a sizable market opportunity, and, with it de-risking its transition to recurring revenue, now could be a good time to take a look at a software company with good clients and strong growth prospects in the coming years.

H&T (LON:HAT)

Share price: 292p (+8.15% at 08:44am)

Shares in issue: 39,864,077

Market cap: £116m

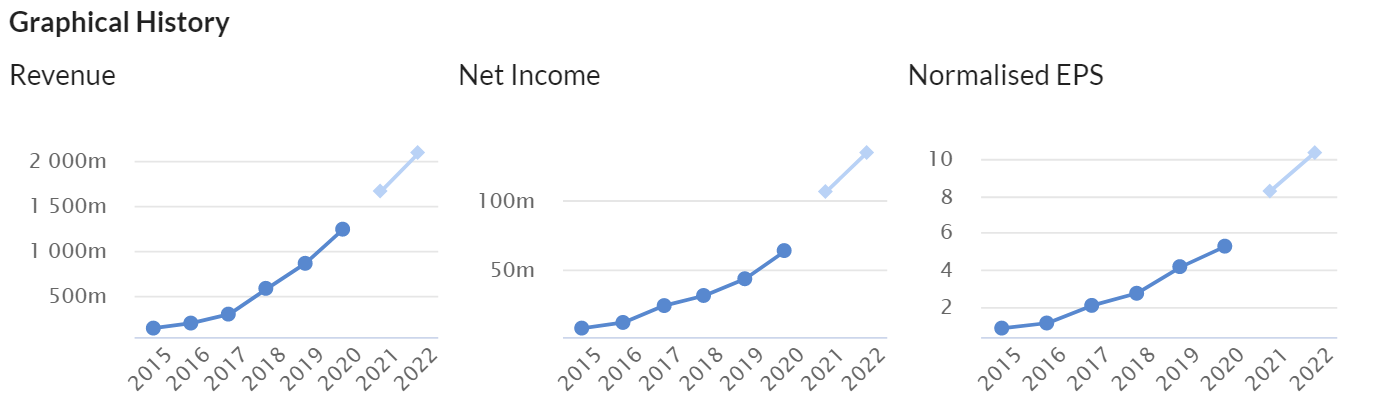

For a long time, H & T (LON:HAT) has seen its share price fall despite looking good value across a range of metrics. The PE ratio has been on a downward trend.

But, pre-Covid, this group had a very solid track record of revenue and earnings growth, comfortably backed up by strong cash generation. It has also built up some attractive growth CAGRs, alongside double-digit margins and returns on capital over the past couple of years.

At some point - unless its business really is fundamentally compromised - that downwards share price pressure has to give.

Today we see an 8% bounce on HAT’s trading update, so let’s take a closer look at this proven operator.

Trading update for the financial year ended 31 December 2020

Here’s the takeaway, right at the top of the update:

Following stronger than anticipated November and December trading, despite lockdown measures, H&T expects the full-year profit before tax to be ahead of market expectations.

The detail:

- Retail jewellery sales during H2 were strong, particularly in December, and for the six months to the year-end were only 6% below prior year

- Returns from precious metal scrappage were 58% up on prior year, reflecting the high gold price

- Foreign currency income was robust at 65% of prior full year levels and Western Union transaction volumes were more than three times higher than in 2019

- The year-end pledge book was £48m, ‘with a resilient performance building through Q4’

- The personal lending book as at 31 December 2020 was £6m, with reduced impairment charges and with repayments and recoveries more than offsetting new lending

- Balance sheet cash balance of £34m with an undrawn £35m bank facility.

Conclusion

There will always be questions around the ethics of pawnbroking but, when provided honestly and with integrity, it has its place in the financial ecosystem.

HAT does say:

We ensured that our customers did not suffer financially while our stores were closed during the Spring, by suspending pawnbroking interest during that period. We continue to work with customers financially impacted by Covid to agree payment deferral arrangements where it is in their best interests to do so.

There is regulatory risk though and the group continues to work with the appointed Skilled Person and the FCA in respect of the HCSTC lending review. H&T expects the outcome of this review to be delayed beyond March due to the pandemic, but ultimately ‘expects an outcome within previous guidance’

For those willing to do the due diligence and confirm that H&T is providing a fair and value-added service to consumers, then the shares do look to offer tempting value on a longer term view given the defensive traits and cash generation.

The group is investing in its stores, technology, and colleagues at a time when other High Street operators (Debenhams and Topshop, for example…) are on their knees. Trading momentum looks to be improving, and there is another potential tailwind in HAT’s exposure to the strong gold price, assuming this trend continues.

Yellow Cake (LON:YCA)

Share price: 223p (+1.26% at 11:51am)

Shares in issue: 84,059,331

Market cap: £187.5m

Here’s an interesting company: Yellow Cake (LON:YCA) buys and holds uranium, offering equity investors a rare option to buy into quite a unique energy source.

It was recently pitched to the SIC, although the Club opted not to buy it (read the write up here). Yellow Cake has also been put forward by a couple of community members that are interested in this part of the market, and Edmund Shing has been flagging the Uranium industry group in his excellent Market Musings posts (most recently here).

It’s certainly not for everyone, and I would point to the comments section in the SIC post in particular for a fairly robust spread of views here from community members.

What’s most interesting in today’s quarterly update is its comments on the market for those interested.

- Yellow Cake's estimated net asset value was £2.43 per share as at 22 January 2021

- 38% increase in value of U3O8 held at 31 December 2020 to $279.5m relative to acquisition cost of $202.3m.

- On 3 November 2020, YCA completed its share buyback programme. A total of 4,156,385 shares were acquired for a total consideration of £8.8m at a volume weighted average price of £2.13 per share and volume weighted average discount to net asset value of 21%.

Uranium market developments

The U3O8 spot market price ended CY2020 at US$30.00/ lb, up slightly from US$29.75/ lb at the end of September 2020.

Spot market volumes decreased noticeably during the December quarter, although Spot market volumes for 2020 reached a new record level of 92.2m lb U3O8 in aggregate.

YCA says this was ‘driven by enhanced purchasing activity by primary uranium producers that had reduced production or suspended their operations due to the Covid-19 pandemic’.

Aggregate term contracting remains low but market sources including UxC indicate that nuclear utilities ‘are beginning to focus on the long-term uranium market and expectations remain for long-term uranium contracting to increase during 2021 as utility fuel managers pursue forward uranium coverage.’

Cameco’s Cigar Lake Mine has also suspended production due to Covid-19 infections. Increased market purchases by Cameco are expected as the company announced, ‘due to the suspension, we plan to increase our purchases in the market to secure uranium we need to meet our sales commitments.’

Conclusion

Promising outlook aside, the global spot uranium market remained quiet entering the first quarter of 2021and UxC noted in its 11 January 2021 Weekly, "Since December 18, overall spot U3O8 demand interest has been very restrained. The notable lack of demand has continued over the first full week of 2021 with almost no activity reported in any component form."

It could be that as the market moves further into the first calendar quarter of 2021, demand picks up across all principal buyer categories; nuclear utilities, uranium producers and traders/intermediaries.

Large uranium producers such as Cameco have already declared their intention to enter the market to procure material to fulfil existing multi-year delivery commitments.

And, ultimately, the uranium price remains too low to support existing production or to incentivise the ramp up of idle capacity. There is little appetite to begin new mine development at these price levels.

If Yellow Cake’s shares continue to trade at a discount to NAV then it will likely initiate another buyback programme. It’s an unusual company that in my view will either do well or continue to go nowhere. And it is totally at the mercy of the uranium spot price. Holders might get bored of waiting for the re-rate.

As such YCA will probably never be a conviction hold for me - I prefer a management team to have a little more operational control over trading prospects - but if you’re looking for a way to play uranium, then this one’s always worth bearing in mind.

.

All done for today, see you tomorrow!

Regards, Paul & Jack.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.